-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Futures Indicate New Highs for S&P500

HIGHLIGHTS:

- Futures indicate further upside bias for stocks

- GBP/USD narrowing in on key support

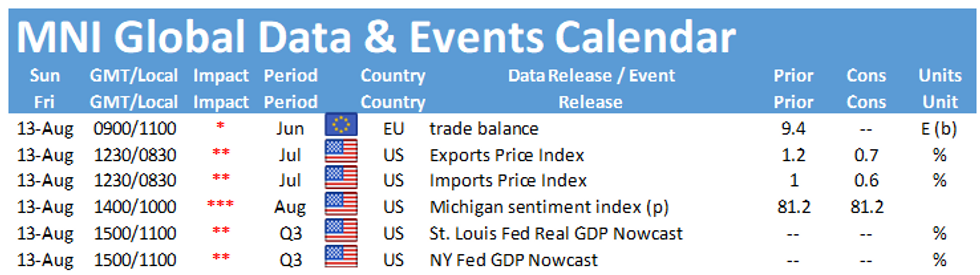

- Import/export prices indices & consumer sentiment data the focus going forward

US TSYS SUMMARY: Modest Gains Overnight, Consumer Sentiment In Focus

The final session of the week has begun with modest gains in Treasuries, though well within Weds-Thurs' ranges.

- Sep 10-Yr futures (TY) up 5/32 at 133-19.5 (L: 133-15 / H: 133-22.5). Light volumes, with under 180k TYU1 traded so far.

- The 2-Yr yield is up 0.2bps at 0.2251%, 5-Yr is down 0.5bps at 0.8184%, 10-Yr is down 1.5bps at 1.3438%, and 30-Yr is down 0.5bps at 1.9937%.

- Modestly risk-off in Asia-Pac trade with semiconductor /tech stocks weakening, but risk appetite picked up in London trading, with S&P futures hitting fresh all-time highs. Dollar a little weaker.

- A relatively quiet schedule to conclude the week: there's no supply or Fed speakers, and there's no 1st tier data.

- 0830ET sees US Import/Export price indices, with prelim Aug UMichigan sentiment data out at 1000ET (probably most closely watched for consumer inflation expectations).

EGB/GILT SUMMARY - Fades the flattening bias

- A low volumes session for EGBs keeps contracts within ranges.

- Bund volumes run at around 85% of the 10 day averages, but doesn't give out the true picture, since volumes have also been on the low of late.

- German curve initially bull flattened, but has since faded and we trade flat at the time of typing.

- BTP/Bund spread continues to find a short term base at 100.00bps.We printed a 100.1972 yesterday and now at 101.2bps.

- Gilts trade inline with their European counter parts, up 5 ticks on the session.

- Volumes in Gilts are at 60% of the 10 day average.

- Gilt/Bund spread is tighter this morning, by 0.7bp.

- Looking ahead, US Michigan is the only notable data release.

- We have no speakers, nor supplies.

- After market, we'll see ratings from Moody's on Ireland and DBRS on Belgium

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 175p, bought for 7 in 2,854

RXV1 172.5/174.5^^, sold at 101 in 1.5k

US:

USU1 161p, bought for '14 in 5k

FOREX: GBP/USD Narrowing the Gap with Key Support at the 200-DMA

- The greenback is inching lower early Friday, with the USD Index just below yesterday's highs although still comfortably clear of the week's lowest levels. The USD's modest weakness has relieved some of the bearish pressure off EUR/USD, which now sits nearer to 1.1750 than the bear trigger at 1.1704.

- GBP has moved from weak to weaker, with GBP/USD printing a new August low and narrowing the gap with the key support at the 1.3779 200-dma.

- NOK is the best performer in G10, with CAD not far behind. USD and GBP are the weakest.

- US Import/Export price indices are on the docket Friday, followed by the prelim reading for August Uni of Michigan sentiment data. Central bank speakers are few and far between, with no FOMC members on the schedule Friday.

FX OPTIONS: Expiries for Aug13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-60(E562mln), $1.1825-35(E926mln)

- USD/JPY: Y110.00($540mln), Y110.45-50($1.7bln), Y111.25($665mln)

- AUD/USD: $0.7600(A$627mln)

- USD/CAD: C$1.2475($612mln), C$1.2600-10($1.2bln), C$1.2650-60($1.1bln)

Price Signal Summary - Gold/Silver Ratio at 2021 Highs

- In FX, EURGBP outlook remains acutely weak, with this week's 0.8450 print the lowest level since February last year. This flags scope for losses toward vol band support at 0.8418 as well as the Feb 27, 2020 low at 0.8430. Moving average studies remain in a bear mode highlighting a downside theme. USDJPY added to recent gains in early Wednesday trade, topping out a new monthly high of 110.80 before fading. This keeps the outlook positive, with 110.82 the next upside level ahead of the 111.66 bull trigger.

- Silver remains weak and has underperformed gold throughout the recovery off the Monday low. This underperformance has accelerated the formation of a death cross in DMA space, adding to bearish pressure on silver. A break and close below Monday's low would be resolutely bearish, opening key Fib support at 20.751. WTI futures levelled off Thursday, holding above the Monday high and erasing the weakness seen at the beginning of the week. Nonetheless, prices hold south of the 50-day EMA at 70.03, which switches from support to resistance.

- S&P E-minis outlook is bullish as evidence of dip buying remains solid on intraday pullbacks. Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. The sell-off Jul 14 - 19 resulted in a break of 4279.25, Jul 8 low. EUROSTOXX 50 futures are extending gains, topping out at new cycle highs of 4228.00 Thursday. This extends the winning streak to eight consecutive sessions of higher highs. This follows the break above previous resistance at 4101.50, Jul 1 high.

- Gilt futures uptrend stalled ahead of the 200-dma last week, but managed a high watermark of 130.72 before prices faded. There remains a bullish outlook which has dominated since the break of 129.92, Jul 8 high.

EQUITIES: Futures Indicate further Alltime Highs Imminent for S&P

- Following the solid close on Wall Street Thursday, markets have progressed further Friday, indicating new alltime highs are likely shortly following the open. Yesterday's high print of 4,461.77 extends the bullish posture and marks the 3rd consecutive record close for the index.

- On the continent, indices are uniformly positive with Germany's DAX extending Thursday's outperformance to add another 0.5% ahead of the NY open. Spain's IBEX-35 is lagging slightly, but still trades with gains of 0.3% or so.

- Europe's consumer discretionary and financials sectors are the strongest performers so far Friday, with energy and tech the only sectors in the red.

COMMODITIES: WTI Pinned Between Key Triggers

- WTI and Brent crude futures both trade toward the upper-end of the week's range and are holding the swift recovery off the Monday low. This leaves WTI pinned between key technical triggers at the 50-day EMA of $69.99 on the way higher, and the 100-dma support at $67.41. A break below the latter opens losses toward the August lows of $65.15.

- Silver remains weak and has underperformed gold throughout the recovery off the Monday low. This underperformance has accelerated the formation of a death cross in DMA space, adding to bearish pressure on silver. A break and close below Monday's low would be resolutely bearish, opening key Fib support at 20.751.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.