-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - GBP Resilient on "Good Chance" of Deal

HIGHLIGHTS:

- Sterling resilient as deal seen as close

- Oil soft as OPEC+ could accept output increase in coming months

- US stock futures 10 points off alltime highs

US TSYS SUMMARY: Edging Higher Within Ranges

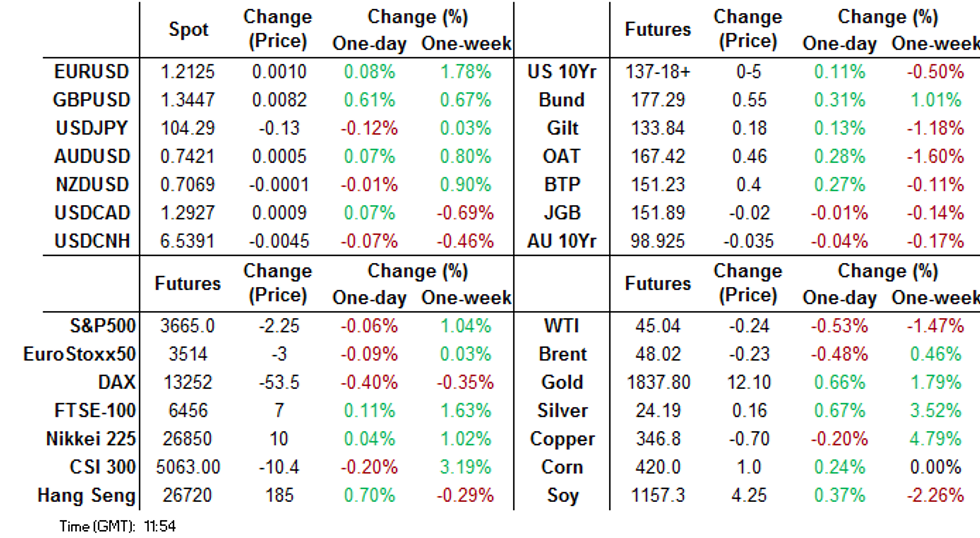

Tsys are touching session highs but well within the ranges post-Tues sell-off and trading in limited volumes, with few headline drivers so far Thursday. Some limited flattening in the curve, with stock futures slightly higher and the dollar weaker.

- Mar 10-Yr futures (TY) up 4/32 at 137-17.5 (L: 137-14 / H: 137-18), just ~185k traded.

- The 2-Yr yield is down 0.4bps at 0.1545%, 5-Yr is down 0.6bps at 0.4083%, 10-Yr is down 0.7bps at 0.9294%, and 30-Yr is down 0.7bps at 1.6783%.

- Morning headlines have mainly been about Brexit (back-and-forth takes on near-term deal potential), with mixed-to-positive eurozone econ data not really moving the needle.

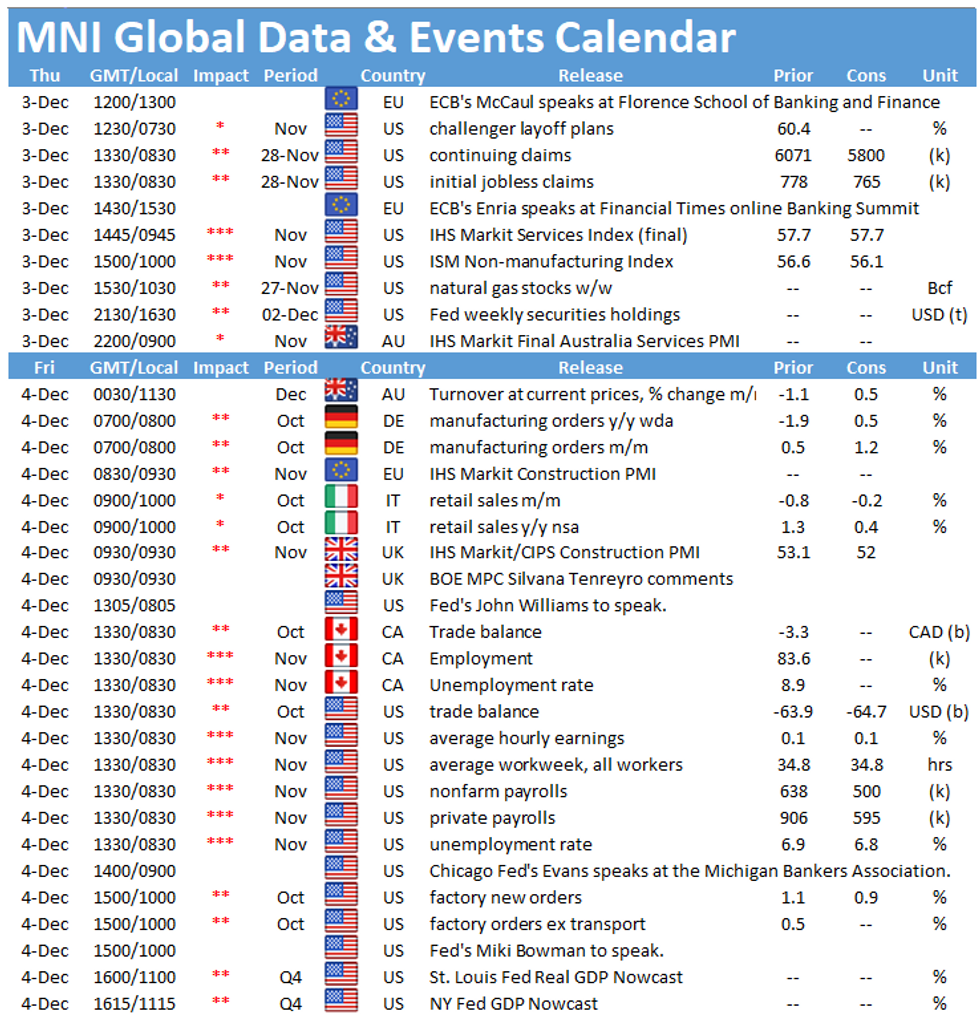

- Challenger Job Cuts for Nov at 0730ET is the appetizer for weekly jobless claims at 0830ET (and of course NFPs Friday). Final Svcs/Composite PMI at 0945ET, then Nov ISM Services at 1000ET.

- No scheduled Fed speakers today; reminder pre-FOMC blackout begins this weekend.

- In supply, it's another day of bill sales: $65B of 4-/8-week at 1130ET. NY Fed buys ~$1.75bn of 20-30Yr Tsys.

EGB/GILT SUMMARY: EGBs Outperforming Gilts

European sovereign bonds have been bid this morning with EGBs outperforming gilts. and curves broadly bull flattening.

- Gilts are marginally firmer and the curve slightly flatter. Last yields: 2-year -0.0386%, 5-year 0.016%, 10-year 0.3426%, 30-year 0.9091%.

- Bunds have rallied and the curve has bull flattened. Cash yields are 2-3bp lower on the day with the 2s30s spread 1bp narrower.

- OATs and BTPs trade in line with bunds.

- Supply this morning came from France (OATs, EUR6.5bn).

- Amid signs that some EU capitals are ramping up pressure on Brexit negotiators not to concede too much ground to the UK, France has warned that it could veto a final trade deal if the final terms are unsatisfactory.

- The final eurozone aggregate services and composite PMIs readings for November were a touch better than the flash estimates. The second read for the UK equivalents was significantly better (47.6 for the services print vs an initial 45.8 and 49.0 for the composite series vs 47.4 previously).

EUROPE OPTION FLOW SUMMARY

UK

LU1 100.12/100.37xs 1x1.5, bought for 2.5 in 11.75k

Sterling versus Euribor: 3LH1 99.62/99.37ps bought for 3.5 in 3.6k vs 3RH1 100.37p, sold at 3.25 in 2k

EUROZONE:

3RM1 100.37/100.12ps vs 100.50/100.75cs, bought the ps for 1.5 in 4k

RXH1 177/176/172 1x1x2 p ladder, sold at 7.5 in 2.75k

FOREX: Sterling Inching Higher on Coveney Comments

After underperforming all others Wednesday, GBP is at the top of the board ahead of NY hours today as markets read positively into comments from the Irish foreign minister Coveney, who stated there's a "good chance" a Brexit deal is resolved in the next few days. As a result GBP/USD has narrowed the gap with yesterday's highs at 1.3441. A break above here would then open the 2020 highs printed in September at 1.3482.

Softer oil markets have taken some of the wind out of NOK and commodity-tied currencies. WSJ reported that OPEC+ are coming closer to an output deal which could see production ramped slightly higher once current output curbs expire. NOK is the poorest performer in G10, with CAD not far behind.

Weekly US jobless claims take focus going forward as well as the November ISM services index, marking the final few datapoints before tomorrow's Nonfarm Payrolls. There are no central bank speakers of note.

OPTIONS: USD/JPY Trades in Close Proximity to Sizeable Strikes

Yesterday's rally in EUR spot brought the pair well clear of the more sizeable option interest layered between 1.18-1.20, leaving little on the table for today's NY cut.

For USD/JPY, pair trades in close proximity to decently sized strikes at Y104: ($3.5bln-$3.46bln USD puts) as well as Y104.45-50($1.6bln).

Other notable strikes include:

AUD/USD: $0.7385-0.7400(A$1.3bln, A$1.1bln AUD puts), $0.7435(A$673mln-AUD puts)

EQUITIES: Stocks a Touch Lower, But Losses Muted

Continental equities sit a touch lower in early Thursday trade, with European indices off 0.1-0.4%, but losses are muted and price action contained ahead of US weekly jobless claims data, the ISM Services Index and tomorrow's nonfarm payrolls report.

Energy and healthcare names are the underperformers so far, with consumer discretionary, tech and industrials just above unchanged.

The e-mini S&P trades well within range of Tuesday's alltime highs of 3677.50, with futures broadly flat on the session. NASDAQ futures modestly outperform, up around 25 points in early trade.

COMMODITIES: Oil Offered as OPEC+ Near Deal on Increased Output

Despite protests among some core OPEC+ members earlier in the week, reports this morning suggest the group are coming closer to an output deal and it could be secured by the end of the week. The shape of such a deal looks for a more gentle lifting of the output curbs over the course of several months, which, judging by the rally in the oil futures curve over the past few weeks Saudi Arabia and Russia could become more comfortable with. Meetings resume Thursday, with a deal still yet to be finalised.

Meanwhile precious metals are making slow progress, with spot gold adding around 0.5% to hit new weekly highs of $1843.58.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.