-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI US MARKETS ANALYSIS - Greenback Fades, Led Lower by USD/CNH

Highlights:

- Greenback fades, led lower by USD/CNH

- OECD sees global growth slowing next year, but urges CBs to stick to tightening

- Fedspeak on deck, with Mester, George and Bullard due

TSYS: Treasuries Reverse Yesterday's Sell-Off With Fedspeak & Supply Ahead

- Cash Tsys firmed through Asia hours with the China Defense Minister stressing no outside force has the right to interfere with Taiwan and a firming has continued through London hours.

- With the belly leading the way, the extension was also helped by the growth negative rather than inflation positive aspects of Russia planning to not supply oil or petroleum products to countries that will introduce a price cap, along with the OECD forecasting global growth of just 2.2% in 2023.

- 2YY -5.4bps at 4.498%, 5YY -8bps at 3.943%, 10YY -3.6bps at 3.791%, and 30YY -1.4bps at 3.882%.

- TYZ2 trades 6 ticks higher at 112-16, just within a session high of 112-18 on subdued volumes. The trend needle points north with resistance at 113-11 (Nov 16 high) whilst support is seen at 111-22 (20-day EMA).

- Fedspeak: Mester (1100ET), George (1415ET), Bullard (1445ET)

- Data: Richmond Fed mfg, Nov (1000ET) after decidedly mixed regional Fed surveys to date for Nov.

- Front-loaded issuance ahead of Thanksgiving closures: US Tsy $22B 2Y FRN auction re-open (91282CFS5) – 1130ET, US Tsy $35B 7Y Note auction (91282CFY2) – 1300ET

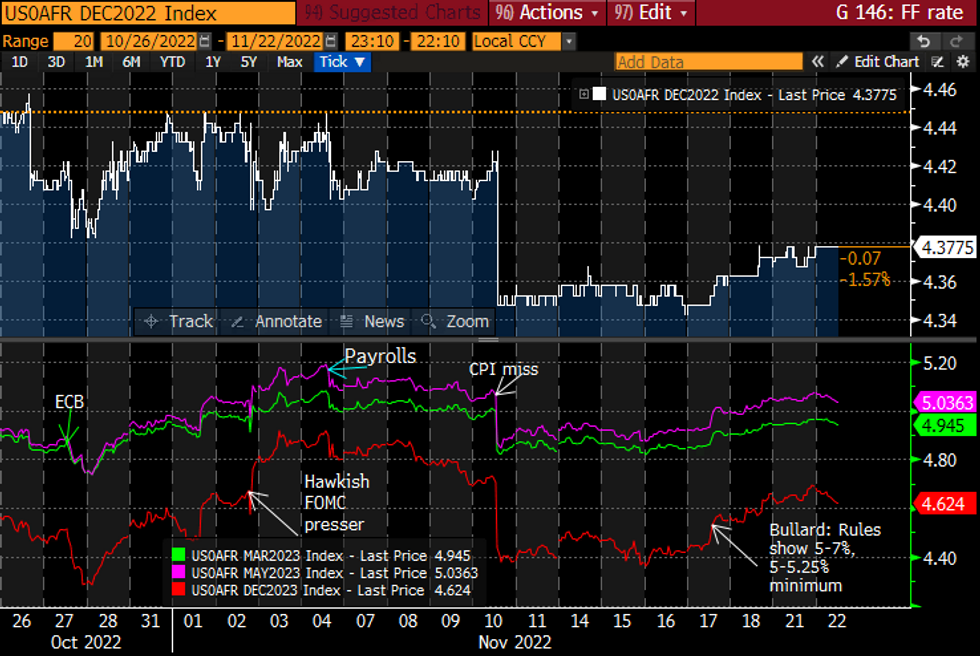

STIR FUTURES: Fed Terminal Hovering Above 5%

- Fed Funds implied hikes give back increases from yesterday’s second half but remain robust.

- 53bp for Dec, 91bp to 4.76% for Feb (-1bp), terminal 5.04% for May/Jun’23 (-4bp) and 4.63% for Dec’23 (-6.5bp)

- Three ’22 voters speaking today: Mester, George and Bullard, all of whom have spoken in the past week, most recently Mester late yesterday “I don’t think the market expectation is really off”.

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

GERMANY: Scholz Warns Against De-Globalisation; 'Must Not Fear Multipolar World'

Speaking at theSuddeutchse Zeitung Economic Summit, German Chancellor Olaf Scholz lamenting efforts to shift away from a globalised economy. Scholz states that de-globalisation is a "dangerous path", and that the German economy, "must not fear developing towards a multipolar world".

- These comments will be viewed with interest in both Washington, D.C., and Beijing. Scholz's recent trip to China for talks with President Xi Jinping was criticised in some western circles given the US-led efforts to reduce the reliance of western supply chains on China.

- Germany has the closest economic relations with China of any major Western nation, and therefore is seen as the least likely to comprehensively side with the US in any burgeoning trade dispute.

- Says that "We should take a very close look at the idea of an industrial tariffs agreement with the United States," with this form of deal being more preferable, "than a bidding war on subsidies and protective tariffs, such as some [we] see coming as a result of the American Inflation Reduction Act."

- States that the German energy, "dependence on Russia was a mistake that should never be repeated", and that "we must expect the situation in Ukraine to escalate further".

GILTS: Rolling into March should pick up this week

- Another spread that should start picking up going into Thursday/Friday is the Gilt roll into the March contract.

- First notice is on the 29th.

- Roll pace is so far just 1%.

FOREX: USD Index Falters, Led Lower by USD/CNH

- The USD Index sits slightly softer, partially erasing the Monday strength as the currency recouples with the US yield curve. 10y yields sit lower by close to 4bps, keeping yields close to yesterday's lows of 3.758%.

- NZD is on the front foot, with markets again posturing ahead of the RBNZ decision on Wednesday. The bank are expected to raise rates by a further 75bps to 4.25%.

- USD/CNH backtracked in early European / late Asia-Pac hours, putting the pair back below the 50-dma in a move that may raise suspicion of official intervention in the currency. No specific headline trigger or newsflow to prompt the move, with USD/CNH now partially erasing the uptick posted early Monday. Any break below 7.1136 opens losses toward 7.1031, the 50% retracement for the Nov 14 - Nov 21 upleg.

- Canadian retail sales, Eurozone consumer confidence and Richmond Fed Manufacturing Index make up the data calendar, with speakers from central banks including Fed's Mester, George and Bullard as well as BoC's Rogers and testimony from the UK Chancellor Jeremy Hunt.

FX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9835-50(E878mln)

- USD/CNY: Cny7.1000($525mln), Cny7.2500($810mln)

Price Signal Summary - Oil Futures Remain Vulnerable

- On the commodity front, short-term trend conditions in Gold are unchanged and remain bullish. The latest pullback is considered corrective. Recent gains resulted in the break of $1729.5, the Oct 4 high. This has strengthened the current bullish theme and opens $1800.0 and a key resistance at $1807.9, Aug 10 high. Initial firm support is seen at $1702.3, the Nov 9 low.

- In the Oil space, WTI futures sold off sharply Monday before retracing its losses. A bearish theme remains in place following recent weakness and an extension of the reversal from $92.53, Nov 7 high. Support at $80.49, Oct 18 low and a bear trigger, was cleared Friday. $79.11, 76.4% of the Sep 28 - Nov 7 bull phase has also been cleared. Attention is on $74.96, the Sep 28 low and the next key support. Initial firm resistance is seen at $85.38, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/11/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/11/2022 | 1600/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 22/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/11/2022 | 1645/1145 |  | CA | BOC's Sr Deputy Rogers talk on financial stability | |

| 22/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 22/11/2022 | 1915/1415 |  | US | Kansas City Fed's Esther George | |

| 22/11/2022 | 1945/1445 |  | US | St. Louis Fed's James Bullard | |

| 23/11/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/11/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/11/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/11/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/11/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/11/2022 | 0830/0930 |  | EU | ECB de Guindos at Encuentro del Sector Financiero | |

| 23/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 23/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/11/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/11/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/11/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/11/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/11/2022 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2022 | 1900/1400 |  | US | FOMC minutes | |

| 23/11/2022 | 1900/1900 |  | UK | BOE Pill Speech at Beesley Lecture Series | |

| 23/11/2022 | 2130/1630 |  | CA | Governor Macklem testifies at House finance committee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.