-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Greenback Touches One Month Lows

HIGHLIGHTS:

- Greenback ebbs lower still, USD Index hits lowest level since late June

- Treasuries are weaker off the Powell presser highs, with curve steepening

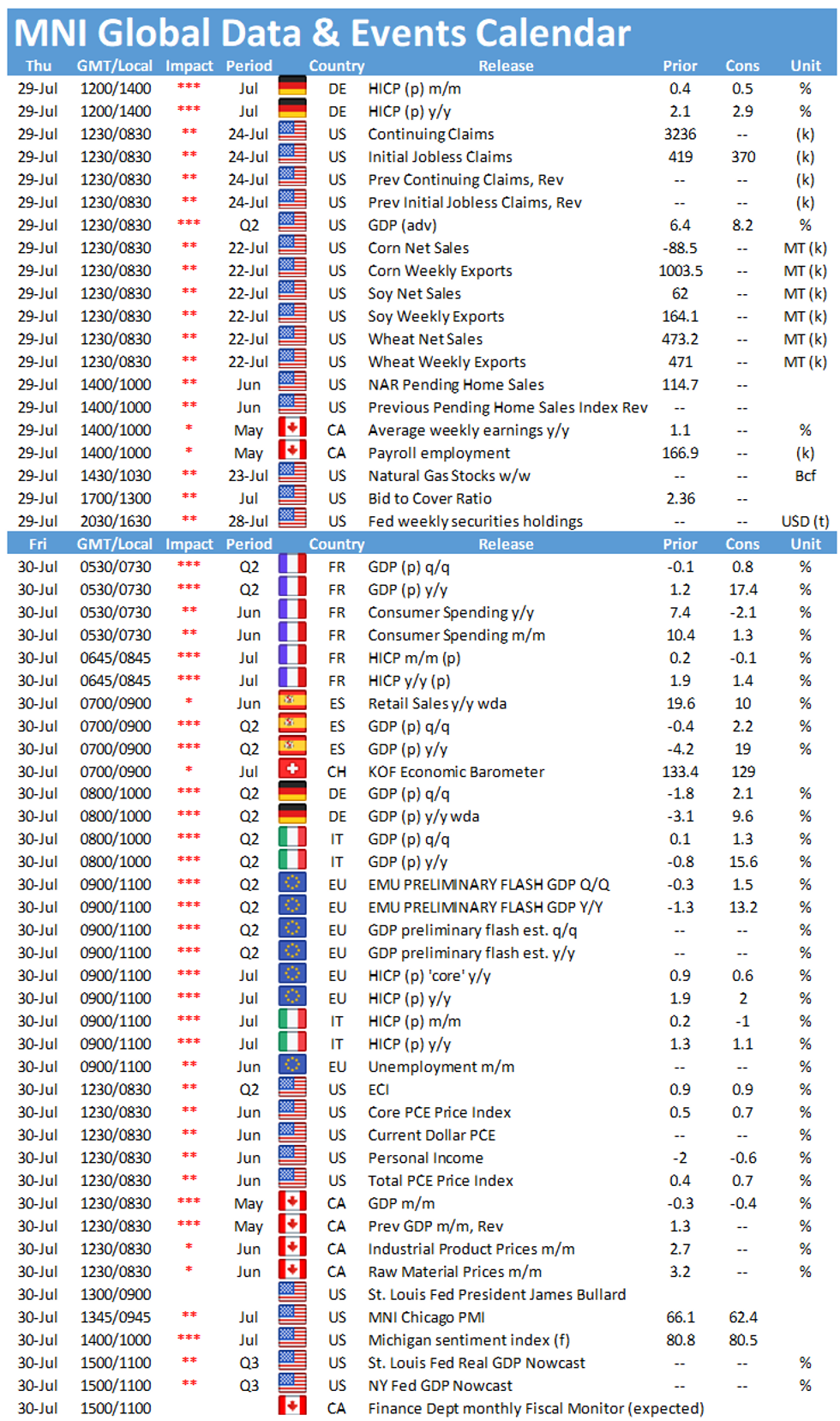

- Weekly jobless claims, advance GDP and pending home sales due

US TSYS SUMMARY: Resolving Weaker Ahead Of GDP, Claims Data

Treasuries have weakened with bear steepening in the curve in European trading, with GDP and jobless claims data awaited.

- TYs are now testing Thursday's post-FOMC Statement lows and well off the post-Powell press conference highs.

- Our review of the FOMC meeting will be out later this morning - we haven't seen any significant changes in sell-side tapering views emerge from yesterday's decision.

- Global equities have stabilized, in part on Chinese authorities' efforts to calm markets. The dollar is weaker (by 0.3-0.4% vs EUR and GBP).

- We get the first read of 2Q GDP at 0830ET, alongside jobless claims. Pending home sales at 1000ET.

- In supply: 1130ET sees $ combined in 4-/8-week bill auctions, with $62B 7Y Note auction at 1300ET. NY Fed buys ~$2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: Risk On

Following the relatively upbeat message about the economy from the FOMC yesterday (making progress on employment and inflation, while still highlighting that there is further to go), markets have turned distinctly risk on this morning. Sovereign curves bear steepening, equities are pushing higher and the dollar is on the back foot against G10 FX.

- Gilts have sold off with yields 2-3bp higher and the curve marginally steeper.

- The bund curve has similarly steepened with the 2s30s spread 2bp wider.

- OATs have slightly underperformed bunds with yields broadly 1bp higher across the curve.

- Regional German CPI data for July surged sharply to 3.4-4.3% YY, setting up a strong national print, which will be published at 1300BST.

- Supply this morning came from Italy (BTPs, CCTeu, EUR7.75bn).

EUROPE ISSUANCE UPDATE

Italy Sells E8.75bn of BTPs/CCTeu vs E7.25-8075bn Target:

- E4.5bn of the 0.00% Aug-26 BTP; Average yield 0.02%, bid-to-cover 1.29x

- E3.0bn of the 0.95% Dec-31 BTP; Average yield 0.66%, bid-to-cover 1.33x

- E1.25bn of the Apr-29 CCTeu; Average yield 0.05%, bid-to-cover 1.86x

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 175.5/178 Combo, bought the put for 15 and 16 in 25k

DUU1 112.20/112ps, bought for half in 5kDUU1 112.30/112.20ps 1x2, bought for 2 in 1k

UK:

0LX1 99.875c, bought for 0.75 in 10k (20k total this week)

US:

TYU1 133.25p, bought for '20 in ~7kTYV1 132/131ps 1x2, bought for -1 (receive) in 2.5k

FOREX: USD Ebbs in Extension of Post-Fed Trend

- Greenback is extending the post-Fed weakness in early Thursday trade, with the USD comfortably the poorest performer in G10 ahead of NY hours. This puts the USD Index at its lowest level since late June, with 92.00 figure seen providing minor support.

- Haven currencies are following the USD lower, with the main beneficiaries being NOK, AUD and NZD. The upside in NZD/USD is running against the short-term trend indicators (50-dma < 200-dma) and faces first resistance at the late July highs of 0.7010.

- Regional German CPIs have tended to edge higher, supporting the market consensus that the nationwide reading will accelerate to 3.2% from 2.3% later today.

- The advance US GDP release for Q2 is also due, with growth seen accelerating to 8.5% from 6.4% on an annualized basis. Pending home sales data could also take some focus given the sharp miss on expectations in the new home sales figure earlier in the week.

FX OPTIONS: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.3bln), $1.1850-70(E3.0bln), $1.1895-00(E750mln)

- USD/JPY: Y110.00-10($593mln), Y110.90($705mln)

- GBP/USD: $1.3750-55(Gbp539mln)

- AUD/USD: $0.7385-00(A$835mln), $0.7500(A$556mln)

- USD/CAD: C$1.2315-30($1.0bln), C$1.2445-55($540mln)

- USD/CNY: Cny6.4000($1.2bln), Cny6.4500($500mln), Cny6.4615($1.3bln), Cny6.5000($945mln)

Price Signal Summary - USD Faces Selling Pressure

- In the equity space, the recent pullback in the S&P E-minis is considered corrective. The outlook is bullish and the focus is on 4420.92, 0.764 projection of the Jun 21 - Jul 14 - 19 price swing. Support is at 4342.30, the 20-day EMA. EUROSTOXX 50 futures are firmer and back above the 4100.00 handle. A bullish theme dominates signalling potential for a climb towards 4153.00 key resistance, Jun 17 high. Support is at 4029.50, Jul 22 high.

- In FX, the USD is facing some selling pressure. EURUSD has traded above 1.1851, Jul 15 high. The focus is on the 50-day EMA at 1.1917. This represents an important resistance area. GBPUSD continues to climb. The pair has cleared its 50-day EMA strengthening the current bullish recovery. The next band of resistance is at 1.3990, 61.8% retracement of the Jun 1 - Jul 20 sell-off and 1.4001, the Jun 23 high. USDJPY remains above 109.07, Jul 19 low. This represents the key short-term support and the bear trigger. Key near-term resistance is 110.70, Jul 14 high. A break of 110.70 would be bullish.

- On the commodity front, Gold is recovering from recent lows. The focus is on the bull trigger at $1834.1, Jul 15 high. Key short-term support is at $1790.0, Jul 23 low. Brent (U1) has cleared $73.87, 61.8% of the Jul 6 - 20 downleg and has tested $75.39, the 76.4% level. An extension would open $76.72, Jul 14 high. WTI (U1) is firmer and the focus is on $73.46, 76% of the Jul 6 - 20 downleg.

- Within FI, Bund futures remain firm and edged higher earlier today. The focus is on 176.79, 1.50 projection of the May 19 - Jun 11 - Jun 22 price swing. Gilts maintain a bullish tone. The recent break of 129.92, Jul 8 high opens 130.72, 2.236 projection of the May 13 - 26 - Jun 3 price swing. We continue to monitor a bearish candle pattern, an evening star reversal from the Jul 21 close. A deeper pullback would expose 128.54, low Jul 14.

EQUITIES: European Markets Edge Higher Despite Mixed US Close

- Cash stock markets finished flat following the Fed, but that hasn't prevented European indices from creeping higher ahead of NY hours, with outperformance in UK and Italian equities leading the way higher. Europe's energy and financials sectors are leading the way higher, more than countering the weakness in real estate and communication services.

- In futures space, the e-mini S&P and Dow Jones contracts are in modest positive territory, but the NASDAQ future sits slightly lower. the recent pullback in the S&P E-minis is considered corrective. The outlook is bullish and the focus is on 4420.92, 0.764projection of the Jun 21 - Jul 14 - 19 price swing. Support is at 4342.30,the 20-day EMA.

- Earnings remain a focus, with updates due from Mastercard, Amazon and T-Mobile among others.

COMMODITIES: Energy Markets Benefit From Softer Greenback

- The greenback is extending it's post-Fed pullback ahead of NY hours Thursday, putting the USD Index at its lowest levels since the end of June. As a result, commodity markets have been buoyed from the off, with WTI futures showing back above the $73/bbl level.

- Attention turns to the raft of US data due later today, with GDP, pending home sales and weekly jobless claims data on the docket. EIA NatGas Storage Change also crosses, with markets expecting a build of 42BCF in the most recent week.

- Gold has recovered from recent lows and support has remained intact. The outlook is bullish and the recent pullback is considered corrective. Price however needs to clear $1834.1, Jul 15 high to confirm a resumption of the bull cycle.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.