-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Jobs Data in Focus Ahead of Friday's NFP

HIGHLIGHTS:

- USD declines as Russia outline plans to drop USD holdings to zero

- UK composite PMI hits series record, highest since data began in 1998

- Data in focus, ISM Services, ADP due ahead of tomorrow's NFP

US TSYS SUMMARY: Modest Weakness Ahead Of Labor Market And Services Data

Treasuries have drifted lower in overnight trade Thursday with modest bear steepening, as we gear up for a series of key labor market data today and Friday.

- Sep 10-Yr futures (TY) down 2.5/32 at 131-27.5 (L: 131-26.5 / H: 131-31.5) Light volumes (~190k traded).

- The 2-Yr yield is up 0.2bps at 0.1466%, 5-Yr is up 1.1bps at 0.8044%, 10-Yr is up 1.4bps at 1.6011%, and 30-Yr is up 1.5bps at 2.2867%.

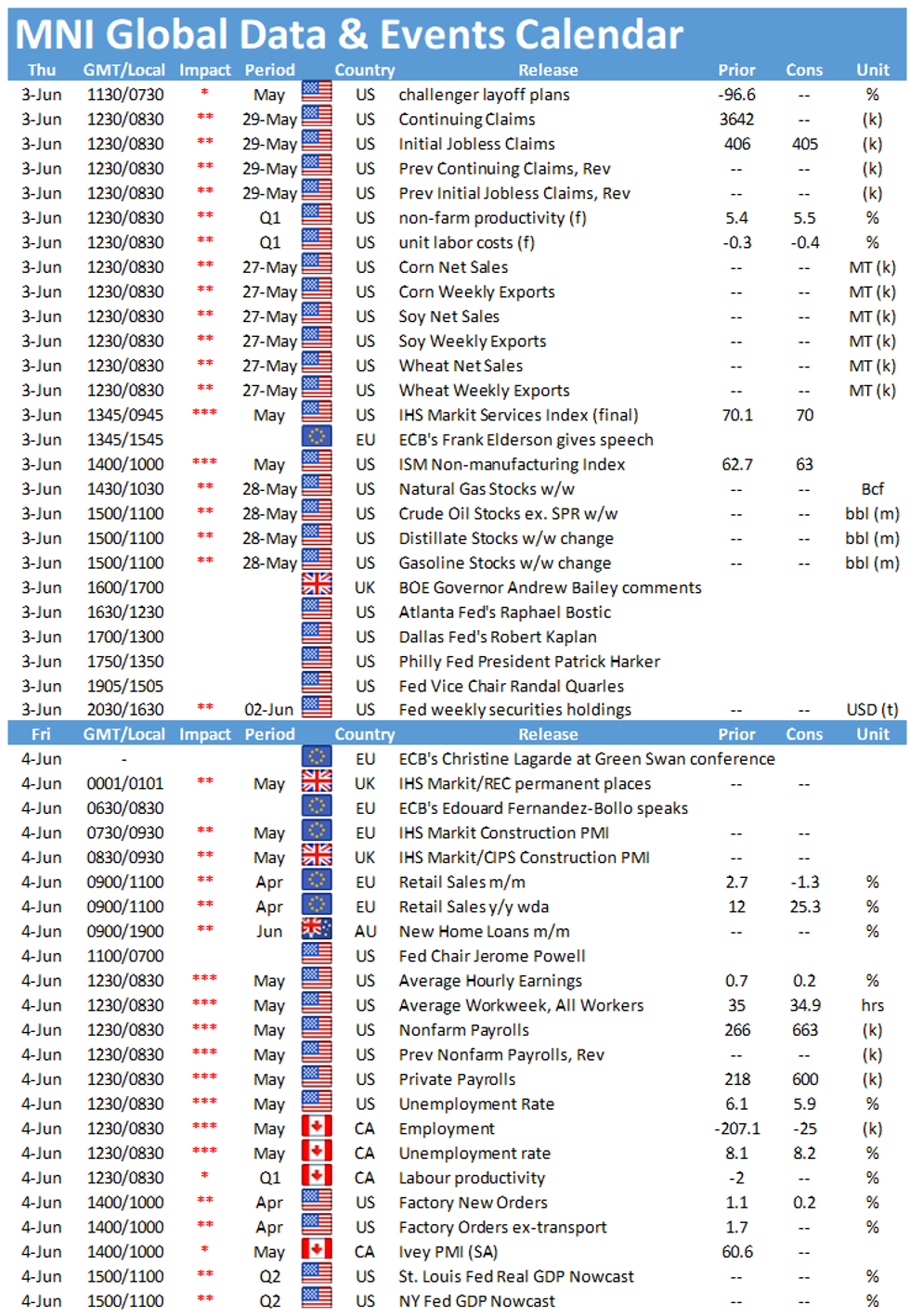

- Today's data lineup, which will be viewed with Friday's employment report in mind: Challenger Job Cuts (0730ET), ADP employment (0815ET), jobless claims (0830ET), productivity/ULC (also 0830ET), final Services PMI (0945ET), and ISM Services (1000ET).

- Fed speakers today are all in the afternoon: Atl Pres Bostic (1230ET), Dallas' Kaplan (1300ET), Philly's Harker (1350ET), and VC Quarles (1505ET).

- Reports overnight suggested that the White House and Senate Republicans remain far apart in infrastructure negotiations, with the GOP potentially making another counteroffer Friday.

- In supply, $80B combined of 4-8-week bills sell at 1130ET. NY Fed buys ~$2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: EGBs Trade Within Ranges

- EGBs have traded within ranges and mostly better offered weighted by heavy supplies from Spain and France this morning.

- Bunds has traded lower on delta hedging, but also helped by the stronger Services PMIs throughout Europe.

- Rolling positions into September is again leading in terms of volumes with investors taking a breather before the US NFP release tomorrow, for clue on the US Labour market recovery.

- Attention though, will be quickly turning towards ECB next week.

- Gilts are underperforming against EGBs, down 23 ticks at the time of typing, pushing the UK/German 10yr spread wider on the session by 1.9bp.

- Curves across the board trades bear steeper, but contract stays within ranges.

- Looking ahead, US ADP, IJC, Service PMI will be final, so more focus on the ISM service index.

- Speakers include BoE Bailey, Fed Bostic, Kaplan, Harker, Quarles

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 172.50/171.50ps 1x1.5, bought for 7 in 2k

RXQ1 173/174.5cs 1x3, sold at 1 in 1k (1kx3k)

OEU1 133.50/133ps, bought for 11 in 1k

3RM1 100.25p, sold at 3 in 5k (ref 100.235, -63 del)

EUROPE ISSUANCE UPDATE: French, Spanish Auctions

Spain sells:- E1.826bln 0% Jan-26 Bono, Avg yield -0.247% (Prev. -0.240%), Bid-to-cover 1.60x, (Prev. 2.08x)

- E1.550bln 1.45% Oct-27 Obli, Avg yield -0.025% (Prev. -0.132%), Bid-to-cover 1.76x (Prev. 2.34x)

- E1.587bln 1.20% Oct-40 Obli, Avg yield 1.144% (Prev. 0.619%, Bid-to-cover 1.68x (Prev. 1.30x)

- E0.511bln 0.65% Nov-27 Obli-Ei, Avg yield -1.383% (Prev. -1.147%), Bid-to-cover 1.74x (Prev. 1.92x)

- E6.270bln 0% Nov-31 OAT, Avg yield 0.160% (Prev. 0.130%), Bid-to-cover 1.98x (Prev 1.73x)

- E1.612bln 4.00% Apr-55 OAT, Avg yield 0.950% (Prev. 0.320%), Bid-to-cover 2.07x (Prev 1.77x)

- E1.308bln 0.50% May-72 OAT, Avg yield 1.110% (Prev. 0.593%), Bid-to-cover 1.87x

- E1.803bln 0.50% Jun-44 Green OAT, Avg yield 0.740% (Prev. 0.526%), Bid-to-cover 1.79x

FOREX: GBP Higher as Composite PMI Hits Series Record

- Having rolled off the week's highs of 1.4248 over the past few sessions, GBP is the strongest performer in G10 so far Thursday, with a decent final revision to May services PMI adding a tailwind. This bumped the composite PMI for May to 62.9, the highest such reading since the series began in 1998. GBP/USD eyes first resistance at 1.4248, which marks fresh 2021 highs, ahead of 1.4315, April 18 2018 high.

- Markets watch the release of ADP employment change today, weekly jobless claims and ISM services data. The manufacturing ISM earlier this week showed a sharp slowdown in the employment subcomponent, raising focus for Friday's nonfarm payrolls release, in which markets see net gains of around 650k jobs. The whisper number for Friday's headline is currently at a lofty 780k.

- Speeches are due from BoE's Bailey, Fed's Bostic, Kaplan, Harker and Quarles.

Dollar Drifts as Russia Outline Plans to Slash USD Holdings to Zero

- The USD is slipping ahead of NY hours, reversing earlier session strength as markets respond to the outlined plans for the Russian Wealth Fund to cut their USD holdings to zero. The shift sees the wealth fund instead rotate into primarily EUR, Gold and CNY and, to a lesser extend, JPY and GBP.

- EUR/USD added around 20 pips to trade back above the $1.22 level, while GBP/USD showed briefly back above $1.42.

- US equities ebbed lower following the headlines, with the e-mini S&P shedding around 10 points to hit new daily lows of 4,190.00.

FX OPTIONS: Expiries for Jun03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E1.4bln), $1.2067-75(E587mln), $1.2100-15(E1.3bln-EUR puts), $1.2150-70(E794mln-EUR puts), $1.2200-20(E933mln-EUR puts), $1.2250-55(E532mln-EUR puts), $1.2300-05(E1.0bln-EUR puts)

- USD/JPY: Y107.75($950mln), Y108.75-90($1.1bln-USD puts), Y109.00-10($1.7bln-USD puts), Y109.15-25($1.1bln), Y109.40-50($856mln-USD puts), Y109.98-110.00($1.5bln), Y110.45-50($521mln-USD puts), Y110.70-75($675mln)

- GBP/USD: $1.3969-70(Gbp444mln), $1.3990-00(Gbp653mln-GBP puts), $1.4100(Gbp721mln-GBP puts), $1.4250(Gbp409mln)

- AUD/USD: $0.7715-30(A$783mln-AUD puts), $0.7835-40(A$812mln)

- EUR/CAD: C$1.4700-05(E930mln-EUR puts)

- USD/CNY: Cny6.42($700mln)USD/MXN: Mxn19.49-50($1.1bln)

Price Signal Summary - Bunds Remain Below Resistance

- In the equity space, S&P E-minis continue to consolidate ahead of resistance at 4238.25 May 10 high. Key trend support is unchanged at 4029.25, May 13 low. The 20-day EMA represents initial support at 4170.22. A break would signal scope for a deeper pullback.

- In the FX space, the EURUSD outlook remains bullish. Key short-term directional parameters have been defined. They are; 1.2133 support, May 28 low and 1.2266 resistance, May 25 high. The latter is the bull trigger. A break of the former would signal scope for a deeper corrective pullback. GBPUSD traded above resistance at 1.4237, Feb 24 high on Tuesday but has since pulled back. A clear break higher would confirm a resumption of the broader uptrend. Support to watch lies at 1.4092, May 27 low. USDJPY attention is on 110.20, May 28 high where a break would resume the recent recovery. Key support is unchanged at 108.56, May 25 low.

- On the commodity front, Gold remains bullish despite this week's pullback. The focus is on the Jan 8 high of $1917.6. The trend remains overbought and we continue to monitor this technical warning sign. $1872.8, May 25 low marks initial support. Trend conditions in Oil remain bullish. Brent (Q1) gains have opened $72.21 next, 0.764 projection of the Mar 23 - May 18 - May 21 price swing. WTI (N1) is approaching the $70.00 psychological level.

- Within FI, Bunds (M1) remain below the 50-day EMA at 170.38. While it holds, the outlook is bearish. A clear break of the average is required to highlight scope for further gains. Support is at 169.02. May 24 low. Gilts (U1) remains below resistance at 127.74/82, highs between Apr 20 and May 26. A bearish risk remains present.

EQUITIES: European Indices Drift as US Data Due

- After a solid Wednesday session, European equity markets are drifting ahead of the NY crossover, with losses led by the UK's FTSE-100, lower by 0.7%, as GBP strength adds to the downside pressure.

- Across the continent, utilities and real estate names are leading the decline, with the consumer discretionary sector the only group to post (mild) gains ahead of the halfway point of the session.

- US futures are tilted slightly lower, with the e-mini S&P rolling further off the week's highs of 4,230. NASDAQ futures are underperforming, pointing to a negative open of around 0.3% in a few hours' time.

- US data will likely prove a decent driver going forward, with ADP employment change, weekly US jobless claims and the ISM services index all due.

COMMODITIES: Precious Metals Underperforming As Dollar Strengthens

- WTI Crude up $0.13 or +0.19% at $69.09

- Natural Gas down $0 or -0.13% at $3.086

- Gold spot down $14.18 or -0.74% at $1897.21

- Copper up $0.45 or +0.1% at $460.7

- Silver down $0.33 or -1.16% at $27.8715

- Platinum down $7.04 or -0.59% at $1187.41

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.