-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY on Backfoot as Uchida Talks Down Tightening Cycle

Highlights:

- JPY under pressure as BoJ Deputy Governor Uchida talks down protracted phase of tightening

- Weekly jobless claims provide latest look at US labour market

- Heavy session for central bank speak, with Fed, ECB, BoE and RBA on tap

US TSYS: Modestly Cheaper Amidst Light Volumes, Jobless Claims In Focus

- Cash Tsys see some light cheapening pressure in recent trade to sit 0-1.5bp cheaper on the day, led by 10s in a reversal after yesterday’s well-received 10Y supply.

- An initial light bid was seen on dovish (at least vs. market pricing/expectations) comments from BoJ Dep Gov Uchida and softer-than-expected China CPI, before more than reversing those gains as Gilts/EGB’s pushed lower.

- TYH4 has recently touched session lows of 111-00 on low volumes of 245k, especially low compared to recent sessions. Support remains exposed with the bear trigger at 110-22+ (Feb 5 low).

- Today sees data focus on jobless claims data – where we’ll especially be looking at non-seasonally adjusted continuing claims data after a recent push higher – before 30Y supply in an otherwise light docket. CPI revisions land tomorrow (see here).

- Data: Weekly jobless claims (0830ET), Wholesale sales/inventories Dec/Dec F (1000ET)

- Fedspeak: Barkin ('24 voter) on BBG TV at 0830ET before Economic Club of NY at 1205ET (incl text)

- Note/bond issuance: US Tsy $25B 30Y Bond auction - 912810TX6 (1300ET)

- Bill issuance: US Tsy $95B 4W, $90B 8W Bill auctions (1130ET)

Fed Rate Path Holds Post Fedspeak Drift Higher

- Fed Funds implied rates are almost unchanged overnight, holding yesterday’s push higher after yesterday’s Fedspeak removed the possibility of any material dovish surprises (e.g. Kugler's speech generally including Q&A that banking sector generally sound, Collins on a methodical adjustment to the policy stance for cuts later this year).

- Cumulative cuts: 6bp Mar, 21bp May, 43bp Jun and 120bp Dec.

- Richmond Fed’s Barkin (’24 voter) appears twice today but spoke in depth yesterday including how it makes sense to be patient on rate cuts whilst waiting to see if disinflation becomes more broad-based.

- On the balance sheet, NY Fed’s Remache said future demand for O/N RRP is an important question with the Fed watching money market conditions as usage falls whilst a return to pre-Covid balance sheet size is unlikely.

OI Points To Mix Of Short Setting & Long Cover on Wednesday

The combination of yesterday’s downtick in Tsy futures and preliminary OI data points to a mix of net short setting (TU, FV & UXY) and net long cover (TY, US & WN) on the day, which essentially balanced out in terms of the net curve DV01 equivalent OI change.

- Bids derived from strong demand metrics at the latest round of 10-Year Tsy supply and NYC Bancorp worry ultimately faded into the close. Fedspeak helped cap/counter the richening, as did a late block sale in the futures space.

| 07-Feb-24 | 06-Feb-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,952,710 | 3,935,061 | +17,649 | +637,278 |

| FV | 5,821,968 | 5,818,638 | +3,330 | +141,089 |

| TY | 4,672,121 | 4,677,098 | -4,977 | -316,223 |

| UXY | 2,187,774 | 2,183,446 | +4,328 | +392,597 |

| US | 1,423,977 | 1,424,410 | -433 | -58,245 |

| WN | 1,648,562 | 1,650,534 | -1,972 | -414,888 |

| Total | +17,925 | +381,608 |

OI Points to Mixed Positioning Swings Across SOFR Futures Strip On Wednesday

The mix of Wednesday's weakness across most of the SOFR futures strip and preliminary OI data points to the following positioning swings:

- Whites: Apparent net long cover (SFRZ3) and modest net short setting (SFRU4). It is hard to be conclusive when it comes to SFRH4 & M4 given their unchanged price status come settlement.

- Reds & Greens: Apparent net short setting in all contracts.

- Blues: A mix of apparent net short setting (SFRZ6 & U7) and long cover (SFRH7 & M7)

- A reminder that Fedspeak helped counter worries re: NYC Bancorp when it came to Wednesday's price action

| 07-Feb-24 | 06-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,182,454 | 1,209,265 | -26,811 | Whites | -1,190 |

| SFRH4 | 1,175,033 | 1,171,628 | +3,405 | Reds | +30,063 |

| SFRM4 | 1,045,351 | 1,023,388 | +21,963 | Greens | +36,746 |

| SFRU4 | 873,208 | 872,955 | +253 | Blues | +848 |

| SFRZ4 | 1,055,530 | 1,046,620 | +8,910 | ||

| SFRH5 | 602,226 | 593,031 | +9,195 | ||

| SFRM5 | 670,186 | 662,724 | +7,462 | ||

| SFRU5 | 599,682 | 595,186 | +4,496 | ||

| SFRZ5 | 696,366 | 683,890 | +12,476 | ||

| SFRH6 | 441,598 | 430,180 | +11,418 | ||

| SFRM6 | 463,420 | 451,749 | +11,671 | ||

| SFRU6 | 304,889 | 303,708 | +1,181 | ||

| SFRZ6 | 274,609 | 270,213 | +4,396 | ||

| SFRH7 | 153,619 | 154,611 | -992 | ||

| SFRM7 | 150,332 | 153,508 | -3,176 | ||

| SFRU7 | 148,139 | 147,519 | +620 |

EUROPE ISSUANCE UPDATE:

Finland ORI Operation auction results

- E151mln of the 0.50% Sep-28 RFGB. Avg yield 2.595% (bid-to-cover 4.01x)

- E251mln of the 1.125% Apr-34 RFGB. Avg yield 2.864% (bid-to-cover 2.55x).

UK: Opposition Labour Set To Sideline GBP28bn Green Investment Plan

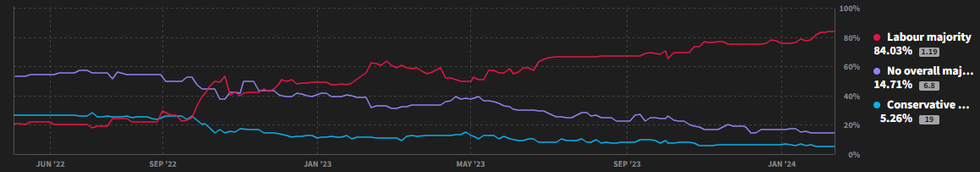

The main opposition centre-left Labour party is later today set to sideline its highly-trailed GBP28bn 'green investment' plan that it has previously indicated would be a key pillar of its manifesto ahead of the general election expected later in 2024. Policies of opposition parties would not ususally garner much market interest. However, the strong likelihood of Labour coming to power in the election (84% implied probability of winning a majority according to betting markets) means that policy announcements by Sir Keir Starmer are likely hove into view as the election approaches given their potential impact on gov't finances and the overall state of the British economy.

- When first announced in Sep 2021, the GBP28bn plan that included major offshore wind network construction and development of electric vehicle infrastructure, was due to be implemented in Labour's first year in power. This was subsequently pushed back to halfway through the parliament.

- With households tackling inflationary pressures and a high tax burden, it would appear Labour has sought to burnish its economic credentials rather than pursing their previously stated green energy aims. The party has a set of states 'fiscal rules', one of which is seeing gov't debt decline as a proportion of the economy by the end of the next parliament.

- The jettisoning of the GBP28bn pledge is seen as an attempt to ensure these rules are met and fend off Conservative attacks about the green investment plan pushing up taxes.

Source: Smarkets. N.b. Purple line-No overall majority, Blue line-Conservative Majority

Source: Smarkets. N.b. Purple line-No overall majority, Blue line-Conservative Majority

MNI Riksbank Analysis – Implications Of The Recapitalisation

The Riksbank announced on January 10 that, to restore its equity to basic levels, it would require a capital injection of approximately SEK40bln from the Riksdag. Initial estimates, announced on Oct 24, 2023, looked for an injection of closer to SEK80bln.

For our full PDF analysis, including a petition size scenario analysis, analyst views and MNI Policy Team exclusives, please see the following link:

MNI - Details and Implications Of The Riksbank's Capital Injection - 240208.pdf

FOREX: JPY Fades as Uchida Talks Down Protracted Tightening Cycle

- JPY trades softer headed into NY hours, with markets focusing on the comms policy from BoJ's Uchida overnight. The policymaker acknowledged the likely need for tighter policy in Japan in the near-term, but played down the prospect of a more protracted tightening cycle after a first theoretical rate hike. He stated that it is hard to see Japan requiring a sharp hiking pace after rate lift-off, helping a recovery in EUR/JPY toward the upper-end of the January/February range.

- CHF sits at the upper-end of the G10 table, reversing a small part of the Wednesday weakness. Resultingly, EUR/CHF is trading back toward the 50-dma mark at 0.9400 - tempering the sharp rally off the February lows.

- GBP similarly trades well, with GBP/USD firmer for a third session, narrowing the gap with 1.2678, the 50-dma. Further progress here opens 1.2673, the 50% retracement for the downleg from the late Dec cycle high. Broader macro newsflow has been few and far between but markets continue to note a possible bottoming-out of the housing market, as the RICS house price balance data improved ahead of expectations, reinforcing the message from last week's upswing in the Nationwide House Price Index.

- Weekly jobless claims data provide the latest look at the US jobs market, with wholesale trade sales and inventories data set to follow. The speakers slate is again busy, with Fed's Barkin, ECB's Vujcic, Wunsch and Lane as well as BoE's Mann on the docket.

Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0745-50(E2.0bln), $1.0800-20(E2.5bln)

- USD/JPY: Y146.25-30($1.7bln), Y147.50($771mln), Y147.75-80($2.4bln), Y148.00($530mln), Y149.00($518mln), Y150.00($541mln)

- GBP/USD: $1.2585-00(Gbp1.1bln)

- EUR/GBP: Gbp0.8475-85(E1.1bln)

- AUD/USD: $0.6520(A$611mln), $0.6565(A$692mln), $0.6670(A$938mln), $0.6700-20(A$1.7bln)

- NZD/USD: $0.6050-60(N$517mln), $0.6140(N$593mln)

Subdued Activity Presses G10 Implied to New Lows

- Wednesday marked another session of declining FX options volumes, with DTCC data showing just over $80bln in contract notional traded vs. the average 2024 daily turnover of ~$91bln.

- Asia-Pac and early European trade looks to extend the theme, with activity pretty light again overnight. Muted markets are led by China, with CNY hedging considerably below average as markets head into the Lunar New Year – however the pattern is consistent across much of G10.

- Coinciding with the fade in volumes for G10 FX options, implied vols are under further pressure, with AUD/USD, GBP/USD, EUR/GBP, EUR/NOK and EUR/SEK 3m implied at, or extremely close to, 12m lows.

- JPY hedging was marginally more active overnight following Uchida’s speech. USD/JPY downside protection was favoured, evident in the put/call ratio approaching 2.00. 1-Month USD/JPY put vols cleared to new YTD lows of 8.9 points overnight – cheapening downside to a near 3-month low.

Figure 1: Quieter FX volumes reflected in range-lows for G10 FX implied vols

EGBS: Core/Semi-Core Off Session Lows; Peripheries Tighten

Core/semi-core EGBs have recovered from intraday lows, with little in the way of fundamental drivers prompting the reversal.

- Bunds are now -10 ticks at 134.20, +32 ticks above this morning's low. Well-defined technical levels contain price action, with 133.76 (Feb 6 low) the first support and 134.84 (20-day EMA) the first resistance. OATs are -5 ticks 128.74.

- German and French cash yields are flat to -2bps lower, while 10-year periphery spreads to Bunds have tightened, the latter aided by this morning's gains of Estoxx futures. The 10-year BTP/Bund spread is -1.1bps tighter at 156.2bps at typing.

- The MNI Policy Team reported this morning that the EU is nearing a deal on fiscal rules this week in three-way institutional talks.

- The remainder of today's docket features scheduled remarks from ECB's Lane at 1530GMT/1630CET, with comments from Vujcic and the usually hawkish Wunsch also scheduled at 1100GMT/1200GMT respectively.

GILTS: Curve a Little Flatter, Yields Off Session Highs in Fairly Contained Trade

Gilt traders have seemingly been happy to track the ebb and flow of wider core global FI markets early today.

- Headline flow has been light since London trade got underway, with much of the Asia-Pac focus falling on the dovish tinge (at least vs. wider market expectations) in the latest address from a BoJ Deputy Governor and a softer-than-expected round of Chinese CPI data, before the modest richening impulse quickly faded from most of the wider core global FI markets.

- Domestic news flow has not been market moving.

- The initial London move lower in futures/higher in yields has faded from extremes.

- Gilt futures sit -13 as a result, with the contract in the middle of its early 40-tick session range. Initial technical parameters on either side of current levels remain untouched.

- Cash gilt yields are 1bp higher to 2bp lower as the curve twist flattens.

- 2s10s continues to coil in a tight range (at least this week), while 5s30s flattens to fresh ’24 extremes.

- STIR markets are pretty much in line with pre-gilt open levels. SONIA futures sit flat to 4.5 lower through the blues, while BoE-dated OIS shows ~84bp of cuts through ’24.

- Comments from BoE hawk Mann (15:00 London) headline the local docket today.

EQUITIES: E-Mini S&P Holding Onto This Week's Gains

- Eurostoxx 50 futures traded higher yesterday and again delivered fresh cycle highs, confirming a resumption of the current uptrend. This reinforces the bullish importance of the recent break of a key resistance at the Dec 14 high of 4634.00. The clear breach of the 4700.00 handle paves the way for a climb towards 4725.50, a Fibonacci projection. Initial firm support lies at 4607.40, the 20-day EMA.

- The trend condition in S&P E-Minis is unchanged and remains bullish - yesterday’s gains reinforce current conditions. The contract has traded to a fresh cycle high, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on 5050.14, a Fibonacci projection. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES: Recent Short-Term Gains in WTI Futures Considered Technically Corrective

- WTI futures remain soft following last week’s steep sell-off and short-term gains are considered corrective. A resumption of weakness would expose support at $70.62, the Jan 17 low, and $69.56, the Jan 3 low. For bulls, a reversal higher is required to refocus attention on the key short-term resistance at $79.29, the Jan 29 high. Clearance of this level would reinstate a bullish theme. Initial resistance is at $76.95, the Feb 1 high.

- Gold is unchanged and the metal continues to trade above the Jan 17 low of $2001.9. Recent short-term gains improved a bullish condition and a resumption of the bull cycle would signal scope for a climb towards $2088.5, the Dec 28 high and a key resistance. For bears, a stronger reversal lower would instead refocus attention on $2001.9, where a break is required to reinstate the recent bearish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 08/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/02/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2024 | 1500/1500 |  | UK | BoE's Mann Speaks At OMFIF | |

| 08/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 08/02/2024 | 1530/1630 |  | EU | ECB's Lane at Brookings Institution | |

| 08/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/02/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2024 | 1705/1205 |  | US | Richmond Fed's Tom Barkin | |

| 08/02/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 08/02/2024 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 09/02/2024 | 0700/0800 | *** |  | DE | HICP (f) |

| 09/02/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 09/02/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 09/02/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 09/02/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 09/02/2024 | 1415/1515 |  | EU | ECB's Cipollone speaks at Assiom Forex Annual Congress | |

| 09/02/2024 | 1530/1030 |  | CA | BOC Senior Loan Officer Survey | |

| 09/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 09/02/2024 | 1830/1330 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.