-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessOpposition Labour Set To Sideline GBP28bn Green Investment Plan

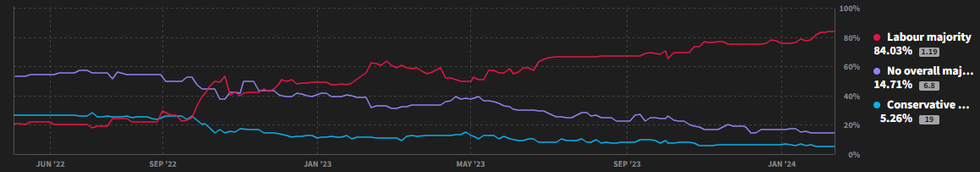

The main opposition centre-left Labour party is later today set to sideline its highly-trailed GBP28bn 'green investment' plan that it has previously indicated would be a key pillar of its manifesto ahead of the general election expected later in 2024. Policies of opposition parties would not ususally garner much market interest. However, the strong likelihood of Labour coming to power in the election (84% implied probability of winning a majority according to betting markets) means that policy announcements by Sir Keir Starmer are likely hove into view as the election approaches given their potential impact on gov't finances and the overall state of the British economy.

- When first announced in Sep 2021, the GBP28bn plan that included major offshore wind network construction and development of electric vehicle infrastructure, was due to be implemented in Labour's first year in power. This was subsequently pushed back to halfway through the parliament.

- With households tackling inflationary pressures and a high tax burden, it would appear Labour has sought to burnish its economic credentials rather than pursing their previously stated green energy aims. The party has a set of states 'fiscal rules', one of which is seeing gov't debt decline as a proportion of the economy by the end of the next parliament.

- The jettisoning of the GBP28bn pledge is seen as an attempt to ensure these rules are met and fend off Conservative attacks about the green investment plan pushing up taxes.

Source: Smarkets. N.b. Purple line-No overall majority, Blue line-Conservative Majority

Source: Smarkets. N.b. Purple line-No overall majority, Blue line-Conservative Majority

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.