-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US MARKETS ANALYSIS - Powell Appearance, 3y Supply in Focus

MNI (LONDON) - Highlights:

- Markets rangebound ahead of Fed risk, CPI later in the week

- Dry data calendar keeps focus on Fed's Powell

- 3y supply in view, ahead of 10y, 30y auctions tomorrow, Thursday

US TSYS: Mild Bear Steepening With Powell Eyed Before 3Y Supply

- Treasuries have seen a mild bear steepening as the longer end trims yesterday’s second half gains.

- Fed Chair Powell headlines the session with his Senate appearance – see STIR bullet.

- 3Y supply then kickstarts the week’s triple coupon issuance with 10s tomorrow and 30s on Thursday. The 3Y auction tailed by 1.1bp in June along with its lowest bid-to-cover since December.

- Cash yields range from +0.2bp (2s) to +1.3bps (20s). 2s10s at -33.7bps (+0.8bp) is off early July high of -27.4bps but relatively elevated by recent month standards.

- TYU4 at 110-14+ (- 04+) sits within yesterday’s range off highs of 110-20+ but more broadly consolidates Friday’s payrolls-driven gains. Volumes are subdued at 215k.

- Yesterday’s latest high marks tentative resistance before a more important bull trigger at 111-01 (Jun 14 high).

- Fedspeak: VC Supervision Barr on financial inclusion (0915ET, text only), Chair Powell semiannual testimony (1000ET), text + Q&A), Gov Bowman on financial inclusion (1330ET, text + Q&A).

- Note/bond issuance: US Tsy $58B 3Y Note auction (1300ET)

- Bill issuance: US Tsy $46B 52W Bill, $70B 42D CMB Bill auctions (1130ET)

STIR: Fed Rates Maintain Attention On September Cut Ahead Of Powell

- Fed Funds implied rates are little changed overnight although tilt to even lower odds of a July cut but marginally higher odds of a September cut.

- Cumulative cuts from 5.33% effective: 1bp Jul, 20.5bp Sep, 31bp Nov, 50bp Dec and 66bp Jan.

- Fed Chair Powell speaks in front of the Senate banking committee in day one of the two-day congressional semiannual testimony. He is due to start speaking at 1000ET, with good historical precedent for his prepared remarks to be released at the same time but we wouldn’t want to rule out an earlier release.

- He stuck to the prior script at his Sintra appearance on Jul 2. The Jun 12 FOMC press conference saw guarded optimism that the FOMC would receive further good news on inflation like the fresh May CPI report, but at this stage more is required to meet the "test" for cutting rates (the other "test" is an "unexpected deterioration in labor market conditions").

- Friday’s nonfarm payrolls report saw the unemployment rate rise further to 4.05%. It probably doesn’t meet an “unexpected” deterioration on its own (which Powell has previously indicated needs to be more than a couple tenths), but the trend is starting to be more notable having increased two tenths over the latest two months and is already above where the median FOMC participant sees it ending 2024.

US TSY FUTURES: OI Points To Net Short Setting In TU Through UXY Futures On Monday

Yesterday’s twist flattening of the Tsy futures curve and preliminary OI data points to net short setting as the dominant positioning factor in TU, FV, TY & UXY futures.

- This came after two days of net long setting in most contracts.

- Fed Chair Powell’s impending appearance may have driven some pre-event positioning.

| 08-Jul-24 | 05-Jul-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 4,291,524 | 4,287,479 | +4,045 | +154,392 |

| FV | 6,367,323 | 6,321,609 | +45,714 | +1,932,142 |

| TY | 4,487,096 | 4,467,091 | +20,005 | +1,295,090 |

| UXY | 2,087,455 | 2,085,566 | +1,889 | +169,254 |

| US | 1,678,719 | 1,678,822 | -103 | -13,570 |

| WN | 1,663,305 | 1,661,515 | +1,790 | +362,459 |

| Total | +73,340 | +3,899,767 |

STIR: OI Suggests Net Short Setting Dominated In SOFR Futures On Monday

Yesterday’s downtick in most SOFR futures points to net short setting as the dominant positioning factor through the greens, albeit with pockets of net long cover also seen.

- Price movements were limited on the day, leaving most to point to pre-Powell positioning adjustments after the recent run of net long setting/short cover.

| 08-Jul-24 | 05-Jul-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM4 | 1,200,115 | 1,190,998 | +9,117 | Whites | +17,304 |

| SFRU4 | 1,104,926 | 1,117,407 | -12,481 | Reds | +34,601 |

| SFRZ4 | 1,075,361 | 1,062,844 | +12,517 | Greens | +1,813 |

| SFRH5 | 826,424 | 818,273 | +8,151 | Blues | -7,549 |

| SFRM5 | 769,538 | 753,879 | +15,659 | ||

| SFRU5 | 669,001 | 659,032 | +9,969 | ||

| SFRZ5 | 833,263 | 828,771 | +4,492 | ||

| SFRH6 | 563,283 | 558,802 | +4,481 | ||

| SFRM6 | 487,645 | 483,194 | +4,451 | ||

| SFRU6 | 421,623 | 417,681 | +3,942 | ||

| SFRZ6 | 386,277 | 388,893 | -2,616 | ||

| SFRH7 | 250,171 | 254,135 | -3,964 | ||

| SFRM7 | 243,253 | 245,368 | -2,115 | ||

| SFRU7 | 186,169 | 184,598 | +1,571 | ||

| SFRZ7 | 170,240 | 178,548 | -8,308 | ||

| SFRH8 | 115,861 | 114,558 | +1,303 |

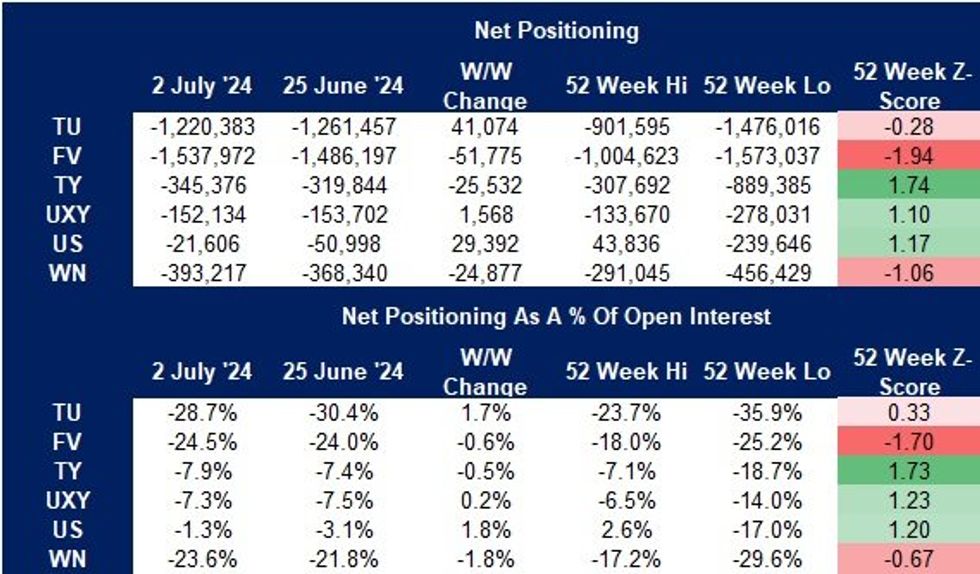

US TSY FUTURES: CFTC CoT Shows Asset Managers Adding To Longs, Hedge Funds Boosting Shorts

The latest CFTC CoT report unearthed some familiar patterns, with hedge funds adding to their overall net short position, while asset managers extended their overall net long position.

- Most of those adjustments came in the TY & UXY contracts.

- Hedge funds also extended their record net short position in TU futures.

- This came a time when odds of second Trump Presidency increased, providing bear steepening pressure for the curve.

- A reminder that CFTC CoT positioning figures will be skewed by basis trades.

- Daily OI data in the time since has pointed to net long setting and short cover, following softer-than-expected labour market data and another weak ISM survey (services this time).

Source: MNI - Market News/CFTC/Bloomberg

Source: MNI - Market News/CFTC/Bloomberg

CFTC: GBP Net Long Hits New High Ahead of Election Date

- The GBP net long improved further in the week-ending Jul 2nd, presaging the eight session rally in GBP/USD as positioning touches 31.3% of open interest - another 52w high. The smooth government transition across the general election will have aided currency strength, with some sell-side analysts bolstering their UK growth outlooks following the results.

- AUD, NZD net positioning rose in tandem, by ~5% of open interest apiece. This reduces the AUD net short to 8% of OI, the smallest net short in a year - and supports the view that the rally from 0.66 to 0.6750 was largely driven by short-covering. The AUD positioning Z-score is now the highest of all currencies surveyed at 3.2.

- The JPY, CAD, CHF net shorts grew, while MXN positioning was broadly unchanged. Full update here:

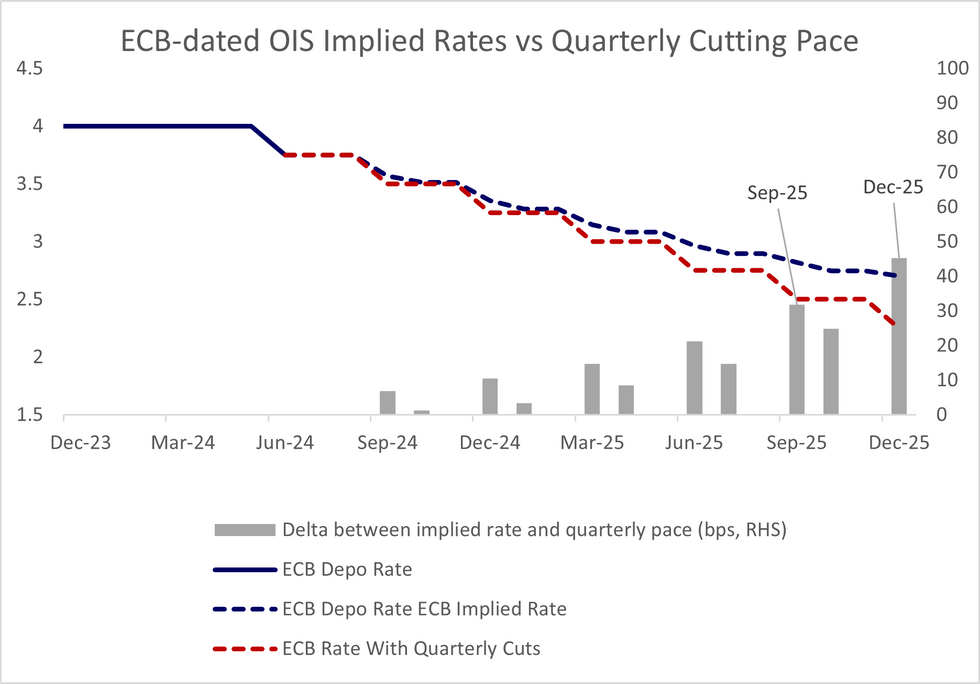

STIR: Markets Do Not Expect Quarterly ECB Cuts In 2025

ECB-dated OIS currently price just over 100bps of cuts through the end of 2025, implying a deposit rate of 2.70% through the December ’25 meeting. The current implied market path is broadly consistent with quarterly cuts in H2 2024 (i.e in September and December) but not in 2025.

- The deposit rate would reach 2.25% were the ECB to deliver 25bp cuts at each of the next six quarterly projection meetings. Such a path would align with the dovish contingent of analyst rate forecasts we have seen.

- We think current market pricing appears reasonable at this stage. Concerns around sticky wage-driven services inflation, fiscal policy pressures and a rising neutral rate of interest warrant a wedge between the “quarterly cut” path and current pricing.

- Markets should also remain cognizant of the risk that the ECB chooses to hold rates at one of the September or December meetings.

- Uncertainty around the Fed's rate path and unfavourable developments in core inflation/labour cost outcomes could be enough for some of the Governing Council to err on the side of caution in easing policy this year.

- However, those expecting the ECB to follow through with consistent quarterly cuts through 2025 - as headline inflation returns to the 2% target in line with the June projections - may find value in the September ’25 and December ’25 OIS contracts (See chart).

Source: MNI, Bloomberg

Source: MNI, Bloomberg

FRANCE: Unclear Path To Stable Gov't Amid Election Fallout

There remains little clarity how a stable gov't coalition can be formed after the legislative elections. On 8 July, President Emmanuel Macron refused the resignation of PM Gabriel Attal, saying he needed to remain in office 'for now'.

- There is no constitutional demand or timeline for appointing a new gov't. The new National Assembly is due to meet for the first time on 18 July, and the Attal gov't could face an immediate vote of no confidence. However, even the political opponents of Macron and Attal may hold fire for several weeks to allow the gov't to oversee the Olympic Games in Paris, running until 11 August.

- The left-wing New Popular Front (NFP) alliance has said it will look to put forward a candidate for PM by the end of this week, but this may prove a difficult task. The largest single party within the NFP is the far-left La France Insoumise (LFI) with 74 deputies. As such, it may demand one of its members gets the PM nomination.

- However, given outside support is needed (or at least mass opposition cannot be afforded) a candidate from the centre-left Socialist Party (PS, 59 seats) or the environmentalist Les Ecologistes (LE, 28 seats) would have a greater chance of winning the backing/avoiding the opposition of the Ensemble bloc, and therefore forming a gov't of 'cohabitation'.

- No clear frontrunners at present. PS First Secretary Olivier Faure, LE National Secretary Marine Tondelier, or Place Publique co-leader Raphaël Glucksmann (an MEP not a deputy) could prove acceptable options for Ensemble, but may not garner enough backing from leftists in the NFP.

Chart 1. Result of French Legislative Election, Seats

Source: Le Monde

FOREX: Mixed Markets, Tight Ranges

- Markets are mixed early Tuesday, with a quiet Asia-Pac session making way for a quieter European morning. Ranges are tight and volatility is muted, putting the USD broadly flat - albeit off the overnight session lows.

- JPY is somewhat softer and is among the poorest performers in G10, however USD/JPY is well short of the best levels of last week, keeping the improvement off lows inside the recent range.

- NOK is a marginal underperformer, softer against all others in G10 as a moderating oil price weighs on commodity-exporters. USD/NOK is back above 10.60 and is bearing in on first major resistance at the 10.6674 50-dma - a break above which opens 10.6993 and the mid-June highs.

- Tuesday is a scant session for data releases, keeping focus on the more consequential US inflation release for June set for Thursday. The central bank speaker slate is busier, however, with Fed's Barr, Powell and Bowman all set to make appearances. Powell presents the semi-annual testimony with an appearance in front of the Senate banking committee at 1500BST/1000ET.

FX OPTIONS: Expiries for Jul09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E708mln), $1.0690-00(E1.2bln), $1.0800(E1.4bln), $1.0820-40(E875mln), $1.0850(E660mln), $1.0905-10(E1.3bln)

- USD/JPY: Y157.00($1.6bln), Y158.00($923mln) Y160.00($1.5bln), Y160.65($572mln), Y161.00($500mln)

- AUD/USD: $0.6780-85(A$639mln)

- USD/CAD: C$1.3580-00($2.4bln)

COMMODITIES: Moderate Pullback in WTI Futures Still Considered Corrective

- A bull cycle in WTI futures remains in play and the latest pullback appears to be a correction. The recent breach of $80.11, the May 29 high and a key resistance, strengthened a bullish theme. Note too that $82.24, 76.4% of the Apr 12 - Jun 4 bear leg, has been cleared. Furthermore, moving average studies are in a bull-mode set-up. Sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $79.63, the 50-day EMA.

- Gold traded higher last week and the yellow metal has pierced resistance at $2387.8, the Jun 7 high. This undermines a recent bearish theme and a clear break would be a bullish development and open the key resistance at $2450.1, the May 20 high. Initial support to watch lies at the 50-day EMA, at 2326.3. A clear break of this average would instead confirm a resumption of the reversal from May 20 and expose $2277.4, May 3 low.

EQUITIES: This Week's Gains Reinforces Bullish Set Up in E-Mini S&P

- A bull cycle in Eurostoxx 50 futures remains intact and attention is on resistance at 5039.84, 61.8% of the May 16 - Jun 14 sell-off. It was pierced Friday, a clear break of it would be a positive development and suggest scope for an extension of the bull cycle that started Jun 14. This would open 5082.32, the 76.4% retracement point. On the downside, a reversal would instead refocus attention on 4846.00, Apr 19 low and a key support.

- The trend condition in S&P E-Minis is bullish and this week’s extension reinforces this set-up. Fresh cycle highs confirm a resumption of the uptrend and maintain the bullish price sequence of higher highs and higher lows. Moving average studies are in a clear bull-mode set-up and this continues to highlight positive market sentiment. Sights are on 5668.00, a Fibonacci projection. Support is at 5526.86, the 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 09/07/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 09/07/2024 | 1315/0915 | Fed Vice Chair Michael Barr | ||

| 09/07/2024 | 1400/1000 | Fed Chair Jerome Powell | ||

| 09/07/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 09/07/2024 | 1530/1130 | ** | US Treasury Auction Result for 52 Week Bill | |

| 09/07/2024 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 09/07/2024 | 1730/1330 | Fed Governor Michelle Bowman | ||

| 10/07/2024 | 0130/0930 | *** | CPI | |

| 10/07/2024 | 0130/0930 | *** | Producer Price Index | |

| 10/07/2024 | 0200/1400 | *** | RBNZ official cash rate decision | |

| 10/07/2024 | 0600/0800 | *** | CPI Norway | |

| 10/07/2024 | 0800/1000 | * | Industrial Production | |

| 10/07/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 10/07/2024 | - | *** | Money Supply | |

| 10/07/2024 | - | *** | New Loans | |

| 10/07/2024 | - | *** | Social Financing | |

| 10/07/2024 | 1330/1430 | BoE Pill At Asia House | ||

| 10/07/2024 | 1400/1000 | ** | Wholesale Trade | |

| 10/07/2024 | 1400/1000 | Fed Chair Jerome Powell | ||

| 10/07/2024 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 10/07/2024 | 1530/1630 | BOE's Mann Panellist on UK Business investment | ||

| 10/07/2024 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 10/07/2024 | 1830/1430 | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.