-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Recovery for Equities Weighs on USD

MNI US OPEN - WSJ Reports on Imminent Ceasefire Deal

MNI US MARKETS ANALYSIS - PPI to Provide Key Jigsaw Piece

MNI (LONDON) - Highlights:

- PPI in focus as US inflation metrics key determinant for Sept rate cut odds

- EUR/GBP further off highs as UK unemployment rate slips

- Rising UK savings stock unlikely to translate to solid future spending

US TSYS: Off Lows But Within Narrow Ranges, PPI In Focus

- Treasuries have lifted off session lows with help from Home Depot earnings and some dovish components to the NFIB small business survey.

- They remain within relatively narrow intraday ranges though, broadly consolidating yesterday’s geopolitical risk driven rally.

- Cash yields currently sit 0.3bp lower (2s) to 0.7bp higher (30s).

- 2s10s at -10.4bps (+0.6bp) continues to hover a little below recent highs having briefly disinverted the Monday after payrolls for the first time since mid-2022.

- TYU4 is little changed on the day at 113-06+ on particularly tepid volumes of 210k. Support is seen at 112-03 (20-day EMA) but declines are deemed corrective with resistance at 114-03 (Aug 6 high).

- Data: PPI inflation Jul (0830ET)

- Fedspeak: Bostic on economic outlook (1315ET, no text) – see STIR bullet

- Bill issuance: US Tsy $75B 42D Bill CMB auction (1130ET)

STIR: Holding Close To 100bp Of Fed Cuts Over Three Meetings Before US PPI

- Fed Funds implied rates hold within yesterday’s range as they await today’s July PPI report. Core PCE inflation implications from the usual components including health care-related services, airfares, car insurance and portfolio management fees should help ultimately set the tone.

- Cumulative cuts: 40bp Sep, 71bp Nov, 102bp Dec and 126bp Jan.

- Ahead, Bostic (’24) voter is the sole scheduled Fedspeak at 1315ET, in first comments since the July FOMC. He’s recently been one of the more hawkish FOMC members, whilst the most recent appearance remains from Gov. Bowman at the weekend (arguably the most hawkish) who noted that the rise in unemployment is exaggerating the labor market cooling.

- Re-upping the US CPI Preview for Wednesday’s release: https://roar-assets-auto.rbl.ms/files/65736/USCPIPrevAug2024.pdf

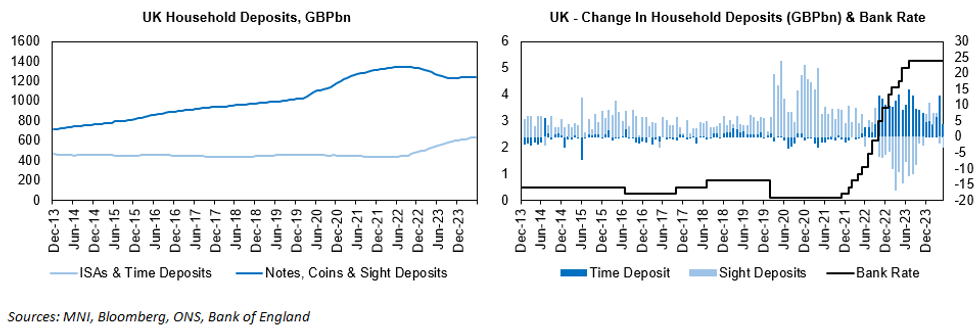

- UK household savings are rising as a result of sustained real wage growth and more attractive deposit rates, with the savings ratio hitting 11.1% in Q124.

- Apart from the extraordinary surge in savings during Covid (driven by the collapse in consumption and introduction of income-protection policies), in the last 25 years the ratio has exceeded 10% only briefly in 2009-2010 and Q415.

- Before the GFC savings were compressed alongside the credit boom, while in the aftermath savings temporarily surged as deleveraging intensified, but then pushed lower as ultra-loose monetary policy re-inflated demand and disincentivised term saving.

- The recent rise in savings is atypical. Real wages have risen steadily since mid-2023 on the back of a tight labour market and rapid disinflation after CPI peaked in Q422. This accounts for the rise in gross disposable income over this period.

- In addition, while households were drawing down savings during the ZIRP era, recent monetary tightening has now motivated a shift away from cash on hand (currency, notes and sight deposits) to term saving (particularly tax-efficient ISAs).

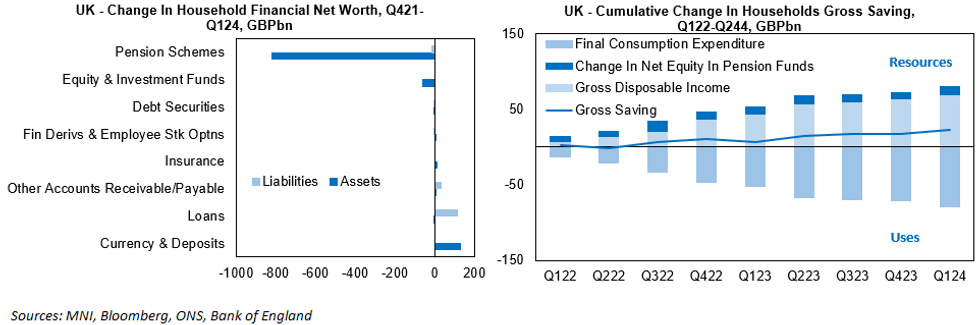

Despite the rise in savings, the UK household net equity position has deteriorated since the end of 2021 as a result of pension assets taking a hit – likely from the sell-off in gilts over this period.

- The rise in savings thus offers limited respite for future spending, with consumption weighed down by multiple drags operating through the wealth channel (sluggish equity market, lower valuation of bond portfolios and the recent inflation adjusted fall in house prices) and the higher cost of credit.

- Moreover, despite the new Labour government promoting a growth-focused agenda, plans and resources available for driving up productivity and incomes are limited, while overcoming the myriad bottlenecks in the housing market is likely to be a multi-decade challenge.

EUROPE ISSUANCE UPDATE:

Gilt auction result

* Strong auction saw the 3.75% Jan-38 gilt match its intraday high of 96.096 (marginally above the average auction price of 96.093) but notably above the 95.913 seen around 18 mins before the auction close. Tight tail of 0.1bp again. Bid-to-cover marginally lower than in June but still over 3x.

* GBP3bln of the 3.75% Jan-38 Gilt. Avg yield 4.131% (bid-to-cover 3.28x, tail 0.1bp).

Schatz auction result

* E5bln (E4.038bln allotted) of the 2.70% Sep-26 Schatz. Avg yield 2.38% (bid-to-offer 1.69x; bid-to-cover 2.09x).

FOREX: EUR/GBP Drifts Further Off Highs as BoE/ECB Gap Widens

- EUR/GBP's drift off the August recovery continues, with the cross fading another 30 pips this morning on the better-than-expected UK unemployment rate data for June. The rate unexpectedly slipped from 4.4% to 4.2%, against expectations for a 0.1ppts rise, prompting EUR/GBP to make a clean break of the 200-dma support and exposure lower levels.

- 0.8411 undercuts as support here, and while the 0.8383 bear trigger is still some way off, market focus remains on the ECB-BoE pricing differential for their respective September meetings. An ECB cut remains fully priced while a similar move from the BoE sits at ~35%. A solid inflation print from the UK tomorrow could open this gap, reduce September MPC pricing, and work in favour of a revisit to recent lows.

- JPY is the poorest peformer in G10 as the corrective bounce in USD/JPY off the pullback low persists. Stronger equities across Europe and the US so far are weighing on funding currencies and haven FX, pressuring both CHF and JPY to the bottom of the G10 pile.

- US inflation takes focus for the duration of the Tuesday session. PPI numbers are expected to show 0.2% reads across all PPI indices - and any hotter-than-expected read will pressure Sept Fed pricing and lessen the odds of a 50bps cut step next month. The USD Index is rangebound, with technical parameters intact at last week's hi/lo. Fed's Bostic is set to speak on the US economy at 1815BST/1315ET - the only CB speaker of note today.

E-Mini S&P Extends Gradual Recovery Off Last Week's Lows

- A bear threat in Eurostoxx 50 futures remains present and the latest climb appears to be a correction - for now. The sell-off between Aug 1 - 5, reinforces the bearish condition. A key support at 4846.00, the Apr 19 low, has been cleared. This highlights a stronger reversal and opens 4478.81 next, a Fibonacci projection. Firm resistance is 4879.91, the 50-day EMA. First resistance is 4784.42, the 20-day EMA.

- Short-term gains in S&P E-Minis are - for now - considered corrective and the 50-day EMA marks a firm resistance, at 5453.59. Clearance of this average is required to alter the picture and signal scope for stronger gains. The contract traded lower on Aug 5 and this confirmed an extension of the bear cycle. The move down resulted in a print below 5185.50, 76.4% of the Apr 19 - Jul 16 bear leg. A clear break of this level would open 5092.00 next, the May 2 low.

Sharp Rally in WTI Futures Undermines Recent Bearish Theme

- WTI futures rallied sharply higher Monday. The move undermines a recent bearish theme and price has traded through both the 20- and 50-day EMAs. A continuation higher would signal scope for a climb towards $80.77, a Fibonacci retracement. Clearance of this level would open $83.58, the Jul 5 high. On the downside, a return to bearish price action would expose key support at $71.67, the Aug 5 low.

- Recent weakness in Gold appears to be corrective and the trend structure remains bullish. Note that the yellow metal has recently managed to pierce support at the 50-day EMA - currently at $2383.4. A clear break of this average would signal scope for a deeper retracement towards $2277.4, May 3 low and a key support. For bulls, attention is on $2483.7, the Jul 17 high and a bull trigger. Clearance of this hurdle would resume the uptrend.

| Date | GMT/Local | Impact | Country | Event |

| 13/08/2024 | 1230/0830 | *** | PPI | |

| 13/08/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 13/08/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 13/08/2024 | 1715/1315 | Atlanta Fed's Raphael Bostic | ||

| 14/08/2024 | 0200/1400 | *** | RBNZ official cash rate decision | |

| 14/08/2024 | 0600/0700 | *** | Consumer inflation report | |

| 14/08/2024 | 0600/0700 | *** | Producer Prices | |

| 14/08/2024 | 0600/0800 | *** | Inflation Report | |

| 14/08/2024 | 0645/0845 | *** | HICP (f) | |

| 14/08/2024 | 0900/1100 | ** | Industrial Production | |

| 14/08/2024 | 0900/1100 | *** | GDP (p) | |

| 14/08/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 14/08/2024 | 1230/0830 | *** | CPI | |

| 14/08/2024 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.