-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Retail Sales, Fedspeak Make for Busy Session

Highlights:

- Dollar off Monday lows, but USD Index still shy of monthly highs

- Eurozone CPI, German ZEW provide little direction

- Retail sales, industrial production and heavy Fed slate to keep markets busy

US TSYS: Tsys Weaker Ahead Full Data Docket, Fed Speaker Schedule

- Treasuries near recent overnight lows ahead a full day of economic data and Fed speakers. Carry-over weakness from Monday puts Treasuries near last Thursday's pre-PPI/Jobless claims levels.

- Sep'24 10Y futures are currently trading -4.5 at 110-08.5 vs. 110-06.5 low - focus on technical support at 109-19+/109-00+ (50-day EMA / Low Jun 10 and key support). On the flipside, resistance above at 111-01 (Jun 14 high).

- Cash yields are running mildly higher: 5s +.0139 at 4.3170%, 10s +.0116 at 4.2925%, 30s +.0166 at 4.4221%, while curves look mildly steeper: 2s10s +0.353 at -48.317, 5s30s +0.097 at 10.155.

- Busy session ahead with Retail Sales and NY Services activity at 0830ET, Industrial Production and Capacity Utilization at 0915ET, followed by Business Inventories at 1000ET and Total Net TIC Flows this afternoon at 1600ET.

- Myriad Fed speakers today with NY Fed Williams starting off with appearance on Fox Business at 0830ET. MNI hosts a webcast with Richmond Fed President Barkin on his outlook for the US economy and Fed policy at 1000ET, Link: MNI Webcast Registration.

- Boston Fed Collins follows with keynote address at Lawrence Partnership annual meeting at 1140ET. Later this afternoon: Dallas Fed Logan moderated Q&A at 1300ET, Fed Gov Kugler on economy, monetary policy at 1300ET, StL Fed Musalem on economy, monetary policy at 1320ET, Chicago Fed Goolsbee panel discussion at 1400ET and Boston Fed Collins Yahoo Finance interview at 1640ET.

US TSY FUTURES: OI Points To Net Long Cover Across The Curve On Monday

The combination of yesterday’s weakness in Tsy futures and preliminary OI data points to net long cover across the curve on Monday.

- There was a relatively notable ~$7.2mn curve-wide reduction in net longs in DV01 equivalent terms, with the most notable positioning move coming in TY futures.

- That comes after a general bias towards long setting in the latter part of last week, when softer-than-expected U.S. inflation data and French political unrest dominated.

- A reminder that a modest reduction in worry surrounding the French political situation and a heavy day of $IG issuance provided much of the pressure on Monday.

| 17-Jun-24 | 14-Jun-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 4,082,910 | 4,086,108 | -3,198 | -122,782 |

| FV | 6,206,521 | 6,247,479 | -40,958 | -1,743,413 |

| TY | 4,338,258 | 4,382,970 | -44,712 | -2,903,904 |

| UXY | 2,049,025 | 2,058,322 | -9,297 | -836,012 |

| US | 1,650,695 | 1,655,044 | -4,349 | -577,379 |

| WN | 1,675,016 | 1,679,786 | -4,770 | -978,916 |

| Total | -107,284 | -7,162,406 |

STIR: OI Points To Mix Of Short Setting & Long Cover On SOFR Strip On Monday

The combination of yesterday’s move lower in SOFR futures and preliminary OI data points to a mix of net short setting and long cover through the blues.

- The whites saw a light bias towards net long cover as net pack OI ticked lower on the day, even though 3 of the 4 contracts seemed to be subjected to net short setting.

- The reds seemed to see net long cover in all contracts.

- Further out, the greens and blues seemed to be subjected to short setting in net pack OI terms, with a couple of pockets of net long cover seen in those contracts.

- This move came as wider core global FI markets were pressured, mainly owing to a slight reduction in worry surrounding the French political situation and a round of heavy $IG issuance.

- FOMC-dated OIS saw a reduction in '24 rate cut premium, moving from pricing ~46bp of '24 cuts late on Friday, to just over 40bp of '24 cuts at yesterday's close.

- That measure remains comfortably within the recent range.

| 17-Jun-24 | 14-Jun-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 904,862 | 903,972 | +890 | Whites | -4,256 |

| SFRM4 | 1,200,808 | 1,185,969 | +14,839 | Reds | -44,516 |

| SFRU4 | 1,133,452 | 1,119,070 | +14,382 | Greens | +12,034 |

| SFRZ4 | 1,004,807 | 1,039,174 | -34,367 | Blues | +7,644 |

| SFRH5 | 815,912 | 818,698 | -2,786 | ||

| SFRM5 | 731,254 | 761,235 | -29,981 | ||

| SFRU5 | 621,486 | 631,970 | -10,484 | ||

| SFRZ5 | 806,665 | 807,930 | -1,265 | ||

| SFRH6 | 572,404 | 567,246 | +5,158 | ||

| SFRM6 | 471,976 | 473,384 | -1,408 | ||

| SFRU6 | 414,782 | 407,463 | +7,319 | ||

| SFRZ6 | 356,502 | 355,537 | +965 | ||

| SFRH7 | 250,083 | 255,660 | -5,577 | ||

| SFRM7 | 193,647 | 190,636 | +3,011 | ||

| SFRU7 | 175,429 | 165,636 | +9,793 | ||

| SFRZ7 | 163,459 | 163,042 | +417 |

SNB: MNI SNB Preview - June 2024: On a Knife Edge

Executive Summary:

- SNB decision could go either way, with markets seeing a 25bps cut more likely but analysts tilting slightly towards a policy rate hold on average – while some underlying considerations might suggest a hold, there is high uncertainty around the decision

- Inflation has accelerated in line with SNB expectations since the March meeting but remained well within the SNB price stability target range

- CHF has appreciated again recently, partly reversing its weakness from earlier in the year, amid slightly hawkish commentary from SNB President Jordan on FX selling and the neutral interest rate

Full preview including summary of sell-side views here:

Analyst views for the SNB’s March decision are on a knife-edge between a 25bps cut or a hold at 1.50%. The decision remains uncertain as the SNB’s target band leaves policy in a grey area – particularly as a new forecast round would likely see inflation remaining within the band over medium-term under either an unchanged, or lower, policy rate. Markets currently price in 17bps of easing for this meeting, corresponding to about a 70% implied chance of a policy rate cut.

Hungary To Set Out EU Presidency Priorities @ 1400CET

At around 1400CET (0800ET, 1300BST) the Hungarian gov't is set to unveil the policy priorities for its period in the chair of the rotating presidency of the Council of the European Union. Hungary takes over from Belgium from 1 July. Politico reports that according to Hungary's EU Affairs Minister Janos Boka, Budapest's priorities will be "Competitiveness, defense, migration, reform of the Common Agricultural Policy and cohesion policy...."

- While the CofEU presidency does not come with any overarching powers that can formulate new policies or hamper efforts to pass others, its role as the convenor and agenda-setter for Council meetings can have some influence on areas the EU focuses on for each six-month period.

- Boka also told Politico that Hungary will not support Commission President Ursula von der Leyen for a second term stating that “The relationship between the Commission president and Hungary as a member state was less than ideal. For these reasons, it will be very difficult for us to support her...”

- Unanimous support among member states is not required for VdL to get a second term, but Hungary's opposition hardly bodes well for a constructive working relationship between the two parties in H224.

EUROPE ISSUANCE UPDATE:

UK auction results

* GBP4bln of the 4.125% Jul-29 Gilt. Avg yield 4.083% (bid-to-cover 3.59x).

Germany auction results

* E4bln (E3.358bln allotted) of the 2.10% Apr-29 Bobl. Avg yield 2.45% (bid-to-offer 1.79x; bid-to-cover 2.13x).

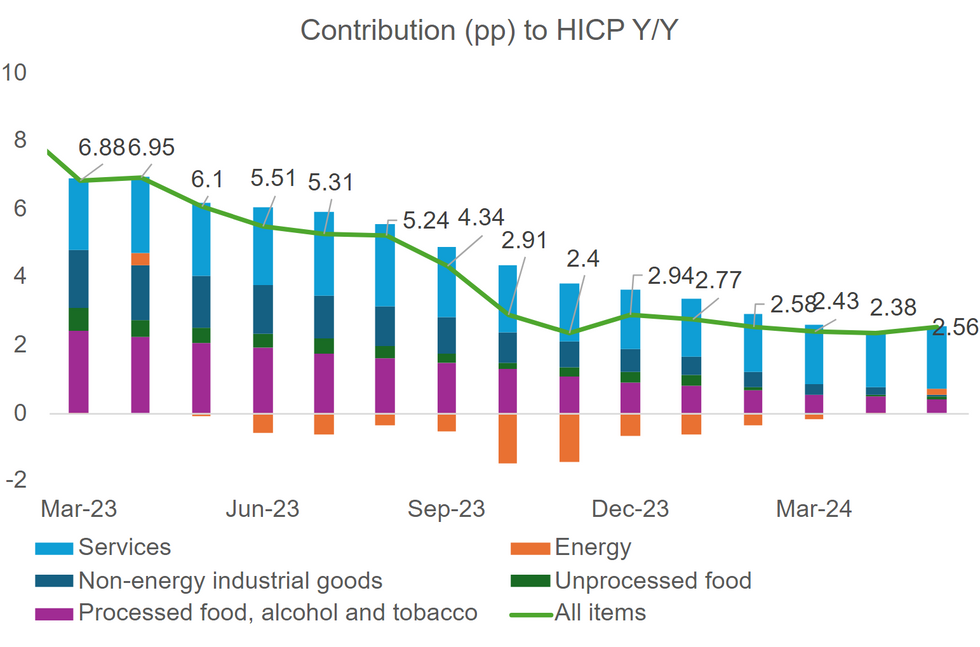

EUROZONE DATA: Final Data Confirms Mixed May HICP Print

Eurozone Final HICP confirmed the May flash prints, at +2.6% Y/Y (vs +2.4% in April) and +0.2% M/M (vs +0.6% in April). Energy ended its 12-month deflationary period. Whilst processed food, alcohol & tobacco and non-energy industrial goods (NEIG, or core goods) disinflated Y/Y, services and unprocessed food inflation accelerated in May.

- Core inflation on an annual basis printed in line with flash at +2.9% Y/Y (+2.7% April), and on a monthly basis it slowed to +0.4% M/M from +0.7% in April.

- In terms of the larger country, France, Portugal, and Finland saw downwardly revisions from flash HICP Y/Y by 0.1pp to 2.6%, 3.8%, and 0.4%, respectively. Greece and Ireland meanwhile saw upwardly revisions, to 2.4% and 2.0%.

- The final readings show the contribution from services inflation rose again after falling in April, contributing +1.83pp (vs 1.64pp April), remaining the largest contributor to HICP overall.

- Meanwhile, the contribution from processed food, alcohol and tobacco fell for the fourteenth consecutive month to +0.43pp (+0.49% April) - the lowest since November 2021. Similarly, NEIG's contribution fell again for the fifteenth consecutive month to +0.18pp (+0.23pp April).

- Energy's contribution was positive for the first time since April 2023 as base effects continue to drop out of the Y/Y comparison, resulting in a contribution of +0.04pp (-0.04pp April).

- To note, unprocessed foods contribution increased slightly further to +0.08pp from +0.06pp in April.

- Later today, the ECB releases calculations of key underlying inflation metrics based on the final data, which will form part of the Governing Council's decision-making process as it assesses price pressures going into the June meeting.

MNI, Eurostat

MNI, Eurostat

USD Off Late Monday Lows, Awaiting Fed Cues

- The greenback is firmer within a range early Tuesday, helping ease major pairs off the late highs posted on Monday. EUR/GBP trades either side of the 1.0725 handle, while GBP/USD is back below 1.27.

- Data so far today was oriented around Europe, with Eurozone CPI unrevised in the final reading at 2.6% Y/Y for May. Germany's ZEW survey was lower-than-expected, however, but added little weight to the single currency.

- The CHF is the session's best performer, despite global equities trading well. Moves come ahead of this Thursday's SNB rate decision, at which markets remain evenly split on expecting either a rate cut or hold - but today's further strength would provide more space for easier policy ahead.

- Focus for the duration of the Tuesday session turns to May retail sales data from the US and the industrial production release. Markets expect advance retail sales to have accelerated to 0.3% on the month, from 0.0% in April.

- Central bank speak is busier, with ECB's Vujcic, Cipollone, de Guindos & Knot as well as Fed's Barkin, Collins, Logan, Kugler, Goolsbee & Collins.

OPTIONS: Expiries for Jun18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0670-80(E2.1bln), $1.0700(E957mln), $1.0725-30(E600mln), $1.0750(E631mln), $1.0880-85(E1.4bln)

- USD/JPY: Y153.50($1.3bln), Y154.00($2.0bln), Y155.00($886mln), Y155.95-00($556mln), Y159.00($537mln)

- AUD/USD: $0.6585-00(A$1.1bln)

- USD/CNY: Cny7.2500($617mln)

EUROZONE ISSUANCE: German Q3 funding plans unchanged

- German Q3 funding plans have remained unchanged with E67.5bln to be sold via capital markets and E45bln via bubills. Note that this was widely expected as the supplementary budget (which includes the planned E11bln of increased deficit) has yet to be passed - so will more likely impact Q4 issuance.

- In terms of the 15-year multi-ISIN auctions:

- 10 July: E1.5bln of the 1.00% May-38 Bund (ISIN: DE0001102598) alongside E500mln of another issue.

- 7 August: E1.5bln of the 2.60% May-41 Bund (ISIN: DE000BU2F009) alongside E500mln of another issue.

- 4 September: E1.0bln of the 2.60% May-41 Bund (ISIN: DE000BU2F009) alongside E500mln of another issue.

- In terms of 30-year multi-ISIN auctions:

- 17 July: E1.0bln of the 2.50% Aug-54 Bund (ISIN: DE000BU2D004) alongside E1.0bln of another issue.

- 14 August: E1.0bln of the 2.50% Aug-54 Bund (ISIN: DE000BU2D004) alongside E1.0bln of another issue.

- 18 September: E1.0bln of the 1.80% Aug-53 Bund (ISIN: DE0001102614) alongside E1.0bln of another issue.

WTI Futures Extend Current Bull Phase Following Move Higher Monday

- WTI futures traded higher yesterday, extending the current bull phase. The climb has resulted in a print above at $80.62, the May 29 high and a key resistance. A clear break of this hurdle would cancel a recent bearish theme and pave the way for $82.93, a Fibonacci retracement point. Initial firm support to watch is $77.83, the 20-day EMA. A break would be seen as an early potential reversal signal.

- Gold is unchanged and is trading closer to its recent lows. A sharp sell-off on Jun 7 reinforced a S/T bearish theme. The yellow metal has traded through the 50-day EMA, at 2314.6. The break confirms a resumption of the reversal that started May 20 and signals scope for a deeper correction. This has opened $2277.4, the May 3 low. Clearance of this price point would strengthen a bearish theme. Initial firm resistance is $2387.8, the Jun 7 high.

E-Mini S&P Clears Bull Trigger, Confirming Extension of Bull Cycle

- The trend condition in Eurostoxx 50 futures remains bullish, however, a corrective cycle has resulted in a pullback from the May high, and this bear remains in play for now. Last week’s move lower resulted in a break of 4943.00, the Jun 11 low, highlighting potential for a deeper retracement. Scope is seen for a move towards 4762.00, the Apr 19 low and a key support. Firm resistance is at 5046.00, Jun 12 high.

- The uptrend in S&P E-Minis remains intact and the contract traded higher Monday, confirming an extension of the current bull cycle. Price has recently cleared 5430.75, the May 23 high and bull trigger. The move has confirmed a resumption of the uptrend. Moving average studies are in a bull-mode position too, highlighting bullish sentiment. Sights are on 5572.00 next, a Fibonacci projection. Key short-term support has been defined at 5267.75, the May 31 low. Initial support is 5419.80, 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 18/06/2024 | 1200/1400 | ECB's Cipollone chairing session on market supervision | ||

| 18/06/2024 | 1230/0830 | *** | Retail Sales | |

| 18/06/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 18/06/2024 | 1315/0915 | *** | Industrial Production | |

| 18/06/2024 | 1330/1530 | ECB's De Guindos at EC and ECB joint conference | ||

| 18/06/2024 | 1400/1000 | * | Business Inventories | |

| 18/06/2024 | 1400/1000 | MNI Webcast with Richmond Fed's Tom Barkin | ||

| 18/06/2024 | 1540/1140 | Boston Fed's Susan Collins | ||

| 18/06/2024 | 1700/1300 | Fed Governor Adriana Kugler | ||

| 18/06/2024 | 1700/1300 | Dallas Fed's Lorie Logan | ||

| 18/06/2024 | 1700/1300 | ** | US Treasury Auction Result for 20 Year Bond | |

| 18/06/2024 | 1720/1320 | St. Louis Fed's Alberto Musalem | ||

| 18/06/2024 | 1800/1400 | Chicago Fed's Austan Goolsbee | ||

| 18/06/2024 | 2000/1600 | ** | TICS | |

| 19/06/2024 | 2301/0001 | * | Brightmine pay deals for whole economy | |

| 19/06/2024 | 2350/0850 | ** | Trade | |

| 19/06/2024 | 0600/0700 | *** | Consumer inflation report | |

| 19/06/2024 | 0600/0700 | *** | Producer Prices | |

| 19/06/2024 | 0600/0800 | ** | Unemployment | |

| 19/06/2024 | 0800/1000 | ** | Current Account | |

| 19/06/2024 | 0900/1100 | ** | Construction Production | |

| 19/06/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 19/06/2024 | 1400/1000 | ** | NAHB Home Builder Index | |

| 19/06/2024 | 1730/1330 | BOC Minutes (Summary of Deliberations) | ||

| 20/06/2024 | 2245/1045 | *** | GDP | |

| 20/06/2024 | 0600/0800 | ** | PPI | |

| 20/06/2024 | 0700/0900 | ECB's Lagarde and Cipollone in Eurogroup meeting | ||

| 20/06/2024 | 0730/0930 | *** | SNB PolicyRate | |

| 20/06/2024 | 0730/0930 | *** | SNB Interest Rate Decision | |

| 20/06/2024 | 0800/1000 | *** | Norges Bank Rate Decision | |

| 20/06/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 20/06/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 20/06/2024 | 1230/0830 | *** | Jobless Claims | |

| 20/06/2024 | 1230/0830 | * | Current Account Balance | |

| 20/06/2024 | 1230/0830 | *** | Housing Starts | |

| 20/06/2024 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 20/06/2024 | 1245/0845 | Minneapolis Fed's Neel Kashkari | ||

| 20/06/2024 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 20/06/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 20/06/2024 | 1500/1100 | ** | DOE Weekly Crude Oil Stocks | |

| 20/06/2024 | 1700/1300 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 20/06/2024 | 1900/2000 | Question Time Leaders' Special | ||

| 20/06/2024 | 2000/1600 | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.