-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US MARKETS ANALYSIS - Risk Knocked, Sentiment Shaky

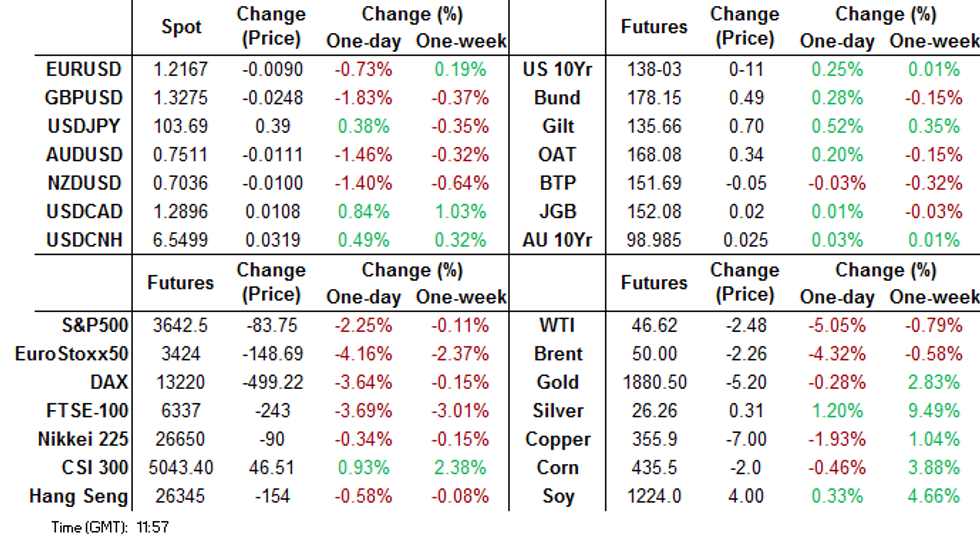

HIGHLIGHTS:

- Stocks, commodities hit hard as new COVID-19 strain hits crossborder trade in/out of UK

- USD and safe haven currencies surge in response

- Data calendar light, keeping focus on COVID, Tesla's inclusion in S&P500

US TSYS SUMMARY: Curve Flattens As COVID Strains Risk Appetite

A very strong start to the holiday-shortened week for Treasuries, with the curve bull flattening as equities fall sharply (S&P eminis down 2.5%).

- The 2-Yr yield is down 1bps at 0.1109%, 5-Yr is down 3.7bps at 0.3447%, 10-Yr is down 5.8bps at 0.8882%, and 30-Yr is down 6.6bps at 1.6256%.

- Mar 10-Yr futures (TY) up 14/32 at 138-06 (L: 137-24 / H: 138-08)

- Concerns over very infectious COVID strain in UK combined w fears of no-deal Brexit nearing have outweighed movement in US on $900bn COVID relief + $1.4trn omnibus funding bill that are eyed to be passed today.

- To watch on that front: 0800ET House Rules Committee meets to get the ball rolling on a vote today, with full House debating the "rule" on the vote late morning/midday. Later, we get a debate and a vote in the House.

- Next is the Senate which meets at noon ET. They need all 100 to give consent to accelerate bill passage which Maj Ldr McConnell thinks will happen. Senate prob won't vote until late afternoon/early evening.

- Only data is Fed nat'l activity index at 0830ET.

- In supply, $105bn of 3-/6-month bills sell at 1130, with $24bn 20-Yr Bond auction at 1300ET. NY Fed buys ~$1.225bn of 7.5-30-Yr TIPS.

EGB/GILT SUMMARY: Core European Sov Curves Bull Flatter

Markets have shifted into a risk-off setting on renewed fears over the economic impact of Covid. Core European sovereign curves have bull flattened alongside broad losses for equities and a resurgent US dollar.

- Gilts have outperformed with yields 6-9bp lower and the curve 3bp flatter.

- The bund curve has similarly bull flattened with the 2s30s spread 3bp narrower.

- OATs trade broadly in line with bunds. The short end of the curve has traded slightly weaker from Friday's close, with the 2s30s spread down 5bp.

- BTPs have underperformed with cash yields up 1-3bp.

- The UK government pushed large parts of the South East of the country, including London, into new Tier 4 restrictions following surging infections and concerns about a new more contagious strain of the coronavirus.

- Governments across Europe have instituted travel bans against the UK.

- The UK Retailing Reported Sales series came in slightly worse than expected for December at -3 vs 0 survey.

Issuance for 2021

The EU has announced that is plans to borrow E62.9bln in 2021 under its existing programmes.

- In total, it plans between its SURE/EFSM programmes to issue E30-35bln in Q1 (SURE) and E25-30bln in Q2 (SURE+EFSM). It also plans issuance of E2.35bln for the MFA.

- SURE: E50.8bln in H1-2021. "It is expected that the current SURE programmes will be concluded by mid-2021."

- EFSM: E9.75bln in Q2-2021. Maturity lengthening operations for Portugal and Ireland, rolling over maturing payments of E4.75bln due in June and E5bln due in September.

- MFA: E2.35bln in 2021. This will fund the disbursement of the E3bln Covid-19 MFA package in addition to "regular" MFA programmes.

FOREX: JPY, USD Sharply Higher as Risk-Off Gathers Pace

After a somewhat quiet start, risk-off is gathering pace ahead of the NY crossover, with JPY, USD sharply higher against all others in G10. Renewed fears over a fresh, more infectious mutation of COVID-19 in the south-east of England has been a primary driver, but stocks are also trading poorly ahead of the inclusion of Tesla in the S&P500 for the first time - their shares are lower by over 5% ahead of the open.

At the bottom of the pile, NOK has reversed recent outperformance, falling against all others as crude prices fall sharply. WTI and Brent are lower by over 5% apiece, knocking commodity-tied currencies across the board.

GBP is also suffering, with the lack of progress in Brexit negotiations knocking sentiment as well as severe controls on cross-border trade due to the new COVID strain. GBP/USD fell through 50-dma support at 1.3207, extending losses to over 300 pips.

Data releases are few and far between Monday, with just Chicago National Activity Index and Eurozone consumer confidence on the docket. There are no speakers of note.

TECHS: Price Signal Summary - E-Mini S&P Back Below 3700

- A risk-off mood dominates the start of this week's market session. The E-Mini S&P is trading lower with the price below 3700.00. The 20-day EMA at 3646.66 is initial support. A break would open 3620.75, Dec 12 low.

- On the commodity front, Gold maintains a bullish tone. The focus is on $1918.2 next, 76.4% of the Nov 9 - 30 sell-off. Oil is down sharply today. Brent (G1) is back below $50.00 and eyeing support at $48.99, the 20-day EMA. WTI (G1) is approaching its 20-day EMA at $46.09. The average represents an important S/T support.

- In the FX space, the USD is firmer this morning. EURUSD key near-term support is seen at 1.2088, the 20-day EMA. Note, a trendline support drawn off the Nov 4 low intersects at 1.2103. Cable together with Brexit matters weighing on sentiment, is approaching key support at 1.3135, Dec 11 low. A break would represent an import bearish development. EURGBP support at 0.8983, Dec 4 / 17 low survived a test last week. This remains a key pivot level - bullish above, bearish below. The cross is approaching key resistance at 0.9230, Dec 11 high. A break would open 0.9292, Sep 11 high.

- Key support in the Bund (H1) lies at 177.31, trendline drawn off the Nov 11 low. Further gains would open 178.77, Dec 1 high. Gilts (H1) have gapped higher and bulls eye 135.99 key resistance, Dec 11 high. Treasuries are firmer with bulls eyeing resistance at 138-08, Nov 20 / 30 high.

OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1880-90(E1.4bln), $1.2000(E665mln), $1.2050(E556mln), $1.2100-05(E534mln), $1.2150-60(E2.4bln), $1.2195-1.2205(E1.1bln), $1.2225(E677mln), $1.2250(E514mln)

USD/JPY: Y102.90-00($581mln-USD puts), Y103.10-25($840mln-USD puts), Y103.90-00($732mln-USD puts)

GBP/USD: $1.3300-10(Gbp695mln mixed, Gbp655mln GBP puts), $1.3600-05(Gbp1.0bln)

AUD/NZD: N$1.0650(A$1.1bln-AUD puts)

AUD/JPY: Y75.70(A$517mln-AUD calls)

USD/CAD: C$1.2675($515mln-USD puts), C$1.2690-1.2700($525mln-USD puts), C$1.2725($555mln), C$1.2750-55($1.1bln-USD puts), C$1.2925($530mln-USD puts), C$1.2945-55($565mln-USD puts)

EQUITIES: Stocks Slide, Europe Down As Much As 4%

Stock markets across Europe and the US are sharply lower in early Monday trade, with some European indices off as much as 4%. Spanish, Italian firms are underperforming, but all major bourses are lower by at least 3.1% at pixel time. Renewed fears over Coronavirus, stemming from a more infectious mutation in south-east England are largely responsible, leading to a closure of cross-border freight and travel between the UK and the rest of Europe.

Energy and financials are the poorest performers, with lower commodity prices not helping. Defensive healthcare and consumer staples are also lower, but are being partially shielded from losses.

US equity futures are following suit, prompting the e-mini S&P to shed over 80 points ahead of the opening bell. VIX futures have taken a decent move to the upside, rising to the best levels of the month and nearing 28 points. Markets have noted that Tesla's debut in the S&P500 today is not off to a good start - with the stock off by well over 5% pre-market.

COMMODITIES: Oil Sharply Lower With Equities

Risk appetite took a sharp knock in European hours Monday, prompting a considerable move lower in both commodity markets and equities. WTI and Brent crude futures have been knocked by around 5% apiece, undoing much of the progress made over the past 2 weeks or so. The 23.6% Fib retracement of the November-December rally comes in as first support at 45.59 for WTI, with the USD remaining a key driver for prices.

Gold took a considerable knock on the initial USD rally, erasing the yellow metal's early outperformance. Much of the move has been pared ahead of the COMEX open, however, prompting gold to trade broadly flat on the day.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.