MNI US MARKETS ANALYSIS - Soft PMIs Prompt Downdrift in EUR

Highlights:

- Soft Eurozone PMIs prompt downdrift in EUR

- US PMI numbers next up, with Fed's Jefferson also due

- USDJPY stages turnaround as BoJ signal still willing to wade into bonds if required

US TSYS: EGBs Help Drive Further Gains But Breakevens Still Elevated

- Treasuries have pulled back from highs seen briefly after a surprisingly soft flash French services PMI, although remain firmer on the day as they underperform EGBs along with a tailwind from lower oil prices.

- Today’s data focus is on flash US PMIs and less so existing home sales, whilst the partisan distortions seen in the U.Mich consumer survey had muddied recent results.

- Cash yields are 1-2.5bp lower, with declines led by the long end.

- The modest flattening pushes 2s10s to 23bps (-0.7bp) but it keeps to ranges seen over the past two weeks.

- Early trade has seen the decline in yields driven by real yields, whilst the 5Y breakeven remains of note with 2.70% one its highest levels since Mar 2023.

- TYH5 trades at 109-07 (+ 01+) off an earlier high of 109-11+ seen on the French PMI headlines, whilst cumulative volumes approaching 675k are heavily boosted by quarterly rolls.

- Further gains would expose key resistance at 110-00 (Feb 7 high and bull trigger) but moving average studies highlight a dominant downtrend with support seen at 108-04 (Feb 12 low) before 108-00 (Jan 16 low).

- Data: S&P flash PMIs Feb (0945ET), Existing home sales Jan (1000ET), U.Mich Feb final (1000ET)

- Fedspeak: VC Jefferson on central bank communications w/ opening remarks from Daly (1130ET) – see STIR bullet.

STIR: 40bp of Fed Cuts Seen This Year, PMIs In Focus Today

- Fed Funds implied rates have modestly extended yesterday’s softening, which came initially with equity weakness but with little sign of paring the move despite a recovery in stocks.

- Cumulative cuts from 4.33% effective: 0.5bp Mar, 6bp May, 15bp Jun, 21.5bp Jul, 29.5bp Sep and 40bp Dec.

- The 40bp of cuts seen for the year is close to the week’s lows.

- Gov. Kugler (permanent voter) late yesterday noted there is “some way to go” on inflation and that upside risks remain whilst downside risks to employment have diminished. Her remarks shouldn’t have surprised as said Feb 7 (post payrolls, pre CPI/PPI) that she saw rates on hold for “some time”.

- Today sees data focus on February flash PMIs before Vice Chair Jefferson (permanent voter) rounds out the week’s scheduled Fedspeak at 1130ET. He’s talking on central bank communication (text + Q&A) after Musalem yesterday favored communicating through forecast scenarios. As for his monetary policy view, he reiterated on Wed that the Fed can take its time before adjusting rates.

SECURITY: EU-Half A Billion To Go On Cable Defences As Baltic Incidents Continue

Wires reporting comments from European Commission Exec VP for Tech Sovereignty, Security and Democracy Henna Virkkunen regarding the investigation by Swedish police of suspected sabotage of a telecoms cable in the Baltic Sea. Virkkunen says "We have been informed about the new cable breach and are following the investigation", adding the EU "will not accept these hybrid actions against us...Our submarine cable action plan is not only for the Baltic Sea area, it's for all of Europe."

- Virkkunen says that the EU will focus investment on the deployment of new cables, as well as establishing a 'Baltic Sea hub' to detect incidents "ideally before they occur" (Ed. Unclear how this might be achieved). Virkkunen says "at least EUR540M" will go into this initiative.

- Reuters: "Swedish police were investigating the matter because the breach had occurred in Sweden's economic zone, police spokesperson Mathias Rutegard told Reuters. "The preliminary investigation relates to suspected sabotage," Rutegard said. It is the third time in recent months that Cinia's C-Lion1 cable was damaged, after it was completely severed in November and December last year."

- Several telecom cables, power lines, and gas pipelines have been damaged in the Baltic in recent months, mainly by commercial ships dragging their anchors. There is speculation among NATO countries that Russia is behind the incidents. Such occurrences present risks to European power and data transfer networks given the substantial number of cables crisscrossing the seafloor (see map below).

Map of Undersea Cables in Baltic and North Seas

Source: Telegeography

RUSSIA: Kremlin-No Comment On Reuters' US-Russia Talks In Switzerland Report

State media reporting comments from Kremlin spox Dmitry Peskov. Says that "there is the understanding of the need for a Trump-Putin meeting" but that there are "no concrete details yet." Says that on the upcoming third anniversary of the full-scale invasion of Ukraine, the "special military operation continues, and its goals will be achieved." Peskov: "We have goals related to our security and we are ready to achieve this through negotiations."

- Peskov: "The movement of NATO's military infrastructure towards Russia causes concern in Moscow, this position of the Russian Federation is well known."

- Asked about the Reuters report overnight claiming that according to its sources, the US and Russia have held contact in recent weeks in Switzerland, Peskov says "I cannot answer this question, I do not have such information,".

- The article claims "U.S. and Russian participants have quietly met in Switzerland for unofficial discussions about the Ukraine war in recent months, including as recently as last week [...]The sources described the talks as a side channel with some contacts occurring during the [Trump] transition period [...]. While the attendees have diplomatic and security experience, they are not government officials, and it was not immediately clear if any were sent by their governments [...]. At least a small number of advisers to Trump are aware of the encounters, said one of the sources, who had direct knowledge of the matter."

- Such reports are likely to only raise concerns in Kyiv and European capitals that the US is looking to exclude Ukraine and Europe from any ceasefire talks.

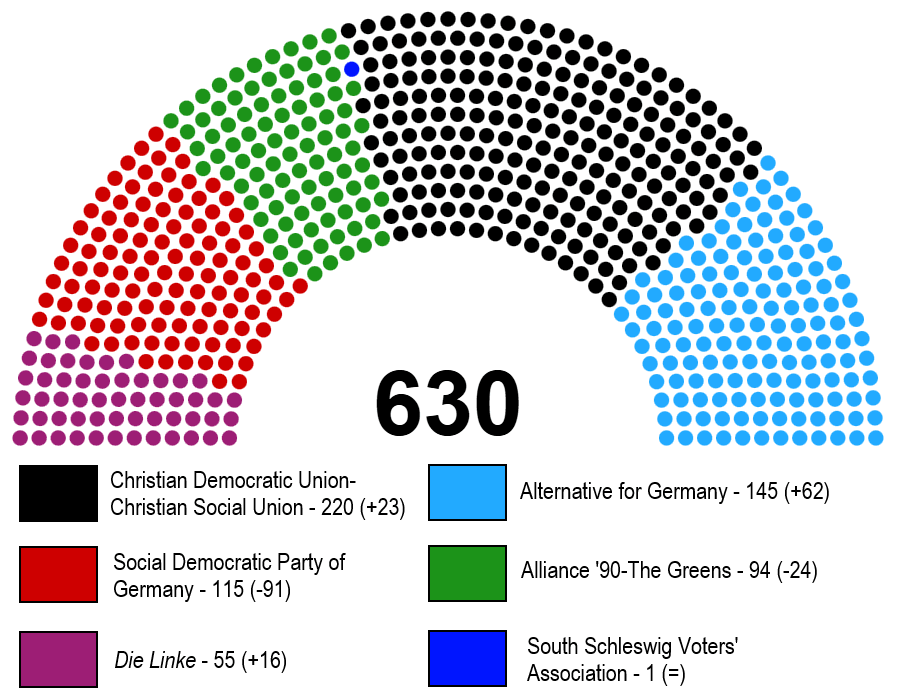

GERMANY: Final YouGov MRP Shows GroKo On Course For Majority

Ahead of the 23 February federal election, the final mass multilevel regression and post-stratification (MRP) opinion poll from YouGov shows the centre-right Christian Democratic Union (CDU) and its Bavarian sister party the Christian Social Union still on course to emerge as the largest party. With its central scenario of the CDU/CSU on 220 seats and the centre-left Social Democrats (SPD) on 115, this outcome would allow for the formation of a 'grand coalition' (GroKo) with 335 seats in the 630-member Bundestag without the requirement of a third party.

- This central scenario would also pave the way for reform to the debt brake. The absence of the pro-business liberal Free Democrats (FDP) and left-wing nationalist Sahra Wagenknecht Alliance (BSW) from parliament removes two known opponents of reform. The nominally pro-reform CDU, SPD, Greens, and Die Linke would hold 484 seats, well over the 420-seat two-thirds threshold.

- This would allow the constitutional reform to pass if fiscally conservative holdouts in the CDU refuse to back reform, or even in the unlikely scenario the far-left progressive Die Linke sought to block reform on the basis that it could be used to increase German defence spending.

- The 'risk' scenario in terms of political stability and for debt brake reform is if the far-right Alternative for Germany (AfD), FDP and BSW all hit their 'high' range seat estimates. This would come in at a cumulative 250 seats, enough to form a blocking minority for reform. It would also likely coincide with the CDU and SPD hitting their 'low' range seat totals, requiring a third party to join gov't in a scenario that risks similar coalition ructions as seen in the 2021-24 'traffic light' coalition.

Chart 1. YouGov MRP Central Seat Projection

Source: YouGov, MNI. Fieldwork 7-19 Feb. 9,281 respondents.

FOREX: EUR Slips on French, JPY Volatility Remains in Focus

- The Euro is softer on Friday following the weaker-than-expected French services PMI. EURUSD slipped from around the 1.05 mark to 1.0468 and subsequently stabilised near session lows on the better-than-expected German manufacturing print. Overall growth prospects in the region continue to appear stagnant, while a renewed uptick in output charges will be of concern to ECB policymakers. 1.0533 the Jan 27 high and a reversal trigger remains key on the topside for EURUSD.

- EURGBP also sits moderately weaker and has been consolidating its position below 0.8300 over the past three sessions. A resumption of weakness would once again refocus attention on 0.8248, the Feb 3 low and the bear trigger, before 0.8203, the lowest point of a multi-year range.

- Elsewhere, the volatile Japanese yen remains of key interest in G10 FX markets. After slipping to a fresh two-month low of 149.29, comments from BOJ Governor Ueda have sparked an impressive relief rally for USDJPY. Ueda told the Diet Friday the Bank would buy bonds nimbly should yields rise sharply, prompting USDJPY to rise around 1% from session lows to a 150.74.

- Losses for the week remain around 1.2% having cleanly traded through the bear trigger on Thursday. 148.65 is the next downside mark and key support.

- AUDUSD has declined 0.25% on Friday, with the overnight high closely coinciding with key resistance at 0.6414 - marking both the 100-dma as well as the 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg. Clearance here opens the next leg higher for the pair, making 0.6471 the next target.

- Canadian retail sales and US flash PMIs headline Friday’s calendar from here, with existing home sales and UMich (2nd reading) also crossing.

OPTIONS: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E2.1bln), $1.0442(E632mln), $1.0450-51(E880mln), $1.0485(E719mln), $1.0500-18(E1.1bln)

- USD/CAD: C$1.4500($1.2bln), C$1.4600($1.7bln), C$1.4700($1.6bln)

EQUITIES: EuroStoxx50 Remains Bullish, Despite Fade Off Highs

- S&P E-Minis have faded sharply off intraday highs Thursday, but remain firm and hold the bulk of the recent phase of strength. Attention remains on resistance at 6162.25, the Jan 24 high.

- The trend condition in Eurostoxx 50 futures remains bullish, with prices edging to a new alltime high on the continuation contract this week. The move higher last week confirmed once again, a resumption of the uptrend.

COMMODITIES: Bull Cycle in Gold Remains Key Driver

- A bull cycle in Gold remains in play and the yellow metal continues to hold on to the bulk of its recent gains. Fresh highs once again confirm a resumption of the uptrend and maintain the bullish price sequence of higher highs and higher lows.

- WTI futures traded firmer Wednesday, before fading into the close and confirming the still-present bear threat. Earlier this week, price pulled back from the recent high and has again traded below the 50-day EMA - at $71.62.

| Date | GMT/Local | Impact | Country | Event |

| 21/02/2025 | 1330/0830 | ** | Retail Trade | |

| 21/02/2025 | 1330/0830 | ** | WASDE Weekly Import/Export | |

| 21/02/2025 | 1330/0830 | ** | Retail Trade | |

| 21/02/2025 | 1430/1530 | ECB's Lane Speech at FIW-Research Conference | ||

| 21/02/2025 | 1445/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 21/02/2025 | 1445/0945 | *** | S&P Global Services Index (flash) | |

| 21/02/2025 | 1500/1000 | *** | NAR existing home sales | |

| 21/02/2025 | 1500/1000 | * | Services Revenues | |

| 21/02/2025 | 1500/1000 | ** | U. Mich. Survey of Consumers | |

| 21/02/2025 | 1630/1130 | Fed Vice Chair Philip Jefferson | ||

| 21/02/2025 | 1630/1130 | San Francisco Fed's Mary Daly | ||

| 21/02/2025 | 1730/1230 | BOC Governor speech/press conference. |