-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Stocks Narrow In On All-time Highs

Highlights:

- Treasury curve modestly bull flatter pre-ISM, weekly jobs data

- AUD/USD hits new 2021 low

- OPEC meeting complicated by US call for 'affordable' energy

US TSYS SUMMARY: Modest Bull Flattening Ahead Of Jobs And ISM Data

Tsys have edged higher from overnight lows, with the Asia-Pac and European sessions seeing trading within the week's ranges and some bull flattening.

- Jun 10-Yr futures (TY) up 5/32 at 131-03 (L: 130-29 / H: 131-06.5). The 2-Yr yield is unch at 0.1605%, 5-Yr is down 0.5bps at 0.9348%, 10-Yr is down 2.1bps at 1.7197%, and 30-Yr is down 2.9bps at 2.3815%.

- Price action slightly subdued as Europe heads into a 4-day weekend (reminder U.S. stocks closed Friday but fixed income has a shortened session).

- Equities stronger, S&P 500 futures pointing to another test of the 4,000 level. Dollar flat.

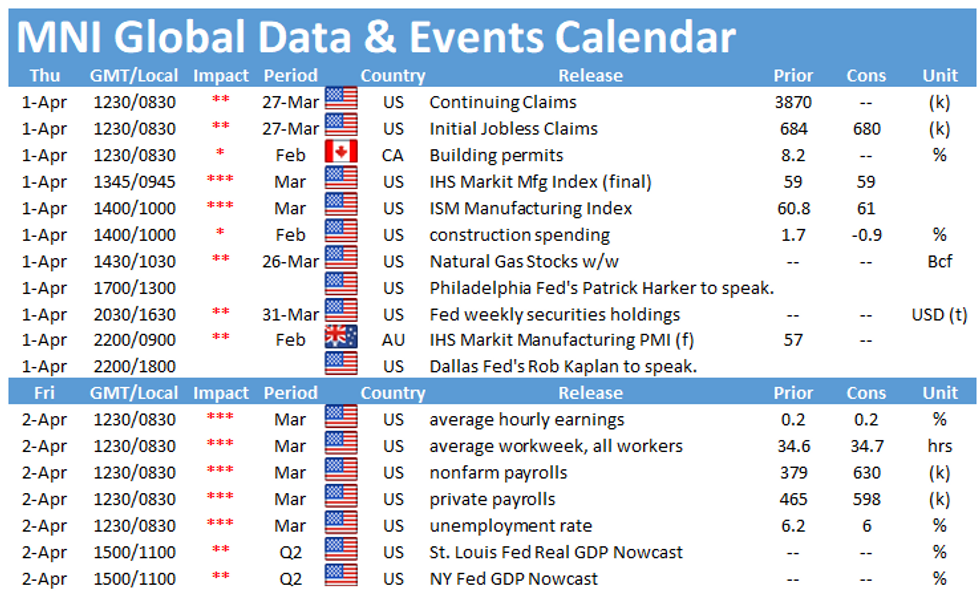

- Data kicks off at 0730ET with Challenger job cuts; 0830ET sees jobless claims. Final reading of Mar PMI at 0945ET, with ISM Manufacturing at 1000ET.

- Philly Fed's Harker speaks at 1300ET. In an interview published late Weds, Richmond Fed's Barkin told MNI that he saw "powerful" long-term disinflationary forces in the economy, while declining to say whether he had advanced his rate hike expectations in March's dot plot.

- In supply, $80B of 4-/8-week bills sell at 1130ET. No NY Fed operational purchases.

EGB/GILT SUMMARY: Holding Firm

European sovereign bonds have rallied this morning alongside modest gains for equities.

- The Gilt curve has bull flattened with the 2s30s spread 2bp narrower.

- German bund yields are 1-2bp lower on the day with the long end of the curve marginally outperforming.

- OATs yields have similarly edged down 1-2bp with the curve close to flat.

- The final euro area manufacturing PMI prints for March were broadly a touch better than initially estimated.

- Speaking in the Financial Times, Irish taoiseach Micheal Martin has urged for a reset of UK-EU relations after the bilateral relationship came under pressure over the Northern Ireland border and access to Covid vaccines.

- Supply this morning came from the UK (Bills, GBP4bn).

EUROPE OPTION FLOW SUMMARY

UK:

0LZ1 99.75/99.87/100.12c fly 1x3x2, bought for -0.5 (receives) in 11k (ref 99.60, 5 del)

0LZ1 99.87c, bought for 3.75 in 4.5k (ref 99.625)

0LH2 99.87c, bought for 5.5 in 1.5k (ref 99.555)

FOREX: AUD Contrasts With Firmer Stocks, Hits 2021 Lows

- The greenback is holding recent gains, with the USD index in a holding pattern just below this week's 93.437 multi-month high. Having underperformed earlier this week, EUR is moderately stronger early Thursday, with EUR/GBP bouncing very slightly off the 2021 low of 0.8503.

- Today's weaker AUD contrasts with continued strength in equity markets as the e-mini S&P continues to probe recent highs. The index looks on track to test the record highs printed mid-March, a move above which would open the 4,000 level. AUD/USD retreated to touch 0.7532 in early Europe, a new 2021 low. Technical pressure and the further trimming of AUD longs by fund-type accounts have been cited for today's weakness.

- NOK is firmer as WTI and Brent crude futures resume their uptrend, with USD/NOK oscillating either side of the 8.5195 50-dma.

- Focus turns to March Manufacturing ISM data as well as US weekly jobless claims. Fed's Harker is also due to speak.

FX OPTIONS: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E468mln-EUR puts), $1.1850(E1.1bln-EUR puts)

- USD/JPY: Y108.00($969mln), Y108.50($655mln), Y108.90-109.00($660mln), Y109.35($585mln), Y110.00($532mln), Y111.00($790mln-USD puts)

- GBP/USD: $1.3800(Gbp399mln)

- AUD/JPY: Y85.85(A$664mln)

- USD/CAD: C$1.2350-55($750mln), C$1.2450($1.5bln), C$1.2600-10($1.5bln-USD puts), C$1.2630-45($1.2bln-USD puts), C$1.2660-75($1.3bln), C$1.2875($502mln)

- USD/CNY: Cny6.5475($750mln)

Price Signal Summary - E-minis Approaching Psychological Level

- In the equity space, S&P E-minis remain in an uptrend as the contract approaches the psychological 4000.00 handle. EUROSTOXX 50 is trading higher too as the uptrend extends. This reinforces the underlying bullish theme and opens 3987.14 next, 2.00 projection of the Dec 21 - Jan 8 rally from the Jan 28 low.

- In the FX space, EURUSD maintains a weaker tone. The focus is on 1.1695 next, 38.2% retracement of the Mar 2020 - Jan rally. The GBPUSD outlook remains bearish with scope for a move towards 1.3641, 38.2% of the Sep 23 - Feb 24 bull cycle. Resistance is at 1.3883, the former bull channel base drawn off the Nov 2 low. USDJPY remains bullish and is holding onto recent gains. The focus is on 111.30 next, Mar 26, 2020 high.

- On the commodity front:

- Gold remains vulnerable despite yesterday's gains. The focus is on the key support at $1676.9, Mar 8 low and the bear trigger.

- Brent (M1) key directional triggers are:

- Resistance at $65.39, Mar 29 high and key support at $60.33, Mar 23 low and the bear trigger

- WTI (K1) directional triggers are:

- Resistance at $62.27, Mar 30 high and support at $57.25, Mar 23 low and the bear trigger

- In the FI space, Bunds (M1) remain vulnerable. Key support to watch is at 170.52, Mar 18 low. The key support and bear trigger in Gilts (M1) is at 126.79, Mar 18 low. Treasuries traded to fresh trend lows Tuesday. The focus is on 130-07, Feb 2, 2020 low and the psychological 130-00 handle.

EQUITIES: Strong April Start for European Stocks

- Continental equities have got off to a good April start, with the EuroStoxx50 adding to the week's gains and hitting new multi-decade highs ahead of the NY crossover.

- The UK's FTSE-100 outperforms, higher by 0.7% as Spain's IBEX-35 lags very slightly - higher by just 0.1% headed into US hours.

- All sectors in Europe trade higher, with real estate and tech outperforming while consumer staples are at the bottom of the pile, but still hold above water.

- In futures space, firmer sentiment toward tech is helping point to a strong open for the NASDAQ-100, while the e-mini S&P is narrowing the gap with alltime highs posted mid-March at 3,988.75.

COMMODITIES: Oil Off Week's Lows Ahead of OPEC+

- Both WTI and Brent crude futures trade in decent positive territory, in the green by just shy of 2% apiece. The OPEC+ meeting today look to decide the group's policy for May output, with some focus paid to reports that the US had reached out to Saudi Arabia to discuss the promotion of 'affordable energy' - possibly complicating matters for the group.

- Expectations remain for the group to rollover pre-existing output cuts from April, although source-based reports this morning eyed gradual oil output increases at a maximum of 500,000bpd.

- Metals markets are less eventful. Spot gold has built upon yesterday's late rally, testing the $1720/oz mark but failing to progress any further. Markets look to top $1733.45 to make any headway toward mid-March's $1755.50 and the 50-dma beyond.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.