-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Stocks Off Lows, But Bounce Shallow

MNI (LONDON) - Highlights:

- Equities off lows, but bounce is shallow at this stage

- PCE data provides last look at the economy pre-Fed decision

- JPY short-covering rally slows, but uptrend remains intact for now

US TSYS: Rangebound, PCE In Focus Before Finalized U.Mich Survey

- Treasuries have kept to narrow ranges overnight after yesterday’s large gyrations on global growth concerns before stronger US data helped eventually steady the risk-off theme.

- Cash yields are between unchanged (2s and 3s) and 0.6bp higher (20s), with 2s holding close to the higher end of yesterday’s more than 10bp rebound but the long end is more firmly rangebound.

- As such, 2s10s at -18.6bps consolidates yesterday’s intraday pullback from fresh ytd highs of -10.9bps.

- TYU4 is at 110-28+ (+ 03) having kept between 110-24 to 110-30+ for firmly within yesterday’s wide range, on moderate cumulative volumes of 275k.

- Yesterday’s high of 111-08+ marked a firm step closer to resistance at 111-13+ (Jul 16 high) and the trend needle points north with some focus on 111-31 (Fibo projection).

- Data: Monthly PCE Jun (0830ET), U.Mich Jul final (1000ET), Kansas City Fed services Jul (1100ET)

STIR: Fed Rates Taking Stock Ahead Of Monthly PCE Report

- Fed Funds implied rates for meetings over the next six months have on balance held steady overnight after yesterday’s large swings on global growth factors before stronger than expected US data.

- The September rate is +0.8bp on the day but still has a first 25bp cut more than fully priced, whilst the Dec and Jan rates are ~0.5bp lower.

- Cumulative cuts from 5.33% effective: 1.5bp Jul, 28bp Sep, 45bp Nov, 68bp Dec and 84bp Jan.

- Today sees the monthly PCE report in focus after yesterday’s Q2 upside surprises for both core PCE inflation and consumer spending, with both watched to see where those stronger readings fell across the quarter.

- Our bias would be that the earlier in the quarter, especially April, the greater the change of a partial retracement of yesterday’s hawkish rebound.

WHITE HOUSE: Obamas Endorse Harris For Democratic Nominee

In a widely-expected, but nevertheless symbolically important move, former President Barack Obama and former first lady Michelle Obama have endorsed Vice President Kamala Harris to be the Democratic presidential nominee. The endorsement of the Obamas means that Harris has the backing of all high-profile Democrats ranging from incumbent President Joe Biden, to former President Bill and 2016 candidate Hillary Clinton, to the Democratic leaders in Congress Sen Chuck Schumer (D-NY) and Rep. Hakeem Jeffries (D-NY), and former House Speaker Nancy Pelosi.

- These endorsements, combined with the backing of more than half of the DNC delegates released after Biden's withdrawal makes Harris all-but-certain to be the Democrat nominee (she is not the 'presumptive nominee', that term is used to describe the candidate who has won a majority of delegates in the primary season).

- NYT reports that Harris is set to name her running mate by 7 Aug, a significantly truncated period of vetting compared to a normal campaign. Sen. Mark Kelly (D-AZ) and Pennsylvania Gov. Josh Shapiro (D) areseen by bettorsas the two frontrunners amid a crowded field.

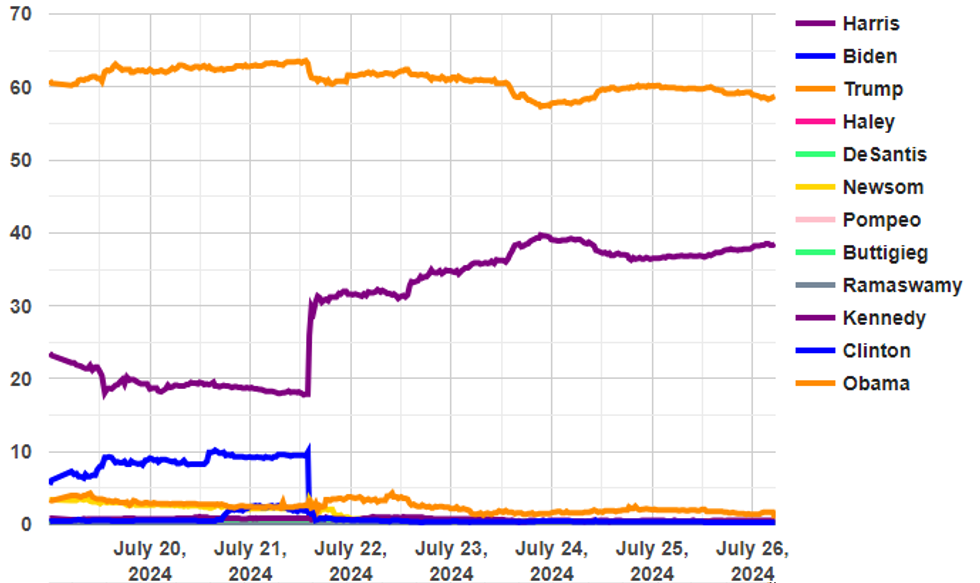

- Harris continues to trail former President Donald Trump in political betting markets, with the GOP nominee given a 57.8% implied probability of winning compared to 38.5% for Harris according to data from Electionbettingodds.com.

- Swing state polling published on 25 July (see 'US: Trump Leads In 4/5 Swing States, But Harris Narrows Gap Compared To Biden' 1134BST 25 Jul) shows Trump leading in key states, but crucially within the margin of error making them effective dead-heats.

Chart 1. Betting Market Implied Probability of Election Winner, %

Source: electionbettingodds.com

Source: electionbettingodds.com

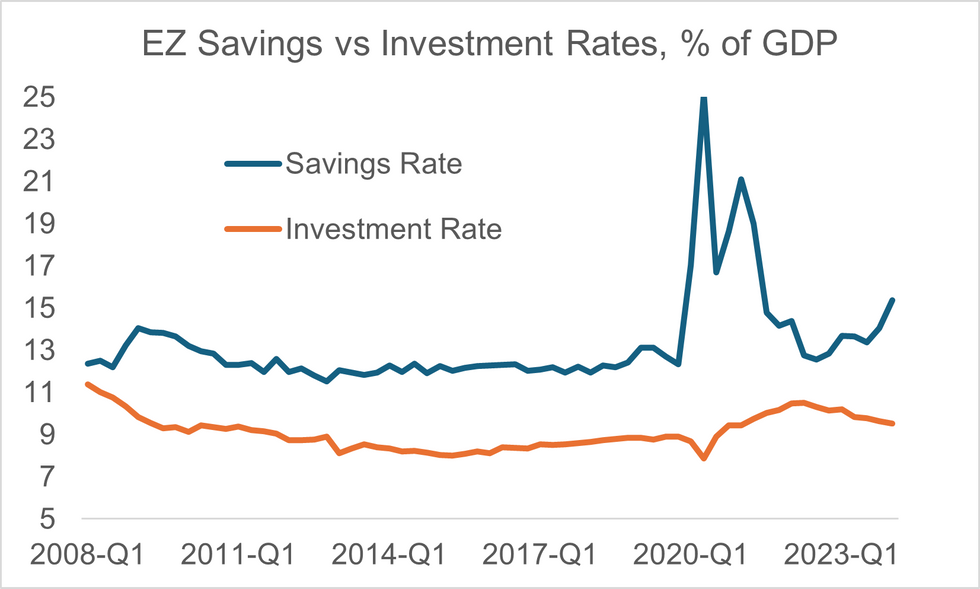

EUROZONE DATA: Q1 Sectoral Accounts Suggest Solid Real Income Gains

The Q1 Eurozone sectoral accounts suggest solid real income gains last quarter. As consumption growth lagged behind income growth, there was a resulting increase in the savings rate. Also, the accounts show savings continuing to outpace investment - suggesting a deterioration of the EZ capital account.

- Household real consumption per capita increased by 0.2% Q/Q (vs +0.1% Q4). Real disposable income per capita meanwhile increased 1.5% Q/Q (vs +0.7% Q4).

- This led the household savings rate to increase by 1.4 percentage points compared to Q4, to 15.4%, continuing its upward trend..

- The household investment rate meanwhile decreased by 0.1pp, to 9.5%, also in line with recent trends - indicating a deterioration of the EZ capital account.

- Looking at the individual countries, the theme that savings outpaced investment (which started around mid-2022) was quite broad-based. A notable exception was Greece, where a 2.0pp decline in the savings rate amid gross fixed capital formation jumping 13.5% indicate large foreign-financed investments in Q1.

MNI, Eurostat

MNI, Eurostat

US DATA: Watching Where Core PCE Upward Revisions Land In Q2

- Today’s PCE report for June at 0830ET headlines the docket.

- Bloomberg consensus sees core PCE inflation at 0.2% M/M in a close call with 0.1 (average 0.15). Indeed, the unrounded estimates we’d seen after CPI and PPI estimates had averaged 0.17% M/M.

- Those are now a little stale after yesterday’s stronger than expected Q2 advance release of 2.89% annualized vs cons 2.7 (albeit with slight skew to 2.8) and above every analyst entry.

- On its own it would imply a 0.28% M/M reading for core PCE in June but we feel it more likely to instead be spread over prior months in the quarter. That has happened a few times recently after past quarterly surprises, providing a partly offsetting market reaction to the prior day’s surprise.

- The current profile sees 0.26% M/M in Apr before what was a surprisingly soft 0.08% M/M in May.

- Non-housing core services remain will also be watched closely for the latest outturn and revisions, having moderated from 0.28% M/M to 0.096% M/M in May.

- The CPI supercore equivalent has seen two particularly weak readings in the latest two months of -0.04% in May and -0.05% in June even if that does reflect some idiosyncratic factors at play.

US DATA: Slightly Stronger Consumer Spending To Be Also Reflected

- Similar to surprisingly strong core inflation, real consumer spending was also stronger than expected in Q2 at 2.3% annualized even if it was closer to the Atlanta Fed’s GDPNow (cons 2.0, GDPNow 2.3).

- For context of the recent trend, the tentative 2.3% follows 1.5% in Q1 and a particularly strong 3.2% average in 2H23.

- Real consumer spending is seen printing another rounded 0.3% M/M in June after a currently seen 0.26% M/M in May.

- That saw a recovery from the -0.13% M/M in April, with the swing coming from goods consumption (0.59% M/M after -0.69% M/M) against a backdrop of steady service consumption moderation (0.10% M/M after 0.14% M/M).

- The quarterly data in yesterday's GDP report roughly support this trend, with goods consumption 2.5% after -2.3% vs services at 2.2% after 3.3%.

- Last week’s retail sales were notably stronger than expected in June, with overall sales flat in nominal terms (cons -0.3) and stronger in real terms considering a decline in CPI core goods prices that month. Further, control group sales jumped a nominal 0.9% (cons 0.2) after 0.4% M/M.

- So, goods consumption was likely solid in May but services are watched seeing as they account for almost 70% of consumer spending.

- Elsewhere, we watch the personal saving rate after revisions left a flatter profile in the May report. At 3.9%, it’s off cycle lows but remains historically depressed, suggesting a new for a (potentially slow) trend higher. That’s especially so with household “excess savings” accumulated through the pandemic now broadly estimated to have fully or almost fully depleted.

FOREX: Sanguine Start Allows JPY, CHF to Roll Off Weekly Highs

- For the first time this week, JPY heads into the NY crossover as the poorest performing currency on an intraday basis, sitting mildly softer against all others in G10 after the sharp rally posted over the past few sessions. The resultant bounce in USD/JPY keeps spot prices pinned between two sizeable option expiries rolling off at today's NY cut, with $1.1bln of strikes expiring between Y153.91-00, and $1.4bln at Y155.30-50.

- The JPY rally this week, and subsequent fade today, had dragged funding currencies higher in tandem, and the co-movement persists. CHF is softer alongside JPY, helping EUR/CHF bounce back toward the 200-dma of 0.9604.

- The USD Index headed through the European open in negative territory, but greenback is off lows into NY hours. Ranges are tight, however, as markets tread water before the bigger data prints later today.

- While spot markets are muted, front-end vol markets remain firm, with markets looking ahead to a busy week next week. The BoJ/Fed/BoE decisions are all due within a single 36 hour period, and all of which could have heavy market implications. USD/JPY one-week vols have been marked above 15 points for the first time since April, and only the second time in 2024.

- Today’s US PCE report for June will take focus, and markets will particularly watch non-housing core services PCE for the latest outturn and revisions, having moderated from 0.28% M/M to 0.096% M/M in May. There are no central bank speakers of note, with both the BoE and the Fed inside their pre-decision blackout periods.

OPTIONS: USD/JPY Slide Slows, Leaving Spot Pinned Between Strikes

- With the JPY short squeeze slowing into the Thursday close, FX options expiries could play a greater role given the more sanguine currency market so far this morning. EUR/USD holds just above a series of decent-sized strikes layered between 1.0800-35, and larger at the 1.09 handle: $1.0800(E620mln), $1.0825-35(E691mln), $1.0900(E832mln), while USD/JPY is inching away from $1.1bln of strikes between Y153.91-00, and toward $1.4bln at Y155.30-50.

- Other G10 FX pipelines are more muted today, with GBP/USD unlikely to make much progress toward GBP814mln rolling off at $1.2970.

Break of 20-, 50-Day EMAs Reinforce Bearish Theme for E-Mini S&P

- Eurostoxx 50 futures traded lower Thursday, reinforcing current bearish conditions. The contract has traded through a key support at 4846.00, the Apr 19 low. A clear break of this level would pave the way for an extension towards 4724.21, the 200 day MA on the continuation chart. Moving average studies are in a bear-mode set-up, highlighting a downtrend. Initial firm resistance to watch is 4980.00, the Jul 23 high.

- S&P E-Minis have traded lower this week and the move down has resulted in a break of both the 20- and 50-day EMAs. This reinforces a short-term bearish cycle and signals scope for an extension near-term. Note that the move down is considered corrective. Potential is seen for a move towards 5429.62, the lower band of a MA envelope, ahead of 5370.62 a Fibonacci retracement. Key short-term resistance is 5629.75, the Jul 23 high.

Short-Term Bearish Threat in WTI Futures Remains Present

- The recent move lower in WTI futures signals scope for an extension near-term. The contract has traded through both the 20- and 50-day EMAs, reinforcing a short-term bearish threat. A resumption of the bear leg would open $72.23, the Jun 4 low and the next key support. For bulls, a reversal higher would instead refocus attention on the key resistance points at $83.58, the Jul 5 high, and $84.36, the Apr 12 high.

- Gold has pulled back from its recent highs. The move down is considered corrective, however, the yellow metal has pierced support at the 50-day EMA - at $2360.0. A clear break of this average would signal scope for a deeper retracement. This would open $2277.4, the May 3 low and a key support. For bulls, a reversal higher would refocus attention on $2483.7, the Jul 17 high, and a bull trigger. A break would resume the primary uptrend.

| Date | GMT/Local | Impact | Country | Event |

| 26/07/2024 | - | ECB's Cipollone at Rio de Janeiro G20 Fin min/central bank meeting | ||

| 26/07/2024 | 1230/0830 | *** | Personal Income and Consumption | |

| 26/07/2024 | 1400/1000 | ** | U. Mich. Survey of Consumers | |

| 26/07/2024 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 26/07/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.