-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - SVB Crisis Bleeds Into European Markets

Highlights:

- SVB crisis bleeds into underperformance for European banks

- Market focus turns to any central response ahead of Fed blackout period

- NFP still to come, consensus looks for +225k

US TSYS: Richer Still Across The Curve, Bid Re-Emerging With US Coming In

- Treasuries have pared overnight gains but remain firmly richer across the curve after yesterday’s SVB-linked safe haven seeking trade. The move extending through Asia hours before some cheapening through the European session but has started to a see a bid emerge again with the US coming in.

- Payrolls provides a next significant test at 0830ET (preview here) with currently no Fedspeak scheduled ahead of tonight's start of the media blackout.

- 2YY -5.4bp at 4.816%, 5YY -6.2bps at 4.130%, 10YY -5.8bps at 3.845% and 30YY -3.5bps at 3.814%. 2s10s now at -97bps have on Wed cleared -110bps.

- TYM3 trades 18+ ticks higher at 112-02 off highs of 112-13 on huge cumulative volumes (~730k vs 300k average for time of day). After yesterday’s late run through resistance at two recent highs plus the 20-day EMA, it next opens 112-18 (Feb 17 high) after which sits the 50-day EMA at 113-01.

- Data: Payrolls for Feb (0830ET), Monthly budget statement for Feb (1400ET)

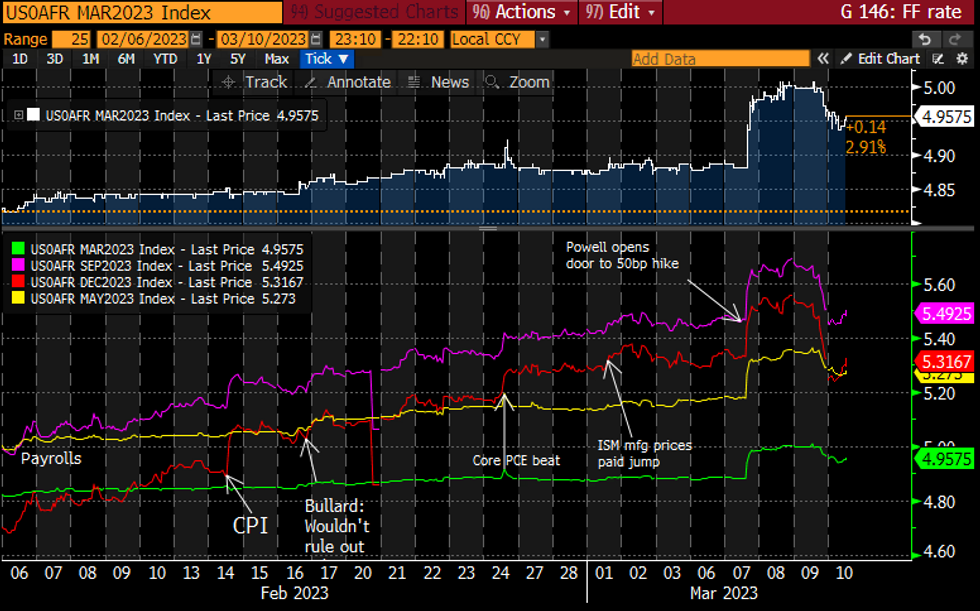

STIR FUTURES: Fed Rate Path Lifts But Only To Yesterday Close

- Fed Funds implied hikes have lifted off overnight lows for little change after yesterday’s SVB-linked slide, back near levels for the terminal prior to Powell opening the .door to a 50bp hike.

- 38.5bp for Mar (-0.5bp on the day, -4.5bp since Wed close), cumulative 70bp for May (-1.5bp, -8.5bp) and 93bps to a 5.50% terminal now back in July (-1bp, -20bp). It’s followed by 18bp of cuts to 5.32% year-end (unch, -24bp).

- No Fedspeak currently scheduled but good potential for pop-ups ahead of the media blackout tonight (preventing talk on macro developments/mon pol issues but not banking, as evidenced by Gov Bowman speaking Tue).

Source: Bloomberg

Source: Bloomberg

Fed Implications Of SVB Crisis

A few thoughts on the unfolding SVB Financial situation and what it means for Fed policy:

- SVB's story and share price collapse yesterday appears to be fairly straightforward: rising US interest rates resulted in a combination of 1) losses on MBS and other fixed income security holdings 2) increasing short-end funding costs 3) SVB's unusually high exposure to the waning tech/start-up space.

- As for Fed policy, SVB is not a game-changer but it will certainly alter the discussion if not the outcome of the March FOMC. The pre-FOMC blackout which starts tonight couldn't come at a worse time, creating a limited window in which to comment pre-Mar 22nd decision on both the Fed's view of potential systemic risk from SVB, or the latest key macro data. The Fed has a long history of hiking rates until something "breaks". To be sure, it would be taking it too far to interpret the SVB episode as the beginning of a systemic crisis, let alone evidence that they've done enough to quell inflation.

- Even if Powell exudes calm on the financial stability front, the more dovish and centrist FOMC participants will be mindful going into the meeting that the hiking cycle has gone on for exactly a year, about enough time for the lagged effects of tightening to start to be seen.

RATINGS: Friday's Sovereign Rating Slate

Sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Fitch on Belgium (current rating: AA-; Outlook Stable) & Cyprus (current rating: BBB-; Outlook Stable)

- S&P on Norway (current rating: AAA; Outlook Stable) & Portugal (current rating: BBB+; Outlook Stable)

- DBRS Morningstar on Greece (current rating: BB (high), Stable Trend)

FOREX: JPY Slips as Kuroda Keeps Tiller Steady in Final Meeting

- Asset prices are closely following the spillover from the fallout of Silicon Valley Bank late yesterday, with markets watching carefully for any similar issues at other exposed banking names. European equities were sold from the off, with the EuroStoxx50 Bank Index erasing six weeks of gains having gapped lower at the open.

- The uncertainty surrounding global financials has led to outperformance in the CHF, while high yielding currencies are hit the hardest. Data releases remain a background driver, with softer CPI hitting the NOK, while firmer-than-expected monthly UK GDP data puts the currency at the top of the G10 pile.

- Elsewhere, JPY is comfortably the poorest performing currency across G10, sliding after the unchanged BoJ rate decision and defying the minority view that Kuroda could tweak yield curve control at his final meeting.

- Focus moving forward rests on the February nonfarm payrolls release, at which markets look for job gains of 225k over the month and an unchanged unemployment rate at 3.4%. The Canadian equivalent is also due, where consensus looks for an uptick in the unemployment rate to 5.1%.

FX OPTIONS: FX Vols on Front Foot, With Risk Proxies Seeing a Particular Focus

- The bout of risk-off stemming from the SVB contagion concerns is making waves across FX vol markets, with the 3m - 1y section of the G10 vol curve notched higher. Gains are led by risk proxy currencies and most notably AUD: AUD/USD 1m implieds have been marked higher to 13.5 points and the highest level since mid-January, potentially capturing any more of the extended fallout from the global banking sector as well as the Mar22 Fed decision.

- The price action is mimicked in other risk-sensitive currencies, with USD/MXN vols clearing the early December highs to touch the highest levels since late September.

- At the extreme short-end, AUD/USD, USD/ZAR and USD/CAD overnight vols have built the largest vol premium ahead of the NFP release later today, suggesting these currency pairs could be a focus in any market reaction to the jobs report.

FX OPTIONS: Expiries for Mar10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0525-30(E1.4bln), $1.0550-65(E1.5bln), $1.0600-20(E1.2bln), $1.0660-65(E1.1bln), $1.0695-00(E616mln)

- USD/JPY: Y135.00($606mln), Y136.00($2.6bln)

- AUD/USD: $0.6750(A$746mln), $0.6800-20($1.0bln)

- AUD/NZD: N$1.0750(A$914mln)

- USD/CAD: C$1.3710($618mln)

- USD/CNY: Cny6.9500($573mln)

EQUITIES: SVB-Inspired Equity Sell Off Bleeds into Friday Morning

- Eurostoxx 50 futures are trading lower today. Price has moved below a key support at 4249.30 - the base of a bull channel drawn from the Oct 13 low. A clear break of this channel base would threaten the uptrend that has been in place since late September last year. An initial downside objective would be 4167.40, the 50-day EMA. Key resistance has been defined at the 4328.00, the Mar 6 high and the bull trigger.

- S&P E-Minis sold off Thursday and the contract is trading lower once again today. Price has cleared key short-term support at 3925.00, the Mar 2 low and this confirms a resumption of the bear cycle that has been in place since the Feb 2 reversal. The move lower signals potential for an extension towards the 3800.00 handle and support at 3788.50, the Dec 22 low. Initial firm resistance is seen at 4015.27, the 50-day EMA.

COMMODITIES: Gold Trades Higher Again Friday, Remains Technically Bearish

- A sharp sell-off in WTI futures Tuesday has defined a key resistance at $80.94, Feb 7 high. A break of this hurdle is required to reinstate the recent bullish theme that would open $82.89, the Jan 23 high and a key resistance. The contract is trading lower today, extending this week’s bearish move and sights are on $73.80, the Feb 22 low. A breach of this level would strengthen a bearish threat. Initial resistance is seen at $78.06, yesterday’s high.

- Trend conditions in Gold remain bearish and Tuesday’s strong sell-off reinforces this theme. The move lower signals the end of the recent corrective bounce and attention is on support at $1804.9, the Feb 28 low. A break of this level would confirm a resumption of the downtrend and open $1787.3, a Fibonacci retracement. The yellow metal needs to breach $1858.3, the Mar 6 high, to signal scope for a stronger reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/03/2023 | 1330/0830 | *** |  | US | Employment Report |

| 10/03/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/03/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 13/03/2023 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.