-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI US MARKETS ANALYSIS - Talk of Sizeable Stimulus Excites Markets

Highlights:

- Stocks on front foot as markets eye stimulus reports

- Italian/German spreads widen out as political crisis deepens

- Fedspeak up next, with Powell, Kaplan, Rosengren & Bostic all due

US TSYS SUMMARY: Weaker Ahead Of Powell And Biden Stimulus Plan

Treasuries are weaker with a steeper curve, ahead of fiscal and monetary policy matters Thursday.

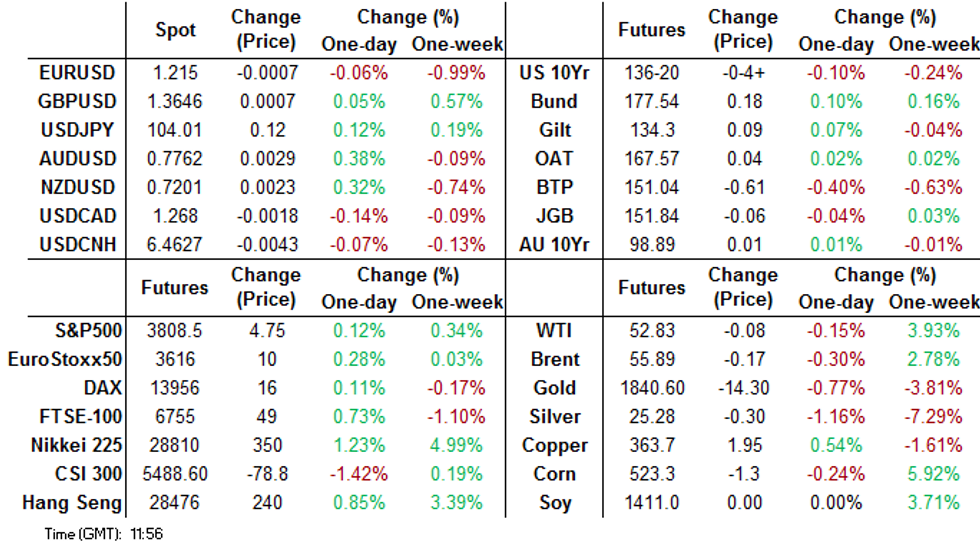

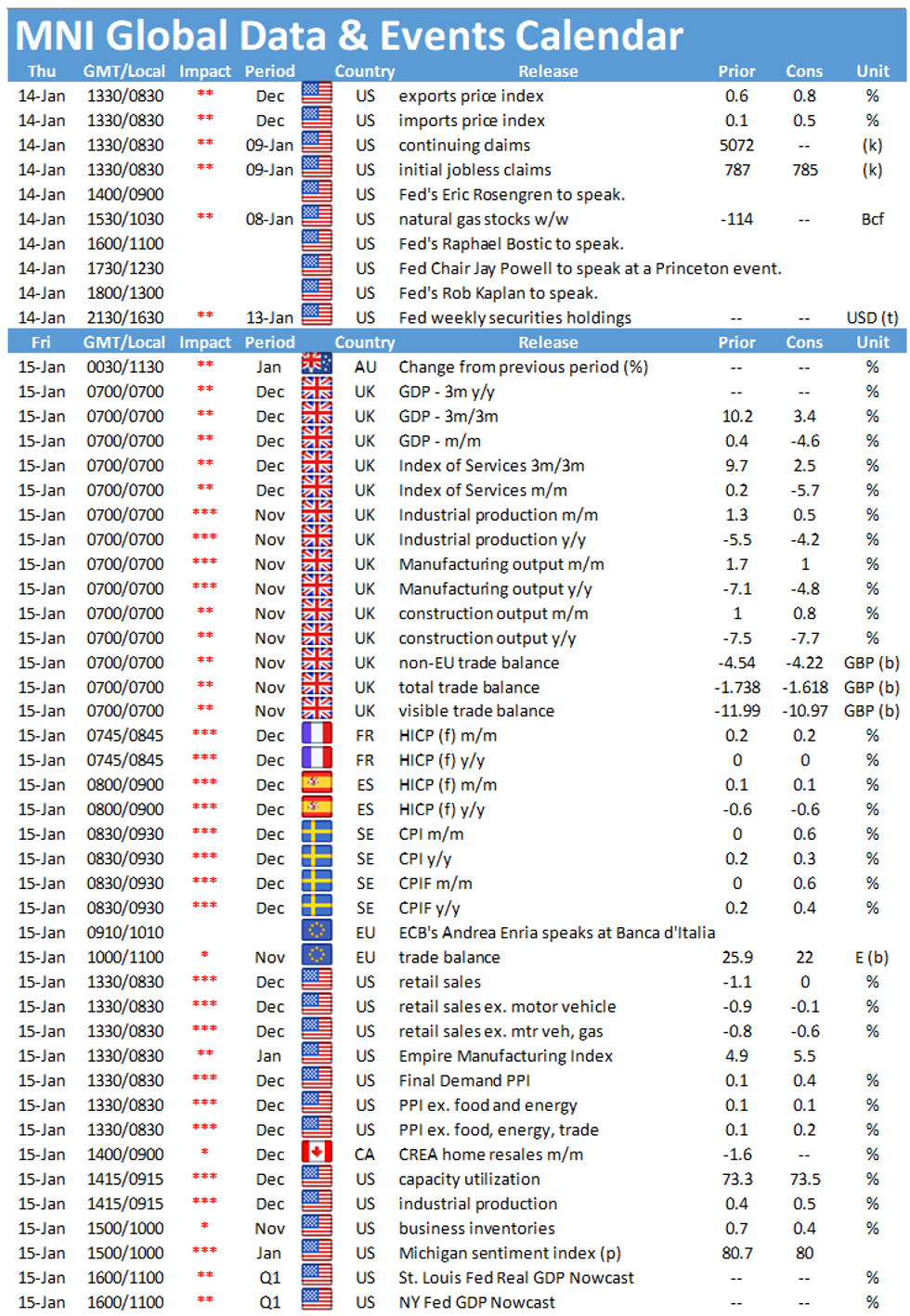

- The 2-Yr yield is up 0.4bps at 0.147%, 5-Yr is up 1.5bps at 0.4836%, 10-Yr is up 2.2bps at 1.1053%, and 30-Yr is up 2bps at 1.8359%.

- Mar 10-Yr futures (TY) down 4/32 at 136-20.5 (L: 136-17 / H: 136-28), strong volumes once again (~370k as of 0630ET).

- The main event of the day is set to be Pres-elect Biden unveiling a stimulus plan that CNN reported overnight would be "in the ballpark" of $2trn (a higher-than-anticipated figure that triggered the Tsy sell-off in Asia-Pac hours). Time expected ~1915ET.

- Fed Chair Powell (1230ET) relegated to second fiddle, but still a key event a day after Gov Brainard attempted to dampen speculation that the FOMC was considering a taper anytime soon, vs VC Clarida seen by some as hawkish saying that the FOMC would not hike until inflation at 2% "for a year" (vs a more aggressive makeup strategy).

- Other Fed speakers include Boston's Rosengren at 0900ET, Atlanta's Bostic at 1100ET, and Dallas' Kaplan at 1300ET (though we've already heard from each of them recently).

- 0830ET sees weekly jobless claims and Dec export/import prices.

- Supply consists of $65B of 4-/8-week bills at 1130ET. NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY: US stimulus and Italian politics the talking points

US fiscal stimulus and the Italian political situation remain the biggest talking points in markets.

- Treasuries saw a decent pullback yesterday on the back of a CNN report that stimulus could be as much as USD2trn. However, we have since drifted a bit higher and remain above the levels seen at this time yesterday.

- Renzi has pulled the support of his party from the Italian government. As our political risk team have pointed out, this doesn't necessarily mean there will be snap elections soon. However, the risk of elections has clearly increased and we have seen BTPs react accordingly.

AUCTION RESULTS: Italy sells E9.25bln of BTPs vs E7.75-9.25bln target

E2.75bln of the 0% Jan-24 BTP:

Average yield -0.23% (-0.30%)

Bid-to-cover 1.44x (1.41x)

Price 100.68 (100.92)

Pre-auction mid-price 100.624

E4.5bln of the new 0.25% Mar-28 BTP:

Average yield 0.30% (0.19%)

Bid-to-cover 1.43x (1.40x)

Price 99.62

E2.0bln of the 1.70% Sep-51 BTP:

Average yield 1.47% (1.763%)

Bid-to-cover 1.37x

Price 105.80 (98.686)

Pre-auction mid-price 105.568

(Brackets refer to previous issuance)

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 176/179 RR, bought for 8.5 in 5k vs RXG1 176p, sold at 5 in 5k (package trades at 3.5)

DUG1 112.30/20/00p fly, sold at 3 in 2k

ERZ2 101c, bought for 1.75 in 10k

UK:

0LU1 99.87/99.75ps 1x2, bought for half in 13.5k

LZ1 100/99.87ps, trades 4 in 2k

0LH1 100.12/100/99.87p fly 1x3x2 sold at 1 in 10k

FOREX: JPY Offered as Stimulus Plans in View

JPY's comfortable the poorest performer across G10 early Thursday, with markets selling haven currencies in response to reports that President-Elect Biden could table a fresh stimulus package amounting to as much as $2trl. Attention now shifts to a speech due Thursday evening for more details on his "shoot for the moon" approach to policy-making.

The greenback initially benefited from the stimulus news, but has been sold since, although yesterday's lows are still a way off from here.

SEK is retracing the Wednesday losses to outperform most others, while AUD and NZD are also seeing decent strength.

Weekly jobless claims data and import/export price indices are the data highlight. Speakers include Fed's Rosengren, Bostic, Powell and Kaplan all due to cross later today.

FX OPTIONS: Expiries for Jan14 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2150(E909mln-EUR puts), $1.2200-05(E527mln), $1.2250-70(E739mln)

USD/JPY: Y102.00($506mln), Y103.90-104.00($694mln-USD puts), Y104.25-40($1.3bln-USD puts)

AUD/USD: $0.7355(A$606mln)

TECHS: Price Signal Summary - FI Gains Considered Corrective

- EURUSD is consolidating. A bear flag has appeared on the charts, reinforcing a short-term bearish risk theme. Support levels to watch are:

- 1.2130, Dec 21 low and 1.2093, the 50-day EMA. A break of both would signal scope for a deeper pullback.

- USDJPY attention remains on key resistance at 104.27, the bear channel top drawn off the Mar 24 high. A break would highlight a stronger reversal. Monday's high of 104.40 is the bull trigger.

- Sterling remains constructive. Resistance levels to watch in Cable today are:

- 1.3704 High Jan 4 and

- 1.3750 0.764 projection of May 18 - Sep 1 rally from Sep 23 low

- EURGBP, this week cleared key support at 08933. The focus is on:

- 0.8867, Nov 23 low and a key support

- On the commodity front, Gold still appears vulnerable following recent weakness. Watch support at $1810.7 - 76.4% of the Nov 30 - Jan 6 rally. Oil contracts remain bullish despite trading lower yesterday. Brent (H1) targets $58.59 - 76.4% of the Jan - Apr 2020 sell-off (cont). WTI (G1) focus is on $54.50 - high Feb 20, 2020 and a key resistance (cont).

- In the FI space, short-term gains are considered corrective. Resistance levels to watch:

- Treasuries (H1) - 136-29+, Jan 8 high.

- Bunds (H1) - 177.69, 61.8% retracement of the Jan 4 - 12. Today's high so far has been 177.62.

- Gilts (H1) - 134.66/70, the 20- and 50-day EMAs

EQUITIES: Stocks Welcome News That Stimulus Could Amount to $2trl

European stock markets are uniformly higher Thursday, with markets advancing on the back of reports that President-Elect Biden could move swiftly with a fresh wave of fiscal stimulus that could amount to as much as $2trl.

The UK's FTSE-100 outperforms slightly, up just over 0.5% while peripheral markets lag slightly, with Spanish, Italian names underperforming. In Europe, energy and consumer discretionary names are top of the table, while utilities and communication services are the sole sectors in the red.

BlackRock have unofficially kicked off quarterly earnings season, beating expectations on both assets-under-management as well as EPS metrics. Wells Fargo, JPMorgan and Citigroup follow on Friday.

COMMODITIES: Oil Rally Cools, Gold Shows Below 200-DMA

The firm rally in WTI and Brent crude futures cooled Wednesday, settling slightly lower after touching new cycle highs in early Asia-Pac trade. Prices Thursday show no signs of picking up further with markets broadly flat ahead of the COMEX open.

Spot gold is softer early Thursday on stimulus hopes for the incoming Biden administration, pressuring prices below the 200-DMA of $1842.68. A close below would be the first since late November, and would open $1817.49, the 2021 low as the first downside target.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.