-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, July 12

MNI US OPEN - Harris Overtakes Biden in Democratic Nomination Betting Odds

MNI US MARKETS ANALYSIS - Tech Sell-Off Bleeds into Europe

HIGHLIGHTS:

- Tech sell-off bleeds into Europe, with continental indices off 2% or more

- Inflation concern evident in Europe, with core EGBs soft

- Calendar light on data, heavy on Fedspeak

US TSYS SUMMARY: Weaker Amid Tech Rout; Fed Speakers And 3-Yr Supply Ahead

Tsys remained on the back foot overnight Tuesday, finding little respite despite a continued rout in equities (led again by tech stocks). A busy Fed speaker schedule and 3-Yr supply lie ahead.

- The 2-Yr yield is unchanged at 0.1528%, 5-Yr is up 0.7bps at 0.7902%, 10-Yr is up 0.6bps at 1.6075%, and 30-Yr is unchanged at 2.3256%. Jun 10-Yr futures (TY) down 2/32 at 132-17.5 (L: 132-14.5 / H: 132-23.5) , with volumes on the higher side (~350k traded as of 0620ET).

- Nasdaq futures off 1.3%; dollar weaker. Notably, Tsys outperforming Bunds and Gilts. Of some note: overnight, 10-Year JGB auction drew its lowest bid/cover ratio since 2015.

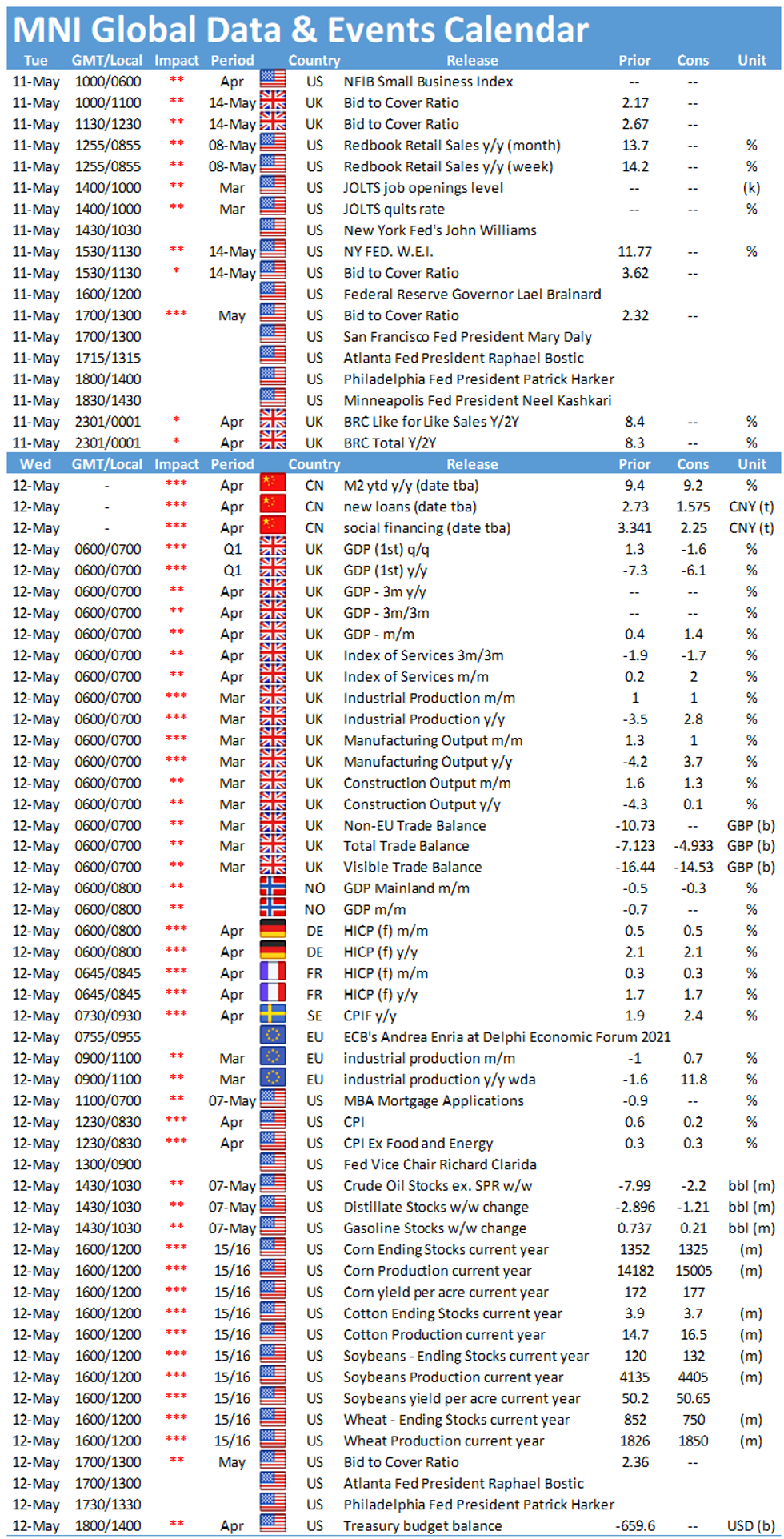

- Seven Fed speakers scheduled today: Clev's Mester (1000ET on Yahoo Finance), NY's Williams (1030ET), Gov Brainard (1200ET), SF's Daly (1300ET), Atl's Bostic (1315ET), Philly's Harker (1400ET), Minn's Kashkari (1430ET).

- In data, NFIB small business optimism a shade worse than expected in Apr (99.8, vs 100.8 surv., 98.2 prior), with Mar JOLTS up at 1000ET.

- Pres Biden meets state governors at 1300ET to discuss COVID vaccine rollout efforts.

- In supply, we get $40B in 42-day bills auctioned at 1130ET, with the highlight being $58B in 3Yr Notes selling at 1300ET. NY Fed buys ~$2.425B of 1-7.5Y TIPS; last purchase before new schedule released Weds.

EGB/GILT SUMMARY - Inflation Concerns Stoke Sell Off

European sovereign bonds have traded weaker this morning and curves have bear steepened alongside a sell-off in stocks on the back of fresh concerns over inflation.

- Gilt yields are 1-4bp higher with the long-end of the curve underperforming.

- The bund curve has similarly bear steepened with the 2s30s spread 2bp wider on the day.

- OATs trade in line with bunds. Last yields: 2-year -0.6446%, 5-year -0.4973%, 10-year 0.1992%, 30-year 0.9823%.

- BTP yields are 1-4bp higher with the curve 1-2bp steeper.

- Supply this morning came from the UK (Gilts, GBP4.5bn), Spain (Letras, EUR1.40bn), the Netherlands (DSL, EUR2.35bn), Belgium (TCs, EUR2.852bn) and the ESM (Bills, EUR1.1bn). Germany today placed EUR6bn of a 30-year green bond with books above EUR38.9bn.

- The German ZEW survey for May surprised higher with the expectations component printing 84.4 vs 72.0 expected.

EUROPE ISSUANCE UPDATE: DMO Gilt Sales, German Syndication

UK DMO sells GBP1.50bln of the 0.50% Oct-61 Gilt, Avg yield 1.264% (Prev. 1.261%), Bid-to-cover 2.27x (Prev. 2.63x), Tail 0.4bp (Prev. 0.2bp)

- Also sells GBP3bln of the 0.375% Oct-26 Gilt, Avg yield 0.457% (Prev. 0.468%), Bid-to-cover 2.57x (Prev. 2.56x), Tail 0.2bp (Prev. 0.3bp)

German syndication: German 30y 0% Aug-50 Green Bond:

- Size: E6bln (including EUR 500mln retained by the issuer)

- Books: Final books at reoffer closed above E38.9bln (incl. E1.95bln JLM interest)

Spread set earlier at conventional 0% Aug-50 Bund minus 2bps

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM1 171/169/168 broken p fly sold at 101 in 2.75k (profit taking)

RXM1 171/170.5ps. Sold at 35,in 4.5k (profit taking)RXM1 168/167ps, bought for 6 in 3k

DUM1 112.10/112.20/112.30c fly, bought for 1.5 in 1.25k

3RZ1 99.87/99.62ps vs 100.25/100.37cs, bought the ps for flat in 2k (ref 100.09, -30 del)

FOREX: Equity Sell-Off Still Hanging Over Markets

- Yesterday's US equity market sell-off is lingering across the continent today, with European markets lower by 1% or more. Currency markets aren't following suit, however, with the JPY the poorest performer so far in G10 (EUR/JPY sits just below yesterday's multi-year high of 132.53) while AUD, EUR hold their ground.

- EUR/USD trades firmer, with the pair eyeing yesterday's 1.2178 high for direction, with this morning's ZEW survey lending some support. The expectations component hit the highest since January 2000 at 84.4.

- Scandi currencies are higher early Tuesday, with SEK and NOK among the best performers in G10 so far. This has kept both USD/NOK and USD/SEK well within reach of the 2021 cycle lows, with markets watching 8.1493 and 8.2058 in each respective pair.

- The data slate is light Monday, with no major releases on the docket. This keeps focus on the central bank speaker slate with a large number of Fed members due. Williams, Brainard, Daly, Bostic, Harker and Kashkari all speak, with Knot and de Cos of the ECB also due.

FX OPTIONS: Expiries for May11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E736mln), $1.1920(E539mln), $1.2050(E508mln), $1.2095-1.2100(E1.4bln-EUR puts), $1.2120-25(E1.4bln-EUR puts), $1.2180-90(E1.75bln)

- USD/JPY: Y108.00($1.5bln), Y108.45-50($665mln-USD puts), Y109.00($830mln-USD puts), Y109.40-50($1.2bln-USD puts), Y109.75($525mln)

- AUD/USD: $0.7620-30(A$2.7bln-AUD puts)

- NZD/USD: $0.7200-05(N$810mln)

- USD/MXN: Mxn19.80($505mln)

Price Signal Summary - Bunds Weaken Towards Key Supports

- In the equity space, S&P E-minis have started the week on a softer pulling back from yesterday's high of 4238.25. Two key supports to watch are located at:

- 4135.30, trendline support drawn off the Mar 4 low

- 4110.50 Apr 20 low

- A break of the latter would confirm a top and suggest scope for a deeper pullback. Until then, the trend remains up.

- In FX, EURUSD maintains a firmer tone following Friday's gains and the break of 1.2150, Apr 29 high. The focus is on 1.2184, Feb 26 high and 1.2243, Feb 25 high. GBPUSD is firm following yesterday's strong rally and attention turns to 1.4237, Feb 24 high and this year's high. USDJPY short-term support has been defined at Friday's low of 108.34. A bullish theme remains intact while this level holds and attention is on 109.70, May 3 high. A break of support would highlight a trendline break, drawn off the Jan 6 low and risk a deeper pullback.

- On the commodity front, the Gold is holding onto gains and the outlook is bullish. Last week's climb has opened $1851.5, 61.8% retracement of the Jan 6 - Mar 8 sell-off. Oil is off recent highs but the uptrend remains intact. The Brent (N1) focus is on the psychological $70.00 level and $71.75, Jan 8 2020 high (cont). Watch key support at $62.91, May 3 low. WTI bulls are eyeing the key resistance at $67.29, Mar 8 high. Support at $66.10, May 3 low is key.

- In the FI space, Bunds (M1) are sharply lower today and approaching initial support at 169.47, May 3 low. A break would expose the major support at 169.24, Feb 25 low and the bear trigger. Near-term risk in Gilts is still skewed to the downside. The next support and intraday bear trigger is at 127.32, Apr 1 low.

EQUITIES: Tech Overhang Weighing on European Indices

- After the lower close on Wall Street Monday (NASDAQ finished off by over 2.5%, while the Dow Jones fell just 0.1%), the tech pullback continues overhang over European markets this morning, with most indices off by 2% or more. Unsurprisingly the tech sector is the poorest performer in Europe, but all sectors are lower at the halfway point.

- Germany's DAX is underperforming, while the decline is most modest in Spain's IBEX-35, which has limited losses to 1.3%.

- In US futures space, Monday's weakness has carried through, with the NASDAQ-100 future off over 1% pre-market to hit the lowest levels since the beginning of April.

COMMODITIES: Energy, Metals Consolidate, But Still Tightly Wound

- Oil markets are consolidating ahead of the Tuesday open, with WTI and Brent crude futures in minor negative territory at pixel time. WTI has, so far, traded wholly inside the Monday range, with directional triggers unchanged at $63.90 and the $62.51 50-dma, with the May 5 high at $66.76 the key upside level.

- In metals space, gold and silver are recovering off the overnight lows as the greenback edges lower, but there's been little momentum pick-up on the way into Monday's highs. For gold, resistance is expected headed into $1845.51, with silver's next level seen at $27.88.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.