-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Firmer Pre-Heavy Data Slate

HIGHLIGHTS:

- Treasuries firm as markets look to digest heavy data slate

- Earnings season continues, with Bank of America, Citigroup and Blackrock all reporting Thursday

- Commodity-tied currencies surge further, AUD on top

US TSYS SUMMARY: Gaining Ahead Of Retail Sales Data, And Non-FOMC Fed Speakers

Tsys have gained in overnight trade Thursday, with TYs cloding in on the week's highs ahead of a heavy data slate.

- Jun 10-Yr futures (TY) up 5/32 at 132-02.5 (L: 131-26.5 / H: 132-04). The 2-Yr yield is down 0.2bps at 0.159%, 5-Yr is down 1.3bps at 0.8419%, 10-Yr is down 1.8bps at 1.6148%, and 30-Yr is down 1.6bps at 2.2954%.

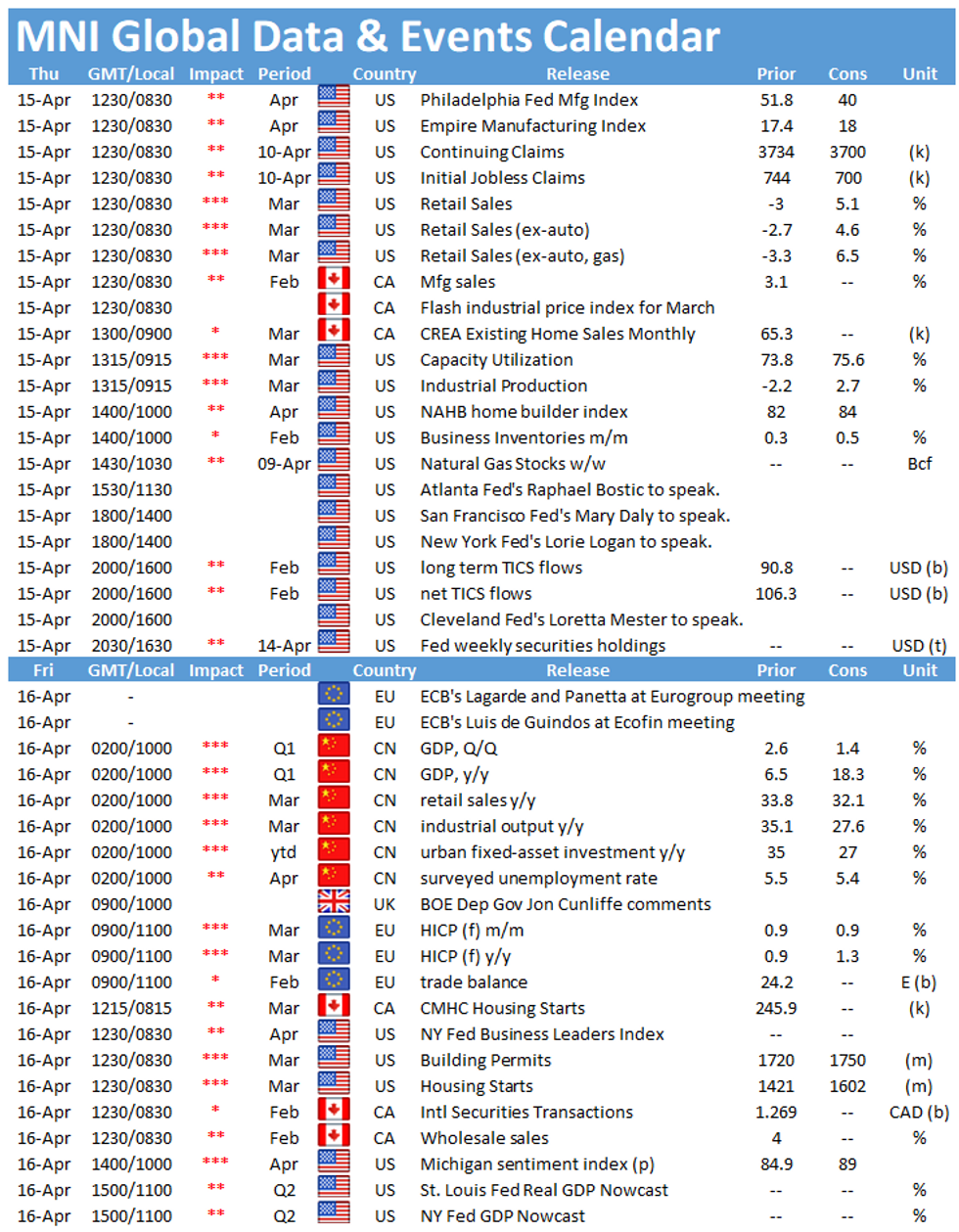

- 0830ET brings weekly jobless claims and Mar retail sales, as well as Apr regional indices (Empire Manufacturing and Philly Fed Biz Outlook).

- Then at 0915ET, Mar industrial production, followed by business inventories at 1000ET.

- Fed speakers include Atl's Bostic (1130ET), SF's Daly (1400ET), and Cleveland's Mester (1600ET), but also some non-FOMC speakers of interest: NY Fed's SOMA head Logan at a SIFMA event at 1400ET and Fed general counsel Van Der Weide on LIBOR transition before the House Financial Svcs commitee.

- Tsy sells $80bn of 4-/8-week bills at 1130ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILT SUMMARY: Bull Flattening

European sovereign bonds have rallied this morning alongside modest equity gains and uneven trading in G10 FX vs the USD.

- Gilt cash yields are 1-3bp lower on the day and the curve has bull flattened.

- Bunds have similarly firmed, but have underperformed gilts. Yields are broadly 1-2bp lower with the curve 1bp flatter.

- OATs trade in line with bunds. Last yields: 2-year -0.6663%, 5-year -0.559%, 10-year -0.0222%, 30-year 0.8335%.

- BTPs have slightly outperformed core EGBs, with yields 3-4bp lower in the belly of the curve.

- Supply this morning came from Ireland (Bills, EUR750mn and the Apr-41 IGB syndication).

- US retail sales and industrial production for March will be a potential price catalyst for EGBs this afternoon.

EUROPE ISSUANCE UPDATE: Ireland Syndication

Ireland 20y update (Apr-41 IGB)

- Spread set on Ireland 20y at MS+13bps

- Books above E30bln

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXK1 172.5/173.0 1x2 put spread bought for 0.5 in 1.5k

RXK1 1 170/169.50 put spread bought for 8 in 4.5k

RXM1 170/168 put spread vs 172 call bought for 3 in 1.5k

RXM1 171.5/172.5 1x2 call spread bought for 3.5 in 1.2k

RXM1 172/173 1x2.5 call spread bought for -3.5 (receiving) in 1.5k

UK:

2LM1 99.375/99.125 put spread sold at 2.75 in 2.5k

FOREX: Growth Proxies Strengthen Further, Retail Sales On Tap

- Commodity-tied and growth-proxy currencies are again outperforming, with AUD, NZD and CAD at the top of the G10 pile. A better-than-expected Australian jobs report helped set the tone, but persistent strength in oil, gold and copper this morning has buoyed sentiment further.

- AUD/USD has now topped the Mar23 high to open resistance at 0.7774 (Mar19 high). USD/CAD is through the 1.25 handle to eye 1.2462, Mar 19 low (1.2365 is the bear trigger) and NZD/USD trades back above both the 50- and 100-dmas, with 0.7269 the key level going forward.

- The USD outlook is more mixed, with the USD Index finding some modest support at the 50-dma, but stopped well short of any material recovery.

- Focus turns to a slew of US data releases, with weekly jobless claims and retail sales numbers due as well as industrial production and the Philly Fed Business Outlook.

- Central bank speakers due include Fed's Bostic, Daly, Mester and New York Fed's Logan who, while not on the Fed, will be a carefully watched speech today.

FX OPTIONS: Expiries for Apr15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-65(E1.2bln), $1.1800(E694mln), $1.1820-25(E544mln), $1.1898-1.1900(E2.3bln, E1.85bln EUR puts), $1.1910-25(E719mln-EUR puts), $1.1960(E563mln-EUR puts)$1.1970-75(E1.3bln-EUR puts), $1.1990(E450mln-EUR puts)

- USD/JPY: Y105.90-106.00($1.1bln), Y108.85-95($627mln-USD puts), Y109.00-10($1.7bln-USD puts), Y109.15-25($993mln), Y109.40-50($715mln), Y110.00($691mln), Y110.50-60($1.3bln-USD puts)

- EUR/NOK: Nok10.08-10.09(E526mln-EUR puts)

- AUD/USD: $0.7700(A$592mln), $0.7750-60(A$1.0bln-AUD puts)

- AUD/NZD: N$1.0850(A$668mln)EUR/AUD: A$1.5450-52(E565mln-EUR puts)

- USD/CAD: C$1.2645-50($765mln), C$1.2680($837mln)

- USD/CNY: Cny6.50($775mln), Cny6.5415($630mln)

Price Signal Summary - Oil Stays Firm And AUDUSD Remains Bid

- In the equity space, S&P E-minis bulls are still in charge. The focus is on 4160.13 next, 1.500 projection of the Feb 1 - Feb 16 - Mar 4 price swing.

- In the FX world, EURUSD has cleared the 50-day EMA and is testing resistance at 1.1990, Mar 11 high. A break would reinforce current bullish conditions and open 1.2037, 61.8% of the Feb 25 - Mar 31 sell-off. The GBPUSD outlook remains bearish despite recent gains. Firm resistance is at 1.3919, Apr 6 high. The key support and bear trigger to watch is 1.3670/69, Mar 25 and Apr 12 low. EURGBP key near term resistance is 0.8731, Feb 26 high. A break is required to suggest scope for an extension of recent gains. USDJPY remains vulnerable, attention is on 108.41, Mar 23 low. AUDUSD is firmer and has traded above the neckline of a recent head and shoulders reversal. The key pivot resistance is 0.7849, Mar 18 high.

- On the commodity front:

- Gold remains below recent highs. Resistance has been defined at $1758.8, Apr 8 high. Watch support at $1721.4, Apr 5 low.

- Brent (M1) rallied yesterday. Resistance to watch is at $67.30, former trendline support drawn off the Nov 2 low and $67.76, the Mar 18 high

- WTI (K1) is firmer too. The next resistance is at $64.47/88, former trendline support and the Mar 18 high.

- In the FI space, key support to watch in Bunds (M1) remains 170.52, Mar 18 low. A break would signal scope for an extension lower and open 170.05, 76.4% of the Feb 25 - Mar 25 rally. Support to watch in Gilts (M1) is 127.32, Apr 1 low. Initial firm resistance is 128.93, Mar 25 high.

EQUITIES: US Futures Keep All Time Highs Under Pressure

- European equity markets are uniformly higher ahead of NY hours, with gains of 0.2% or more across the core continental indices. UK's FTSE-100 modestly outperforms, while Italy's FTSE-MIB lags slightly, although remains higher on the day.

- European cash markets are rising in tandem with equity futures in the US, which hold just below the all time highs printed earlier in the week. US retail sales, industrial production and weekly jobless claims data is next up.

- Earnings remain favourable for the financials sector, with Bank of America this morning reporting EPS ahead of expectations, fuelled by a better-than-forecast showing from trading revenue.

- Citigroup and Blackrock are still due to report. Full timings with EPS and revenue expectations here: https://roar-assets-auto.rbl.ms/documents/9444/MNIUSEARNINGS090421.pdf

COMMODITIES: Gold Holds Below Key Resistance

- WTI and Brent crude futures trade just below the week's best levels, as markets watch geopolitical drivers in Russia/Ukraine as well as persistent strength in stock markets. Key resistance remains for Brent at $66.94, the overnight high ahead of $67.14 Key support is unchanged at $60.33, Mar 23 low. WTI (K1) is edging higher too. Key resistance shifts to $63.88, the 61.8% retracement of the February – March downleg.

- Spot gold trades higher, with prices adding around $10/oz to narrow the gap with key resistance at the 50-dma, which has worked well in containing prices over the past few weeks.

- Today, that level intersects at $1751.68 and will remain a point of focus going forward.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.