-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasury Curve a Touch Steeper Pre-Fed

HIGHLIGHTS:

- Treasury curve a touch steeper pre-FOMC

- Shallow bounce in Chinese equities, CSI 300 higher by 0.2%

- Corporate earnings continue apace, with Boeing, McDonalds, Facebook and PayPal due

US TSYS SUMMARY: A Bit Of Steepening Pre-FOMC

The Tsy curve is a little steeper Wednesday ahead of the July FOMC decision.

- The 2-Yr yield is up 0.2bps at 0.2055%, 5-Yr is up 2bps at 0.7191%, 10-Yr is up 1.2bps at 1.2527%, and 30-Yr is up 1.6bps at 1.9092%.

- Sep 10-Yr futures (TY) down 3/32 at 134-12 (L: 134-09.5 / H: 134-17). OK volumes (~310k).

- Focus is on the 1400ET FOMC decision, with Powell's presser at 1430ET.

- Equities have found their footing from Tuesday's lows, with S&P eminis back around the 4,400 mark.

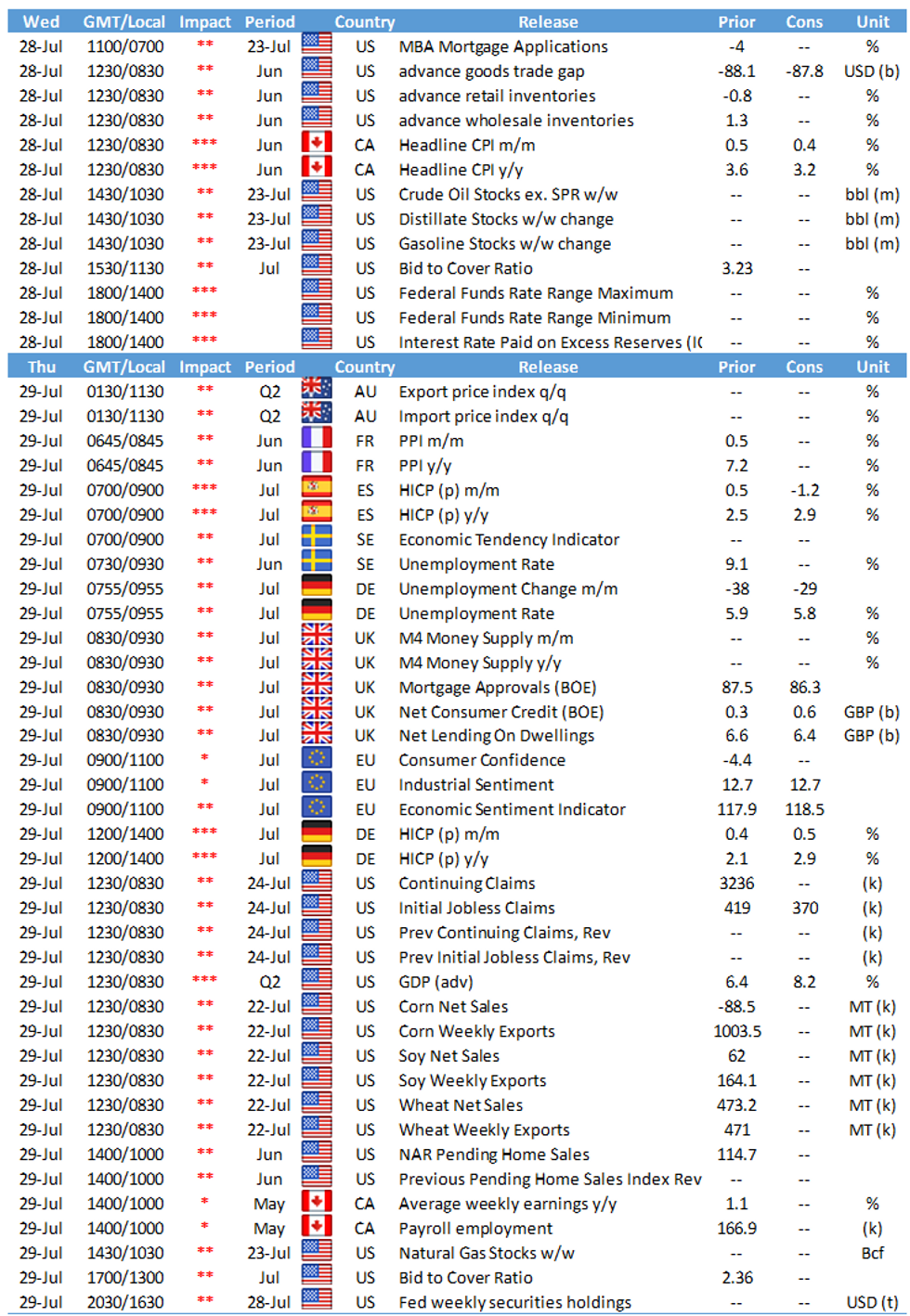

- Data includes weekly MBA mortgage apps (0700ET), and at 0830ET, retail/wholesale inventories alongside advance goods trade balance.

- $28B 2Y FRN / $30B 119-day bill auction at 1130ET. No NY Fed operational purchases due to the Fed meeting.

EGB/GILT SUMMARY: Mixed Session Ahead of Tonight's FOMC

Gilts have weakened a touch this morning while EGBs have broadly firmed alongside gains for equities.

- Gilt started on a strong foot before weakening through the morning. Cash yields are now 1bp higher on the day with the curve close to flat overall.

- Bunds have firmed with yields 1bp lower across much of the curve.

- The OAT curve has steepened slightly on the back of the short end firming and long end yields inching higher.

- BTPs have been relatively directionless this morning and currently trade just above yesterday's close.

- Supply this morning came from Germany (Bund, EUR1.79bn) and Italy (Bills, EUR7bn).

- The Nationwide house price index show UK property prices dropping 0.5% M/M in July, though still recording a 10.5% annualised climb.

EUROPE ISSUANCE UPDATE

Germany allots E1.79bn of the 0% May-36 Bund: Average yield -0.18%, Buba cover 1.1x, bid-to-cover 0.796x

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 174.5/1725ps 1x2, bought for 16 in 1k

DUU1 112.30/112.20ps 1x2 bought for 2.25 in 4k

FOREX: USD gives back some of its overnight gains

USD started the European session on the front foot, a continuation from the Asian session.

- The Dollar was up across G10s, besides the CAD, but the Greenback has faded some of the bid, after Equities moved to session high.

- Now, only the JPY, NZD and AUD are still down versus the USD.

- EURUSD is a 28 pips range (1.1802/1.1830), and worth noting 3.05bn between 1.1790 and 1.1825 of option expiry for today.

- The pound is having a good session, but Cable has been choppy, initially rallying to 1.3895, to then quickly fading to the session low at 1.3862, and now trading back at 1.3887.

- Resistance in Cable comes at 1.3910 (High Jul 12 and a key resistance)

- NOK and CAD were initially under some pressure, as WTI slipped below $72, but crosses have reversed the early price action, following WTI breaking back above $72.

- Looking ahead, US Whole sales inventory, is the main data for the session.

- We also get the Canadian CPI, but most of the attention will be on the FOMC and presser.

FX OPTIONS: Expiries for Jul28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1790-00(E1.7bln), $1.1820-40(E2.1bln), $1.1850-60(E1.6bln), $1.1880-00(E1.6bln)

- USD/JPY: Y110.00-20($713mln), Y110.25-40($878mln), Y110.65-70($910mln)

- GBP/USD: $1.3685-00(Gbp569mln)

- AUD/USD: $0.7390(A$710mln)

- USD/CAD: C$1.2555-65($510mln)

Price Signal Summary - S&P E-Minis Find Support Once Again

- In the equity space, the S&P E-minis pullback is considered corrective. The outlook is bullish and the focus is on 4420.92, 0.764 projection of the Jun 21 - Jul 14 - 19 price swing. Support is seen at 4336.88, the 20-day EMA. EUROSTOXX 50 futures recently traded above the important 4101.50 resistance, Jul 1 high. An extension would open the 4153.00 key resistance, Jun 17 high. Support to watch is at 4029.50, Jul 22 high.

- In FX, the USD outlook is unchanged and remains bullish. EURUSD is slightly firmer but remains in a tight range. The outlook is bearish and the focus is on 1.1704, Mar 31 low and a key support. Resistance is at 1.1851, Jul 15 low. GBPUSD is holding onto recent gains and testing the 50-day EMA at 1.3884. A clear break of the average is required to strengthen a bullish case. Currently, recent gains are still considered corrective. Watch resistance at 1.3910, Jul 12 high. USDJPY is lower but remains above 109.07, Jul 19 low. This represents a key S/T support and the bear trigger. Key near-term resistance is 110.70, Jul 14 high. A break of 110.70 would be bullish.

- On the commodity front, Gold is consolidating and maintains a bullish tone with the focus on the bull trigger at $1834.1, Jul 15 high. Key short-term support is at $1791.7, Jul 12 low and has recently been tested and briefly probed. A clear break of this level would be bearish. Brent (U1) has cleared $73.87, 61.8% of the Jul 6 - 20 downleg and is approaching $75.39, the 76.4% level. A break would open $76.72, Jul 14 high. WTI (U1) is firmer and the focus is on $73.46, 76% of the Jul 6 - 20 downleg.

- Within FI, Bund futures remain firm and have edged higher today. Sights are on 176.64, the Feb 11 high (cont). Gilts maintain a bullish tone. The recent break of 129.92, Jul 8 high opens 130.72, 2.236 projection of the May 13 - 26 - Jun 3 price swing. We are still monitoring a bearish candle pattern, an evening star reversal from the Jul 21 close. A deeper pullback would expose 128.54, low Jul 14.

EQUITIES: Hang Seng Bounces, But Upside is Shallow

- Japan's NIKKEI down 388.56 pts or -1.39% at 27581.66 and the TOPIX down 18.39 pts or -0.95% at 1919.65

- China's SHANGHAI closed down 19.593 pts or -0.58% at 3361.59 and the HANG SENG ended 387.45 pts higher or +1.54% at 25473.88 with the German Dax up 25.15 pts or +0.16% at 15547.47, FTSE 100 up 10.9 pts or +0.16% at 7008.16, CAC 40 up 45.46 pts or +0.7% at 6579.68 and Euro Stoxx 50 up 22.4 pts or +0.55% at 4087.85.

- Dow Jones mini down 52 pts or -0.15% at 34906, S&P 500 mini up 1.75 pts or +0.04% at 4396.75, NASDAQ mini up 24.25 pts or +0.16% at 14972.

COMMODITIES: Copper Edges Further Off Week's High

- WTI Crude up $0.37 or +0.52% at $72.04

- Natural Gas down $0.07 or -1.66% at $3.905

- Gold spot up $0.62 or +0.03% at $1799.81

- Copper down $0.6 or -0.13% at $454

- Silver up $0.11 or +0.43% at $24.799

- Platinum up $0.62 or +0.06% at $1055.92

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.