-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsy Issuance Profile in Focus

Highlights:

- Treasury issuance profile in focus after holiday weekend

- UK shadow chancellor rules out emergency budget in case of election victory

- Muted markets await cues from Thursday's PCE indices

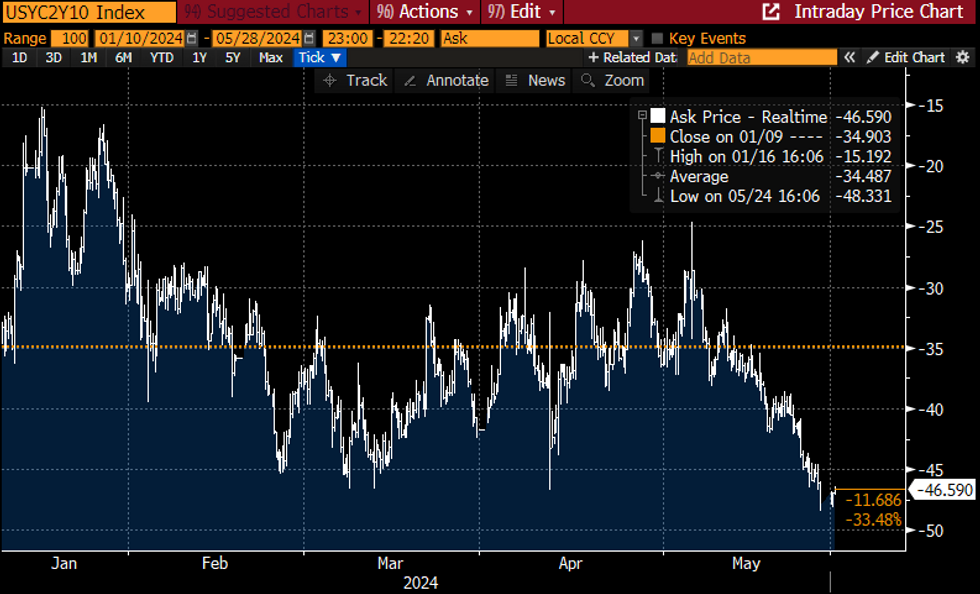

US TSYS: 2s10s Steepen Off YtD Lows, Heavy Issuance In Focus Ahead

- Treasuries trade twist steeper after yesterday’s closures for Memorial Day and other regional bank holidays, the steepening taking 2s10s away from YtD lows.

- Cash yields range from 1.7bp lower (2s) to +0.5bps (30s), pivoting after 10s. They underperform Gilts, but both outperform EGBs in catch-up after the latter rallied yesterday on dovish ECB speak.

- TYM4 has kept to reasonably narrow ranges overnight after yesterday’s holiday-thinned session, back at 108-24+ (+02 from Friday’s full close). Key support at 108-15 (May 14 low) remains intact for now whilst resistance is seen at 109-05+ (50-day EMA).

- Treasury issuance can play a large role today with a heavy slate in the Memorial Day-shortened week. Beyond that, data focus should be on the Conf. Board consumer survey after the recent slide in the U.Mich counterpart, whilst keeping an eye on the labor market differential as usual ahead of next week’s payrolls report.

- Data: FHFA/S&P CoreLogic house prices Mar (0900ET), Conf. Board Consumer Survey May (1000ET), Dallas Fed Mfg May (1030ET)

- Fedspeak: Kashkari panel remarks (0955ET, just Q&A), Cook & Daly on AI & economy (1305ET, just Q&A)

- Note/bond issuance: US Tsy to sell $69bn 2Y notes (1130ET), US Tsy to sell $70bn 5Y notes (1300ET)

- Bill issuance: US Tsy to sell $70bn 13-wk bills, $70bn 26-wk bills (1000ET), US Tsy to sell $65bn 42-day CMB (1130ET)

2s10s lift on YtD lowsSource: Bloomberg

2s10s lift on YtD lowsSource: Bloomberg

STIR: Fed Rates At Most Slightly Lower, Mester Wants More Forecast Details

- Post-Memorial Day, Fed Funds implied rates are unchanged from Friday’s close for meetings through to September (where there are still low odds of a first cut), with meetings beyond that drifting slightly lower.

- Cumulative cuts from 5.33% effective: 0.5bp Jun, 3bp Jul, 14bp Sep, 21bp Nov and 35bp Dec.

- Ahead, Kashkari (non-voter) gives panel remarks at 0955ET (no text) before Governor Cook (voter) and Daly (’24 voter) speaks on AI’s impact on the economy at 1305ET (also no text).

- Overnight, Kashkari said he needs "Many more months of positive inflation data, I think, to give me confidence that it's appropriate to dial back" when asked what’s needed for cuts.

- Before that, Mester called for more detail in Fed statements and forecasts, building on a growing number of FOMC participants critiquing the current approach.

- Gov. Bowman (voter) meanwhile “would have supported either waiting to slow the pace of balance sheet runoff to a later point in time or implementing a more tapered slowing in the pace of runoff.”

EUROPE ISSUANCE UPDATE

Netherlands auction results

* E1.625bln of the 0% Jan-38 DSL. Avg yield 2.923%.

Italy auction results

* E1.75bln of the 0% Dec-24 BTP. Avg yield 3.48% (bid-to-cover 1.73x).

* E2.75bln of the 3.20% Jan-26 BTP Short Term. Avg yield 3.51% (bid-to-cover 1.42x).

* E1.5bln of the 0.10% May-33 BTPei. Avg yield 1.72% (bid-to-cover 1.44x).

Germany auction results

* E1bln (E986mln allotted) of the 2.10% Apr-29 Green Bobl. Avg yield 2.6% (bid-to-offer 2.70x; bid-to-cover 2.73x).

* E1bln (E846mln allotted) of the 2.30% Feb-33 Green Bund. Avg yield 2.51% (bid-to-offer 2.87x; bid-to-cover 3.39x).

UK: Shadow CX Appears To Rule Out Emergency Budget If Labour Win Election

In her first major speech of the election campaign, Shadow Chancellor of the Exchequer Rachel Reeves has appeared to rule out the holding of an emergency summer budget in the event that the centre-left Labour party wins the general election on 4 July. Says that “The [independent Office for Budgetary Responsibility] OBR requires 10 weeks’ notice to provide an independent forecast ahead of a budget, and I've been really clear that I would not deliver a fiscal event without an OBR forecast”.

- Opinion polling shows Labour with a substantial lead just over five weeks ahead of the election, with the party seen as strong favourites to win power with a large majority in the House of Commons.

- Post-election budgets are relatively common, especially when power changes hands. However, if Reeves maintains her stance it would likely see the next fiscal event take place in the autumn, potentially delaying the implementation of its provisions into 2025.

- Reeves also shot down the prospect of Labour matching the Conservatives' pledge of a 'triple lock plus' for state pensions that would see the tax-free pensions allowance rising by 2.5%, earnings, or inflation (whichever is highest). The shadow chancellor called the plan “another desperate gimmick” and said “she will never take those risks” with public finances.

GBPUSD Rally Contained as BRC Shop Prices Slow

- SEK, NZD modestly outperform, while USD, GBP and JPY are among the poorest performing currencies.

- The UK BRC Shop Price Index came in lower than expected, at 0.6% vs. Exp. 1.0% and the lowest since November 2021. The data, while stopping well short of arguing for a June rate cut, may be helping contain the rally in GBP/USD posted off last week's low, with the 1.28 handle.

- Nonetheless, the GBPUSD trend condition remains bullish and the pair is trading higher this week. An important retracement point at 1.2754 has been cleared, 76.4% of the Mar 8 - Apr 22 bear leg. This reinforces current bullish conditions and paves the way for a climb towards 1.2803 next.

- USD/CNH traded firmer again in early London hours, extending recent outperformance and putting the pair to new monthly highs at 7.2642. Today's price action narrow the gap with next major resistance into 7.2739.

- SEK extends recent outperformance to press EUR/SEK below the 200-dma of 11.4988 - a close below which would be the first since early April.

- Focus for the duration of the Tuesday session turns to house price index data and the May consumer confidence release from the US. Central bank speak includes ECB's Centeno and Knot, while Fed's Kashkari, Cook and Daly also make appearances.

Eurostoxx 50 Futures Extend Corrective Recovery From Last Week's Lows

The trend condition in Eurostoxx 50 futures remains bullish and the recent pullback appears to be a correction. The contract has recently cleared a key hurdle at 5079.00, the Apr 2 high, to confirm a resumption of the uptrend. This opens 5127.70 next, a Fibonacci projection. Key trend support is 4762.00, the Apr 19 low. Support at the 20-day EMA has been pierced. The next level to watch is 4959.80, the 50-day EMA. The uptrend in S&P E-Minis remains intact and the pullback last Thursday appears to have been a correction. The contract also traded to a fresh cycle high that day, reinforcing a bullish theme. Recent gains have also resulted in a break of 5333.50, Apr 1 high. This confirms a resumption of the primary uptrend and opens 5372.73, a Fibonacci projection. Moving average studies are in a bull-mode set-up. Initial support is 5259.02, the 20-day EMA.

- Japan's NIKKEI closed lower by 44.65 pts or -0.11% at 38855.37 and the TOPIX ended 2.14 pts higher or +0.08% at 2768.5.

- Elsewhere, in China the SHANGHAI closed lower by 14.471 pts or -0.46% at 3109.572 and the HANG SENG ended 6.19 pts lower or -0.03% at 18821.16.

- Across Europe, Germany's DAX trades higher by 64.82 pts or +0.35% at 18838.87, FTSE 100 lower by 9.26 pts or -0.11% at 8309.19, CAC 40 down 12.1 pts or -0.15% at 8122.38 and Euro Stoxx 50 up 8.96 pts or +0.18% at 5068.74.

- Dow Jones mini up 26 pts or +0.07% at 39185, S&P 500 mini up 15 pts or +0.28% at 5337.5, NASDAQ mini up 92.75 pts or +0.49% at 18973.

Gold Trades Just Ahead of Recent Lows

WTI futures are trading inside a range. A bearish theme remains intact and the sideways move is seen as a pause in the downtrend. Price has recently traded below the 50-day EMA, strengthening a bearish set-up that highlights potential for a deeper correction. Scope is seen for a move to $75.64, the Mar 11 low. Key resistance and the bull trigger is at $86.16, the Apr 12 high. Initial resistance to watch is at $80.11, the May 20 high. Gold traded down last week and the yellow metal is trading just ahead of its recent low. The trend structure remains bullish and the move down appears to be a correction Moving average studies are in a bull-mode position and the move lower is allowing an overbought condition to unwind. A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2301.9, represents a key support. A clear break of it would be bearish.

- WTI Crude up $1.06 or +1.36% at $78.81

- Natural Gas down $0.01 or -0.28% at $2.513

- Gold spot down $6.93 or -0.29% at $2343.96

- Copper up $4.35 or +0.92% at $479.8

- Silver down $0.17 or -0.53% at $31.474

- Platinum down $8 or -0.76% at $1047.81

| Date | GMT/Local | Impact | Country | Event |

| 28/05/2024 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 28/05/2024 | 1300/0900 | ** | S&P Case-Shiller Home Price Index | |

| 28/05/2024 | 1300/0900 | ** | FHFA Home Price Index | |

| 28/05/2024 | 1300/0900 | ** | FHFA Home Price Index | |

| 28/05/2024 | 1300/0900 | ** | FHFA Quarterly Price Index | |

| 28/05/2024 | 1300/0900 | ** | FHFA Quarterly Price Index | |

| 28/05/2024 | 1355/0955 | Minneapolis Fed's Neel Kashkari | ||

| 28/05/2024 | 1400/1000 | *** | Conference Board Consumer Confidence | |

| 28/05/2024 | 1400/1000 | * | US Treasury Auction Result for 26 Week Bill | |

| 28/05/2024 | 1400/1000 | * | US Treasury Auction Result for 13 Week Bill | |

| 28/05/2024 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 28/05/2024 | 1530/1130 | * | US Treasury Auction Result for 2 Year Note | |

| 28/05/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 28/05/2024 | 1700/1300 | * | US Treasury Auction Result for 5 Year Note | |

| 28/05/2024 | 1700/1300 | San Francisco Fed's Mary Daly | ||

| 28/05/2024 | 1705/1305 | Fed Governor Lisa Cook | ||

| 29/05/2024 | 0130/1130 | *** | CPI Inflation Monthly | |

| 29/05/2024 | 0600/0800 | * | GFK Consumer Climate | |

| 29/05/2024 | 0600/0800 | ** | Retail Sales | |

| 29/05/2024 | 0600/1400 | ** | MNI China Liquidity Index (CLI) | |

| 29/05/2024 | 0645/0845 | ** | Consumer Sentiment | |

| 29/05/2024 | 0800/1000 | ** | M3 | |

| 29/05/2024 | 0800/1000 | ** | ISTAT Business Confidence | |

| 29/05/2024 | 0800/1000 | ** | ISTAT Consumer Confidence | |

| 29/05/2024 | 0800/1000 | *** | North Rhine Westphalia CPI | |

| 29/05/2024 | 0800/1000 | *** | Bavaria CPI | |

| 29/05/2024 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 29/05/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 29/05/2024 | 1200/1400 | *** | HICP (p) | |

| 29/05/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 29/05/2024 | 1400/1000 | ** | Richmond Fed Survey | |

| 29/05/2024 | 1430/1030 | ** | Dallas Fed Services Survey | |

| 29/05/2024 | 1530/1130 | ** | US Treasury Auction Result for 2 Year Floating Rate Note | |

| 29/05/2024 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 29/05/2024 | 1745/1345 | New York Fed's John Williams | ||

| 29/05/2024 | 1800/1400 | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.