-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: UK PMI, Villeroy set competing tones

Highlights:

- Fourth largest ever month-to-month fall in the UK composite PMI (and exceeding anything prior to the pandemic).

- Villeroy says rates will back back to neutral of 1-2% next year.

- BOE hiking expectations reduced by the market, pulling Fed pricing with it to some extent, but ECB pricing holding up after Villeroy comments.

US TSYS: Treasuries Rally On Softer Growth Outlook, 2Y Auction Later

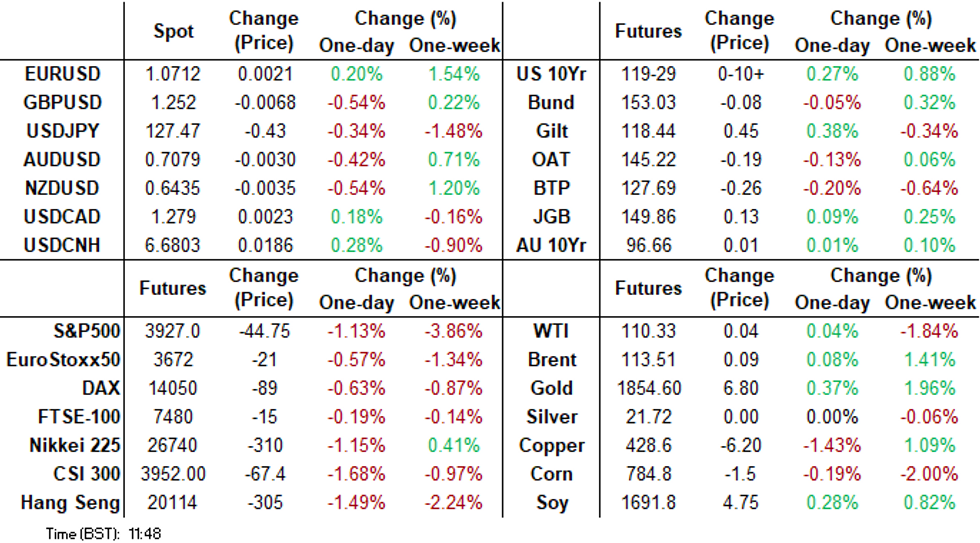

- Renewed growth concerns set the tone in early trade, instigated by further worry on Chinese growth overnight before being compounded by weak European PMIs and more recently Beijing looking to strengthen covid controls among essential workers.

- The net impact sees cash Tsys rally broadly across the curve after yesterday’s bear steepening, with 2YY -3.7bps at 2.583%, 5YY -4.3bps at 2.825%, 10YY -3.6bps at 2.815% and 30YY -2.4bps at 3.028%.

- TYM2 sits 11 ticks higher on the day, well within the range of the past three days. Short-term gains are still considered corrective, with resistance still eyed at 120-10 (May 19 high) and support at 118-16 (May 18 low).

- Fedspeak: Chair Powell at 1220ET with pre-recorded video remarks at an economic summit.

- Data: The highlight is likely the preliminary May S&P Global PMI at 0945ET but also receive Richmond Fed Mfg Index and New Home Sales.

- Bond issuance: US Tsy $47B 2Y note auction (91282CER8) – 1300ET

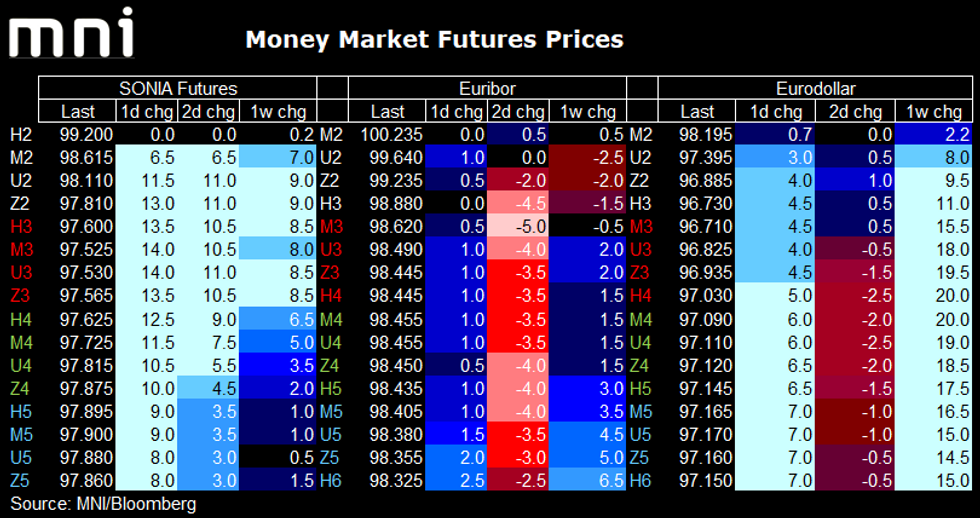

STIR FUTURES: Fed Hikes Cool With Softer European PMIs

- Fed Funds implied hikes give back yesterday’s rise through the European session, sitting at 52bps for Jun, 101bps for Jul and with larger relative declines further out with 139bps for Sep (-3bps) and 190bps for Dec (-5bps).

- Weak European preliminary PMIs for May with a particularly sharp decline in UK services add focus on the US PMIs at 0945ET, with consensus for a manufacturing-led moderation after weak regional Fed surveys.

- Fedspeak: Powell gives pre-recorded welcoming remarks at an economic summit at 1220ET.

- Recap: George (’22 voter) expects to lift the main rate to around 2% by Aug (as priced) with subsequent moves then guided by inflation, whilst Bostic (’24) also open-ended, currently seeing 25 or 50bps on the table in Sep if inflation too high (after two 50bp hikes) but also possible to pause.

Cumulative hikes implied by FOMC-dated Fed Funds futures (%pts)Source: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futures (%pts)Source: Bloomberg

STIR FUTURES: Different drivers across major STIR markets this morning

SONIA futures continue to lead the way higher for STIR futures after the disappointing UK PMI prints; the Eurodollar strip was dragged higher earlier following risk-off initially triggered by Snapchat earnings and concern about the Chinese growth outlook. Villeroy's comments about the ECB moving back to a neutral rate of 1-2% next year have contained moves higher for the Euribor strip.

- SONIA Whites/Reds/Greens are up 10-14 ticks (with the biggest moves in the June-23 and Sep-23 area). The market-implied probability of a 50bp hike by August reduced from around 65% at yesterday's close to 30% earlier and is now back to around 40%. June is now priced for 29bp (from 31bp yesterday close), August 60bp (from 66bp), September: 83bp (from 91bp) with 118bp by year-end (from 129bp).

- The majority of the Euribor strip is up 0.5-1.0 ticks. Markets now price 32bp by July (cumulatively), 65bp by September, 83bp by October and 104bp by year-end.

- The Eurodollar strip has flattened with Whites up 3.0-4.5 ticks and Blues up 7.0 ticks (with Reds/Greens between these). Markets now price 52bp for June, 101bp for July, 138bp by September and 191bp by year-end.

EGB/GILT: Gilts move notably higher post-PMI data; German curve holds after Villeroy

- Gilts are leading the way (but have moved off their highs) after a significant repricing of BOE hiking expectations following the fourth largest ever month-to-month fall in the UK composite PMI (and exceeding anything prior to the pandemic). The picture for the labour market is also looking gloomy with companies not fully replacing those who have voluntarily left.

- The gilt curve has seen a notable bull steepening and has dragged 10-year UST and Bund yields higher.

- After hitting their highest level since May 5 ahead of the data overnight, 2-year gilt yields are almost 11bp lower on the day now.

- There was no lasting reaction in bond markets to the Eurozone PMI releases.

- Also this morning we have heard from ECB's Villeroy who said that 50bp hikes are not the consensus of the ECB but that the repo rate would be back at the neutral rate next year (which he described as between 1-2%). This has helped anchor Schatz and the rest of the German curve somewhat, although yields are still lower on the day after the UK PMI print.

- Bund futures are down -0.03 today at 153.08 with 10y Bund yields down -0.8bp at 1.006% and Schatz yields down -0.3bp at 0.401%.

- Gilt futures are up 0.49 today at 118.48 with 10y yields down -4.8bp at 1.921% and 2y yields down -8.4bp at 1.471%.

EUROPEAN SUPPLY

- Austria syndicaiton: E4bln of the May-49 Green RAGB

- Italy syndication: E5bln WNG of the Mar-38 BTP

- Netherlands auction: E1.53bln of the 0% Jan-52 DSL

- UK auction: GBP750mln of the 0.125% Mar-39 linker

- Finland: Long 10y RGB mandate (15 Sep, 2032)

- France: 15y Green OATei (25 July 2038)

- Lithuania: 10y benchmark

OPTION RECAP

- DUN2 109.70/60/50/30p Condor, bought for -2 (receive) in 2.4k

- 0RZ2 98/75/99.00/99.25c fly, bought for 2.35 synthetic in 5k

- SFIM2 98.65/98.75cs, sold at 2 in 6.1k

FOREX: A busy morning session

- A busy morning session for FX, starting with a EUR rally, after ECB Lagarde in an Bloomberg interview in Davos, noted that the ECB were attentive to the EUR level.

- The EUR strength initially kept the lid on the Dollar, but both currencies reversed, after ECB Villeroy said that a 50bps hike was not the consensus at the ECB.

- The second main story of the session was the big UK Services and Composite PMI miss, which saw the Pound plummeting, and in turn lifted Govies and rate markets.

- As per S&P: "Service providers signaled the greatest loss of momentum in May (index at 51.8, down from 58.9 in April), with survey respondents often noting that economic and geopolitical uncertainty had contributed to a slowdown in client demand. However, many businesses in the travel, leisure and events sector still commented on strong growth conditions due to a rapid recovery from pandemic restrictions."

- Even employment growth "was the least marked for 13 months. Some businesses noted that a desire to reduce costs had led to the non-replacement of voluntary leavers."

- Cable crashed through 1.2500, over 100 pips range for the pair.

- The Yen is the best performer against the Pound in G10, up 1.31%, and GBP trades in the red across the majors.

- Looking ahead, US PMIs are the notable data. Speakers still scheduled, ECB Villeroy, Riksbank Breman, and Fed Powell (pre recorded Welcoming remarks at an Economic Summit).

FX OPTION EXPIRY

Of note:

USDCNY 1.7bn at 6.65 (tomorrow)- EURUSD: 1.0650 (779mln), 1.0740 (924mln), 1.0805 (268mln), 1.0815 (353mln).

- GBPUSD; 1.2500 (378mln).

- USDJPY; 127 (599mln), 128 (405mln).

- USDCAD: 1.2720 (225mln), 1.2820 (250mln).

- NZDUSD: 0.6500 (785mln).

- EURSEK: 10.52 (682mln).

Price Signal Summary - S&P E-Minis Bearish Threat Still Present

- In the equity space, S&P E-Minis remain below resistance at 4099.00, May 9 high. The contract remains vulnerable following a fresh trend low on Friday. Attention is on 3801.97, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). 3807.50, Friday’s low is the bear trigger. A break of resistance at 4099.00 is required to signal a base. The primary trend direction in EUROSTOXX 50 futures is down. A corrective cycle is still in play though following the recovery from 3466.00, May 10 low. Price last week probed the 50-day EMA, today at 3727.1. A clear break of this average would improve a short-term bullish theme. On the downside, key support and the bear trigger is unchanged at 3466.00.

- In FX, EURUSD has cleared the 20-day EMA, and 1.0642, the May 5 high. The current bull cycle started at 1.0350, May 13 low and from the base of a bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0848 and is a potential short-term objective. Initial support is at 1.0533, May 20 low. GBPUSD started the week on a firmer note, trading above last week’s high of 1.2525 and the 20-day EMA at 1.2500. This signals scope for a stronger recovery and opens 1.2638, the May 4 high and a key resistance. Today’s pullback is - for now - considered corrective. Initial firm support lies at 1.2438, May 20 low. USDJPY is trading closer to its recent lows. Recent weakness has exposed the next key support at 126.95, Apr 27 low. The current pullback is likely a correction. A break of 126.95 however would signal scope for an extension, towards the 50-day EMA at 125.86. A reversal higher and a move above 129.78, May 17 high would be bullish.

- On the commodity front, Gold started the week on a firmer note. The yellow metal has traded above resistance at $1859.0, the 20-day EMA. This opens the 50-day EMA at $1885.3. The move higher is still considered corrective and the trend direction remains down. A resumption of bearish activity would refocus attention on last week’s $1787.0 low (May 16). In the Oil space, WTI futures maintain a firm tone. The contract last week breached resistance at $110.07, Mar 24 high. A resumption of gains would open $116.43, the Mar 7 trend high. Initial support is at $103.24, the May 19 low.

- In the FI space, Bund futures resistance has been defined at $155.33 May 12 high. The trend direction remains down and an extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has recently found resistance at 121.07, May 12 high. The bear trigger is at 116.87, May 9 low.

LOOK AHEAD

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1620/1220 |  | US | Fed Chair Jerome Powell | |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1800/2000 |  | EU | ECB Lagarde Opens World Economic Forum Dinner | |

| 25/05/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 25/05/2022 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 25/05/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 25/05/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/05/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 25/05/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 25/05/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2022 | 0700/0900 |  | EU | ECB Panetta Speaks at Goethe University | |

| 25/05/2022 | 0730/0930 |  | SE | Riksbank Financial Stability Report | |

| 25/05/2022 | 0800/1000 |  | EU | ECB Lagarde in Stakeholder Dialogue | |

| 25/05/2022 | 0900/1100 | ** |  | SE | Economic Tendency Indicator |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/05/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.