-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

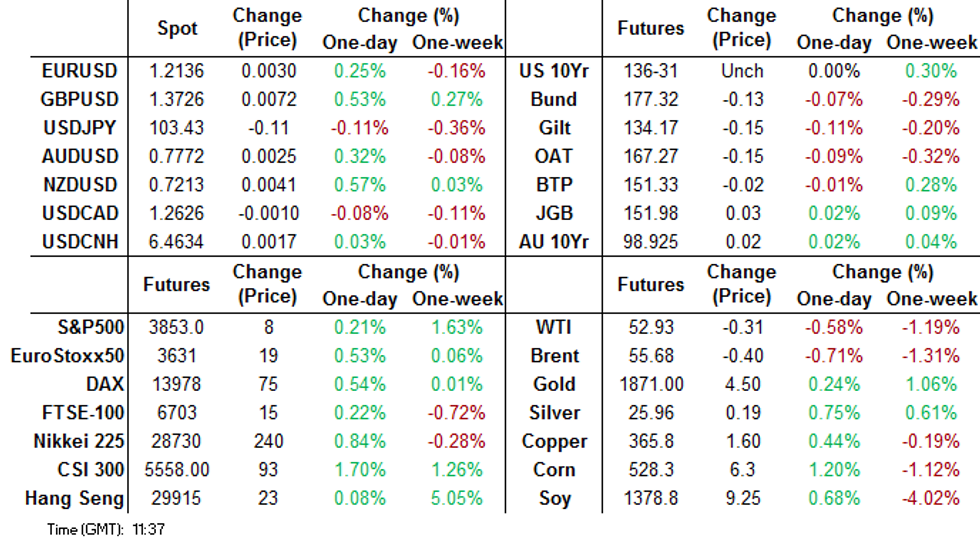

MNI US MARKETS ANALYSIS - USD in Retreat as Biden Admin Takes Shape

HIGHLIGHTS:

- Biden admin takes shape, to re-enter international COVID programs

- ECB rate decision in focus, no changes expected to policy

- US weekly jobless claims, housing starts, building permits on the docket

US TSYS SUMMARY: Slightly Weaker Ahead Of Jobless Claims/Housing Starts

Tsys are on session lows but it's been narrow range trading overnight on thin volumes, with more attention on equity futures pushing (briefly) to all-time highs and the USD weakening.

- Mar 10-Yr futures (TY) down 0.5/32 at 136-30.5 (L: 136-30 / H: 137-02), on a mere 175k traded.

- The 2-Yr yield is up 0.4bps at 0.1311%, 5-Yr is up 1bps at 0.4502%, 10-Yr is up 0.9bps at 1.0888%, and 30-Yr is up 1.1bps at 1.8409%.

- Something of a holding pattern ahead of the ECB decision/press conference (0745ET/0830ET).

- Overnight news included further leaks/reports on early Biden admin actions, little market-moving as had already been reported on/speculated: WHO re-engagement and Covax membership; COVID precautions for travellers (eg masks in airports); use of Defense Production Act; etc.

- Data dump at 0830ET includes weekly jobless claims, Dec housing starts/building permits, and Jan Philly Fed.

- In supply: $65B of 4-/8-week bills at 1130ET; $15B 10-Y TIPS sale at 1300ET. Plus, we get announcement of next week's 2-/5-/7-Yr Coupon and 2-Yr FRN supply.

- NY Fed buys ~$3.625B of 7-20Y Tsys.

EGB/GILT SUMMARY: Peripheral Bonds Mixed Headed Into ECB

Core EGBs trade weaker and the periphery mixed heading into the ECB meeting.

- Gilts started session on a firm footing but have gradually sold off through the morning with yields 1bp above yesterday's close.

- Bund yields are similarly 1bp above the close.

- The OAT curve has marginally steepened with the 2s10s and 2s30s spreads 1bp wider on the back of longer end yields drifting higher.

- BTPs rallied in early trade, but quickly gave back the gains with yields now marginally below the last close.

- Focus is on the ECB today, although no material changes in monetary policy are expected. Questions during the press conference will concentrate on the ECB's tolerance for further euro strength, the impact of recent lockdown restrictions on economic activity and whether or not the current PEPP envelope provides a ceiling on asset purchases.

- Supply this morning came from the UK (Gilts, GBP3.25bn), France (OATS, EUR9.993bn, Linkers, EUR2.37bn), Spain (Bonos/Oblis, EUR6.104bn), and Ireland (T-Bills, EUR750mn)

AUCTION RESULTS

FRENCH AUCTION RESULTS:

France sells E2.37bln of the new 0.10% Jul-31 OATei vs E1.5-2.5bln target

- Average real yield: -1.44%

- Bid-to-cover: 1.93x

- Price: 117.55

Sells E3.741bln of new 0% Feb-24 OAT

- Average yield -0.66%

- Bid-to-cover 2.33x

- Price 102.06

Sells E4.005bln of 0% Feb-26 OAT

- Averate yield -0.60% (-0.62%)

- Bid-to-cover 2.10x (1.89x)

- Price 103.09 (103.30)

Sells E2.247bln of 0.75% Nov-28 OAT

- Averate yield -0.46% (-0.04%)

- Bid-to-cover 2.08x (1.71x)

- Price 109.67 (106.80)

UK AUCTION RESULTS

UK DMO sells GBP3.25bln nominal of 0.125% Jan-24 gilt

- Avg yld -0.025% (-0.001%)

- Bid-to-cover 2.56x (2.28x)

- Yield tail 0.2bp (0.3bp)

- Price 100.455 (100.396)

SPAIN AUCTION RESULTS: E6.104bln of Bono/Obli vs target of E5.5-6.5bln.

Spain sells E1.569bln of 0% Jan-26 Bono

- Average yield -0.381% (-0.407%)

- Bid-to-cover 1.84x (3.51x)

Price 101.936 (102.09)

Sells E1.333bln of 0.80% Jul-27 Obli

- Average yield -0.254% (-0.04%)

- Bid-to-cover 1.91x (3.43x)

- Price 106.934 (105.77)

Sells E1.752bln of 1.85% Jul-35 Obli

- Average yield 0.366% (0.636%)

- Bid-to-cover 1.30x

- Price 120.929 (117.39)

Sells E1.450bln of 1.20% Oct-40 Obli

- Average yield 0.619% (0.602%)

- Bid-to-cover 1.82x (2.01x)

- Price 110.771 (111.21)

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXG1 176p, trades 1 in 2k

DUH1 112.20/112.10ps, bought for 1 in 3k

DUH1 112.30/112.40cs 1x2, bought for 1 in 2k

DUH1 112.40/112.30/112.20p fly bought vs selling 112.30/112.20/112.10p fly, for 1 in 10k

ERM2 100.50^, sold at 18 in 2k

SX7E Mar21 82/92cs, bought for 1.30 in 20k

UK:

LU1/0LH1 100^ spread, bought the Sep for 5 in 2k

2LZ1 99.75/99.62/99.50p ladder, bought for 0.25 in 1.5k

FOREX: Greenback At New Weekly Low as Biden White House Takes Shape

The USD's softer early Thursday, prompting the USD index to edge below the Monday low ahead of the NY crossover, as markets confirm a retreat from the 50-dma resistance earlier in the week at 90.887. Biden's White House is continuing to take shape, with a few more announcements this morning giving markets a further glimpse of the new administration.

Reports this morning show Biden is to use the production act to boost the supply of vaccines, PPE and COVID-19 tests, and is to clamp down on airport mask-wearing and air travel tests - signalling the new admin's commitment to arresting the spread of the virus.

Equities are higher in Europe, translating to modest risk-on in currency markets. Alongside the weaker greenback, JPY is also soft, with CHF also on the backfoot.

Best performers so far Thursday are GBP, NOK and NZD, with GBP/USD seeing another notable rise to multi-year highs of 1.3746.

Focus turns to the ECB rate decision and press conference, as well as policy statements from the South African, Turkish central banks.

FX OPTIONS: Expiries for Jan21 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E1.7bln), $1.2100-05(E992mln)

USD/JPY: Y102.00($580mln), Y103.25($940mln-USD puts), Y103.50-60($1.5bln-USD puts), Y103.65-75($1.4bln), Y104.00-10($1.2bln), Y104.20-25($860mln)

AUD/USD: $0.7750(A$751mln-AUD puts)

USD/CAD: C$1.2550($612mln-USD puts), C$1.2600($555mln-USD puts), C$1.2675-85($767mln-USD puts),C$1.2700-15($2.5bln-USD puts)

USD/MXN: Mxn19.50($1.3bln), Mxn19.70($616mln), Mxn20.00($650mln)

TECHS: Price Signal Summary - E-Mini S&P Trends Higher

- E-mini S&P futures rallied to a fresh trend high yesterday, clearing resistance at 3824.50, Jan 8 high. This opens the 3900.00 level next. Key trend support has been defined at 3740.50.

- In FX, EURGBP remains weak following yesterday's break of support between 0.8867 and 0.8861, the Nov 23 and Nov 11 lows. This paves the way for a move towards 0.8808, May 13 low and 0.8759, May 12 low, 2020

- EURUSD maintains a bearish short-term theme. Support levels to watch are:

- 1.2054, Jan 18 low where a break would open 1.2011, Sep 1 high.

- Resistance is at 1.2165 20-day EM

- USDJPY has failed to breach the bear channel top drawn off the Mar 24 high that intersects at 104.09 today.

- The pair is pulling away from recent highs and support at 103.53, Jan 13 low has been breached.

- This opens 103.28 and 103.02, 61.8% and 76.4 % of the Jan 6 - 11 rally.

- On the commodity front, Gold is firmer and yesterday's rally signals a potential reversal of the recent Jan 6 - 18 sell-off. Price is testing the 20- and 50-day EMAs where a clear break would open $1900.3, 76.4% of the Jan 6 - 11 rally. Oil contracts remain above support. Brent (H1) support to watch is at $53.97, the 20-day EMA and WTI (H1) support lies at $51.81, Jan 19 low.

- In the FI space:

- Bunds (H1) are off recent highs. Support is at 176.96, 61.8% of the Jan 12 - 14 rally.

- Gilts (H1) resistance is seen at 134.58/66, the 20- and 50-day EMAs. A bearish outlook dominates while activity remains below these EMA levels.

EQUITIES: Strong Start Gives Way to Mixed Picture

After a decent start for European equity markets, the picture is more mixed ahead of the NY open, with some continental markets edging back into negative territory. The EuroStoxx50 is higher by 0.4%, with tech and consumer discretionary names leading gains, while energy and real estate stocks lag slightly.

Having touched all time highs following Biden's inauguration yesterday, the e-mini S&P edged higher still overnight, touching 3,859.75. Earnings remain front-and-centre, with tech giants IBM and Intel due Thursday.

COMMODITIES: Oil Off as Rally Hits Pause

After the recent rally extended Wednesday, oil contracts are a touch softer this morning, with WTI and Brent futures off around 0.5% apiece. The WTI futures curve has steepened slightly since the beginning of the week, but the cycle high at $53.93 continues to cap progress. Focus turns to weekly US jobless claims data and the latest housing starts/building permits data.

Spot gold made further gains in Asia-Pac trade, with the metal touching new weekly highs at $1875.20. The 100-dma is the near-term upside target at $1884.45.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.