-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Index Down for Fifth Session

HIGHLIGHTS

- US regulators take action against Chinese listings

- Equity indices well off Thursday high

- MNI Chicago PMI and Fed's Bullard take focus

US TSYS SUMMARY: Curve Flattens Further, China Worries Weigh

- The curve sits slightly flatter, with outperformance in the front and belly of the curve. Most notable strength seen in 5y, pressing yields lower by close to 3bps.

- Uncertainty surrounding Chinese listings in the US (US regulators have paused IPO registrations for Chinese firms) as well as a particularly poor earnings report from Amazon after-market yesterday have sent index futures lower, prompting yields to follow suit.

- Corporate pipeline typically light for a Friday after Thursday's relatively busier session. Markets digested $15.1bln in supply, with $6.5bln stemming from the Apple deal.

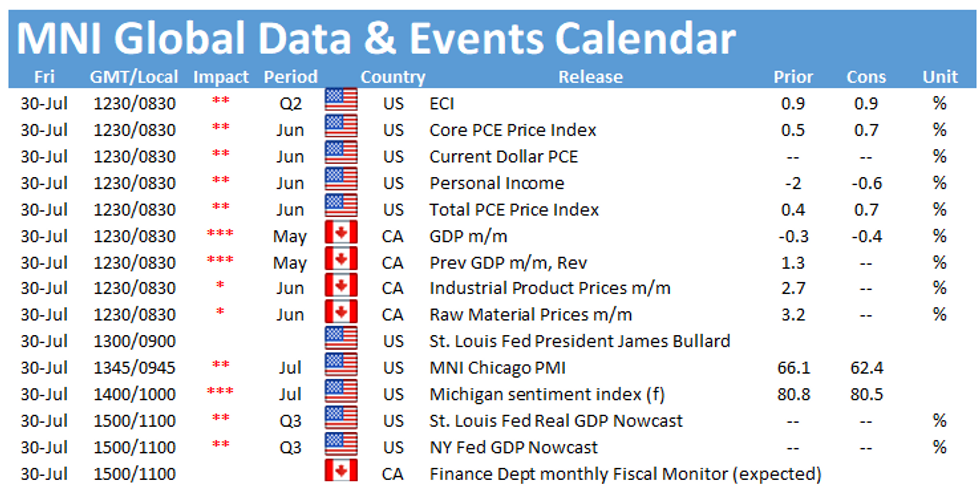

- Focus turns to PCE numbers for June as well as the July MNI Chicago Business Barometer.

- The 2-Yr yield is down 1bps at 0.1937%

- The 5-Yr yield is down 2.7bps at 0.7079%

- The 10-Yr yield is down 2.2bps at 1.2473%

- The 30-Yr yield is down 1.8bps at 1.9019%

EGB/GILT SUMMARY: Cautious Trading Amid Equity Concerns

EGBs are a touch weaker this morning amid fresh losses for equities in the wake of concerns about Chinese tech stocks and the regulatory clampdown.

- Gilts have traded firmer this morning, in contrast to EGBs. Cash yields are broadly 1bp lower across the curve, which is close to flat overall.

- Bunds have lacked direction, with yields only marginally above yesterday's close.

- OATs similarly trade soft with price action relatively contained.

- It is a similar story for BTPs, which trade in line with core EGBs.

- Eurozone GDP data for the second quarter came in better than expected (2.0% Q/Q vs 1.5% survey). Headline inflation for July was similarly above consensus at 2.2% Y/Y vs 2.0% expected.

- Supply this morning came from the UK (Bills, GBP3bn).

- Market focus shifts to the US PCE data later today.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 174.5/173.5ps, bought for 11.5 in 1k

RXU1 175.5 conversion, bought the call sell the put for 0.25 in 25k versus 100d futures

RXV1 170.5/169.5ps, bought for 11 in 1k (underlying Dec trades at 173.63)

ERH3 100.37/100.25ps vs 100.50/100.62cs 1x2, sold the ps for -0.75 (receive) in 4k

UK:

0LV1 99.62/99.75/100 broken c fly, sold at 1.5 in 4k

US:

TYU1 133/132.5ps, bought for 4 in ~2k

FOREX: Greenback Lower for a Fifth Session

- The greenback is softer for a fifth consecutive session, with USD index showing below yesterday's lows to touch the poorest level since late June. Major support undercuts at the 50-, 100- and 200-dmas that cross between 91.35-91.54.

- This morning's Eurozone data had little market impact, but confirmed a slow down in core price growth across the Euroarea, with Core Y/Y slowing to 0.7% from 0.9%. EUR remains bid, with EUR/USD topping 1.19 to touch a new July high at month-end.

- GBP, CHF and CAD are the strongest currencies in G10, while NOK, USD and JPY are the weakest.

- Focus turns to the upcoming US PCE release, expected to tick slightly higher from the previous, while the MNI Chicago PMI is seen slowing to 64.1. Canada's monthly GDP data is also due, with Y/Y growth expected to slow to 14.8% from 20.0% previously. Fed's Bullard is due to comment on policy and the economy at 1400BST/0900ET, the first Fed member to speak since Wednesday's rate decision.

FX OPTIONS: Expiries for Jul30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E1.2bln), $1.1700(E1.2bln), $1.1850-52(E1.6bln), $1.1865-75(E954mln), $1.1900-20(E1.3bln)

- USD/JPY: Y109.00($527mln), Y110.25-40($615mln)

- USD/CAD: C$1.2400($580mln), C$1.2450($615mln), C$1.2500($630mln)

- USD/CNY: Cny6.4650($585mln)

Price Signal Summary - S&P E-Minis Pullback Considered Corrective

- In the equity space, the recent pullback in the S&P E-minis is considered corrective. The outlook remains bullish and the focus is on 4420.92, 0.764 projection of the Jun 21 - Jul 14 - 19 price swing. Support to watch is at 4348.92, the 20-day EMA. A bullish theme remains intact in EUROSTOXX 50 and potential is for a climb towards the 4153.00 key resistance, Jun 17 high. Support is at 4029.50, Jul 22 high.

- In FX, the USD is weaker. EURUSD focus is on the 50-day EMA at 1.1916. This represents a short-term pivot resistance. GBPUSD is holding onto recent gains. The pair has cleared its 50-day EMA strengthening the current bullish recovery. The next band of resistance is at 1.3990, 61.8% retracement of the Jun 1 - Jul 20 sell-off and 1.4001, the Jun 23 high. A break through this zone would strengthen a short-term bullish outlook. USDJPY remains above 109.07, Jul 19 low, the key short-term support and bear trigger. Key near-term resistance is 110.70, Jul 14 high. A break of 110.70 would be bullish.

- On the commodity front, Gold has recovered from recent lows. The focus is on the bull trigger at $1834.1, Jul 15 high. Key short-term support is at $1790.0, Jul 23 low. Brent (V1) has cleared $74.47, 76.4% of the Jul 6 - 20 downleg. The focus is on $75.92, Jul 14 high. WTI (U1) is firmer and the focus is on $74.90, Jul 13 high.

- Within FI, Bund futures remain firm with sights on 176.79, 1.50 projection of the May 19 - Jun 11 - Jun 22 price swing. Gilts maintain a bullish tone. The recent break of 129.92, Jul 8 high opens 130.72, 2.236 projection of the May 13 - 26 - Jun 3 price swing. We continue to monitor a bearish candle pattern, an evening star reversal from the Jul 21 close. A deeper pullback would expose 128.54, low Jul 14.

EQUITIES: Amazon Set to Wipe Out $100bln in Market Cap at the Open

The notable downtick in Amazon shares ahead of the open today likely to garner some focus. AMZN reported earnings after-market yday and are lower by over 6% pre-market (their German listing is off 6.5%), set to wipe off over $100bln in market cap at the open. Amazon reported a miss on quarterly sales for the first time in over three years.

- AMZN sees both net sales and operating income for Q3 considerably lower than market expectations, with expectations of a shift back to hospitality and brick & mortar outlets the main driver.

- Online retailers across Europe are lower in sympathy, with ASOS, Zalando both sharply lower.

COMMODITIES: Gold Still Inching Higher, Testing 50-dma

- WTI Crude down $0.23 or -0.31% at $73.4

- Natural Gas down $0.07 or -1.77% at $3.986

- Gold spot up $0.09 or +0% at $1828.78

- Copper up $0.65 or +0.14% at $453.3

- Silver up $0.04 or +0.17% at $25.573

- Platinum down $8.32 or -0.78% at $1056.8

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.