-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Xi-Biden Summit Tops Agenda

- HIGHLIGHTS:

- Stoxx600 touches new record high, cementing last week's dip as corrective

- Focus turns to Xi-Biden summit, but expects little progress on trade

- Tsy futures start firmer, but still inside Friday's range

US TSYS SUMMARY: Firmer Rates Inside Fri's Range

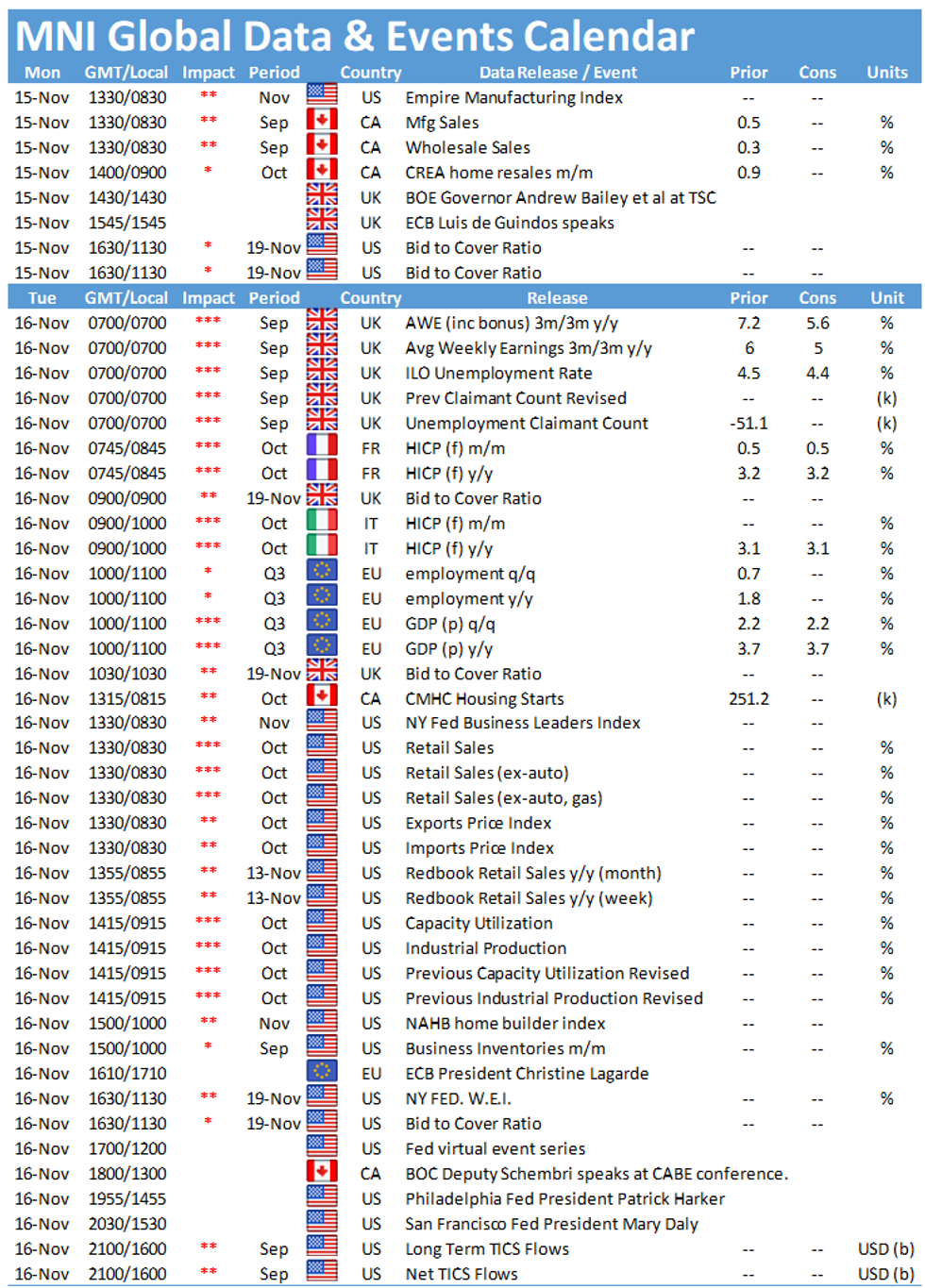

Tsy futures kicking off new week firmer, still inside Friday's range (after last Wed's tumble), yield curves mixed w/5s and 10s vs 30s running steeper. Modest volumes (TYZ1 122k). Equities firmer (ESZ1 +10.75), Gold and Crude weaker.- Limited data: Empire Mfg (22.0 est vs. 19.8 prior), more focus on Tue: Retail Sales (1.3% MoM est vs. 0.7% prior), Import/Export prices, Industrial Production/Cap-U, Business Inventories and Net TIC Flows.

- NY Fed buy-operation: Tsy 0Y-2.25Y, appr $10.875B and total $108B Tsy 13W and 26W bill auctions on tap Monday.

- Overnight trade: Pick-up in corporate issuance spurring rate locks, option-tied flow, two-way from fast$ and prop accts in 2s-5s.

- Currently, the 2-Yr yield is down 0.4bps at 0.5076%, 5-Yr is down 1bps at 1.2113%, 10-Yr is down 1bps at 1.5511%, and 30-Yr is up 0.1bps at 1.9322%.

EGB/GILT SUMMARY: European FI Trades Mixed At The Start of the Week

European bonds have traded mixed at the start of the week while equities have broadly inched higher.

- The gilt curve has steepened on the back of the short-end firming and longer-end yields inching higher.

- The bund curve has also steepened, albeit with the shorter end trading below the Friday close while the longer end is marginally below closing levels. The 2s30s spread is 2bp wider.

- OATs have broadly firmed across much of the curve with longer end yields down 1-2bp.

- ECB President Lagarde has continued to assert that inflation will remain below 2% over the medium-term, in contrast to the hawkish posturing of the Fed and BoE. Lagarde further stressed that policy should remain persistent to entrench the recovery.

- Supply this morning came from Germany (Bubills, EUR4.882bn allotted), Netherlands (DTCs, EUR3.11bn) and Slovakia (SlovGBs, EUR335mn).

- The European data calendar was relatively light this morning. Swedish inflation data for October came in a touch above expectations (CPI: 2.8% Y/Y vs 2.7% Y/Y, CPIF: 3.1% Y/Y vs 3.0%).

EUROPE OPTION FLOW SUMMARY

Eurozone:

DUZ1 112.20p, bought for 1.5 in 5k

2RF2 99.87/99.75/99.62p fly, bought for 1.25 in 1.5k

US:

YZ1 129p, bought for '03 in ~10k,

FOREX: CNH Shrugs Off Solid China Data as Xi Meets Biden

- China data crossed overnight and proved generally better than expected. Retail sales came in firmer than forecast, while industrial production also tipped ahead of expectations. CNH was little changed, however, with focus resting instead of the Xi-Biden virtual summit due to kick off at the tail-end of the session. The two Presidents are expected to discuss responsibility, with the US seen urging that China play by the rules on the international stage. No deliverables or progress on trade are seen emerging from the summit.

- Markets are little changed early Monday, with the greenback modestly on the backfoot, alongside the EUR and JPY in what's been a generally direction-less session so far.

- Equity markets are trading generally well, with the e-mini S&P higher by around 10 points and nearing the alltime highs posted on Nov5 at 4711.75.

- US Empire Manufacturing and Canadian manufacturing sales numbers are the Monday highlights, with a few speakers worth watching also: namely ECB's de Cos & de Guindos and BoE's Bailey, Pill, Mann and Saunders, who testify in front of Parliament.

FX OPTIONS: Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375(E553mln), $1.1580-00(E1.3bln)

- USD/JPY: Y113.95-00($519mln), Y114.75($570mln)

- AUD/USD: $0.7267-80(A$600mln)

Price Signal Summary - USD Trend Outlook Remains Bullish

- In the equity space, the outlook is unchanged in the S&P E-minis and a bullish theme remains intact. The contract has recovered from recent lows and attention is on a climb towards 4717.00 next, 1.50 projection of the Jul 19 - Aug 16 - Aug 19 price swing. Initial support to watch is 4599.19, the 20-day EMA. EUROSTOXX 50 futures uptrend remains intact and the contract has registered a fresh trend high today of 4373.00, reinforcing bullish conditions. Attention is on the 4400.00 handle.

- In FX, a sharp sell-off in EURUSD last week confirmed a resumption of the downtrend and conditions remain bearish. The focus is on 1.1375 next, 1.382 projection of the Jan 6 - Mar 31 - May 25 price swing. GBPUSD remains vulnerable following the sharp sell-off on Nov 10. The break of 1.3412, Sep 29 low, opens 1.3334 next, 1.00 projection of the Sep 14 - 29 - Oct 20 price swing. The Nov 10 candle pattern in USDJPY is a bullish engulfing reversal. This pattern signals scope for a climb towards key resistance at 114.70, Oct 20 high. Key support has been defined at 112.73, Nov 9 low.

- On the commodity front, Gold maintains a firmer tone and is trading near recent highs. The focus is on $1877.7 next, Jun 14 high ahead of the $1900.00 handle. WTI key resistance remains at $85.41, Oct 25 high where a would confirm a resumption of the uptrend. On the downside, key S/T support to watch is $78.25, Nov 4 low.

- In the FI space, Bund futures maintain a bullish short-term tone . The focus is on 171.95, 61.8% of the Aug - Nov sell-off. Gilts also maintain a firmer tone. The focus is on a climb towards 127.69 next, Sep 21 high. The recent pullback is considered corrective.

EQUITIES: Stoxx600 Plumbs a New Record High

- European markets trade more mixed, with UK and Spanish indices lagging somewhat against a more buoyant theme across French and German headline markets. This has helped tilt the Stoxx600 to the highest level on record, with the EuroStoxx50 nearing the Global Financial Crisis highs printed in 2008.

- Energy and consumer discretionary names are leading the way higher across the Stoxx600, more than countering weakness noted across materials and communication services names.

- In US futures space, the three main indices are in the green, helping the e-mini S&P higher by 10 points or so to narrow the gap with the alltime highs posted in early November at 4711.75.

COMMODITIES: Crude leading commodities a little lower

- WTI Crude down $0.85 or -1.05% at $79.98

- Natural Gas up $0 or +0.02% at $4.793

- Gold spot down $1.85 or -0.1% at $1862.32

- Copper down $1.15 or -0.26% at $443.95

- Silver down $0.1 or -0.39% at $25.2139

- Platinum down $7.07 or -0.65% at $1077.93

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.