-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis

US TSY SUMMARY

US Treasuries have traded in a 7 ticks range during our European morning session (139.17-139.24 low/high).

- Covid spreads from China to Europe and Australia has kept core bonds underpinned, despite the fall in hard hit states, Florida, California and Texas over the weekend.

- Curve play is bull flattening in early trading, albeit just pairing some the move we saw last Friday. -2s/10s trades at 42.75.

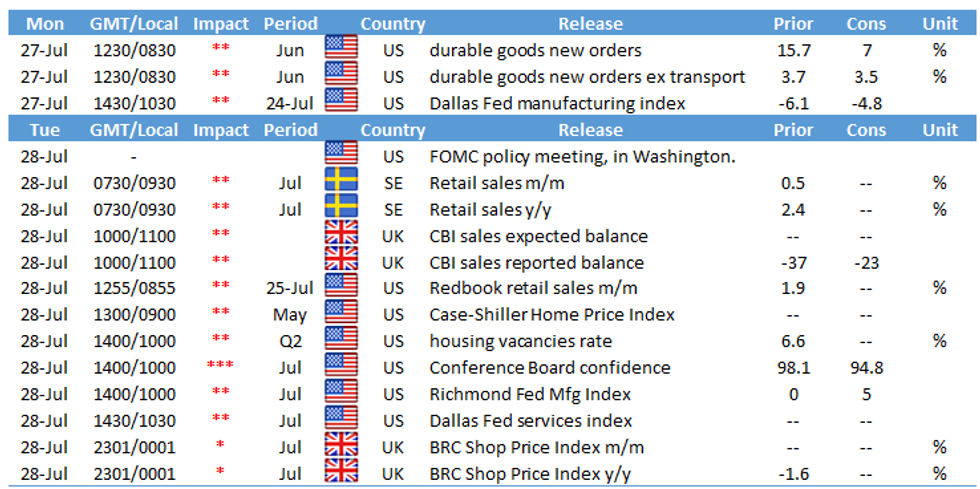

- Focus this afternoon turns to the US Durable goods data release and 5yr and 2yr supply.

- TY1 futures are up 0-4 today at 139-22+

- 2y yields down -0.6bp today at 0.142%-

- 5y yields down -1.4bp today at 0.262%

- 10y yields down -1.7bp today at 0.573%

- 30y yields down -2.0bp today at 1.211%

- 2s10s down -1.1bp today at 43.1bp

EGB/GILT SUMMARY

European govies have shifted to a risk-off posture this morning as global risk sentiment is undermined by simmering US-China tensions and concerns about the European tourism industry (and broader recovery) as the risk of fresh travel bans rises.

- Gilts are bid with cash yields broadly 2bp lower on the day and the curve trading close to flat overall.

- The bund curve has bull flattened with the 2s30s spread 4bp narrower.

- OATs trade in line with bunds. Last yields: 2-year -0.6258% ,

- 5-year -0.534%, 10-year -0.1746%, 30-year 0.5261%.

- BTPs have traded weaker with cash yields up ~1bp.

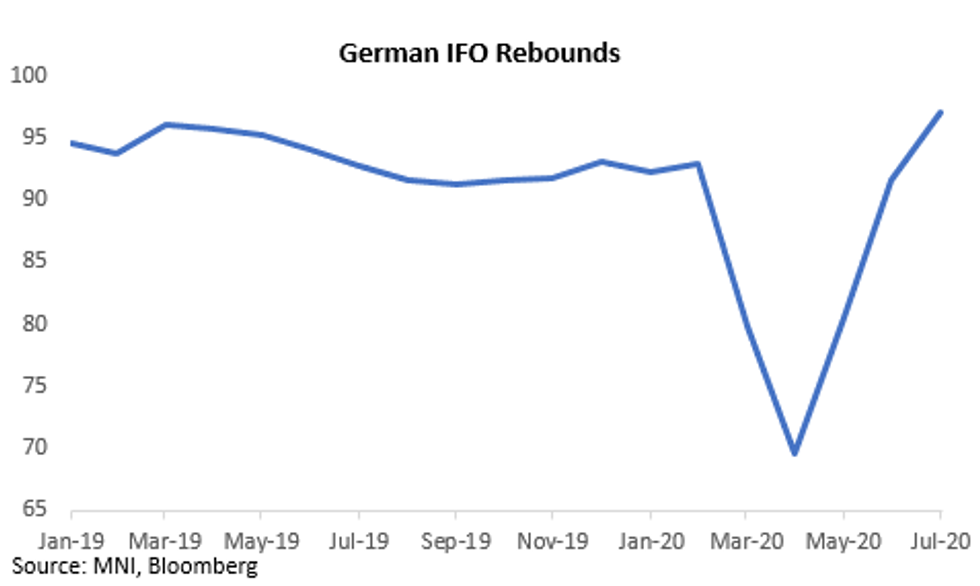

- The Business Climate and Expectations component of the Germany IFO for July came in above expectations.

- Supply this morning came from Germany (Bubills, EUR3.58bn), the Netherlands (DTCs, EUR3.3bn) and Belgium (OLOs, EUR2.008bn)

OPTIONS: Small morning recap

- ERZ0 100.50 c, sold at 1.5 in 2.5k

- L Z1 99.75/99.50ps, bought for 3 in 1k

- OEU0 134.75 puts, sold at 28.5 in 2.3k

TECH UPDATES

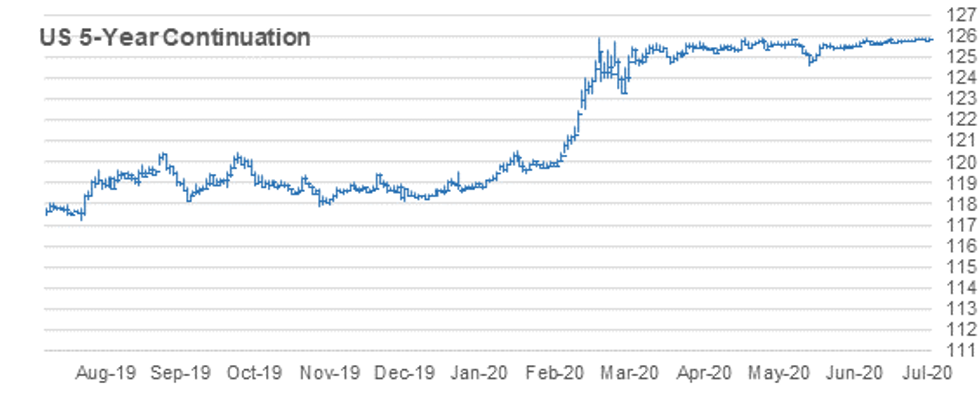

US 5Y FUTURE TECHS: (U0) Closing In On Resistance

- RES 4: 126-04+ 0.764 projection of Jun 5 - 15 rally from Jun 16 low

- RES 3: 126-00 Round number resistance

- RES 2: 125-31+ 0.618 projection of Jun 5 - 15 rally from Jun 16 low

- RES 1: 125-28+ High Jul 10 and near-term bull trigger

- PRICE: 125-276 @ 11:12 BST, Jul 27

- SUP 1: 125-196 Low Jul 13

- SUP 2: 125-166 Low Jul 2 and key near-term support

- SUP 3: 125-096 Low Jun 16 and a reversal trigger

- SUP 4: 125-03 Low Jun 10

5yr futures are firmer today. The outlook is bullish with attention 125.28+, Jul 10 high. Recent gains resulted in a breach of 125-272, Mar 30 high to confirm a resumption of the underlying uptrend. From a trend perspective, the move higher signalled a resumption of the positive price sequence of higher highs and higher lows. A clear breach of 125.28+ would open 125 31+, a Fibonacci projection. Key support is 125-166, Jul 2 low.

US 10Y FUTURE TECHS: (U0) All Eyes On The 139-25 Resistance

- RES 4: 140-22+ High Mar 9 and key resistance (cont)

- RES 3: 140-02 0.764 projection of Jun 5 - 11 rally from Jun 16 low

- RES 2: 140.00 High Mar 17 (cont) and psychological barrier

- RES 1: 139-25 High Mar 25 and Jul 24 and bull trigger

- PRICE: 139-22+ @ 11:22 BST Jul 27

- SUP 1: 139-00+ Low Jul 13

- SUP 2: 138-23+ Low Jul 2 and key near-term support

- SUP 3: 138-07 Low Jun 16 and reversal trigger

- SUP 4: 137-22 Low Jun 10

10yr futures edged higher Friday to register a fresh high print of 139-25. The outlook remains bullish. Note that 139-25 also marks the high on Mar 25 and represents a major resistance. Attention is on this level where would confirm a resumption of the uptrend and expose 140-00, Mar 17 high (cont) and a key psychological barrier. Key support remains 138 23+, a breach would signal a reversal. Initial support is 139-00+.

US 30Y FUTURE TECHS: (U0) Bullish Focus

- RES 4: 183-02 High Apr 22 (cont)

- RES 3: 182-15 High May 15 (cont)

- RES 2: 182-12 1.000 proj of the Jun 5 - 11 rally from the Jun 16 low

- RES 1: 181.30 High Jul 24

- PRICE: 181-18 @ 11:39 BST, Jul 27

- SUP 1: 178.31 Low Jul 13

- SUP 2: 177-06 Low Jul 6 and key near-term support

- SUP 3: 176-13 Low Jun 24

- SUP 4: 174-29 Low Jun 16 and the reversal trigger

30yr futures maintain a firmer tone. The contract traded higher Friday and clearing resistance at 181-14/15, high Jul 10 and Apr 21 respectively to register a high print of 181-30. These gains reinforce the underlying bullish theme with further appreciation likely near-term. Furthermore, Friday's gains also signal a broader range breakout and open 189-24 further out, Mar 9 high. The initial key support is at 177-06, Jul 6 low.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.