-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Dust Starting To Settle Following US Electin

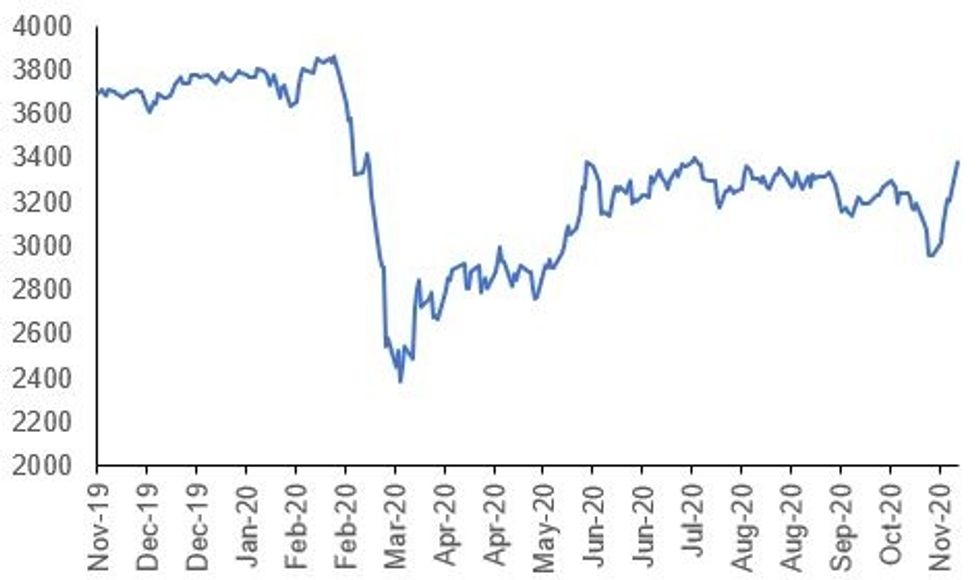

Fig 1. Euro Stoxx index

US TSYS SUMMARY: Everything Rallies

Treasuries have gained ground to start the week, alongside a sea of green in equities and a slightly stronger USD.

- Modest bull flattening: The 2-Yr yield is down 0.2bps at 0.1508%, 5-Yr is down 1.3bps at 0.3483%, 10-Yr is down 1.2bps at 0.8067%, and 30-Yr is down 1.6bps at 1.5837%.

- Dec 10-Yr futures (TY) up 4.5/32 at 138-22 (L: 138-14.5 / H: 138-24.5), volumes returning to more normal levels (TYZ0 ~ 275k at 0630ET) after a heavy week.

- S&P futs +1.5%; DXY dollar Index +0.2%.

- First day of trading since networks declared Biden the winner and he delivered "acceptance" speech Saturday, with split gov't among other factors seen continuing to boosting post-election risk appetite (Georgia Senate run-offs in January notwithstanding).

- Trump has not conceded, with some focus on his promise to launch court challenges today.

- The data slate today is bare, but we do get some Fed speakers: Cleveland's Mester at 1330ET, and Dallas's Kaplan at 1700ET.

- A busy auction schedule: $105B in 13-/26-week bills at 1000ET, $60B in 42-/119-day bills at 1130ET, and $54B 3-Yr Note at 1300ET. NY Fed meanwhile buys ~$1.750B of 20-30-Yr Tsys.

BOND SUMMARY: EGB/GILT

European sovereign curves have bull flattened this morning alongside broad gains for equities and an uplift in oil.

- Gilts have outperformed EGBs. Cash yields are 1-3bp lower with the curve 2bp flatter.

- Bunds have traded firmer with the longer end similarly outperforming. Last yields: 2-year -0.7938%, 5-year -0.8147%, 10-year -0.6323%, 30-year -0.2130%.

- OATs trade broadly in line with bunds with the curve marginally flatter.

- It is the same story for BTPs with yields up to 3bp lower on the day.

- France will offer E6.3-7.5bn of 3/-6-/12-month BTFs this afternoon.

- German exports for September came in slightly stronger than expected (2.3% M/M vs 2.0% survey).

OPTIONS

SHORT STERLING OPTIONS: Rate cut bet

LH1 100.25c, bought for half in 2.5k

TECHS

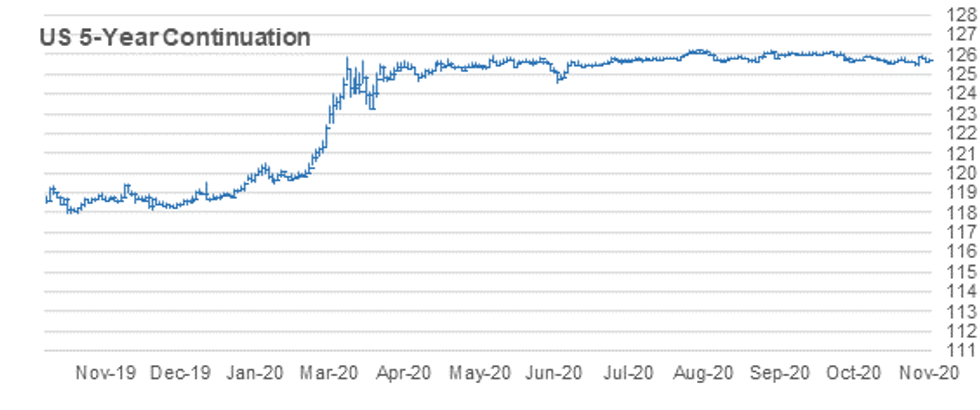

US 5YR FUTURE TECHS: (Z0) Dips Likely Corrective

- RES 4: 126-046 High Sep 30

- RES 3: 126-03+ High Oct 2

- RES 2: 125-31 High Oct 15 and a key near-term resistance

- RES 1: 125-29+ High Nov 5 and the bull trigger

- PRICE: 125-22+ @ 11:17 GMT Nov 9

- SUP 1: 125-186 Low Nov 6

- SUP 2: 125-122 Low Nov 4 and key support

- SUP 3: 125-112 Low Jun 10 (cont)

- SUP 4: 125-10+ 1.236 proj of Aug 4 - 28 sell-off from Sep 3 high

5yr futures rallied sharply higher on Nov 4. The rally led to a break of trendline resistance at 125-236, drawn off the Sep 30 high and was confirmed by the breach of a bull trigger at 125-272, Oct 28 high. This strengthens a bullish outlook and signals a clear reversal of the entire downleg since early October. Pullbacks are considered corrective. Key support has been defined at 125-122 with initial support at 125-186, Friday's low.

US 10YR FUTURE TECHS: (Z0) Bullish Reversal Still In Play

- RES 4: 139-30 1.0% 10-dma envelope

- RES 3: 139-26 High Sep 29 and a key resistance

- RES 2: 139-13+ Bear channel top drawn off the Aug 4 high

- RES 1: 139-08+ High Nov 5

- PRICE: 138-22 @ 11:27 GMT Nov 9

- SUP 1: 138-12+ Low Nov 6

- SUP 2: 137-20+ Low Nov 4 and key support

- SUP 3: 137-15 1.382 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-08 1.500 proj of Aug 4 - 28 decline from Sep 3 high

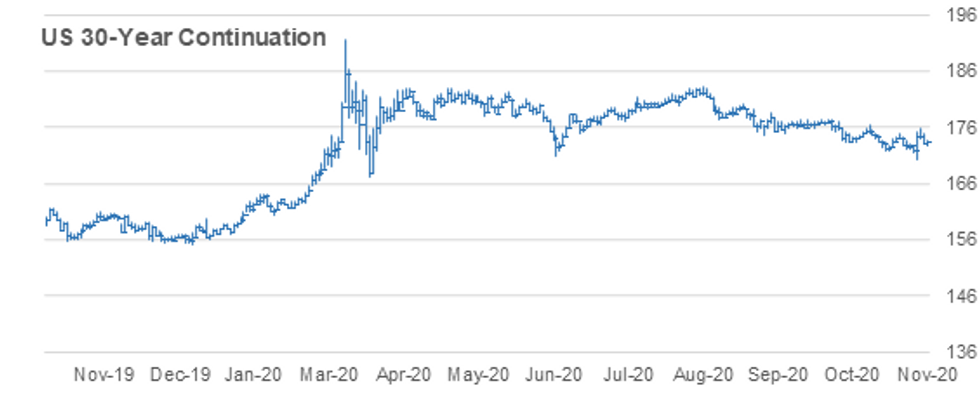

US 30YR FUTURE TECHS: (Z0) Bullish Focus

- RES 4: 177-12 High Sep 29 and a key resistance

- RES 3: 177-00 High Oct 2

- RES 2: 176-10 High Oct 15 and a key resistance

- RES 1: 175-27 High Nov 5 and the bull trigger

- PRICE: 173-15 @ 11:35 GMT Nov 9

- SUP 1: 172-27 Intraday low

- SUP 2: 170-07 Low Nov 4 and key support

- SUP 3: 170-00 Round number support

- SUP 4: 168-19 1.236 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures rallied sharply higher on Nov 4 off the day low of 170-07 and price last week cleared trendline resistance drawn off the Aug 6 high. The trendline break was also confirmed by the breach of resistance at 174-29, Oct 28 high and a recent bull trigger. The break signals a more significant reversal of the entire downleg since the Aug 6 high. Pullbacks are considered corrective, key support lies at 170-07.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.