-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: ECB Week

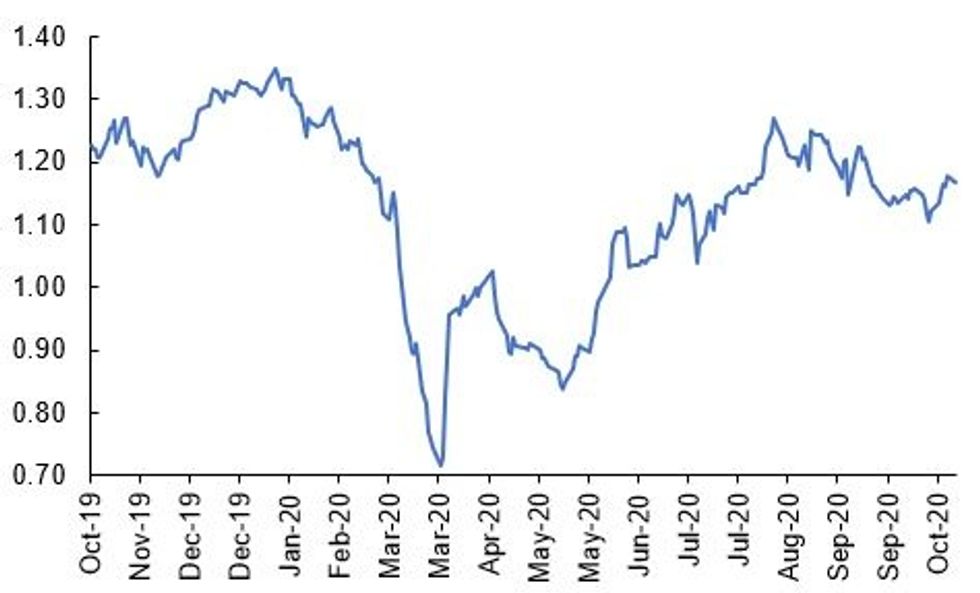

Fig 1 EUR 5y5y Forward Inflation Swap

Source:MNI/Bloomberg

US TSYS SUMMARY: Bull Flattening Continues

Some decent bull flattening to start the week, continuing Friday's bias, as risk is on the back foot.

- The 2-Yr yield is down 0.6bps at 0.1494%, 5-Yr is down 1.9bps at 0.3573%, 10-Yr is down 3bps at 0.8128%, and 30-Yr is down 3.6bps at 1.6053%. Futures volumes decent (~270k), front TYs off highs: Dec 10-Yr up 5/32 at 138-16.5 (L: 138-11 / H: 138-19.5).

- Dollar stronger, equity futures lower. COVID concerns prevalent in Europe, not just lockdowns, but spilling into tech stocks (Germany's SAP citing demand in downgraded outlook, stock sinking most since 1999).

- Risk appetite also not helped by continued fiscal impasse in D.C.; Senate's focus will be to confirm Amy Coney Barrett to the Supreme Court this evening, then go home until after the election.

- As the days tick down to Nov 3, outcome odds little changed from Friday; Biden seen w 67% chance of victory, Dems/No Majority 45%/31% respectively (per Betfair).

- A fairly quiet calendar ahead of a busier data flow later in the week (FOMC speakers silent of course due to pre-meeting blackout). We get Chicago Fed nat'l activity index at 0730ET, Sep new home sales at 1000ET, and Oct Dallas Fed Manufacturing at 1030ET.

- In supply, 1130ET sees combined $105B of 13-/26-week bill sales. No NY Fed operational purchases.

BOND SUMMARY: Periphery EGBs Rallying

Periphery EGBs have rallied this morning against weaker trading in core markets. Outside of the FI space, markets have adopting a risk-off posture with equities broadly lower, oil posting fresh losses and the dollar on the front foot against G10 FX.

- Gilts rallied soon after the open, but have quickly given back the early gains and now trade close to unch on the day.

- It is a similar story for bunds which are back to flat on the day. Last yields: 2-year -0.7630%, 5-year -0.7718%, 10-year -0.5740%, 30-year -0.1564%.

- BTPs have rallied sharply and the curve has bull flattened. Cash yields are 3-7bp lower while the 2s30s spread is 4bp narrower.

- Germany allotted E2.51bn of the Oct 27, 2021 bubill. France will auction 3-/6-/12-month BTFs for E4.1-5.3bn later today.

- Focus this week will be on the ECB Governing Council meeting on Thursday. No material change in monetary policy is expected, but there is some speculation that the ECB may use the October meeting to tee-up further policy easing in December.

DEBT SUPPLY

GERMAN T-BILL AUCTION RESULTS: Germany Allots E2.505bn of Oct 27, 2021 Bubills

- Average yield -0.7145%, Buba cover 1.7x, bid-to-cover 1.42x

OPTIONS

EGB OPTIONS: Bund Downside

- RXZ0 174.00 put bought for 26 in 1k

- RXZ0 175.00/174.00 1x1.5 put spread bought for 16 in 0.75k

TECHS

US 5YR FUTURE TECHS: (Z0) Bearish Conditions Dominate

- RES 4: 125-31 High Oct 15

- RES 3: 125-27+ 50-day EMA

- RES 2: 125-252 20-day EMA

- RES 1: 125-22+ High Oct 22

- PRICE: 125-202 @ 10:20 GMT Oct 26

- SUP 1: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 2: 125-112 Low Jun 10 (cont)

- SUP 3: 125-08 1.382 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 4: 125-06+ Low Jun 6

5yr futures maintain a weaker tone following last week's strong selling pressure. The Oct 21 breach of support at 125-202, Oct 7 low, confirmed a resumption of the downtrend that has been in place since early August. This paves the way for weakness towards 125-16+ next, a Fibonacci projection and last week's low ahead of 125-112, Jun 10 low (cont). Initial resistance is at 125-22+.

US 10YR FUTURE TECHS: (Z0) Attention Is On The Bear Channel Base

- RES 4: 139-14 High Oct 15

- RES 3: 139-04+ 50-day EMA

- RES 2: 138-30+ 20-day EMA

- RES 1: 138-20+ Low Oct 7 and this week's breakout level

- PRICE: 138-17 @ 10:34 GMT Oct 26

- SUP 1: 138-05 Low Oct 23

- SUP 2: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 3: 138-01 Bear channel base drawn off the Aug 4 high

- SUP 4: 137-29 76.4% retracement of the Jun - Aug rally (cont)

Treasuries remain in a downtrend following the recent sell-off. A bearish theme was reinforced on Oct 21 following the break of 138-20+, Oct 7 low. The move lower confirmed a resumption of the broader reversal that occurred on Aug 4 and clears the way for an extension lower. This has opened 138-04+ next, a Fibonacci projection ahead of 138-01, a bear channel base drawn off the Aug 4 high. Initial resistance is seen at 138-20+.

US 30YR FUTURE TECHS: (Z0) Bearish Trend Sequence Remains Intact

- RES 4: 176-10 High Oct 15

- RES 3: 175-08 Trendline resistance drawn off the Aug 6 high

- RES 2: 174-16 20-day EMA

- RES 1: 173-24 High Oct 21

- PRICE: 173-10 @ 10:40 GMT Oct 26

- SUP 1: 171-22 Low Oct 23 and the bear trigger

- SUP 2: 171-00 Round number support

- SUP 3: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

- SUP 4: 170-00 Psychological round number

30yr futures maintain a bearish tone despite the recent recovery. Price on Oct 21 cleared key support at 173-10, Oct 7 low. The break negates recent bullish developments and instead confirms a resumption of the downtrend that has been in place since the Aug 6 reversal. A number of price objectives have already been achieved. Attention is on 170-16 next, a Fibonacci projection. Initial resistance is at 173-24, Oct 21 high. Trendline resistance is at 175-08.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.