-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US Morning FI Analysis: Election Hangover

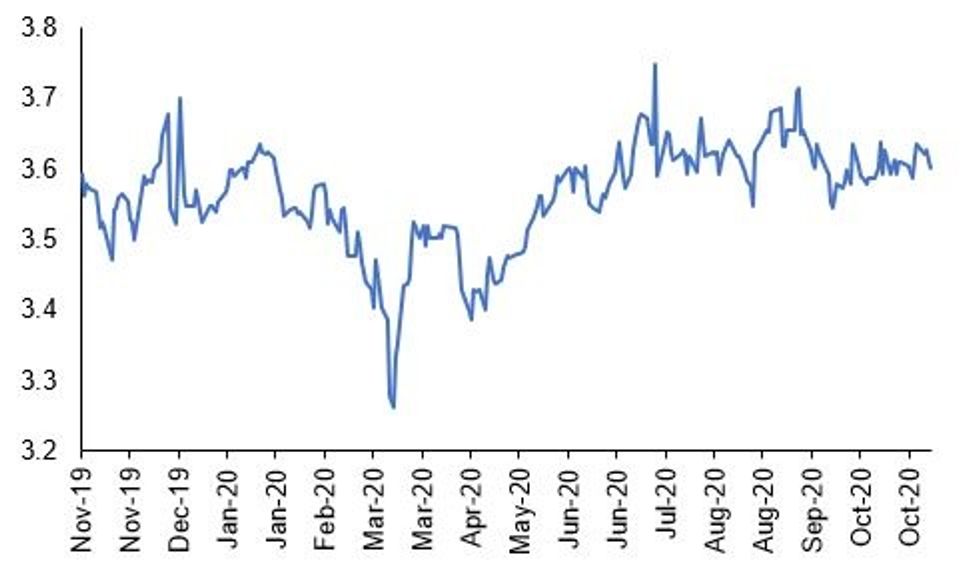

Fig 1. GBP 5y5y Forward Inflation Swap, %

Source: MNI/Bloomberg

US TSYS SUMMARY: Tsys Continue To Unwind 'Blue Wave' Move, With FOMC Eyed

- The 2-Yr yield is unchanged at 0.1447%, 5-Yr is down 1.4bps at 0.3132%, 10-Yr is down 3bps at 0.7328%, and 30-Yr is down 4.8bps at 1.493%. Dec 10-Yr futures (TY) up 5/32 at 139-4.5 (L: 138-30.5 / H: 139-08.5)

- While there is possibly a case for a further dovish tilt from the FOMC (decision 1400ET, Powell presser at 1430ET) in the wake of Tuesday's not-quite-yet-concluded election, as a 'blue wave' fiscal stimulus package looks all but ruled out - most expectations are that it'll largely be a non-event, with action waiting until December at the earliest, once the political/fiscal landscape is clearer.

- The fact that risk assets continue to strengthen post-election gives Powell and co. breathing room to assess.

- That said, some lingering questions over the election keeping a cautious tone. Biden about 85% prob to win on Betfair; off highs and still uncertainty w votes to be counted and legal challenges to arise so the waiting game continues, but he is favored to take Arizona, Georgia, Pennsylvania, and Nevada per bookmakers.

- In data, we get Oct Challenger layoffs at 0730ET, jobless claims and Q3 productivity/labor costs at 0830ET.

- In supply, $65B combined of 4-/8-week auctions at 1130ET.

BOND SUMMARY: Post-Election EGB/GILT Rally Subsides

Following yesterday's sharp rally on the back of heightened uncertainty over the outcome of the US presidential election, momentum has subsided this morning as Biden inches closer to the White House.

The Bank of England increased the capacity of the Asset Purchase Programme by GBP150bn to GBP895bn, exceeding the GBP100bn expansion expected.- UK Chancellor of the Exchequer Rishi Sunak will update parliament the government's fiscal support measures for tackling the economic impacts of the Covid crisis. Sunak is expected to announce an extension of the furlough scheme by several months.

- Gilts have traded weaker with yields 1-2bp higher. The Dec-20 gilt future trades at 136.19, towards the bottom end of the day's range (L: 136.09 / H: 136.69).

- Bunds started the session on a firm footing but quickly gave up the early gains and now trade close to unch on the day.

- The OAT curve has flattened slightly on the back of the short end trading firmer and yields at the longer end inching lower. The 2s30s spread is 2bp narrower.

- BTPs have rallied with yields 2-4bp lower.

DEBT SUPPLY

SPAIN AUCTION RESULTS: Spain Sells E1.826bn of Obli/ObliEis Vs E1.25-2.75bn Target

- E1.356bn of the 1.20% Oct-40 Obli: Average yield 0.602% (1.25%), bid-to-cover 2.01x

- E0.47bn of the 0.15% Nov-23 ObliEi: Average yield -0.995% (-0.57%), bid-to-cover 2.37x (1.57x)

France Sells E10.994bn of L/T OATs:

- E3.497bn of the 0.50% May-29 OAT: Average yield -0.50% (-0.13%), bid-to-cover 1.81x (1.96x)

- E3.498bn of the 0% Nov-30 OAT: Average yield -0.38% (-0.25%), bid-to-cover 2.36x (1.82x)

- E2.521bn of the 1.50% May-50 OAT: Average yield 0.27% (0.41%), bid-to-cover 1.61x (2.54x)

- E1.478bn of the 4.00% Apr-55 OAT: Average yield 0.32% (0.60%), bid-to-cover 1.77x (1.64x)

OPTIONS

EGB OPTIONS: Schatz Condor vs PS

DUZ0 112.20/112.30/112.50/112.60 c condor vs 112.10/112ps, sold the condor at 7.5 in 7k

EGB OPTIONS: Bund call seller

RXF0 181 call, sold at 27.5 in 5k

SHORT STERLING OPTIONS: More rate cut bets

More upside via option post BoE.

LH1 100.12/100.25/100.37c fly, bought for 1 in 2k

SHORT STERLING OPTIONS: 1yr vs 2yr

0LH1 100c vs 2lH1 100c, bought the 1yr and receive 0.25 in total 9k

SHORT STERLING OPTIONS: Call fly buyer

L M1 100.125/100.25/100.375c fly, bought for 1.5 in 6k

TECHS

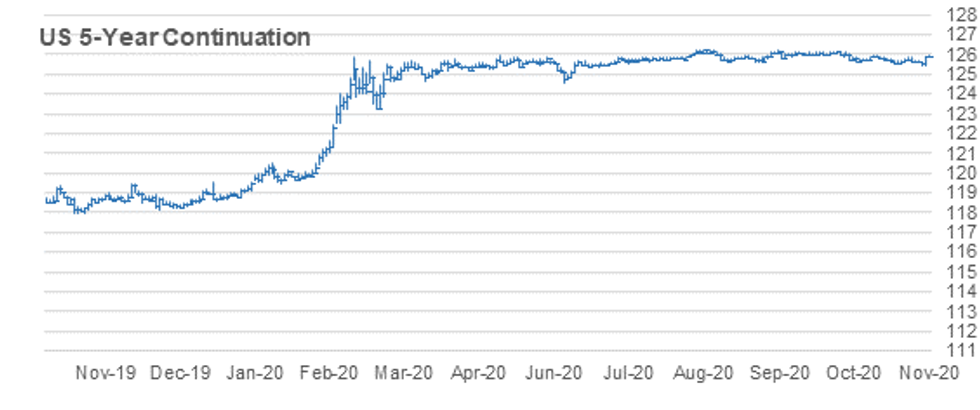

US 5YR FUTURE TECHS: (Z0) Clears Trendline Resistance

- RES 4: 126-046 High Sep 30

- RES 3: 126-03+ High Oct 2

- RES 2: 125-31 High Oct 15 and a key near-term resistance

- RES 1: 125-29+ Intraday high

- PRICE: 125-282 @ 11:34 GMT Nov 5

- SUP 1: 125-206 50% retracement of the Nov 4 - 5 climb

- SUP 2: 125-122 Low Nov 4 and key support

- SUP 3: 125-112 Low Jun 10 (cont)

- SUP 4: 125-10+ 1.236 proj of Aug 4 - 28 sell-off from Sep 3 high

5yr futures rallied sharply higher yesterday off the day low of 125-122. The rally led to a break of trendline resistance at 125-236, drawn off the Sep 30 high and was confirmed by the breach of a bull trigger at 125-272, Oct 28 high. This strengthens a bullish outlook and signals a clear reversal of the entire downleg since early October. Key support has been defined at 125-122.

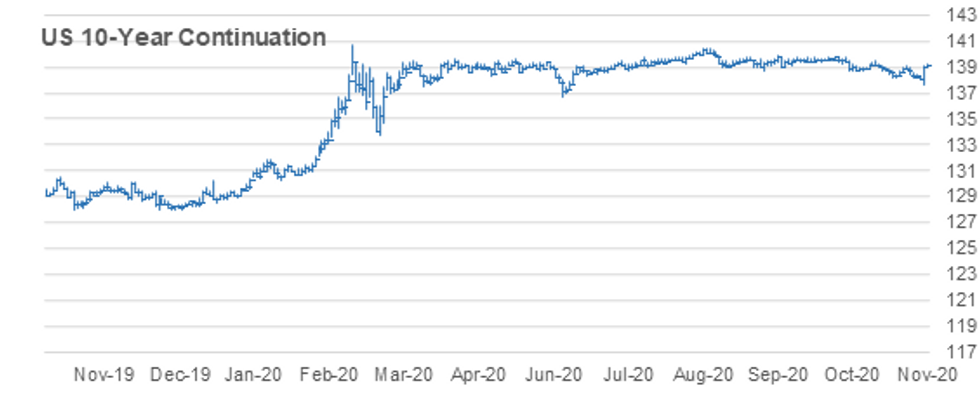

US 10YR FUTURE TECHS: (Z0) Strong Reversal

- RES 4: 139-28 1.0% 10-dma envelope

- RES 3: 139-26 High Sep 29 and a key resistance

- RES 2: 139-14 Bull channel top drawn off the Aug 4 high

- RES 1: 139-08+ Intraday high

- PRICE: 139-04 @ 11:51 GMT Nov 5

- SUP 1: 138-14+ 50% retracement of the Nov 4 -5 rally

- SUP 2: 137-20+ Low Nov 4 and key support

- SUP 3: 137-15 1.382 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-08 1.500 proj of Aug 4 - 28 decline from Sep 3 high

Treasuries rallied sharply yesterday off 137-20+. Price as a result cleared trendline resistance at 138-29, drawn off the Oct 2 high. The break of the trendline was confirmed by a breach of resistance at 139-03, Oct 28 high and the recent bull trigger. The strong rally signals a more significant reversal of the entire decline since early August and attention turns to 139-14, the top of a bull channel drawn off the Aug 4 high. 137-20+ marks key support.

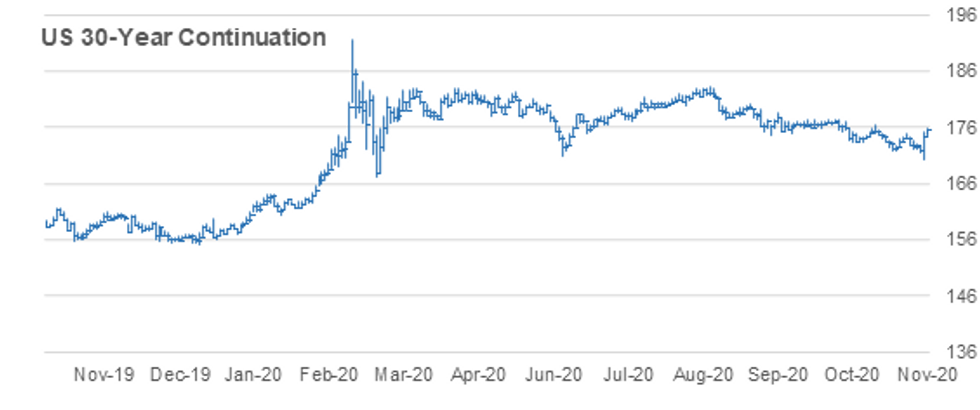

US 30YR FUTURE TECHS: (Z0) Rally Highlights Sentiment Shift

- RES 4: 177-12 High Sep 29 and a key resistance

- RES 3: 177-00 High Oct 2

- RES 2: 176-10 High Oct 15 and a key resistance

- RES 1: 175-27 Intraday high

- PRICE: 175-10 @ 11:59 GMT Nov 5

- SUP 1: 173-01 50.0% retracement of the Nov 4 - 5 rally

- SUP 2: 170-07 Low Nov 4 and key support

- SUP 3: 170-00 Round number support

- SUP 4: 168-19 1.236 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures rallied sharply higher yesterday off the day low of 170-07. Price has also cleared trendline resistance at 174-15, drawn off the Aug 6 high. The trendline break was also confirmed by the breach of resistance at 174-29, Oct 28 high and a recent bull trigger. The break signals a more significant reversal of the entire downleg since the Aug 6 high. On the downside, 170-07 has been defined as a key support.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.