-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Risk-On Pivot

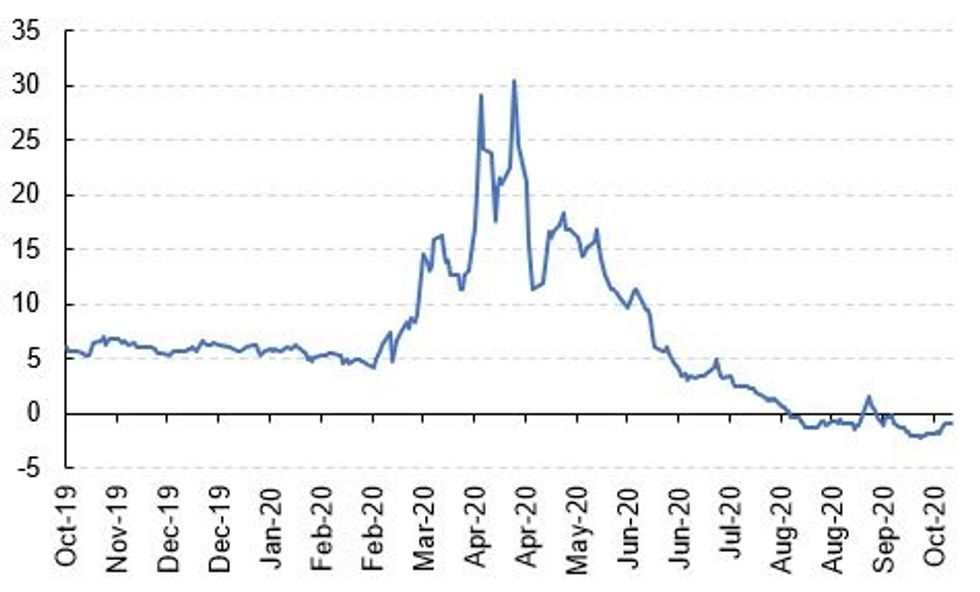

Fig 1. EUR 3m FRA-OIS

Source: MNI/Bloomberg

US TSYS SUMMARY: Grinding Lower Ahead Of Tuesday Deal "Deadline"

A tentative firming in risk assets to start the week, as market participants weigh the potential for fiscal stimulus from Washington (Speaker Pelosi's setting over the weekend of a Tuesday "deadline" for a deal w White House).

- Risk appetite also being helped to some extent by reports suggesting renewed Brexit deal impetus. Equities higher, dollar a little weaker.

- Dec 10-Yr futures (TY) grinding lower in the European morning on decent volume (250k @ 0630ET), last down 8/32 at 138-26 (L: 138-25/ H: 139-01.5).

- Curve bear steepening: 2-Yr yield is up 0.6bps at 0.1491%, 5-Yr is up 1.6bps at 0.3377%, 10-Yr is up 2.7bps at 0.7723%, and 30-Yr is up 3bps at 1.5583%.

- Also notable that over the weekend, the presidential race seen tightening by betting markets: Betfair sees the race at 60-40% in Biden's favor, vs 66-34% end-Fri (and 72-28% peak on Oct 11).

- Fed Chair Powell speaks at 0800ET, with NY's Williams at 0900ET, VC Clarida at 1145ET, Minn's Kashkari at 1200ET, Atl's Bostic at 1420ET and Philly's Harker at 1500ET.

- Light on data today though.

- 1130ET sees sale of $105B in 13-/26-week bills. NY Fed buys ~$1.750B of 20-30Y Tsys.

BOND SUMMARY: EGBs/Gilts Off to a Weak Start

European govies have started the week on a looser footing and have unwound some of last week's bull flattening. Markets have pivoted to a risk-on position more broadly with the dollar on the backfoot against the G10 and equities inching higher.

- Gilts trade weaker with cash yields broadly 1bp lower across the curve. The Dec-20 gilt future trades at 136.37 - towards the bottom of the morning range (L: 136.33 / H: 136.58).

- Bunds trade close to unch on the day. Last yields: 2-year -0.7824%, 5-year -0.8013%, 10-year -0.6135%, 30-year -0.1938%.

- OATs have underperformed relative to bunds, particularly at the longer end where cash yields are 2bp higher on the day.

- BTPs have sold off sharply at the curve has bear steepened. The 2s30s spread is 4bp wider.

- Supply this morning came from Germany (Bubills, EUR2.93bn), Netherlands (DTCs, EUR1.08bn), Belgium (OLOs, EUR1.80bn), and Slovakia (SlovGBs, EUR478mn).

- The data calendar is light today, although there is a strong slate of central bank speakers from the ECB (Pablo Hernandez de Cos, Mersch, Lagarde, Lane) and the BoE (Broadbent, Cunliffe).

DEBT SUPPLY

GERMAN T-BILL AUCTION RESULTS: Germany Allots E2.93bn of Bubills

- E1.472bn of the Mar 3, 2021 Bubill: Average yield -0.7201%, Buba cover 3.4x, bid-to-cover 3.4x

- E1.454bn of the Sep 29, 2021 Bubill: Average yield -0.7124%, Buba cover 4.0x, bid-to-cover 3.8x

NETHERLANDS AUCTION RESULTS: The Netherlands Sells E1.08bn of 6-Month DTCs Vs E0.5-1.5bn Target

- Average yield -0.7%, bid-to-cover 2.04x

BELGIUM AUCTION RESULTS: Belgium Sells Ebn of OLOs Vs E1.3-1.8bn Target

- E1.154bn of the 0.10% Jun-30 OLO: Average yield -0.399% (-0.23%), bid-to-cover 1.71 (1.79x)

- E0.649bn of the 1.45% Jun-37 OLO: Average yield -0.015%, bid-to-cover 2.63x

SLOVAKIA AUCTION RESULTS: Slovakia Sells E478mn of SlovGBs

- E136mn of the 0.125% Jun-27 SlovGB: Average yield -0.5008%, bid-to-cover 1.28x

- E149mn of the 0.75% Apr-30 SlovGB: Average yield -0.3856%, bid-to-cover 1.34x

- E79 of the 1.625% Jan-31 SlovGB: Average yield -0.3282%, bid-to-cover 1.75x

- E114mn of the 1.875% Mar-37 SlovGB: Average yield 0.0022%, bid-to-cover 1.32x

OPTIONS

EGB OPTIONS: Downside buyer

RXZ0 174.50p, bought for 39 in 3k (ref 175.91)

SHORT STERLING OPTIONS: More upside buyer

LH1 99.875/100/100.12c fly 1x3x2, bought for 1.75 in 3k

EURIBOR OPTIONS: 2yr mid downside

2RX0 100.50/100.37ps, bought for 0.75 in 5k (ref 100.565, 16 del)

EGB OPTIONS: Bund broken put fly

RXZ0 175/173/169 broken put fly, bought for 24/26 in 1k

SHORT STERLING OPTIONS: Upside interest

0LZ0 100.125/100.25cs, bought for 2 in 1k

TECHS

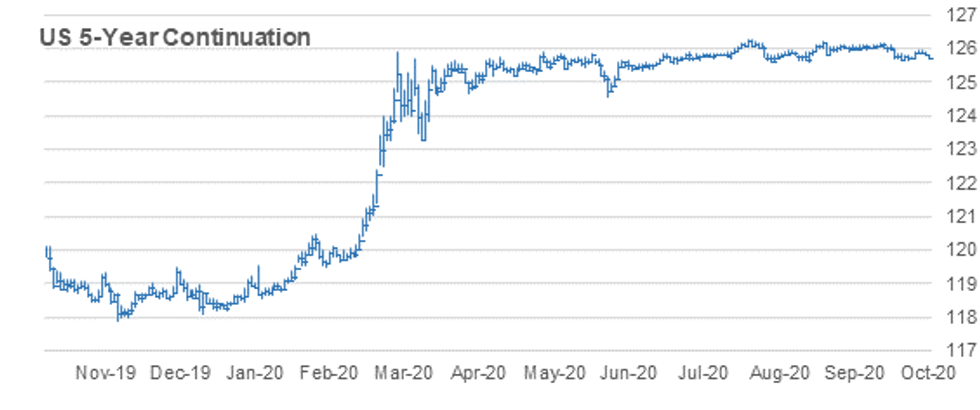

US 5YR FUTURE TECHS: (Z0) Under Pressure

- RES 4: 125-316 High Oct 5

- RES 3: 125-30+ 61.8% retracement of the Sep 30 - Oct 7 sell-off

- RES 2: 125-31 High Oct 15

- RES 1: 125-26 Intraday high

- PRICE: 125-226 @ 11:23 BST Oct 19

- SUP 1: 125-21 Low Oct 9

- SUP 2: 125-202 Low Oct 7 and the bear trigger

- SUP 3: 125-18 Low Aug 28 (cont)

- SUP 4: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

5yr futures have started the week under pressure. The move below 125-23+ today, Oct 13 low exposes the key support at 125-202, Oct 7 low. A break of this level would negate recent bullish developments and instead confirm a resumption of the downtrend that has been in place since early August. This would open 125-16+, a Fibonacci projection. Key short-term resistance is at 125-31.

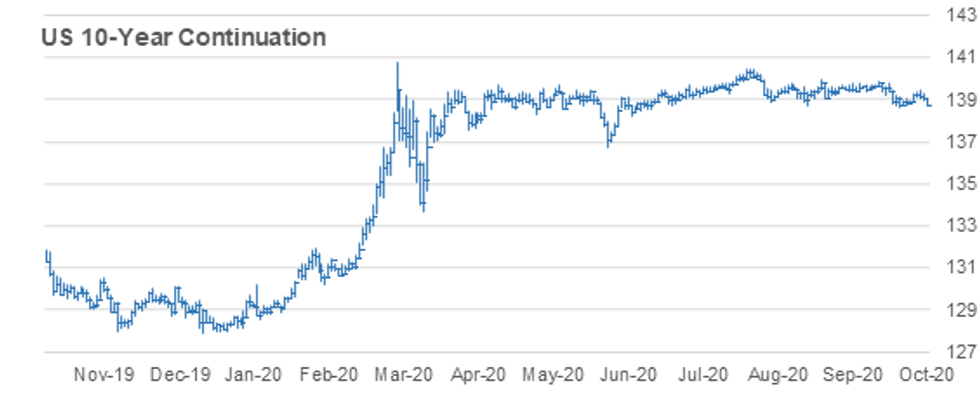

US 10YR TECHS: (Z0) Selling Pressure Dominates

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 2: 139-14 High Oct 15

- RES 1: 139-01+Intraday high

- PRICE: 138-25+ @ 11:38 BST Oct 19

- SUP 1: 138-20+ Low Oct 7 and the bull trigger

- SUP 2: 138-18+ Low Aug 28 and the bear trigger

- SUP 3: 138-16+ Low Jun 23 (cont)

- SUP 4: 138-12 61.8% retracement of the Jun - Aug rally (cont)

Treasuries have reversed last week's positive tone. Today's sharp sell-off marks an extension of the pullback from the recent high of 139-14 on Oct 15. The move through support at 138-28+, Oct 13 low exposes 138-20+, Oct 7 low and 138-18+, Aug 28 low. The latter is the bear trigger where a break would signal a resumption of the reversal that occurred on Aug 4. This would open 138-04+, a Fibonacci projection. Firm resistance is at 139-14.

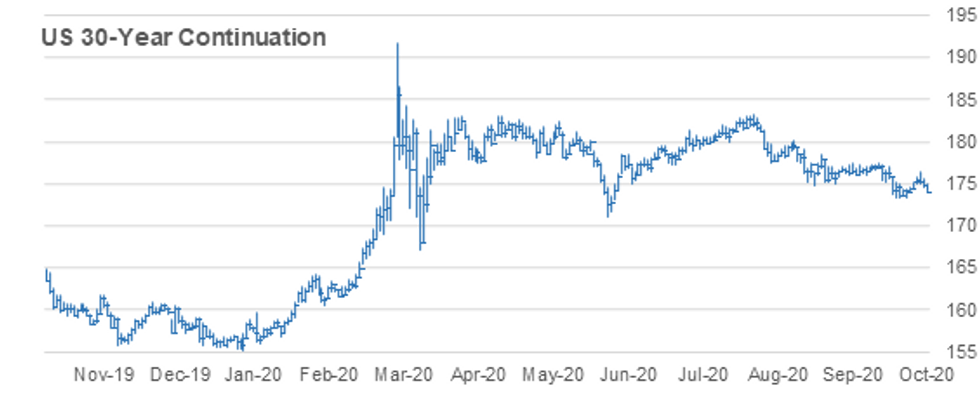

US 30YR TECHS: (Z0) Starts The Week On A Softer Note

- RES 4: 177-14 High Sep 17 and a bull trigger

- RES 3: 177-00 High Oct 2

- RES 2: 176-10 High Oct 15

- RES 1: 174-27 Intraday high

- PRICE: 174-04 @ 11:49 BST Oct 19

- SUP 1: 173-10 Low Oct 7 and the bear trigger

- SUP 2: 172-17 Low Jun 5 (cont)

- SUP 3: 172-13 0.764 proj of Aug 6 - 28 downleg from Sep 3 high

- SUP 4: 172-00 Round number support

30yr futures are trading lower having started the week on a softer note. Price has breached 174-08, Oct 13 low, exposing the key level at 173-10, Oct 7 low. A break of 173-10 would negate recent bullish developments and instead confirm a resumption of the downtrend that has been in place since the Aug 6 reversal. This would open 172-17, Jun 5 low (cont) and 172-13, a Fibonacci projection. Key resistance has been defined at 176-10, Oct 15 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.