-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: U.K.-E.U. Locked In Talks

EXECUTIVE SUMMARY:

- BREXIT NEGOTIATORS TURN UP HEAT AS U.K. DEADLINE APPROACHES

- MORE P.B.O.C. TOLERANCE FOR STRONG YUAN AMID REBOUND (MNI SOURCES)

U.K./E.U. (BBG): The U.K. and European Union are locked in talks over a deal on their future relationship with each daring the other to blink just one day before Boris Johnson's deadline for abandoning the negotiations expires. Neither side believes the other has offered enough for talks to reach a conclusion, with the British government deriding the EU for its hard-line stance on fisheries and the EU calling for the U.K. to cede ground in other key areas such as business subsidies. The deadlock is set to continue on Wednesday when Johnson and European Commission President Ursula von der Leyen discuss the impasse on a video call. The prime minister has said he will walk away from the negotiations if there is no clear progress by Thursday, when EU leaders hold a summit in Brussels.

P.B.O.C. (MNI SOURCES): The People's Bank of China is becoming more tolerant of a strong yuan, as the country's economy recovers more strongly than its major competitors from the pandemic hit earlier in the year and as Beijing abides by the currency stipulations of the Phase One trade deal with the U.S. despite bilateral tensions, policy advisors and foreign exchange strategists told MNI. For full article contact sales@marketnews.com

BANK OF KOREA (MNI): The Bank of Korea kept monetary policy unchanged on Wednesday, maintaining the base rate at a historic low of 0.5% but indicated it would act as needed to support the economy and stabilize the inflation rate. The decision was flagged in MNI's preview published Tuesday.

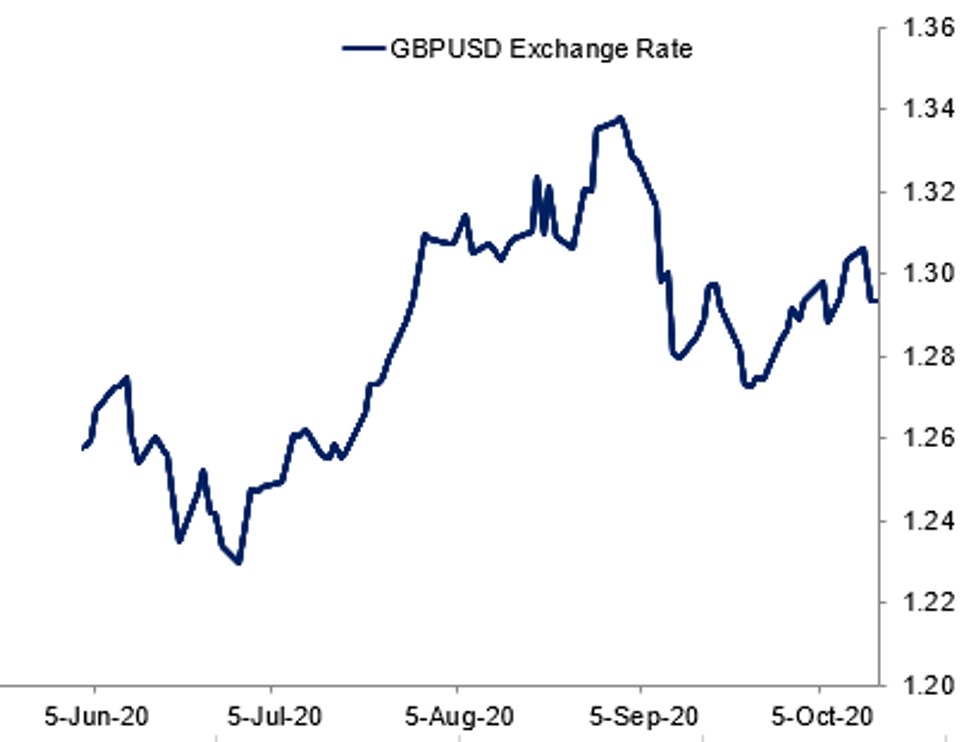

Fig. 1: Cable Hanging In There Ahead Of EU Summit

Bloomberg, MNI

Bloomberg, MNI

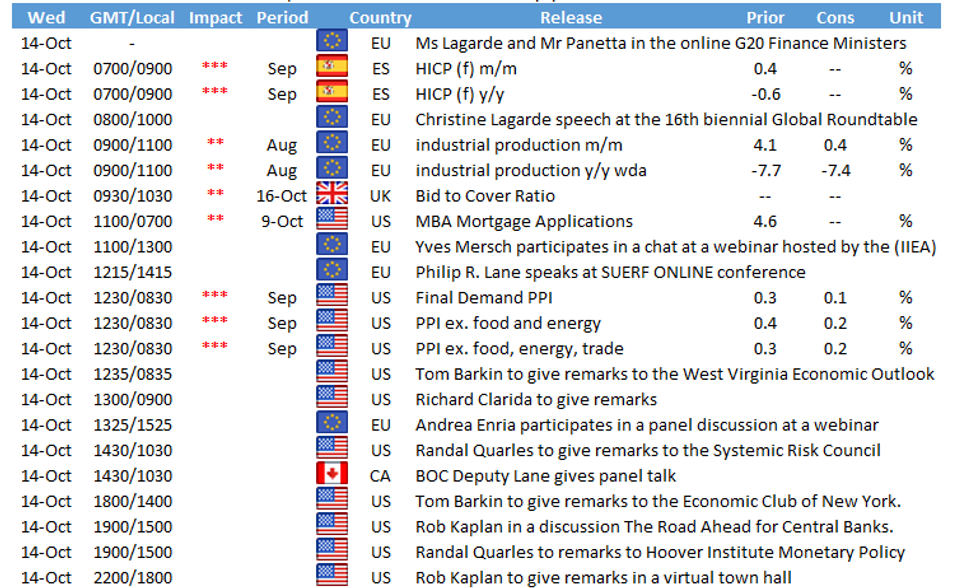

DATA:

FIXED INCOME: European fixed income higher despite equities moving higher

- European core fixed income is trading a bit higher this morning with Treasuries erasing some slight overnight weakness to be largely flat on the day.

- Risk sentiment has recovered a bit from yesterday and equities are generally higher across the board but core fixed income has largely ignored the moves in equity this morning.

- Despite equities moving higher, European peripheral spreads are generally a bit wider today. BTP futures have made new highs again this morning but have given up some of their gains.

- There are a number of speakers due up today notably the Fed's Clarida, Barkin, Quarles, Kaplan, the ECB's Billeroy, de Cos, BOE's Haldane and BOC's Lane.

- TY1 futures are flat today at 139-06+ with 10y UST yields down -0.3bp at 0.725% and 2y yields unch at 0.140%.

- Bund futures are up 0.22 today at 175.28 with 10y Bund yields down -1.6bp at -0.573% and Schatz yields down -0.8bp at -0.747%.

- Gilt futures are up 0.19 today at 136.10 with 10y yields down -1.9bp at 0.219% and 2y yields down -1.5bp at -0.63%.

FOREX SUMMARY

A mixed session for FX this morning.

- Safer asset, like Core bonds, Gold and of course the USD were initially favoured, as US stimulus, Covid cases, J&J and Eli Lilly & Co, pausing their studies have limited Equity upside.

- Nonetheless, Equities slowly reversed the small early pressure, to trade back into green territory.

- As such, USD reversed early gains and trade mix against G10

- Biggest move of the day was seen in the GBP, when Cable spiked some 69 pips, following a headline hitting our screens:

- "UK signals it won't walk from EU trade talks".

- Cable spiked from 1.2907 to 1.2976, but there was nothing really new in the story, and Cable settled back towards 1.2927, now at 1.2930 at the time of typing.

- Turnovers have been below averages, around 30% versus 5 days.

- Looking ahead, Earning season continues, with BofA, UTD Health and Wells.

- Speaker's schedule is packed, with ECB Mersch, Lane, Villeroy, and de Cos. Fed Barkin, Clarida, Quarles, Logan, and Kaplan. BoE Haldane is also set to speak.

- ALL EYES are on the call between EU Ursula and UK Boris, but no official timing has been released.

- On the data front, US PPI is the highlight

EQUITIES: Broadly Higher Ahead Of More U.S. Earnings

US earnings today include BofA, Goldman Sachs, United Airlines, Wells Fargo and United Health.

- Asian stocks closed mixed, with Japan's NIKKEI up 24.95 pts or +0.11% at 23626.73 and the TOPIX down 5.2 pts or -0.32% at 1643.9. China's SHANGHAI closed down 18.972 pts or -0.56% at 3340.778 and the HANG SENG ended 17.41 pts higher or +0.07% at 24667.09.

- European stocks are a little higher, with the German Dax up 16 pts or +0.12% at 13045.65, FTSE 100 up 33.72 pts or +0.56% at 5996.33, CAC 40 up 12.24 pts or +0.25% at 4942.87 and Euro Stoxx 50 up 0.94 pts or +0.03% at 3278.43.

- U.S. futures are edging higher too, with the Dow Jones mini up 91 pts or +0.32% at 28675, S&P 500 mini up 13.25 pts or +0.38% at 3517.75, NASDAQ mini up 31 pts or +0.26% at 12124.5.

COMMODITIES: Natural Gas Drops

NatGas is the big loser so far Wednesday, on expectations of milder weather on the US East Coast.

- WTI Crude up $0.11 or +0.27% at $39.93

- Natural Gas down $0.16 or -5.67% at $2.71

- Gold spot up $6.29 or +0.33% at $1895.17

- Copper up $1.65 or +0.54% at $306.45

- Silver up $0.04 or +0.15% at $24.1573

- Platinum up $3.54 or +0.41% at $874.36

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.