-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Countdown To Stimulus

EXECUTIVE SUMMARY:

- $1.4T SPENDING BILL TEXT DUE TODAY, CONGRESS WORKING ON COVID AID

- U.K. JOB LOSSES CONTINUED AHEAD OF NOVEMBER LOCKDOWN

- E.C.B.'S BOND PURCHASE BUDGET A CEILING, NOT A TARGET: REHN

- FED 2-DAY MEETING BEGINS TODAY WITH ASSET PURCHASE GUIDANCE EYED (MNI PREVIEW)

- FANNIE, FREDDIE PRIVATIZATION DECISIONS LIKELY TO BE LEFT TO BIDEN ADMINISTRATION (WSJ)

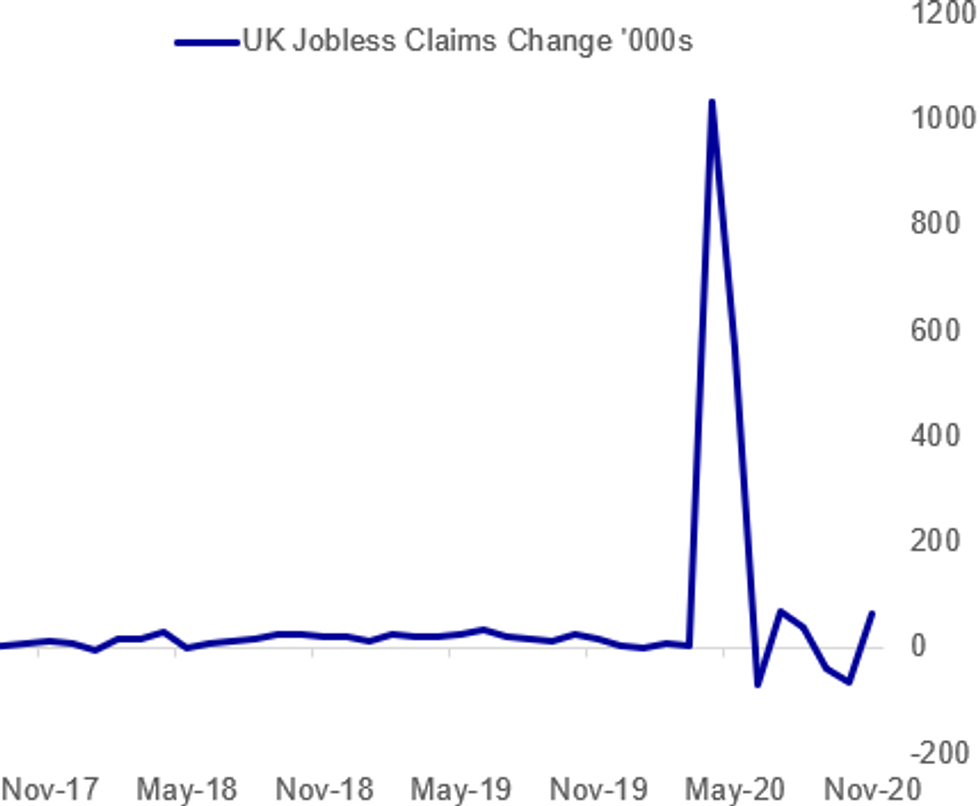

Fig. 1: U.K. Claims Rise In Nov

ONS, MNI

ONS, MNI

NEWS:

U.S.: Chad Pergram at Fox news tweets: "We expect text of USD1.4 [trillion] omnibus spending pkg today. Gov't funded through Friday night. Work continues behind the scenes today on potential coronavirus relief plan"- Last night following a call with Treasury Sec Steve Mnuchin, House Speaker Nancy Pelosi (D-CA) stated that the issues still dividing Democrats and Republicans "could be readily resolved".

- Given how little floor time is left before the Christmas break, the omnibus spending bill is seen as the best opportunity to get a COVID-19 relief package through.

- However, there remain divisions between Democrats and Republicans on a whole host of issues, both broad and technical, including liability protection, the Mexico border wall, veterans' health funding, medical bills, and labour protection on public works projects.

UK DATA: The UK's jobless rate ticked up again in Oct to 4.9%, up from 4.6% recorded previously and coming in better than market forecasts. The employment rate edged lower to 75.2%, while the inactive rate was unchanged at 20.8%. More up-to-date PAYE data showed another fall of 28,000 in payrolled employees in Nov compared to Oct, leading to 819,000 fewer people in payrolled employment since Mar 2020. Redundancies increased again in Oct, rising to a new series high of 370,000 in the three months to Oct and showing a record quarterly uptick of 217,000. However, the number of redundancies eased slightly in Oct. Vacancies continued to recover in Nov, showing an increase of 110,000 to 547,000. Nevertheless, vacancies remained below pre-pandemic levels and are 31.5% lower than a year ago. Hours worked revealed a record quarterly increase in Aug-Oct when covid-restrictions were eased with average actual weekly hours worked rising to 29.5 hours. The claimant count rate ticked up to 7.4% in Nov, up from 7.2% recorded in Oct.

E.C.B. (RTRS): The European Central Bank will take market conditions into consideration when buying bonds and considers its new bond purchase quota as ceiling rather than a target, Finnish central bank chief Olli Rehn said on Tuesday. The ECB last week raised the "envelope" of its Pandemic Emergency Purchase Programme to 1.85 trillion euros from 1.35 trillion euros ($1.64 trillion) and extended the lifetime of the scheme until the end of March 2022. "This new number is not a target but a ceiling for now," Rehn told a news conference. "And as I said, we will implement the programme so that we can ensure favourable financing conditions and that means we are taking market conditions, market developments into implementation."

MNI DECEMBER FED PREVIEW (resend from yesterday): The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short of adjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step. While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants – setting up the potential for a mildly hawkish disappointment on Wednesday. FOR FULL PDF PREVIEW USE THE FOLLOWING LINK: https://roar-assets-auto.rbl.ms/documents/7672/Fed...

TECH/E.U. (BBG): Twitter Inc. was fined 450,000 euros ($547,000) by its chief European Union data protection watchdog for failing to give a timely warning about a breach that threatened the privacy of Android phone users across the bloc. Twitter violated EU data protection rules by failing to report a breach within the required 72 hours, Ireland's Data Protection Commission said Tuesday in a statement. Twitter was also fined over its "failure to adequately document the breach." The administrative fine was levied as "an effective, proportionate and dissuasive measure," the Irish watchdog said.

FANNIE/FREDDIE (WSJ): Joe Biden's election victory has likely ended the Trump administration's efforts to return Fannie Mae and Freddie Mac to private hands. Treasury Secretary Steven Mnuchin suggested in an interview with The Wall Street Journal that he is unlikely to support a legal move -- called a consent order -- to end the government conservatorships of the mortgage-finance companies before President Trump leaves office. His signoff would be required for any change in their legal status. "We're going to not do anything that jeopardizes taxpayers and puts them at additional risk," Mr. Mnuchin said. "We also want to be careful that we don't do anything that overnight would limit access to mortgage finance."

DATA:

UK Jobless Rate Rises; Redundancies At New Record High

AUG-OCT LFS JOBLESS RATE 4.9% VS 4.6%

AUG-OCT AVG TOTAL EARNINGS +2.7% VS +1.4% PRIOR

AUG-OCT AVG EARNINGS EX-BONUS +2.8% VS +1.9% PRIOR

NOV CLAIMANT COUNT up 64,300 to 2,663,700

FIXED INCOME: Steady European session

Bund has traded in a tight 20 ticks range during the morning European session.

- Despite the buying interest in risk, German curve and the long end contract are flat so far today.

- Notable price action was seen in peripheral with Portugal trading deeper in negative yield territory, followed by the Spanish 10yr and Italian 10yr yield printing a new record low at 0.43%.

- Gilt are underpinned on the GBP early weakness,

- Regarding 10yr yield UK is the next Bond still in positive territory from developed countries, printed a 0.206% low this morning.

- And for the fan of yield, 0% Yield would equate to Gilt futures at 137.69 (ref 135.25).

- US Treasuries are trading close to flat and in tight ranges, with investors awaiting on US stimulus, after Nancy Pelosi told Mnuchin that the remaining open items on the spending bill could be readily resolved.US curve is bear steeper on the margin.

- Looking ahead, US IP, ECB Lane and BoC Macklem are scheduled to speak.

- Gilt futures are up 0.29 today at 136.40 with 10y yields down -0.2bp at 0.219% and 2y yields up 1.2bp at -0.84%

- Bund futures are up 0.03 today at 178.45 with 10y Bund yields down -0.4bp at -0.625% and Schatz yields down -0.4bp at -0.781%.

- BTP futures are down -0.03 today at 152.15 with 10y yields up 0.6bp at 0.545% and 2y yields down -0.7bp at -0.454%.

- TY1 futures are down -0-5 today at 138-11 with Bund futures up 0.03 at 178.45 and Gilt futures up 0.29 at 136.40.

FOREX: USD Trades Mixed

USD trades mixed, despite the better early bid in Equities, with Auto leading gains in Stoxx600.

- With investors and market participants waiting on Brexit US stimulus and the Fed tomorrow, most pairs have traded within ranges this morning.

- GBP saw some early selling, combined with short term long bailing out as we broke below 1.3300 in Cable.

- Brexit is at the forefront, and although extensions from the weekend talks is seen as positive, mood is fragile.

- Cable has faded the early weakness to trade back above 1.3300 at the time of typing.

- EURGBP tested resistance at 0.9230/45 High Dec 11 / 2.0% 10-dma envelope, printing a 0.91489 high.

- AUD has recovered some of its overnight weakness, that was driven by US lockdown fears, helped by the better Equity bid during our European morning session.

- Nonetheless AUD still trade in the red against all G10s, besides the kiwi, up 0.08%.

- Looking ahead, some focus on US IP, and on the speaker front, ECB Lane and BoC Macklem are scheduled to speak.

- All eyes are squarely on Brexit, US stimulus progress and the Fed tomorrow.

EQUITIES: Higher On European Open

Stocks began climbing at the European open, following a weak Asian session.

- Asian markets closed weaker, with Japan's NIKKEI down 44.6 pts or -0.17% at 26687.84 and the TOPIX down 8.47 pts or -0.47% at 1782.05. China's SHANGHAI closed down 1.887 pts or -0.06% at 3367.233 and the HANG SENG ended 182.23 pts lower or -0.69% at 26207.29

- European equities are higher, with the German Dax up 90.88 pts or +0.69% at 13291.32, FTSE 100 up 10.22 pts or +0.16% at 6528.02, CAC 40 up 34.7 pts or +0.63% at 5552.9 and Euro Stoxx 50 up 17.45 pts or +0.5% at 3520.88.

- U.S. futures are also higher, with the Dow Jones mini up 159 pts or +0.53% at 30024, S&P 500 mini up 21.5 pts or +0.59% at 3668, NASDAQ mini up 52.25 pts or +0.42% at 12508.75.

COMMODITIES: Gold And Silver Rebound

Precious metals are rebounding Tuesday (up >1%), with US stimulus eyed in both monetary (Fed) and fiscal forms.

- WTI Crude up $0.07 or +0.15% at $46.88

- Natural Gas down $0.02 or -0.71% at $2.666

- Gold spot up $19.42 or +1.06% at $1846.13

- Copper up $0.2 or +0.06% at $353.05

- Silver up $0.45 or +1.87% at $24.2824

- Platinum up $9.83 or +0.97% at $1017.46

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.