-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: AZ/Oxford Vaccine not near EU approval

EXECUTIVE SUMMARY:

- US HOUSE BACK TRUMP'S PROPOSAL TO BOOST STIMULUS CHECKS TO $2,000

- DEBATE ON WHAT BREXIT DEAL MEANS FOR UK FINANCIAL SECTOR

- AZ/OXFORD VACCINE WON'T BE APPROVED IN EU FOR SOME TIME (NIEUWSBLAD)

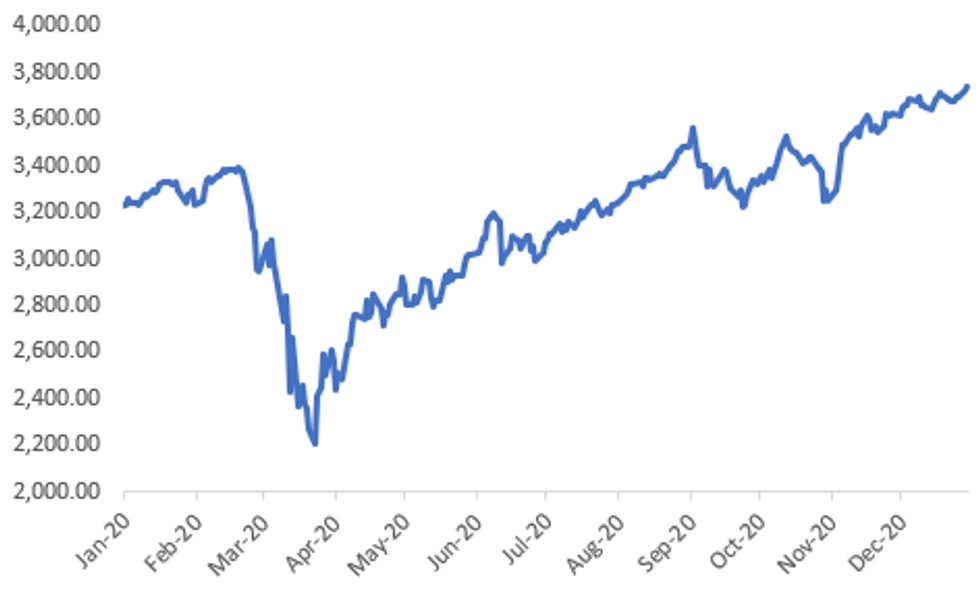

Fig 1. S&P500 FUTURES MOVE TO RECORD HIGHS

Source: MNI, Bloomberg

NEWS:

EU/COVID: The United Kingdom wants to start rolling out the British AstraZeneca / Oxford vaccine on January 4. That is still unthinkable on the European mainland, says Noël Wathion, number two of the European Medicines Agency. "The data we have at the moment is not even enough to give the AstraZeneca vaccine a conditional authorization." (Nieuwsblad)

UK/COVID: Members of the armed forces are to give remote support to secondary schools and colleges in England setting up mass Covid testing as the new term begins. The Ministry of Defence said 1,500 military personnel will hold webinars and give phone support to school staff. (BBC)

CHINA / ANT GROUP: Jack Ma's besieged Ant Group Co. is planning to fold its financial operations into a holding company that could be regulated more like a bank, according to people familiar with the situation, potentially crippling the growth of its most-profitable units (Bloomberg).

FIXED INCOME: Gilts lead the way

Most core fixed income markets are largely unchanged on the day, with the exception of gilts which have moved higher. The move in gilts was originally a catch-up move after yesterday's public holiday but gilts have continued to move higher, possibly as a result of some front running of month-end flows.

- There have been no market moving headlines in the European morning session with the debate focused on what the Brexit deal means for UK services and in particular the financial sector. Elsewhere the US House of Representatives has backed Trump's proposal to increase stimulus checks to $2,000.

- TY1 futures are down -0-1+ today at 137-28 with 10y UST yields up 1.6bp at 0.941% and 2y yields down -0.1bp at 0.127%.

- Bund futures are up 0.32 today at 177.71 with 10y Bund yields down -1.1bp at -0.578% and Schatz yields down -0.4bp at -0.720%.

- Gilt futures are up 0.51 today at 135.33 with 10y yields down -4.7bp at 0.206% and 2y yields down -2.9bp at -0.172%.

FOREX: A fairly light turnovers session for FX, given the festive period.

- USD leads FX, with the dollar trading in the red against all G10s.

- US stimulus and Brexit done has kept risk buoyed.

- The pound was initially the best performing currency in G10 versus the USD, up 0.5% in early trade, but cable has since pared some of its gains, now up just 0.23%.

- No fundamentals, or new story headlines, and more likely order flow related to explain the pullback in cable, as move are exacerbated by low turnovers.

- Cable runs at 22% of the 5 day averages.

- SEK leads gains, up 0.62% against the Dollar, taking its cue from the risk on tone.

- Looking ahead, we have no data of note.

- Some focus on Month/Year end with liquidity likely to dissipate by tomorrow.

- Desk here expects for some moderate USD selling into year end.

EQUITIES: Moving to new highs

- Japan's NIKKEI up 714.12 pts or +2.66% at 27568.15 and the TOPIX up 31.14 pts or +1.74% at 1819.18

- China's SHANGHAI closed down 18.249 pts or -0.54% at 3379.036 and the HANG SENG ended 253.86 pts higher or +0.96% at 26568.49

- German Dax up 53.96 pts or +0.39% at 13842.84, FTSE 100 up 165.95 pts or +2.55% at 6669.49, CAC 40 up 28.87 pts or +0.52% at 5617.29 and Euro Stoxx 50 up 19.72 pts or +0.55% at 3594.74.

- Dow Jones mini up 159 pts or +0.52% at 30465, S&P 500 mini up 17.75 pts or +0.48% at 3745.25, NASDAQ mini up 53 pts or +0.41% at 12885.75.

COMMODITIES: Higher on the day, but still some way off yesterday's highs

- WTI Crude up $0.65 or +1.37% at $48.27

- Natural Gas up $0.02 or +0.82% at $2.29

- Gold spot up $8.02 or +0.43% at $1881.96

- Copper up $0.2 or +0.06% at $357.45

- Silver up $0.06 or +0.24% at $26.3308

- Platinum up $11.42 or +1.1% at $1044.88

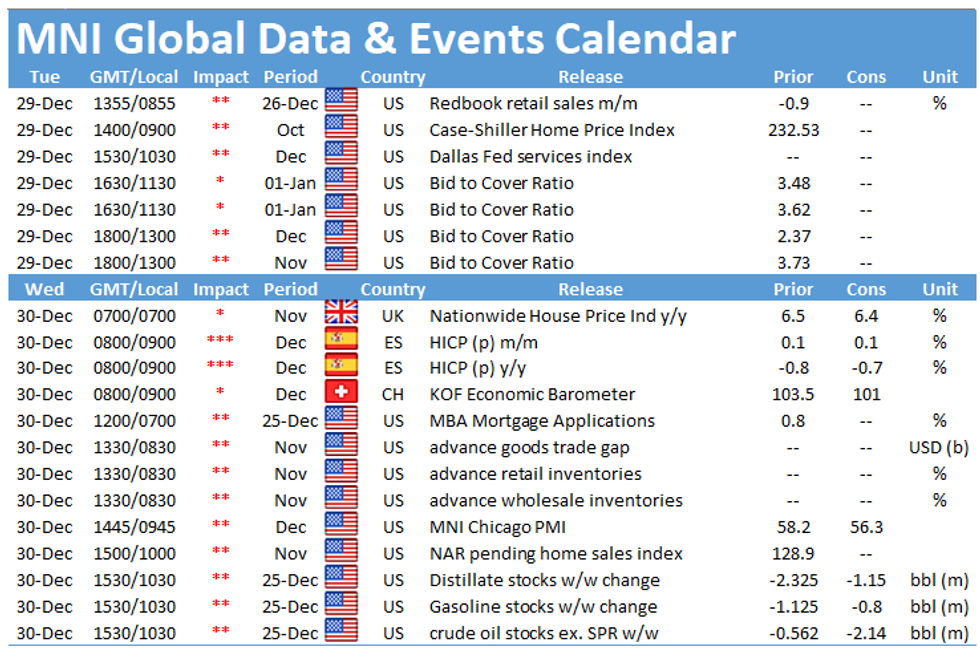

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.