-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: European Political Risk Simmering

EXECUTIVE SUMMARY:

- CONFLICTING REPORTS ON ITALY P.M. CONTE RESIGNATION PLANS

- FRANCE'S LE PEN LEADS MACRON IN 1ST ROUND ELECTION POLL

- GERMAN I.F.O. MISSES EXPECTATIONS

- CAUTIOUS OPTIMISM ON U.S. TIES: CHINA ADVISORS (MNI EXCLUSIVE)

- FED MAY UNDERLINE PATIENT Q.E. PLAN THIS WEEK (MNI STATE OF PLAY)

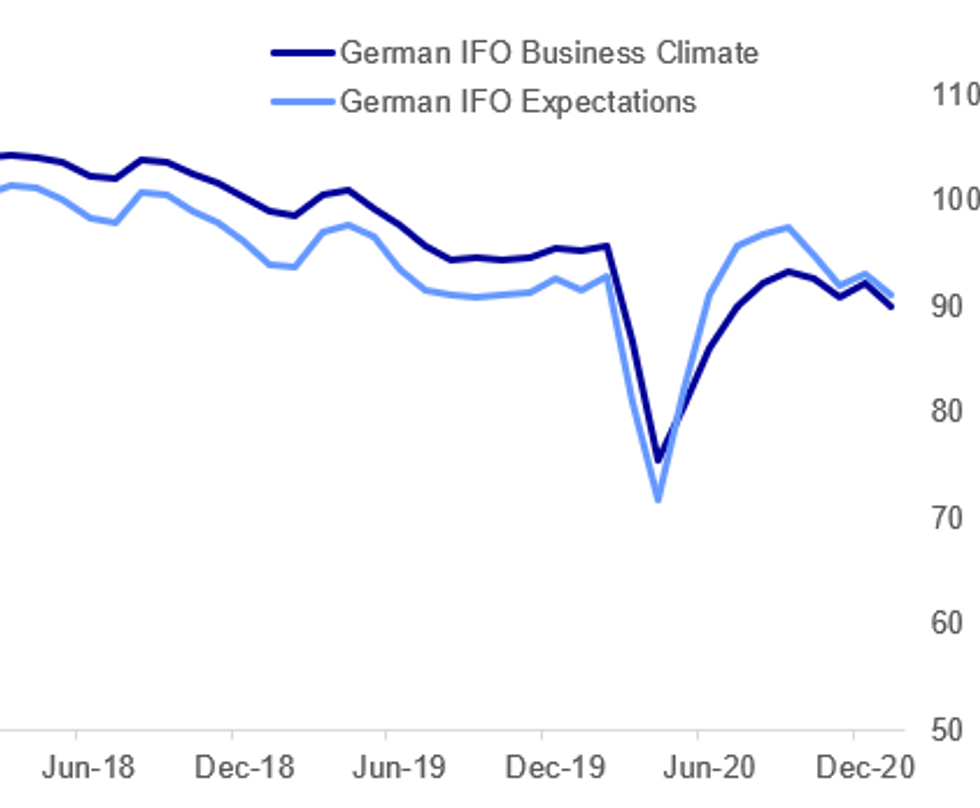

Fig. 1: Weaker Than Expected

IFO, BBG, MNI

IFO, BBG, MNI

NEWS:

ITALY (RTRS): Italian Prime Minister Giuseppe Conte is not planning on resigning with a view to forming a new government, a senior government source said on Monday. Earlier, several Italian newspapers reported that Conte was set to hand in his resignation to the head of state this week and then put together a new, broader based coalition. Asked if this was Conte's intention, the source said: "no".

ITALY (BBG): Conte is weighing a plan to offer his resignation to the country's president in a bid to then return to power at the head of a new government, Corriere della Sera reported earlier on Monday. Conte would be tasked with appealing to all political forces to build a new majority, and could count on support from his current partners plus Matteo Renzi's Italy Alive, some centrists and several lawmakers from Silvio Berlusconi's Forza Italia.

FRANCE (BBG): French far-right National Rally leader Marine Le Pen leads President Emmanuel Macron in voting intentions for first round of next year's presidential election, according to survey by Harris Interactive for L'Opinion and CommStrat. Of those interviewed, 26%-27% intend to vote for Le Pen, while 23%-24% intend to vote for Macron, poll shows.

GERMAN IFO: - The Ifo business climate indicator eased slightly in January to 90.1, just below market forecasts. Current conditions declined by 2.1 points to 89.2, coming in slightly weaker than expected. The Ifo Expectations index dropped 1.9 points to 91.1 in contrast to markets looking for an uptick. Following eight months of successive gains, manufacturing business climate fell in January, mainly due to a decline of expectations, while the assessment of the current situation was better. The business climate indicator for the service sector saw a sharp, driven by a decrease of both current conditions and expectations. The report noted weaker orders, especially in the transport and logistics industry.

CHINA-US (MNI EXCLUSIVE): China should seize on Joe Biden's initiatives to deal with the pandemic and climate change as opportunities to cooperate on shared interests and foster dialogue, said policy advisors who are cautiously optimistic that the bilateral relationship will improve to the extent allowed by differing ideologies and rising competition. For full article contact sales@marketnews.com

FED (MNI STATE OF PLAY): The Federal Reserve is expected to keep buying USD120 billion in Treasuries and mortgage assets a month and hold a near-zero interest rate Wednesday while looking for evidence that new fiscal relief and wide dissemination of Covid vaccines are bringing palpable improvements to jobs and inflation. For full article contact sales@marketnews.com

GLOBAL INFLATION (MNI STATE OF PLAY): Massive global stimulus and the possibility of a sudden snap-back to growth as Covid vaccines are rolled out are prompting some investors and commentators to sharpen their focus on a pick-up - even a surge -in inflation, but extensive central bank contacts continue to tell MNI they see this as only a remote possibility. For full article contact sales@marketnews.com

B.O.J.: Bank of Japan Governor Haruhiko Kuroda said on Monday that both the government's fiscal and the BOJ's monetary policies have been successful in stabilizing markets and maintaining employment. "Economic policies (implemented by the BOJ and the government) have avoiding unemployment and corporate failure," Kuroda told a panel discussion at the World Economic Forum via an online.

ECB: The European Central Bank will use part of its own funds portfolio to invest in euro-denominated green bonds issued by the Bank for International Settlements, it was announced Monday. BIS green bonds invest in renewable energy production, energy efficiency and other environmentally friendly projects.

U.K.: The Bank of England should align its corporate bond buying with the Paris Climate accord, the House of Commons Environmental Audit Committee have said. Members of EAC have written to Governor Andrew Bailey to say the central bank should take a leadership role on global climate change ahead of the COP26 summit in the UK later this year.

DATA:

FIXED INCOME: Core FI rallies as risk appetite softens

Bonds are on the front foot this morning with a general risk-off tone sweeping over the market. Some are pointing towards French first round election polling where le Pen is said to be leading Macron as the trigger. 10-year Bund and gilt yields are around 2.2bp lower at writing, with Treasuries trailing. A slightly disappointing IFO print has not helped sentiment either.

- Against this backdrop, 10-year BTP spreads have narrowed around 4.5bp after headlines this morning that Conte would not step down (contradicting reports on Friday and in the weekend press).

- Looking ahead we have a number of speakers and panels in Davos today while the ECB's Frank Elderson will give an introductory statement at the ECON Hearing of the European Parliament.

- TY1 futures are up 0-2 today at 137-03 with 10y UST yields down -0.7bp at 1.080% and 2y yields up 0.1bp at 0.124%.

- Bund futures are up 0.39 today at 177.55 with 10y Bund yields down -2.2bp at -0.536% and Schatz yields down -1.5bp at -0.728%.

- Gilt futures are up 0.31 today at 134.47 with 10y yields down -2.3bp at 0.283% and 2y yields down -1.0bp at -0.141%.

FOREX: EUR Softer, Davos Speakers Awaited

Risk is a little lower ahead of the NY open, with equities softer and core bond markets bid. Currency markets aren't quite following suit, with haven currencies CHF and JPY failing to garner any bidtone.

EUR trades poorly on the back of an IFO business climate survey that missed expectations (90.1 vs. Exp. 91.4), which also added to the core bond bid. EUR/USD retreated from just below the 1.22 mark to trade either side of the 1.2150 level ahead of the NY crossover.

The strongest currencies so far Monday include the AUD, NZD and CAD, which are benefiting from a slightly firmer commodities complex.

The Chicago Fed National Activity Index crosses later today, but the central bank speakers slate is busy: today sees speeches from ECB's Lagarde, Panetta, Lane, Weidmann and others. BoE's Bailey and PBoC's Yi Gang are also scheduled. Davos' virtual World Economic Forum begins, with keynote speakers including China's Xi Jinping.

EQUITIES: Tech Is Up, Amid A Sea Of Red

- Asian markets closed higher, with Japan's NIKKEI up 190.84 pts or +0.67% at 28822.29 and the TOPIX up 5.36 pts or +0.29% at 1862. China's SHANGHAI closed up 17.488 pts or +0.48% at 3624.238 and the HANG SENG ended 711.16 pts higher or +2.42% at 30159.01.

- European equities are weaker, with the German Dax down 31.52 pts or -0.23% at 13841.53, FTSE 100 down 14.83 pts or -0.22% at 6679.9, CAC 40 down 21.81 pts or -0.39% at 5537.96 and Euro Stoxx 50 down 7.14 pts or -0.2% at 3594.5.

- U.S. futures are mixed, with the Dow Jones mini down 20 pts or -0.06% at 30889, S&P 500 mini up 8.75 pts or +0.23% at 3843, NASDAQ mini up 117.25 pts or +0.88% at 13478.5.

COMMODITIES: Oil Outperforming, With Metals Flat

- WTI Crude up $0.38 or +0.73% at $52.64

- Natural Gas up $0.08 or +3.15% at $2.523

- Gold spot down $0.18 or -0.01% at $1855.36

- Copper down $0.3 or -0.08% at $362.3

- Silver up $0.08 or +0.31% at $25.5685

- Platinum up $1.48 or +0.13% at $1105.06

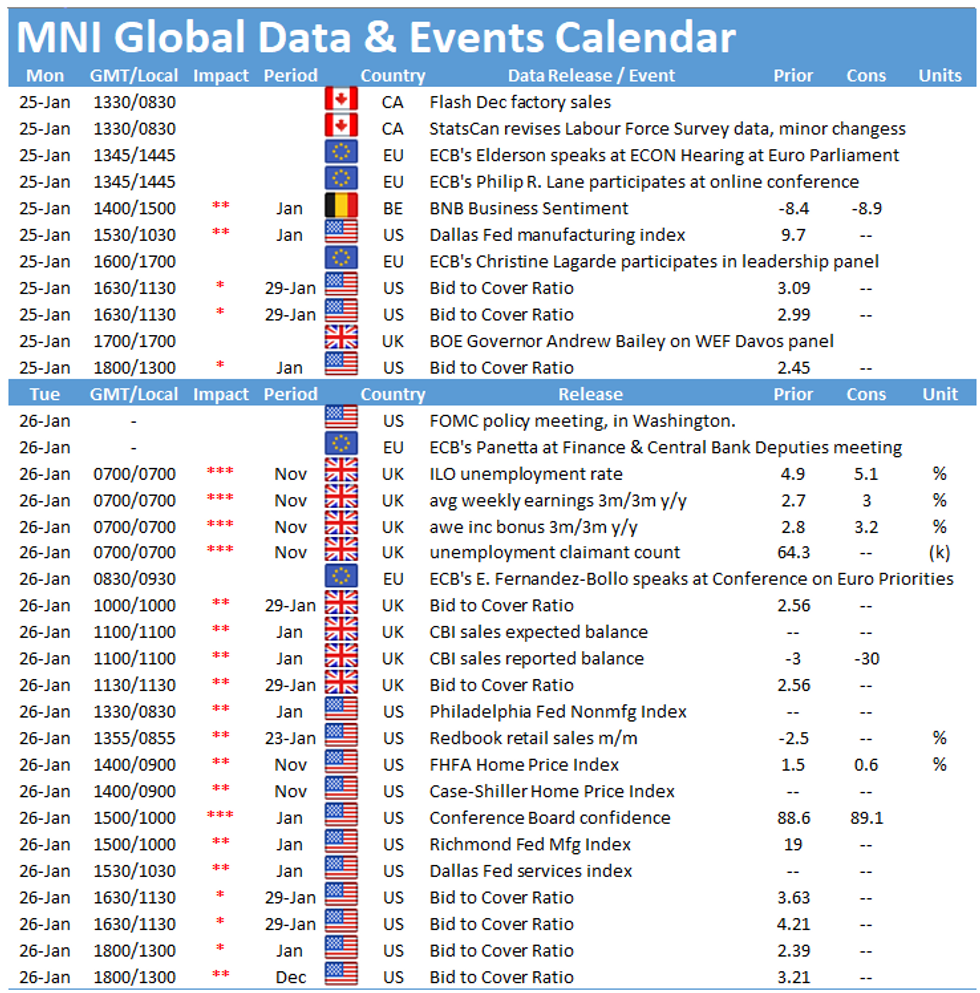

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.