-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks Show Resilience As Dollar Stagnates

EXECUTIVE SUMMARY:

- BIDEN TO ORDER SUPPLY CHAIN REVIEW; WON'T CALL OUT CHINA

- ASTRAZENECA SEEKING TO FULFIL 100% OF ORIGINAL EU VACCINE ORDER (IRISH TIMES)

- FRENCH BUSINESS CLIMATE EASED IN FEB; GERMAN Q4 GDP REVISED UP

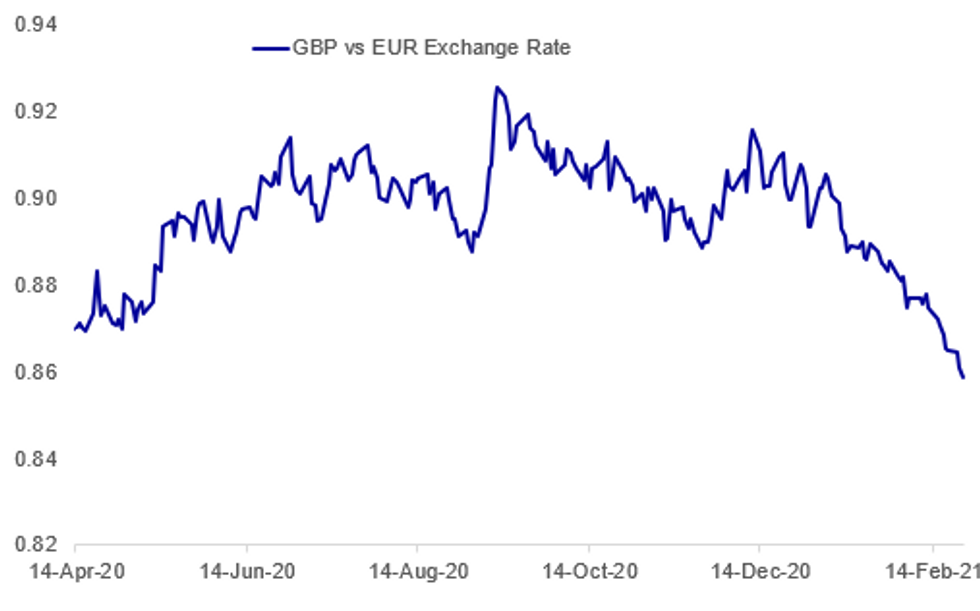

Fig. 1: Pound On A Hot Streak

BBG, MNI

BBG, MNI

NEWS:

U.S. (DJ): President Biden plans to sign an executive order Wednesday directing a broad review of supply chains for critical materials from semiconductors to pharmaceuticals and rare-earth minerals, aiming to spur domestic production while strengthening ties with allies. A chip shortage is squeezing auto makers in the U.S. and world-wide, and Biden administration officials have been working with industry to free up supplies. Cars use chips for numerous systems, including engine management, automatic braking and assisted driving. "There isn't kind of a magic bullet to solve the near-term problem," a White House official who works on economic issues said in a briefing with reporters before Mr. Biden's action.

U.S.-CHINA (BBG): Biden's executive order isn't aimed at China or any one country but instead focuses on diversifying supply more generally, officials said. Still, they said an over-reliance on China and other adversaries for critical goods is a key risk that must be addressed.

ASTRAZENECA/COVID: Naomi O'Leary at The Irish Times tweets: "AstraZeneca says it is working to fulfill 100% of original EU order: "AstraZeneca is working to increase productivity in its EU supply chain and to continue to make use of its global capability in order to achieve delivery of 180 million doses to the EU in the second quarter."

- Comes as the leaders of Belgium, Denmark, Lithuania, Poland and Spain write to the EU Council to request that vaccine production is boosted dramatically within the EU.

- Letter states: "Our key message today is that we urgently need to integrate and strategically steer our value chain to boost our vaccine production capacities in Europe [...] Existing production facilities will have to be adapted. New ones will need to be built."

EUROZONE ISSUANCE (MNI INTERVIEW): Slovakia is actively considering issuing ultra-long bonds and may sell foreign currency bonds in the near future, the head of the country's Debt and Liquidity Management Agency told MNI. For full article contact sales@marketnews.com

GERMANY: The current lockdown is leading to staff reductions, especially in the retail trade sector, but other parts of the service sector are now planning to scale back on hiring, Klaus Wohlrabe, a senior researcher at the Ifo institute said Wednesday. The manufacturing sector saw an overall improvement, with more firms planning to recruit new staff and fewer firms reporting layoffs. Wholesalers and the construction sector plan to leave their staff levels unchanged, Wohlrabe said.

CHINA-US: China's Minister of Commerce Wang Wentao said he is "looking forward to" working with U.S. counterparts to cooperate and manage differences, following a phone call earlier in February between President Xi Jinping and President Joe Biden. Economics and trade are drivers of the two countries' relations, Wang told reporters on Wednesday, noting that China was the U.S.'s largest trade partner last year despite the Covid-19 pandemic.

OPEC: The 8th International OPEC seminar was due to take place in Vienna in June, but has been pushed back to 29-30 June 2022. The seminar usually brings together major oil multinational CEOs, senior government officials, oil market analysts and journalists. Press release: https://www.opec.org/opec_web/en/press_room/6370.htm

DATA:

FR Business Climate Eased in Feb

FEB BUS CLIM INDICATOR 90; JAN 91r

FEB MFG SENTIMENT 97; JAN 96r

FEB SERVICES SENTIMENT 88; JAN 92r

- French business climate ticked down in Feb, falling by 1pt to 90 in contrast to markets looking for an unchanged reading.

- Feb's downtick was mainly driven by a significant decline in service sector and retail trade business climate which both dropped by 4pt to 88 and 89, respectively, showing the lowest levels since Nov 2020.

- Business climate in the manufacturing sector gained 1pt in Feb and rose to 97 following a downward revised reading for Jan (2pt down to 96).

- Employment climate declined as well in Feb, slipping 3pt to a three-month low of 85.

- All indicators continue to post readings below the long-term average and their pre-pandemic levels.

Final German Q4 GDP Saw Stronger-Than-Expected Gain

GERMANY Q4 FINAL GDP +0.3% Q/Q SA; -3.7% Y/Y WDA

GERMANY Q4 FINAL GDP REVISED FROM FLASH +0.1% Q/Q SA; -3.9% Y/Y WDA

- German GDP rose 0.3% q/q in Q4, slightly stronger than estimated in flash results.

- Annual growth stood at -3.7% in Q4, up from -3.9% reported in the flash estimate.

- The second wave of Covid-19 and the renewed lockdown slowed the recovery significantly at the end of the year.

- Household consumption took the largest hit, falling by 3.3% in Q4 after rebounding to 10.8% in Q3.

- Government consumption eased by 0.5% in Q4, almost offsetting Q3's uptick of 0.6%

- Gross fixed capital formation in machinery and equipment declined by 0.1% in Q4, while gross fixed capital formation in construction rose 1.8%, contributing positively to growth.

- Foreign trade improved in Q4 and contributed positively to growth as well, with exports rising 4.5%, while imports were up 3.7%.

- Annual domestic demand remains subdued, with household spending down 6.5% y/y, while investment in machinery and equipment fell 6.0%.

- On the other hand, government consumption was up 2.6% on an annual basis.

FIXED INCOME: Focus on speeches

Moves have generally been less pronounced in core fixed income today with Bunds and Treasuries remaining within yesterday's ranges. Gilts have been the exception with 10-year gilt yields surpassing yesterday's high.

- Looking ahead there will be a lot of speeches today. From the BoE we will hear from Haldane at midday GMT (7am ET) before Bailey, Haskel, Broadbent and Vlieghe all testify before the Treasury Select Committee with Annual Reports due from the latter two. From the Fed, Powell will testify before the House before Brainard and Clarida speak.

- TY1 futures are up 0-0+ today at 135-14 with 10y UST yields up 2.2bp at 1.365% and 2y yields unch at 0.114%.

- Bund futures are down -0.03 today at 174.32 with 10y Bund yields down -0.3bp at -0.320% and Schatz yields down -0.1bp at -0.691%.

- Gilt futures are down -0.47 today at 128.40 with 10y yields up 3.6bp at 0.754% and 2y yields up 0.4bp at 0.038%.

FOREX: GBP Bull Binge Sees Cable Narrow Gap With 2018 High

GBP's impressive rally continued in early Asia-Pac hours, with GBP/USD running higher amid thin liquidity to touch 1.4237 - the best level since 2018. This narrows the gap considerably with the multi-year highs of 1.4377 - a considerable level for the pair. Contrasting the recent bull run, RSI measures are flashing the pair as technically overbought, which could suggest progress may slow from here.

At the other end of the scale, JPY is on the backfoot, reflecting the impressive recovery in US equity markets ahead of the Tuesday close. USD/JPY trades within 40 pips of the 2021 highs, but EUR/JPY's run has been more notable, with the cross extending gains to the best levels since late 2018.

There are few tier one data releases due Wednesday, leaving focus on the central bank speaker slate - BoE's Bailey, Haldane, Broadbent, Vlieghe and Haskel all speak as well as Fed's Powell (second part of his semi-annual testimony), Clarida and Brainard.

EQUITIES: Futures Bouncing From Overnight Lows

- Asian stocks closed lower, with Japan's NIKKEI down 484.33 pts or -1.61% at 29671.7 and the TOPIX down 35.28 pts or -1.82% at 1903.07. China's SHANGHAI closed down 72.277 pts or -1.99% at 3564.08 and the HANG SENG ended 914.4 pts lower or -2.99% at 29718.24.

- European equities are largely higher, with the German Dax up 93.13 pts or +0.67% at 13946.71, FTSE 100 down 8.56 pts or -0.13% at 6605.14, CAC 40 up 8.26 pts or +0.14% at 5786.7 and Euro Stoxx 50 up 12.66 pts or +0.34% at 3697.93.

- U.S. futures are up slightly, with the Dow Jones mini up 29 pts or +0.09% at 31521, S&P 500 mini up 7 pts or +0.18% at 3885, NASDAQ mini up 31.5 pts or +0.24% at 13223.5.

COMMODITIES: Mixed, With Oil And Platinum Outperforming

- WTI Crude up $0.19 or +0.31% at $61.75

- Natural Gas down $0.03 or -1.01% at $2.85

- Gold spot down $1.24 or -0.07% at $1805.12

- Copper down $1.4 or -0.33% at $416.7

- Silver up $0.06 or +0.22% at $27.7383

- Platinum up $23.34 or +1.88% at $1265.75

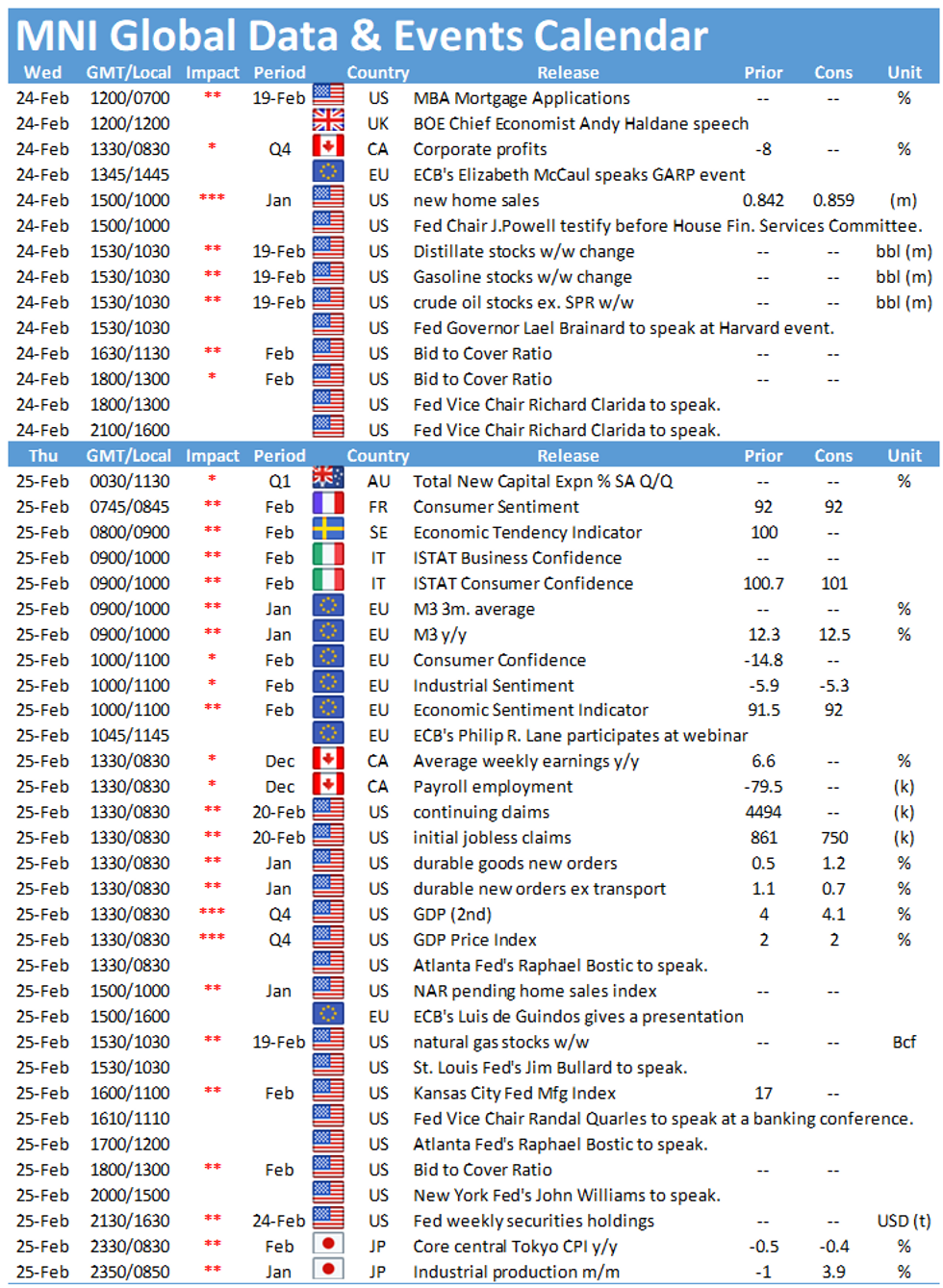

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.