-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Tuesday, October 15

MNI BRIEF: Iron Ore Prices Have Potential To Increase

MNI US Open: Bear Steepening Ahead of FOMC

MNI US Open: Bear Steepening Ahead of FOMC

EXECUTIVE SUMMARY:

- Govies have traded weaker and curves have bear steepened ahead of the FOMC meeting later today

- India suffers deadliest day in Covid surge

- European parliament formally backs Brexit trade and security deal.

- Brussels court holds two more hearings in legal case against AstraZeneca

Source: MNI/Bloomberg

NEWS:

INDIA (REUTERS): India's toll from the coronavirus surged past 200,000 on Wednesday, the country's deadliest day, as shortages of oxygen, medical supplies and hospital staff compounded a record number of new infections. The second wave of infections has seen at least 300,000 people test positive each day for the past week, overwhelming healthcare facilities and crematoriums and fuelling an increasingly urgent international response. The last 24 hours brought 360,960 new cases for the world's largest single-day total, taking India's tally of infections to nearly 18 million.

CHINA (DOW JONES): China plans to lower tariffs on imports and exports of steel and iron products, in a bid to lower costs of buying steel overseas while supporting domestic production. The country's Ministry of Finance said Wednesday in a brief statement that the government would lower import tariffs on pig iron, crude steel, raw materials of recycled steel and ferrochrome to zero. China would also increase export tariffs for ferrosilicon, ferrochrome and high-purity pig iron up to 25%. The adjustments will take effect May 1. The ministry said the tariff adjustments were temporary, but didn't specify how long they will be effective.

VACCINES/EU (REUTERS): A Brussels court decided on Wednesday to hold two more hearings on May 26 in a legal case brought by the European Union against AstraZeneca over COVID-9 vaccine deliveries. A first hearing was held on Wednesday. AstraZeneca lawyer Hakim Boularbah told journalists after the hearing: "AstraZeneca deeply regrets the decision of the European Commission to start this legal action in relation with the COVID-19 (vaccine) supply agreement. We hope to resolve this dispute as soon as possible."

UK/EU (GUARDIAN): The European parliament has given its overwhelming backing to the Brexit trade and security deal, prompting senior figures on both sides to speak of hope for a "new chapter" of friendly relations after four years of division. Just five MEPs voted against the deal, with 660 in favour and 32 abstentions, although in an accompanying resolution the chamber described the referendum result of 23 June 2016 as a "historic mistake".

UK (GUARDIAN): Boris Johnson is being urged by senior Tories to come clean about the funding of his flat refurbishment as it emerged that a former Labour chancellor refused to join a trust overseeing Downing Street upkeep out of concerns it could lead to a cash-for-access scandal. The prime minister faced growing disquiet from within his own party on Tuesday over allegations that he was loaned £58,000 from Conservative party funds while being seen to personally foot the bill for renovations of his Downing Street residence.

DATA

French Consumer Confidence Unchanged

FRANCE APR CONSUMER CONF IND 94; MAR 94

- Consumer sentiment remained at Mar's level of 94 in Apr, in contrast to markets looking for a downtick to 93.

- The indicator remains well below the long-term average of 100.

- Household's assessment of their future financial situation deteriorated by 3pt, after improving in the previous month, while their opinion about their past financial situation rose 2pt.

- The fear of unemployment eased 1pt, but remains elevated throughout the pandemic.

- Saving intentions for the next year ticked up by 2pt to a record high, while intentions to make major purchases edged up 2pt as well.

- Consumer's opinion about the general economic situation in the last 12 and future 12 months was unchanged.

- Infection rates in France are still high and restrictions remain tight, which weighs on consumer sentiment.

- A significant improvement regarding the pandemic is needed for the consumer mood to pick up markedly.

FIXED INCOME: A busier morning session

A busier morning session for Global Govies.

- EGBs volumes are running at 180% of the 15 day average, but also note that the past 15 day volume have been on the lower side, so not necessarily a full representation.

- Bund was under early pressure, brushing aside the German GFK data miss (rarely a market mover).

- Price action dragged BTP lower, and the BTP/Bund spread above 110 handle, now at 111.75.

- Immediate upside target comes at 113.804 (02/02 high).

- Early Equity bid, was one of the driver, after good Bank early earnings, saw Energy, Bank, and Financial services leading gains in Stoxx600.

- Long squared, and early positioning was noted ahead of the FOMC later today.

- Gilts were dragged lower in tandem with Bunds.

- The EU/UK trade deal was mostly talked about for the past 12 hours, but still a contributing factor on the more positive outlook

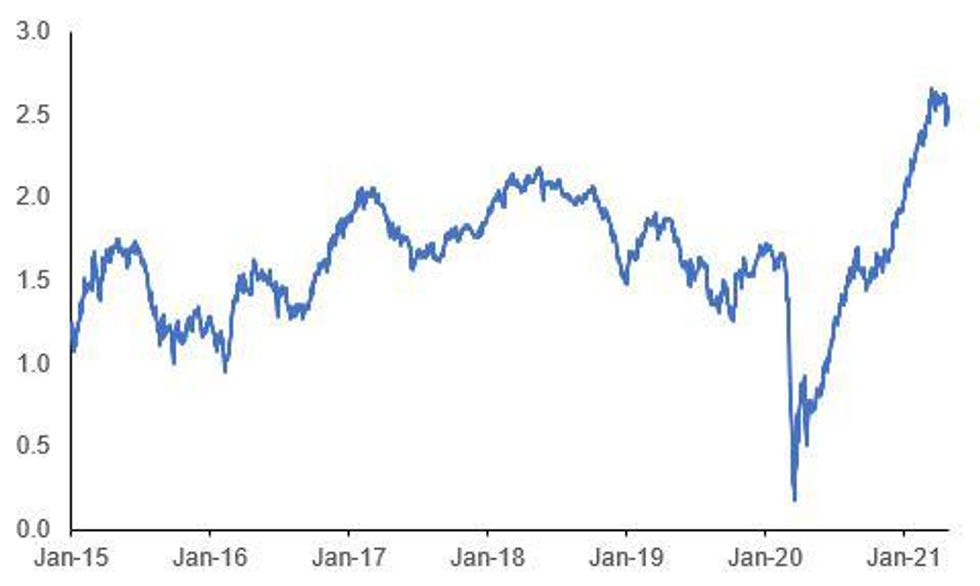

- US treasuries dipped lower, pushing US 10yr yield to the 14-15th April high at 1.6483%, printed a 1.6484%hiigh, as investors position for the FOMC

- Looking ahead, US Wholesale Inventories is the notable data.

- Most of the focus will be on the FOMC, but most investors see the June meeting as they key one..

- Earning tech season continues and includes Apple, Ebay and FB today

FOREX: USD Index Trades Either Side of 91.00 Pre-Fed

- With focus on the Fed rate decision later today, markets are trading inside their recent ranges with equity futures broadly flat, although US 10y yields are inching higher. The USD index holds the week's gains into the NY crossover, trading either side of the 91.00 handle.

- CHF, AUD and JPY are trading poorly, while NOK, NZD are trading more favourably. USD/JPY's minor uptrend this week remains intact, with the pair touching 109.08 and extending the bounce from the late Friday lows of 107.48.

- Their April decision is not seen as a major factor for markets at this juncture, with the board expected to stay the course on policy and steer clear of any discussion over the tapering of asset purchases.

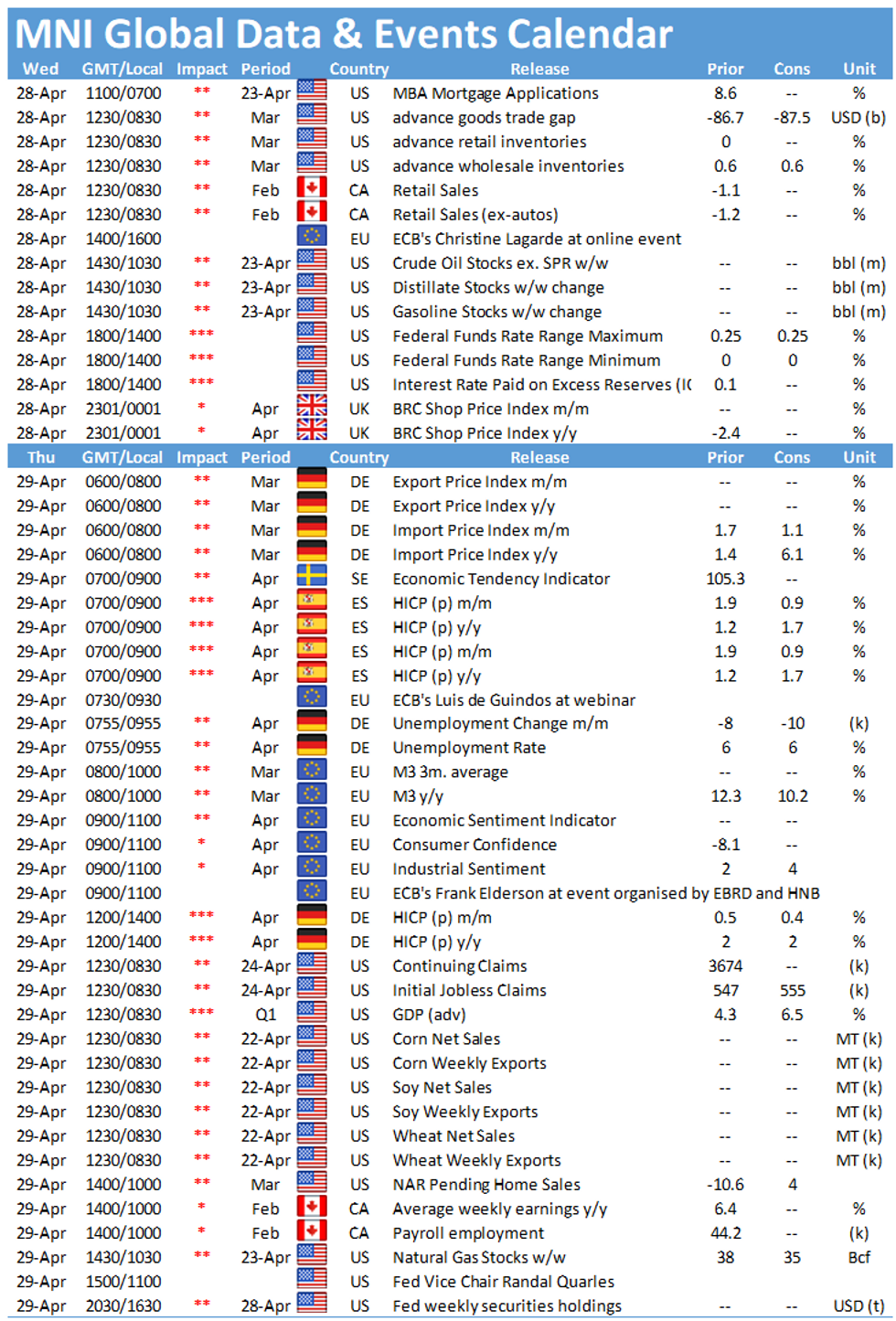

- Outside of the FOMC decision, Canadian retail sales and speeches from ECB's Rehn, Schnabel and Lagarde are due to cross.

EQUITIES: Asian/European stocks a bit higher but US equity futures flat

- Japan's NIKKEI up 62.08 pts or +0.21% at 29053.97 and the TOPIX up 5.51 pts or +0.29% at 1909.06

- China's SHANGHAI closed up 14.457 pts or +0.42% at 3457.068 and the HANG SENG ended 129.8 pts higher or +0.45% at 29071.34

- The German Dax up 49.29 pts or +0.32% at 15298.05, FTSE 100 up 15.88 pts or +0.23% at 6961.75, CAC 40 up 23.62 pts or +0.38% at 6297.58 and Euro Stoxx 50 up 1.33 pts or +0.03% at 4012.82.

- Dow Jones mini down 46 pts or -0.14% at 33837, S&P 500 mini up 2.25 pts or +0.05% at 4181, NASDAQ mini down 23.25 pts or -0.17% at 13928.5.

COMMODITIES: Silver weaker but all the majors within 1% of close

- WTI Crude up $0.05 or +0.08% at $62.99

- Natural Gas up $0.01 or +0.35% at $2.883

- Gold spot down $6.95 or -0.39% at $1769.27

- Copper down $1.8 or -0.4% at $446.75

- Silver down $0.22 or -0.85% at $26.0284

- Platinum down $3.83 or -0.31% at $1226.76

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.