-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Final EZ PMIs Confirm Bounce Back

MNI US Open: Final EZ PMIs Confirm Bounce Back

EXECUTIVE SUMMARY

- EC Proposes Easing Restrictions On Non-Essential Travel To EU

- NZ PM States Differences With China Are Becoming "Harder To Reconcile"

- Former UK PM Abandons Plan For UK-China Investment Fund

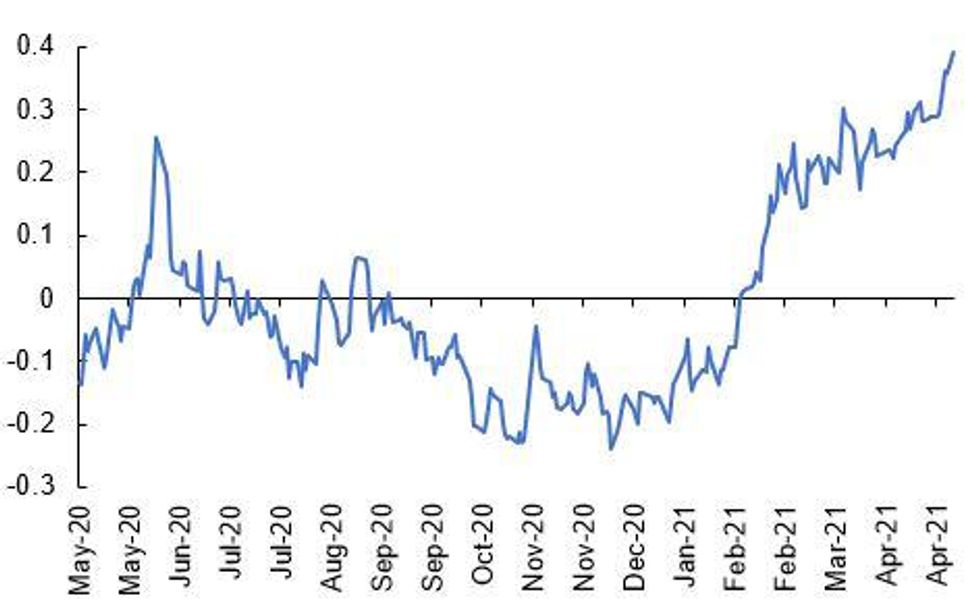

Source: MNI/Bloomberg

NEWS

EU (BLOOMBERG): EU Commission proposes easing restrictions on non-essential travel to the EU while addressing variants through new emergency brake mechanism, according to statement. Proposes Member States ease restrictions to reflect progress of vaccination campaigns and developments in the epidemiological situation worldwide. Proposes to allow entry to the EU for non-essential reasons not only for all persons coming from countries with a good epidemiological situation but also all people who have received the last recommended dose of an EU-authorised vaccine

CHINA/NEW ZEALAND (GUARDIAN): New Zealand's differences with China are becoming "harder to reconcile," the prime minister Jacinda Ardern has said, as she called on China "to act in the world in ways that are consistent with its responsibilities as a growing power". Ardern's comments were made as New Zealand's government comes under increasing pressure, both internally and from international allies, to take a firmer stance on concerns over human rights abuses of Uyghur people in China's Xinjiang province. Last week, the Act party presented a motion for New Zealand's parliament to debate whether the treatment of Uyghurs in Xinjiang constitutes genocide – a motion that Labour will discuss this week.

UK (FT): Former UK prime minister David Cameron has all but given up on his plan of launching a $1bn UK-China investment fund after relations nosedived between London and Beijing, according to people briefed on the situation. Cameron, who is embroiled in the Greensill Capital scandal, agreed in 2017 to develop a fund seeking partnership opportunities between the UK and China that would focus on technology, healthcare, energy and manufacturing. But potential investors, including banks such as Standard Chartered and HSBC, were reluctant to commit to the plan even though it had early support from the UK and Chinese governments.

DATA:

FIXED INCOME: Bund Under Pressure

Despite some countries out on Holiday today, it has been a fairly busy session in terms of market movements.

- EU PMIs uplifted outlook, providing a risk on tone, as countries look to re open, putting the odds of a summer economic boost on the table.

- EU seeks to lift travel restriction for people that have been vaccinated.

- Bund has pushed through lowest levels since 26/02.investors will now look at the 25/02 low at 169.24, but key will be in yield terms at 169.15 (equates to-0.14%, 2020 peak and highest yield since 28/05/19)

- German 5/30s break out above the 2021 peak, and we are now trending at steepest levels since 25/07/2019.

- Gilts are closed for UK Bank Holiday.

- US treasuries are lagging Germany somewhat, and trade 3.3bps tighter against the German 10yr.

- Looking ahead, US Final manufacturing PMI is set for release.

- Fed Powell is set to speak, but this will be on on community development, so unlikely to hear about Monetary Policy.

FOREX: FX SUMMARY

USD has given back some of its overnight gains, but a more subdued session for FX.

- All of the action this morning has been in EU Government bonds, plummeting.

- EUR has been underpinned, on a combination of a weaker Dollar, and uplifting EU PMI releases, which push yields higher.

- The EU now also seek to lift travel restriction for travelers that have been vaccinated.

- Risk on tone, has puts some pressure on JPY

- The pound leads against the Yen in G10, up half a percent.

- Initial target here, comes at Thursday high, 152.40.

- USDJPY tested through 109.64 61.8% retracement of the Mar 31 - Apr 23 sell-off.

- Further upside traction opens to 109.96 High Apr 9 next.

- Broader base USD selling has been noted against the EUR, GBP, SEK, AUD, SEK, NOK, CNH. INR, CZK.

- Looking ahead, Canadian and US Manufacturing PMI are set for release.

- Fed Powell is the scheduled speaker, but he will be speaking on community development, so unlikely to hear about Monetary Policy.

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.