-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI US Open: Strong Outturn For European Data

MNI US Open: Strong Outturn For European Data

EXECUTIVE SUMMARY:

- Strong European data this morning reinforce the rapid rebound narrative

- Israel and Hamas call a truce

- The UK is expected to offer Australia a tariff free, quote free trade deal

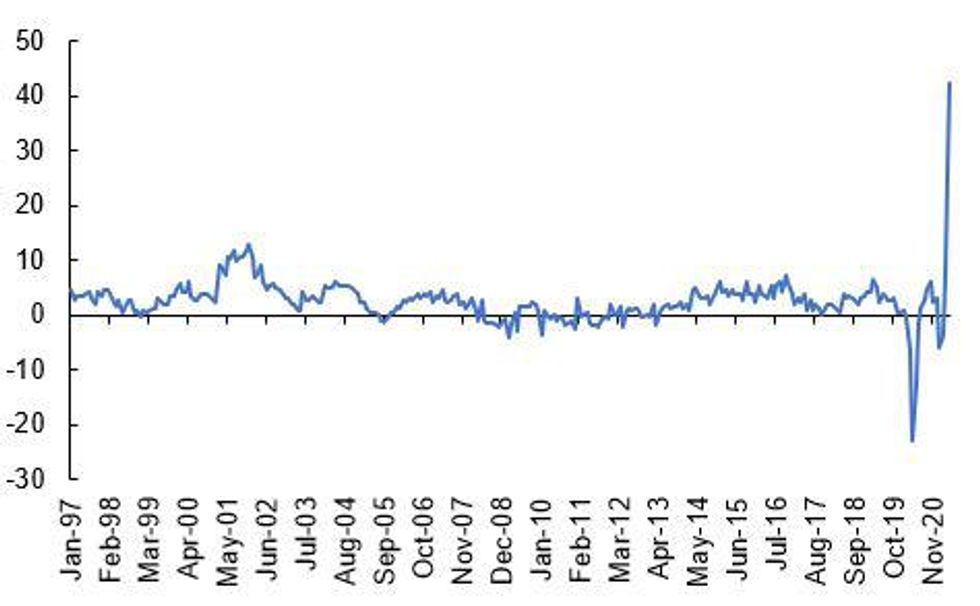

Source: MNI/Bloomberg

NEWS

ISRAEL-PALESTINE (REUTERS): A truce between Israel and Hamas took hold on Friday after the worst violence in years, with U.S. President Joe Biden pledging to salvage the devastated Gaza Strip and the United Nations urging renewed Israeli-Palestinian dialogue. Israeli aerial bombardment of the densely populated enclave killed 243 Palestinians, including 66 children, wounded more than 1,900 and damaged critical infrastructure and thousands of homes. In Israel, 12 people were killed and hundreds treated for injuries in rocket attacks that caused panic and sent people rushing into shelters.

OIL (BLOOMBERG): Brent crude headed for its biggest weekly drop since March as a potential end to years-long sanctions raised the prospects of Iran ramping up supplies. Futures in London rose near $65 a barrel on Friday but are down about 5% this week. While the global benchmark topped $70 earlier on Tuesday, the market has dramatically repriced as a deal to lift restrictions on Iran's oil exports appeared to be ever closer. The Persian Gulf nation's president, Hassan Rouhani, said world powers have accepted that major sanctions will be lifted, though details and finer points still needed to be ironed out. Some of the most optimistic analysts estimate the country could return to pre-sanctions production of 4 million barrels a day in as little as three months.

UK (FT): The UK will on Friday offer Australia a tariff-free, quota-free trade deal after Boris Johnson insisted it should go ahead in spite of warnings it could seriously damage British farmers. Downing Street refused to comment on the details but has not denied a report in The Sun that tariffs would be removed after 15 years to give British farmers time to prepare to face new competition in areas like beef and lamb. That outcome represents a victory for cabinet free traders, led by international trade secretary Liz Truss, who insisted that Britain should offer Australia a similar deal to the zero-tariff, zero-quota deal it struck with the EU after Brexit.

UK (GUARDIAN): A decision in Brussels to add the UK to an EU "white list" of countries from where tourists will be welcome this summer is to be delayed, it is understood, due to concerns over the Covid variant first identified in India. EU diplomats were expected to use a revised threshold of infection cases to extend the list of countries at a meeting on Friday but sources said that the decision will be put back by two weeks. While the UK easily meets a new threshold of under 75 cases per 100,000 people over days, allowing it to be added to the list, the strong emergence of the India variant, or B.1.617.2, in the UK, is key to the delay.

DATA

UK Retail Sales Surge in Apr On Reopening

UK APR RETAIL SALES +9.2% M/M; +42.4% Y/Y

UK APR RETAIL SALES EX-FUEL +9.0% M/M; +37.7% Y/Y

UK MAR TOTAL SALES REVISED DOWN TO +5.1% M/M

UK APR RETAIL SALES DEFLATOR +1.0% Y/Y; EX-FUEL +0.4% Y/Y

- UK retail sales surged by 9.2% in April, coming stronger than markets expected (Median: 4.8%). The reopening of non-essential businesses provided a significant boost to sales at the beginning of Q2.

- Retail sales are now 10.6% higher than in Feb 2020, reflecting the easing of lockdown restrictions.

- Annual sales jumped to 42.4%, better than expected (BBG: 36.8%) and mainly driven by base effects as April 2020 was the first full month of lockdown.

- Apr's increase was broad-based with every category recording m/m increases, except for food stores where sales eased by 0.9%.

- Clothing and footwear saw the largest m/m gain, up 69.4%, followed by other stores where sales grew by 25.3% in Apr.

- The proportion of online sales fell in all retail sectors, leading to a fall of the total proportion to 30.0% y/y in Apr, down from 34.7% in Mar.

- While internet sales (value) fell 5.6% on a monthly basis, annual internet sales decelerated to 31.9%, almost half the rate from Mar (61.7%).

FIXED INCOME: ECB tapering concerns recede a little

- Core fixed income is on the front foot this morning as some concerns surrounding potential ECB tapering recede following some pretty disappointing details in the German PMI release.

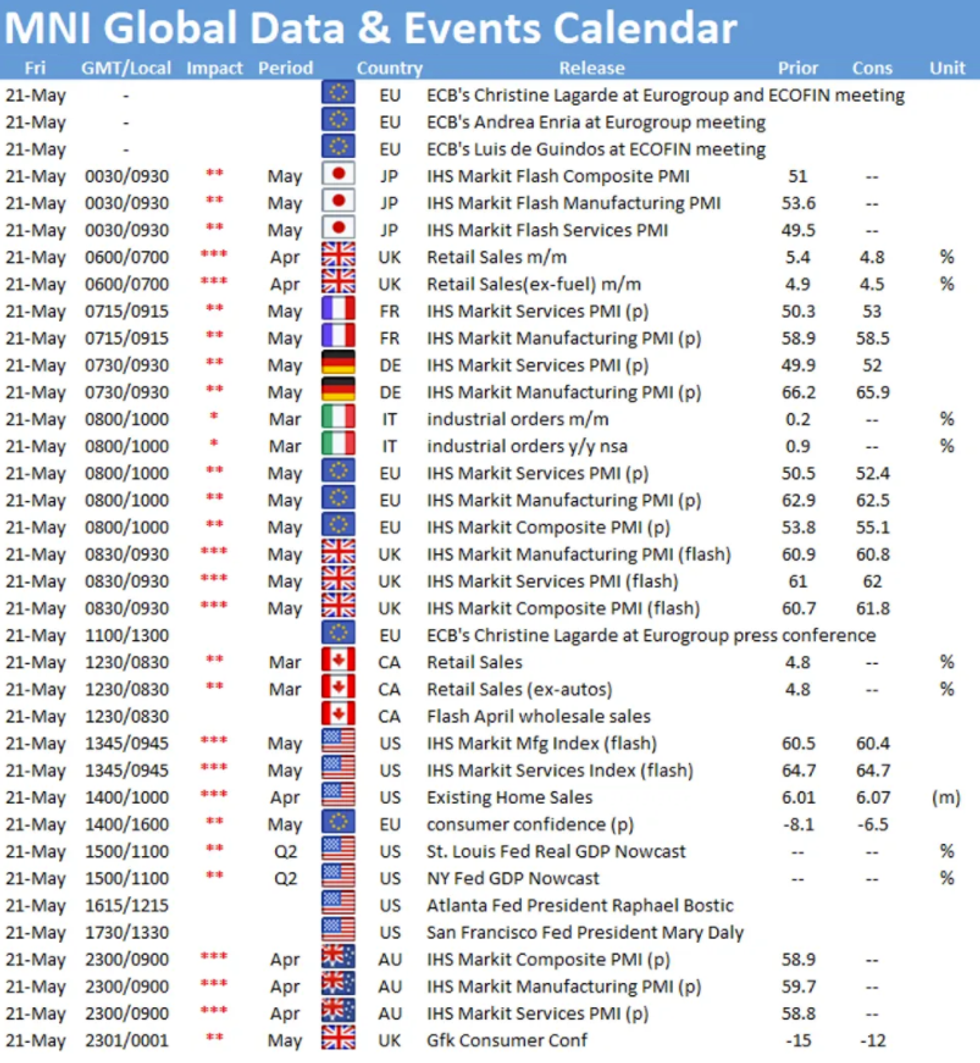

- The market has largely ignored better than expected data this morning with UK retail sales rising to around 10% above the pre-pandemic level and with the monthly growth rate almost double consensus expectations. Eurozone services PMI and UK manufacturing PMI prints were also better than expected.

- The Bank of England has set out some of the options for greening its corporate bond portfolio in line with its recently revised mandate to help the UK achieve "strong, sustainable and balance growth that is also environmentally sustainable and consistent with the transition to a net zero economy."

- Looking ahead, ECB President Lagarde will attend a press conference following the Eurogroup meeting while the Fed's Kaplan, Bostic, Barkin and Daly are all due to speak today. In terms of data releases, the US PMI and existing home sales will be the highlights.

- TY1 futures are up 0-0+ today at 132-16 with 10y UST yields down -0.1bp at 1.626% and 2y yields up 0.4bp at 0.150%.

- Bund futures are up 0.16 today at 169.00 with 10y Bund yields down -1.0bp at -0.120% and Schatz yields down -0.1bp at -0.655%.

- Gilt futures are unch today at 127.73 with 10y yields up 0.3bp at 0.841% and 2y yields up 1.1bp at 0.055%.

FOREX: FX SUMMARY

A more range bound session so far in FX and most cross assets.

- Initial price action was led by European PMIs.

- France beat expectation, and EURUSD went bid to print 1.2240 high.

- But a miss for Germany saw EURUSD pushing to session low at 1.2210.

- This was followed by decent PMIs for the EU, which in turn brought back the pair at mid range 1.2222.

- AUD and NZD are the poorer performers against the Greenback, on lower Commodities.

- But the NZD is been over taken in the raking by the NOK, as WTI extend losses in the early European session.

- WTI has now lost just over 8% from May's high, albeit trading flat today, after bouncing off the lows.

- UK Retail Sales was a big beat, providing a 15 pips spike for the Cable, testing the 1.4200 figure, to trade 0.05% versus the Dollar (pretty much flat).

- UK PMI saw a beat for Manufacturing and Composite, and slight miss for services.

- GBP trades in the green against most G10s, besides the SEK and JPY, buoyed by the data.

- Looking ahead, US PMI and Canadian retail sales are the notable releases.

- On the speaker front, ECB Lagarde, Fed Bostic, Kaplan, Barkin, Daly

- After market, Moddy rating on Greece

EQUITIES: China and UK lower but most other markets higher

- Japan's NIKKEI up 219.58 pts or +0.78% at 28317.83 and the TOPIX up 8.77 pts or +0.46% at 1904.69

- China's SHANGHAI closed down 20.387 pts or -0.58% at 3486.557 and the HANG SENG ended 8.15 pts higher or +0.03% at 28458.44

- German Dax up 23.97 pts or +0.16% at 15390.12, FTSE 100 down 18.57 pts or -0.26% at 7000.58, CAC 40 up 20.63 pts or +0.33% at 6363.68 and Euro Stoxx 50 up 12.76 pts or +0.32% at 4012.21.

- Dow Jones mini up 67 pts or +0.2% at 34099, S&P 500 mini up 10.25 pts or +0.25% at 4164.25, NASDAQ mini up 36.5 pts or +0.27% at 13522.25.

COMMODITIES: Copper lower while most other commodities move higher

- WTI Crude up $0.46 or +0.74% at $62.44

- Natural Gas up $0.03 or +0.99% at $2.957

- Gold spot up $2.03 or +0.11% at $1878.97

- Copper down $2.25 or -0.49% at $454.45

- Silver up $0.05 or +0.19% at $27.8024

- Platinum down $0.09 or -0.01% at $1199.08

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.