-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY11.0 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI US Open: Dollar Bounces Ahead Of Powell's Testimony

EXECUTIVE SUMMARY:

- ECB POLICYMAKERS AT ODDS ON INFLATION STRATEGY, HOPE FOR SEPT DEAL (RTRS SOURCES)

- ECB'S KAZIMIR: CURRENTLY NO REASON TO CHANGE POLICY SETTINGS

- RUSSIA WEIGHS PROPOSING OPEC+ OUTPUT HIKE AT NEXT WEEK'S MEETING

- MERKEL SAYS IN NEXT FEW YEARS WE WILL HAVE TO SPEND "GIGANTIC" AMOUNTS IN GERMANY

- DRAFT COMMUNIQUE OF G20 FINANCIAL LEADERS FOR JULY 9-10 MENTIONS NO NUMBER FOR MINIMUM LEVEL OF GLOBAL CORPORATE TAX

NEWS:

ECB (BBG): European Central Bank (ECB) policymakers are still some way apart on their new inflation strategy but hope to reach an agreement before debating the future of their pandemic-fighting programme in September, sources told Reuters.

ECB (BBG): The European Central Bank's monetary policy stance remains very relaxed and "currently we don't see any reason to change this setting," Governing Council member Peter Kazimir says at press conference in Bratislava. "In our view, this loose monetary policy is working in a very targeted way and is helping the economy recover"

OPEC+ (BBG): Russia is considering proposing an OPEC+ oil-output increase at the group's meeting next week because the nation sees a supply deficit in the market, according to officials familiar with the matter. Moscow expects the current global oil-output deficit to persist in the medium term, two officials said, asking not to be named because the discussions are not public. The country's final position going into the July 1 meeting with its OPEC+ partners is still being shaped, another official said.

GERMANY (RTRS): Germany will in the next few years have to spend "gigantic" amounts to help it address environmental and technological challenges once the coronavirus pandemic has receded, Chancellor Angela Merkel said on Tuesday. Addressing a BDI industry association conference, Merkel said that some sectors may still need further aid after the crisis. In addition, she singled out the microchip branch. "Without state aid, the expansion of microchip production in Europe will not be possible," said Merkel, who is not running for a fifth term in a September election, adding the public finances must be brought back into order in coming years.

GERMANY: Germany raises Q3 bond funding requirements by E2.0bln. Total capital markets funding total in Q3-21 now E62.0bln (up from E60.0bln). 7-year 0% Nov-28 Bund reopening on 20 July now E4.0bln (instead of E3.0bln). 30-year 1.25% Aug-48 Bund reopening on 21 July no E1.5bln (instead of E1.0bln). New 10-year Green Bund on 8 September now E3.5bln (instead of E3.0bln). No changes to bubill schedule/amounts.

G20/GLOBAL TAX (RTRS): The world's financial leaders will endorse on July 9-10 a deal setting a global minimum corporate tax and call for technical work to be finished so they can approve the framework for implementation in October, their draft communique showed. "After many years of discussions and building on the progress made last year, we have achieved an historical agreement on a new, fair and stable international tax architecture," the draft said. "We endorse the core elements of the two pillars on the profit reallocation of multinational enterprises and the global minimum tax as set out in the statement released by the G20/OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS)," it said.

FED (REPEAT FROM MONDAY): Federal Reserve Chair Jerome Powell said the economy has shown sustained but uneven improvement while highlighting "elevated" unemployment and temporary inflation pressure, in remarks published Monday ahead of a Congressional hearing on Tuesday at 1400ET. "As with overall economic activity, conditions in the labor market have continued to improve, although the pace has been uneven," Powell said in the text of opening remarks for a House of Representatives pandemic subcommittee.

U.K. / COVID (RTRS): Britain is working on easing travel restrictions for the fully vaccinated to allow people to enjoy a summer holiday on Europe's beaches but the plans are not finalised yet, Health Secretary Matt Hancock said on Tuesday. Currently British citizens are essentially prevented from travelling to most countries - including those in the European Union - as the quarantine and testing rules are so cumbersome and expensive. British tourists are the second biggest outbound holiday spenders in Europe after Germans so their absence hurts the economies of southern Europe while the British tourism sector is reeling from a ruinous loss of income due to the restrictions. Hancock told Sky News that the government did want to let people have a family holiday abroad, but only when it was safe to do so. "The whole point of the vaccine programme is to be able to remove restrictions, and for people to be able to be kept safe by the vaccine, rather than by these rules," Hancock told LBC. "So we are working on a plan for double vaccinated people, using tests, to have that testing regime in place, instead of having to have the quarantine, in some circumstances," he said.

E.U. / TECH (RTRS): Europe's top court on Tuesday said that Google's YouTube and other online platforms are not liable for copyright-infringing works uploaded by users onto their platforms under certain conditions. The case marks the latest development in a long-running battle between Europe's $1 trillion creative industry and online platforms, with the former seeking compensation or action from the latter for unauthorised works that are uploaded.

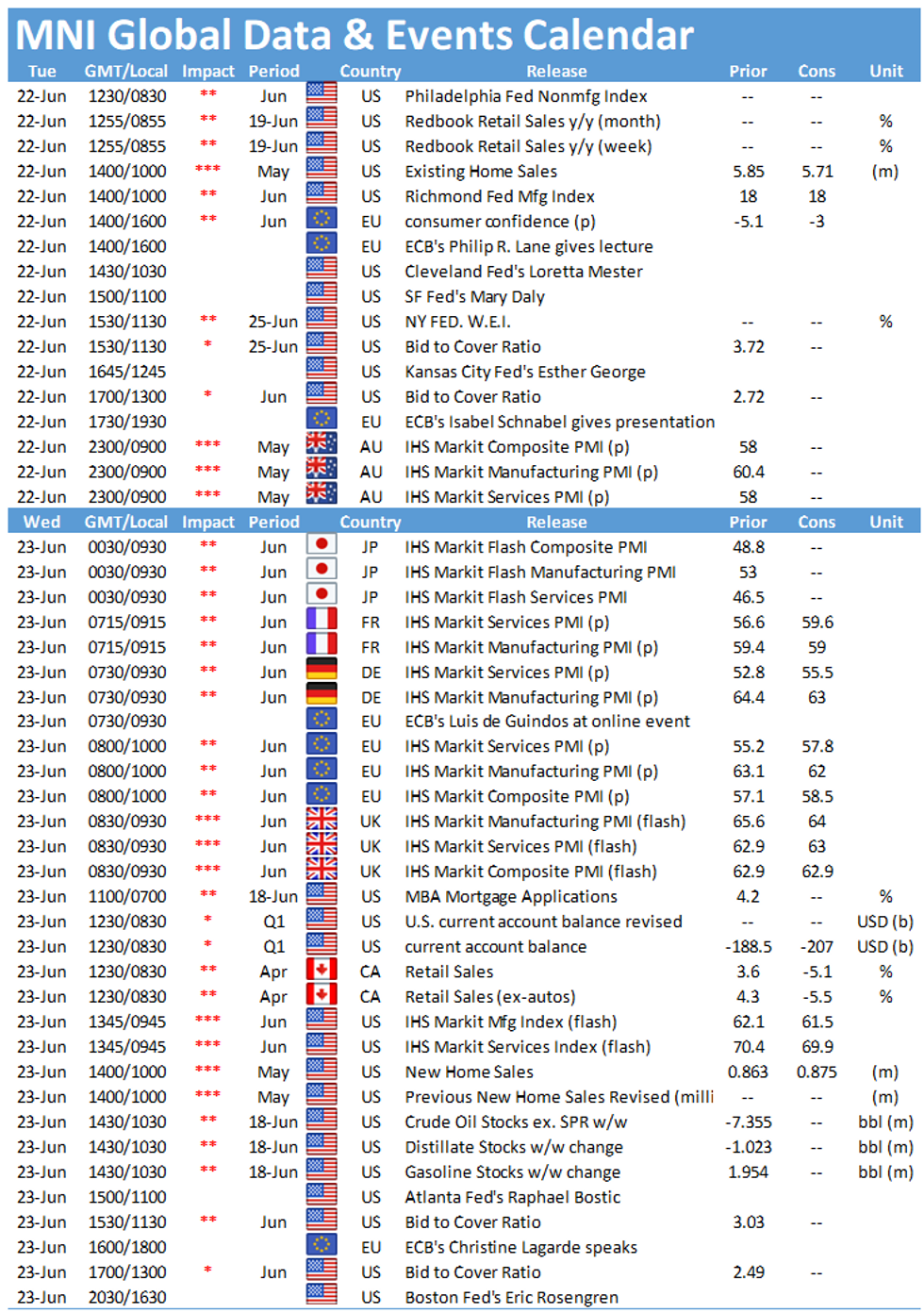

DATA:

MNI DATA BRIEF: UK's 20/21 Overall Borrowing Revised Lower

UK government borrowing for the latest fiscal year was revised downward for the second straight month, to GBP299.171 billion, pushing borrowing further below the OBR's like-for-like target of GBP327.4 billion, the Office for National Statistics said Tuesday.

The adjusted target includes GBP27.2 billion in covid-related loan write offs not yet reflected in ONS figures, leaving the OBR with a headline target of GBP355 billion. That debt ratio was unchanged from from previous reports at 97.4% of GDP, although the debt ratio increased to 99.2% in the month of May. As a percentage of GDP, the 2020/21 deficit remained at 14.3%, unchanged from a month earlier.

FIXED INCOME: Bunds attempt to break lower

- Bunds have been the underperformer in core fixed income this morning, breaching support at yesterday's low of 171.93 and the June 17 low of 171.80 before moving as low as 171.67. This move saw an intra-day breach of the 50-dma but we have since retraced most of the losses and at the time of writing have moved back to around 172.00. There is no real fundamental driver for the move.

- Gilts also saw a weak open but have moved back to yesterday's closing levels while Treasury futures are little changed on the day.

- The economic data calendar is rather quiet today with the highlight being UK public finance data which came in better than expected. US existing home sales are due up later.

- In terms of central bank speakers the ECB's Lane and Schnabel are both due up as well as the Fed's Mester and Daly.

- TY1 futures are down unch today at 132-06+ with 10y UST yields down -0.6bp at 1.484% and 2y yields down -0.9bp at 0.247%.

- Bund futures are down -0.15 today at 172.01 with 10y Bund yields up 0.4bp at -0.169% and Schatz yields up 0.1bp at -0.656%.

- Gilt futures are down -0.04 today at 127.58 with 10y yields down -0.1bp at 0.767% and 2y yields down -1.7bp at 0.102%.

EQUITIES: Energy Stocks Lead Gains

- Asian stocks closed mixed, with Japan's NIKKEI up 873.2 pts or +3.12% at 28884.13 and the TOPIX up 60.08 pts or +3.16% at 1959.53. China's SHANGHAI closed up 28.229 pts or +0.8% at 3557.412 and the HANG SENG ended 179.24 pts lower or -0.63% at 28309.76

- European equities are mixed, with the German Dax down 34.4 pts or -0.22% at 15569.53, FTSE 100 up 20.15 pts or +0.29% at 7083.15, CAC 40 down 6.39 pts or -0.1% at 6604.95 and Euro Stoxx 50 down 7.84 pts or -0.19% at 4100.59.

- U.S. futures are flat/lower, with the Dow Jones mini up 1 pts or +0% at 33762, S&P 500 mini down 2.5 pts or -0.06% at 4211.25, NASDAQ mini down 26.25 pts or -0.19% at 14105.25.

COMMODITIES: Crude Weaker On Possible OPEC+ Output Hike

- WTI Crude down $0.55 or -0.75% at $73.3

- Natural Gas up $0.02 or +0.5% at $3.209

- Gold spot down $3.11 or -0.17% at $1779.68

- Copper down $0.5 or -0.12% at $418

- Silver down $0.04 or -0.17% at $25.8726

- Platinum up $3.01 or +0.28% at $1065.81

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.