-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Mixed Start

MNI US Open: Mixed Start

EXECUTIVE SUMMARY

- European Sovereigns Trade Mixed This Morning Amid Modest Upside For Equities

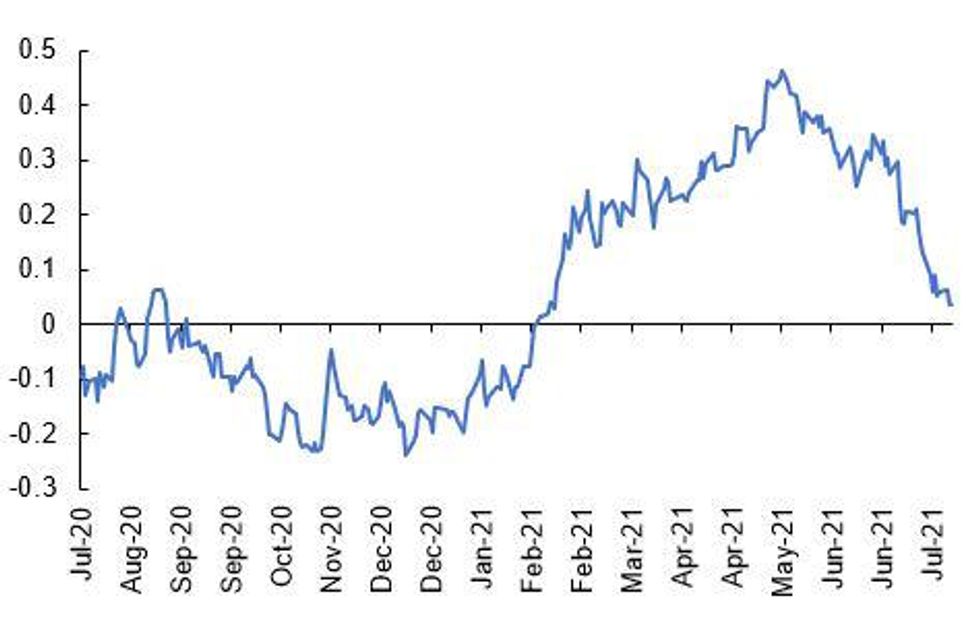

- The Number of UK Firms In Financial Distress Has Fallen

Source: MNI, Bloomberg

NEWS:

NEWS:

US-China (Reuters): The Pentagon and Republican congressmen on Tuesday aired fresh concerns about China's build-up of its nuclear forces after a new report saying Beijing was building 110 more missile silos. An American Federation of Scientists (AFS) report on Monday said satellite images showed China was building a new field of silos near Hami in the eastern part of its Xinjiang region. The report came weeks after another on the construction of about 120 missile silos in Yumen, a desert area about 240 miles (380 km) to the southeast.

UK (FT): The number of UK companies in significant financial distress has fallen from a record high earlier in the year, with the hospitality, leisure and retail sectors boosted by the gradual reopening of the economy from Covid-19 lockdown measures. The number of companies reporting financial difficulties fell by 10 per cent to 650,000 in the second quarter compared with the first three months of 2021, according to Begbies Traynor. The insolvency specialist's red flag alert, which has measured the health of small and medium-sized companies across the UK since 2004, said that some had been able to pay down debt as coronavirus restrictions were lifted and business returned.

North & South Korea (Reuters): North and South Korea are in talks to reopen a joint liaison office that Pyongyang demolished last year and hold a summit as part of efforts to restore relations, three South Korean government sources with knowledge of the matter said. South Korean President Moon Jae-in and North Korean leader Kim Jong Un have been exploring ways to improve strained ties by exchanging multiple letters since April, the sources said on condition of anonymity due to diplomatic sensitivity. The discussions signal an improvement in ties that have deteriorated in the past year after three leaders' summits in 2018 promised peace and reconciliation.

ITALY DATA: Italy Business Sentiment At Highest Since 2005

- Jul SA manufacturing morale 115.7 vs Jun 114.8, beating forecasts expecting an uptick to 113.7

- Jul composite business sentiment indicator 116.3 vs Jun 112.8

- Jul SA bus. sentiment highest in time series since Mar 2005--Istat says

- Jul m/m intermed., capital, consumer gds all rose--Istat

- Manufacturing current orders +8.9 in Jun vs +6.5 in Jun

- 3-month manuf. output outlook +19.1 vs +19.7 in Jun

- Current manufacturing inventory levels -2.0 vs. Jun-1.2

French Consumer Dipped in July

FRANCE DATA: FRANCE JUL CONSUMER CONF IND 101; JUN 103r

- Consumer confidence slipped 1pt to 101 in Jul, falling short of market forecasts looking for an unchanged reading (BBG: 102), but shows the second highest reading since the start of the pandemic.

- Jun's reading was revised up by 1pt to 103.

- Household's assessment of the future economic situation deteriorated markedly, falling 8pt, while their opinion about the past economic situation improved slightly by 3pt.

- The amount of consumers thinking that prices increased in the past year rose significantly, up 14pt.

- Intentions to make major purchases declined in July by 5pt, after increasing to 40-month high in Jun.

- Household's savings intentions eased further in Jul, down 4pt and showing third consecutive drop.

- Both consumer's assessment of their future and past financial situation fell in July, decreasing by 3pt and 1pt, respectively.

ITALY DATA: Italy Consumer Sentiment Up Again in July

- Jul SA consumer confidence 116.6 vs Jun 115.1, beating expectations looking for an uptick to 115.5

- Consumer confidence index highest since Sept 2018--Istat says

- Consumer's sentiment on the economy rose to 129.6 vs Jun 126.9

- Confidence in future outlook up to 123.5 from Jun 125.5

- Sentiment on their personal climate climbed to 112.2 vs Jun 111.1

- Sentiment on the current climate rose to 111.9 from Jun 108.1

FIXED INCOME: Europe holds onto gains, while Treasuries are offered

EGBs are better bid on the margin, but price actions have been limited overall, as investors and market participants awaits the US FOMC later today.

- Bund trades in a 29 ticks range (176.20/176.49), and up 6 ticks at the time of typing.

- Peripherals have kept up with Bund, translating in flat spreads versus the German 10yr.

- The only standout is Greece, trading 1bp tighter.

- Gilts initially outperformed Bund of the open, but the contract has since pared its gains, to trade 0.8bp wider against the Bund.

- UK/Bund spread move back to the widest level since the 4th of June.

- While we see German curve leaning steeper, the UK 5/30 is bull flatter, and just short of yesterday's low, now at 69.28.

- US Treasuries saw better selling during our morning European session but moves lack clear momentum.

- Tnotes are down 5 ticks at the time of typing and the US/German spread is 1.4bp wider so far.

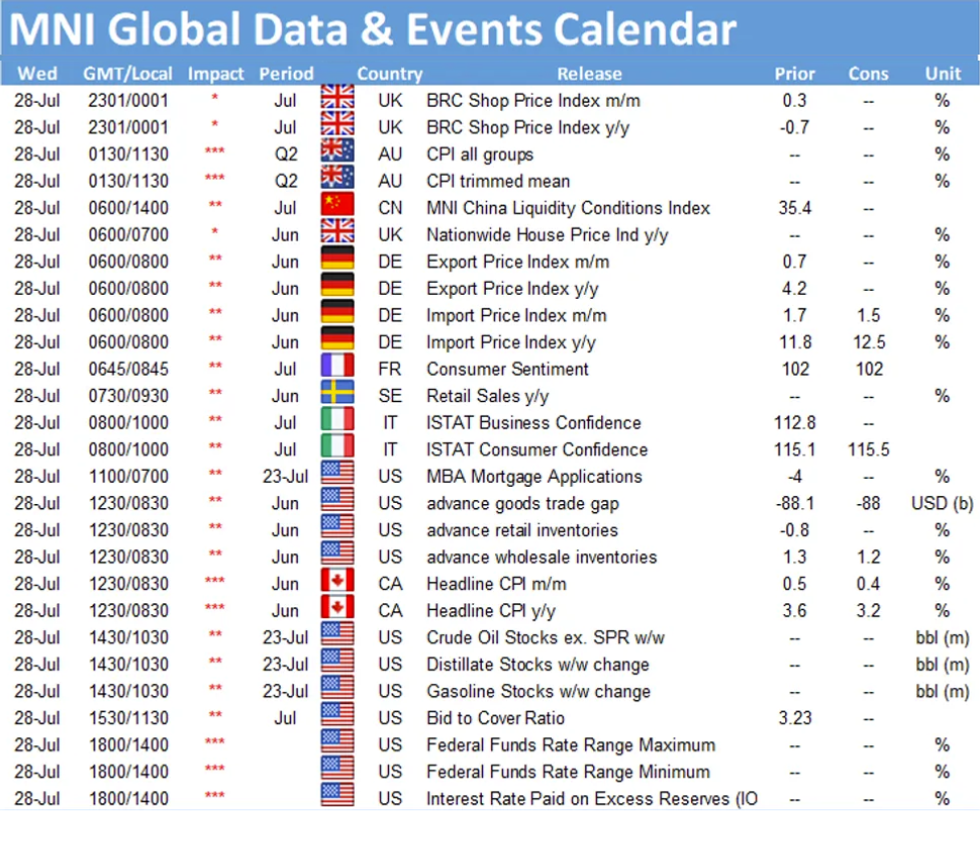

- Looking ahead, US Wholesale Inventories is the notable release.

- Most of the attention is on the FOMC, but unlukely to change path at this meeting

FOREX: USD gives back some of its overnight gains

USD started the European session on the front foot, a continuation from the Asian session.

- The Dollar was up across G10s, besides the CAD, but the Greenback has faded some of the bid, after Equities moved to session high.

- Now, only the JPY, NZD and AUD are still down versus the USD.

- EURUSD is a 28 pips range (1.1802/1.1830), and worth noting 3.05bn between 1.1790 and 1.1825 of option expiry for today.

- The pound is having a good session, but Cable has been choppy, initially rallying to 1.3895, to then quickly fading to the session low at 1.3862, and now trading back at 1.3887.

- Resistance in Cable comes at 1.3910 (High Jul 12 and a key resistance)

- NOK and CAD were initially under some pressure, as WTI slipped below $72, but crosses have reversed the early price action, following WTI breaking back above $72.

- Looking ahead, US Whole sales inventory, is the main data for the session.

- We also get the Canadian CPI, but most of the attention will be on the FOMC and presser.

EQUITIES: Move to session highs

- US Equities extends gains, and mini S&P trades back above the 4400.0 figure.

- All time here was printed on Monday at 4416.75.

- Estoxx (VGU1) on the follow, move to session high, with resistance coming at 4100, followed by MNI tech 4111.50 High Jul 23

- Stoxx600 sees Retail, Tech, and Travel/Leisure as the leading stocks

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.