-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Villeroy Indicates PEPP Decision Not Urgent In Sep

MNI US Open: Villeroy Indicates PEPP Decision Not Urgent In Sep

EXECUTIVE SUMMARY:

- The ECB's Villeroy noted that financing conditions are more favorable, but there is no urgency to act in September

- US anti-missile defences intercepted rockets at Kabul airport.

- New Zealand has extended the national lockdown by a further two weeks

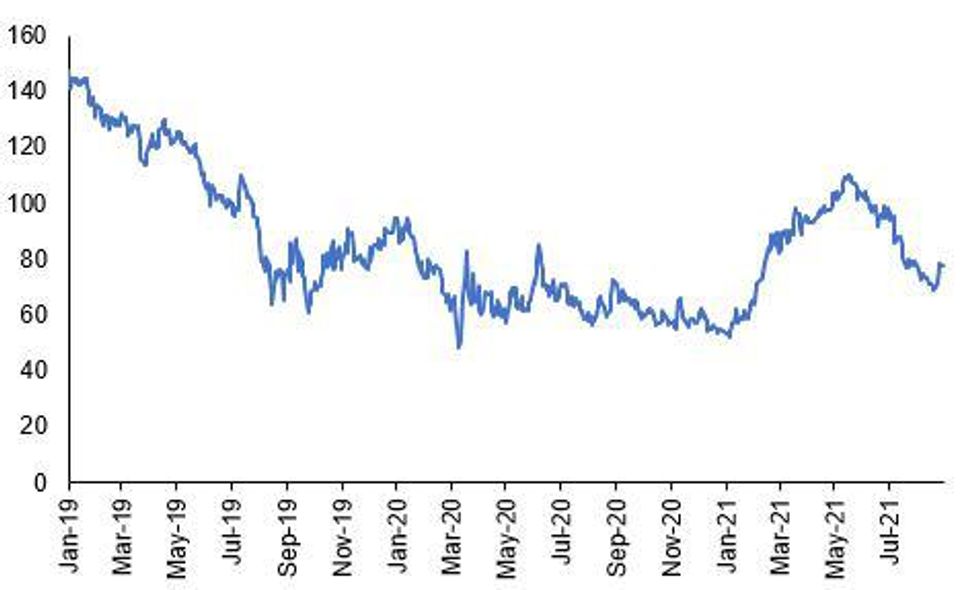

Source: MNI, Bloomberg

NEWS

ECB (BLOOMBERG): European Central Bank Governing Council member Francois Villeroy de Galhau said policy makers should take into account more favorable financing conditions in the region when they decide on the pace of emergency bond-buying next week, hinting a slowdown may be in the cards. Any changes in the program dubbed PEPP would not amount to tapering like that announced by U.S. Federal Reserve Chair Jerome Powell on Friday, according to Villeroy, who is also the governor of the Bank of France. Yet the ECB should be coherent with the principle that has led it to purchase assets at a significantly higher pace since March to ensure conditions supported a recovery in the euro area. "On monthly volumes, we are looking at the favorable financing conditions, and we should underline that they are more favorable than at our June meeting," Villeroy said on BFM Business radio. "We have to decide the monthly volumes for the fourth quarter."

US-AFGHANISTAN (REUTERS): U.S. anti-missile defences intercepted as many as five rockets that were fired at Kabul's airport early on Monday, a U.S. official said, as the United States rushed to complete its withdrawal from Afghanistan to end its longest war. Having evacuated about 114,400 people, including foreign nationals and Afghans deemed "at risk", in an effort that began a day before Kabul fell to the Taliban on Aug. 15, U.S. and allied forces are set to complete their own withdrawal by a Tuesday deadline agreed with the Islamist militants. The number of U.S. troops at the airport had fallen below 4,000 over the weekend, as departures became more urgent after an Islamic State suicide bomb attack outside the gates on Thursday killed scores of Afghans and 13 U.S. troops.

NEW ZEALAND (REUTERS): New Zealand Prime Minister Jacinda Ardern on Monday extended a lockdown in Auckland by two weeks, while officials reported the country's first death linked to the Pfizer-BioNTech COVID-19 vaccine. New Zealand had been largely virus-free for months, barring a small number of cases in February, until an outbreak of the Delta variant imported from Australia prompted Ardern to order a snap nationwide lockdown on Aug. 17. Infections in the outbreak have reached 562 but the number of daily new cases dropped to 53 on Monday, the lowest over the past five days. "I know we all feel encouraged that our number is lower than what we've seen in the last few days and I know we're all willing for that trend to remain," Ardern said at a news conference. "The job is not yet done and we do need to keep going."

US (BBC NEWS): The US city of New Orleans has lost power, with only generators working, as Hurricane Ida batters Louisiana. The storm brought 150mph (240km/h) winds when it made landfall and those people who did not flee have been advised to shelter in place. One person was killed when a tree fell on their home in Ascension Parish, in the Baton Rouge area. Ida will test New Orleans' flood defences, strengthened after Hurricane Katrina killed 1,800 people in 2005. President Joe Biden said Ida would be "life-threatening", with immense devastation likely beyond the coasts.

NORTH KOREA (BBC NEWS): North Korea appears to have restarted its Yongbyon nuclear reactor, the UN atomic agency has said in a report. Plutonium, which is used for nuclear weapons, is believed to be produced at the reactor's complex. The International Atomic Energy Agency (IAEA) was expelled by Pyongyang in 2009 but relies on satellite imagery to carry out assessments. The watchdog said the reactor has been discharging cooling water since July, suggesting it is operational. Yongbyon, a nuclear complex with a 5-megawatt reactor, is at the heart of North Korea's nuclear programme. This was the first sign of operational activity at the reactor since December 2018, months after US President Donald Trump met Kim Jong-un in Singapore, according to the IAEA.

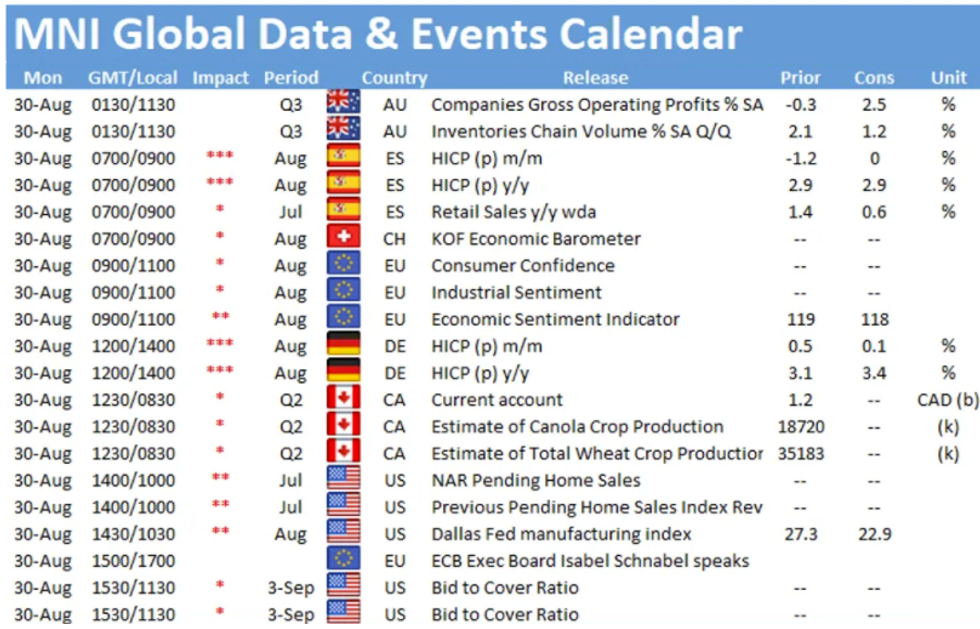

DATA:

FIXED INCOME: USTs Firm, EGBs Weaken Slightly

USTs have firmed while EGBs have traded a touch weaker alongside uneven trading in equities.

- The UST curve has marginally bull flattened with the 2s30s spread 1bp narrower.

- Bunds sold off in early trade before clawing back losses to now trade marginally below the Friday close. The curve is a modestly flatter.

- It is a similar story for OATs, with the curve close to flat overall.

- BTPs have so far failed to claw back the earlier losses with cash yields 1-2bp higher across much of the curve.

- German regional CPI data show an acceleration in inflation for August, with the national estimate due out at 1300GMT.

- The gilt market is closed on account of the UK national holiday observed today.

- France will offer EUR4.8-6.0bn of BTFs later today

FOREX: Mixed USD

A calmer start for FX, with the UK on a Bank holiday, and all the focus on Friday's NFP and ISM.

USD trades mixed in G10, up 0.45% versus the Swissy, while down 0.30% against the NOK.

EUR still lead in G10 versus the Swissy, extending gains and now up 0.44% on the session.

Risk (Equity) is doing very little, with prices anchored at current levels.

Market participants will look at Friday's high 1.07973 as initial resistance.

Looking ahead, German CPI is the only notable data. Out of the US, sees pending home sales, but won't move markets.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.