-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN - Pressure on BoE Intensifies Following CPI Release

MNI US OPEN - Pressure on BoE Intensifies Following CPI Release

EXECUTIVE SUMMARY:

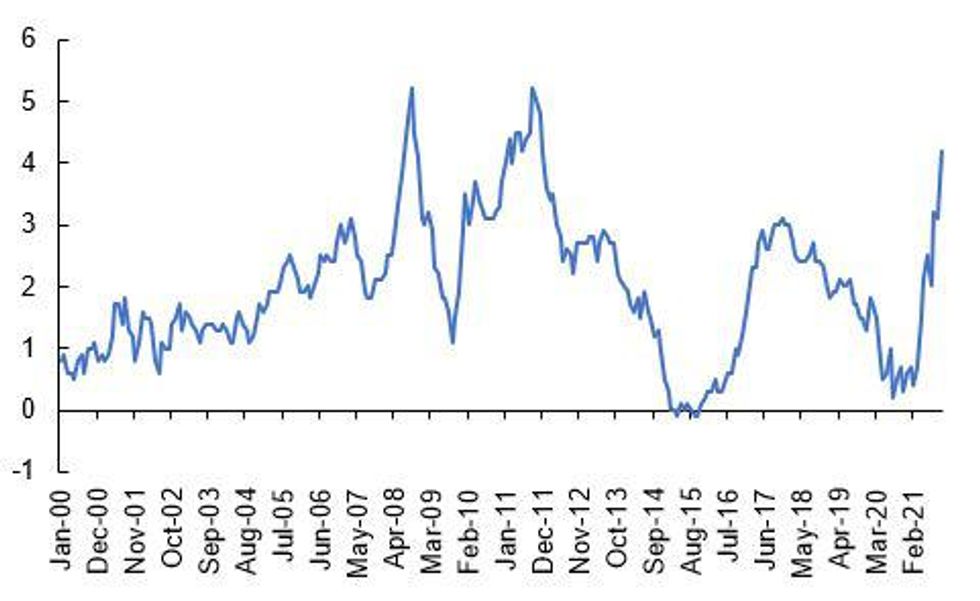

- UK CPI surprised higher in October, elevating pressure on the BoE to respond

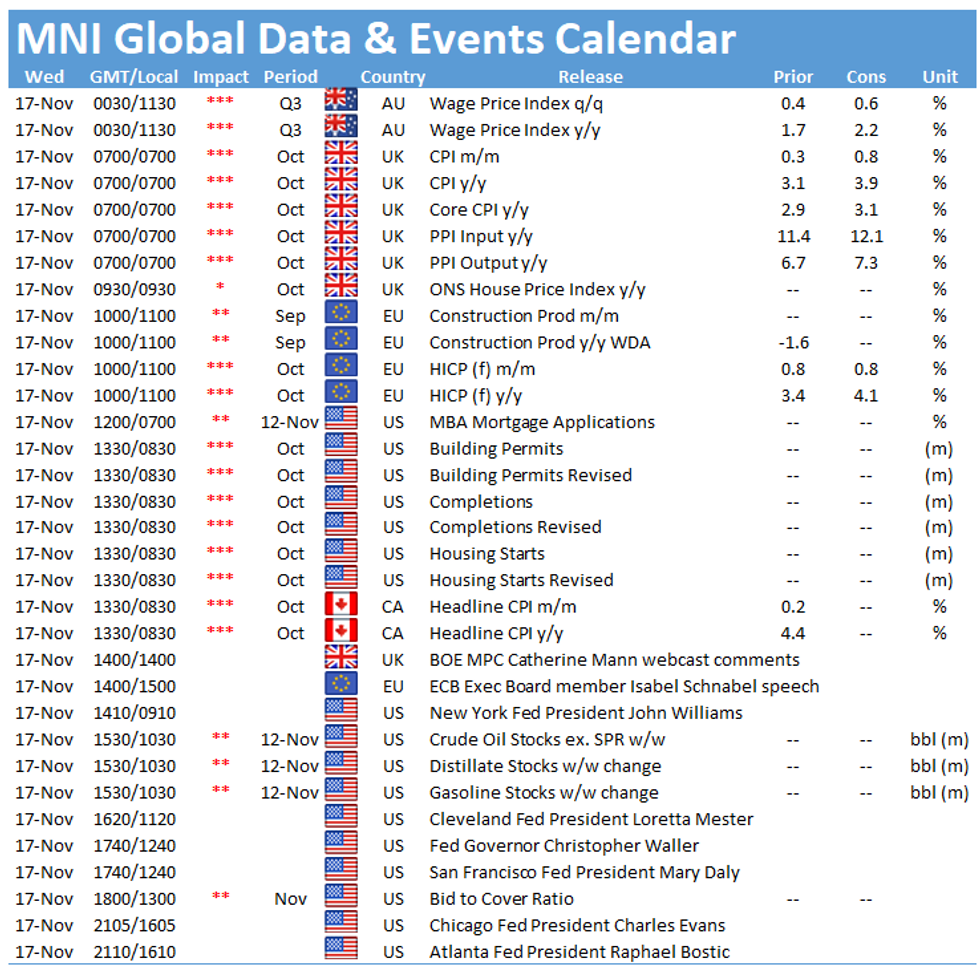

- There is a heavy slate of Fed speakers today (Williams, Bowman, Mester, Daly, Waller, Evans and Bostic)

- The Bo'e Catherine Mann and the ECB's Isabel Schnabel are also due to speak later today

NEWS

CHINA-US (BLOOMBERG): China and the world must work together to boost global economic growth, Vice President Wang Qishan said, vowing that Beijing will continue opening up more to foreign investment at a time when more countries are raising barriers over national security concerns. "China can not develop in isolation of the world and nor can the world develop without China," Wang said Wednesday at the Bloomberg New Economy Forum in Singapore. "China will not waver in its resolve to deepen reform and expand opening up."

ECB (FT): Increased "exuberance" in housing markets, junk bonds and crypto assets have created vulnerabilities that will be exposed if higher than expected inflation leads to a sharp rise in interest rates, the European Central Bank has warned. This year's rebound in the eurozone economy from the coronavirus pandemic has reduced short-term risks to the financial system, but it has also led to a build-up of longer term risks, the ECB said on Wednesday in its twice yearly financial stability review. "Concerns particularly relate to pockets of exuberance in credit, asset and housing markets as well as higher debt levels in the corporate and public sectors," the ECB said. Rising inflation and falling real interest rates have prompted investors to take greater risks in their search for yield, which has left parts of the property, debt and crypto asset markets "increasingly susceptible to corrections", it warned.

UK-EU (GUARDIAN): The Brexit minister, Lord Frost, has said suspending parts of the Northern Ireland protocol by triggering article 16 of the agreement with the EU is still a "very real option" but has indicated that he hopes a deal can be done by Christmas. He has also given assurances during a visit to Northern Ireland that the UK is not trying to move border checks and controls from the Irish Sea to the Irish border. Frost met the Democratic Unionist party (DUP) leader, Sir Jeffrey Donaldson, in Belfast on Tuesday night and will be meeting the Sinn Féin leader, Michelle O'Neill, on Wednesday morning. "We very much hope that we'll be able to bring those talks to a conclusion, that's what we would most like to do. If we can't, if they can't be in agreement, then obviously the famous article 16 is a very real option," he told BBC Good Morning Ulster.

UK (BBC): Boris Johnson will face questions from across Parliament later, as a row about MPs' second jobs continues to engulf Westminster. The PM announced plans on Tuesday to stop MPs working as political consultants, ahead of a Commons debate later. Labour wants to ban all second jobs, apart from "public service" roles or professions requiring registration. The row comes after ex-Tory MP Owen Paterson broke Commons lobbying rules. MPs will vote later on whether to back the government's or Labour's blueprint for resolving the increasingly fraught debate over outside roles. Before that, Mr Johnson will face MPs during Prime Minister's Questions at 12:00 GMT, and appear before a committee of senior MPs at 15:30.

GERMANY (BLOOMBERG): Germany's likely next ruling coalition is pushing ahead with tougher measures to tackle record increases in coronavirus cases, including requiring companies to let employees work from home where possible. The proposed law also in some cases limits access to the workplace to people who are vaccinated, recovered or provide a negative test, according to parliamentary documents published Wednesday. The Social Democrats, Greens and Free Democrats aim to use their Bundestag majority to get it through the lower house of parliament on Thursday. The law is designed to provide a nationwide framework while giving regions room to tighten restrictions in coronavirus hot spots where needed. Olaf Scholz, who is aiming to be sworn in to replace Angela Merkel as chancellor early next month, has described it as an effort to "winter proof" Germany against the disease and prevent hospitals becoming overloaded.

DATA

MNI: UK Oct OUTPUT PPI +1.1% M/M, +8.1% Y/Y

MNI: UK Oct CPI +1.1% M/M, +4.2% Y/Y

EZ SEP CONS OUTPUT +0.9% M/M, +1.5% Y/Y; AUG -1.4%r M/M

EZ OCT FINAL HICP +0.8% M/M, +4.1% Y/Y; SEP +3.4% Y/Y

FIXED INCOME: Gilts take centre stage

- In what has been a relatively stable European morning session for Treasuries and Bunds, gilts have taken centre stage.

- Gilts sold off at the open with the curve shifting around 1.0bp after a stronger than expected CPI print combined with yesterday's positive payroll market report. However, the market seems to be taking a bit of a breather with the short sterling strip (which had been 3-4 ticks lower on the day through Reds and Greens on the open, now around 3-4 ticks higher on the day. A December hike is still almost fully priced while a February hike is still also heavily priced.

- Looking ahead, the calendar is fairly light with the highlights being central bank speakers: ECB's Schnabel, Fed's Williams, Mester, Daly, Waller, Evans and Bostic and BOE's Mann are all scheduled. On the data front we have US housing data.

- TY1 futures are up 0-01 today at 130-06+ with 10y UST yields down -0.7bp at 1.628% and 2y yields down -0.3bp at 0.516%.

- Bund futures are up 0.13 today at 170.90 with 10y Bund yields down -1.0bp at -0.254% and Schatz yields down -0.6bp at -0.832%.

- Gilt futures are down -0.01 today at 125.80 with 10y yields down -1.6bp at 0.972% and 2y yields down -2.5bp at 0.574%.

FOREX: EUR/USD Losses Accelerate, Shows Below 1.13

- Single currency weakness played out further overnight, with EUR/CHF slipping sharply amid thin Asia-Pac trade. Stop-loss selling and option related flow was cited behind the move that drove the cross to 1.0508 - a fresh YTD low, narrowing the gap with major support at May 2020's 1.0505.

- EUR/USD breaking through the 1.13 handle added to the downside pressure. CHF has slipped off the overnight highs since, with the currency among the weakest in G10 headed into the US crossover. The price action will raise focus on the SNB's FX policy, with markets looking to gauge the bank's tolerance levels for the CHF rate.

- Elsewhere, AUD trades poorly, with AUD/USD showing through last week's lows as markets responded to wage index data overnight, which showed pay growth well shy of the RBA's cited 3% requirement for rate hikes. Wages grew at a pace of 2.2% - alongside expectations.

- Canadian CPI and US housing data take focus going forward. Canada's inflation report is seen showing core metrics inching higher still, although trimmed core CPI is seen holding at 3.4%. On the speaker slate, BoE's Mann, ECB's Schnabel and Fed's Williams, Bowman, Daly and Evans are all on the docket.

FX OPTION EXPIRY

- EURUSD: 1.1280 (474mln), 1.1300 (296mln), 1.1360 (219mln), 1.1390 (964mln)

- USDJPY: 114.70 (215mln), 115.00 (608mln).

- USDCAD: 1.2500 (551mln), 1.2525 (560mln), 1.2550 (275mln)

- AUDUSD; 0.7300 (984mln)

- USDCNY: 6.38 (420mln), 6.40 (376mln)

EQUITIES: Mixed moves in European/US markets

- Japan's NIKKEI down 119.79 pts or -0.40% at 29688.33 and the TOPIX down 12.49 pts or -0.61% at 2038.34

- China's SHANGHAI closed up 15.579 pts or +0.44% at 3537.366 and the HANG SENG ended 63.7 pts lower or -0.25% at 25650.08

- German Dax up 19.51 pts or +0.12% at 16267.16, FTSE 100 down 18.18 pts or -0.25% at 7308.47, CAC 40 up 8.46 pts or +0.12% at 7160.93 and Euro Stoxx 50 up 1.31 pts or +0.03% at 4402.96.

- Dow Jones mini down 5 pts or -0.01% at 36058, S&P 500 mini down 1 pts or -0.02% at 4695.5, NASDAQ mini up 17 pts or +0.1% at 16320.

COMMODITIES: Natgas lower, reversing some of the recent rally

- WTI Crude down $0.78 or -0.97% at $80.15

- Natural Gas down $0.12 or -2.34% at $5.06

- Gold spot up $10.24 or +0.55% at $1859.71

- Copper down $5.25 or -1.2% at $431.45

- Silver up $0.26 or +1.05% at $25.087

- Platinum up $5.59 or +0.52% at $1071.34

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.