-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gilts lead FI lower

HIGHLIGHTS:

- Fixed income moves lower, led by gilts.

- European natgas off of yesterday's highs despite other commodities moving higher.

- USD underperforming in G10 FX.

US TSYS SUMMARY: Treasury Sell-Off Resumed

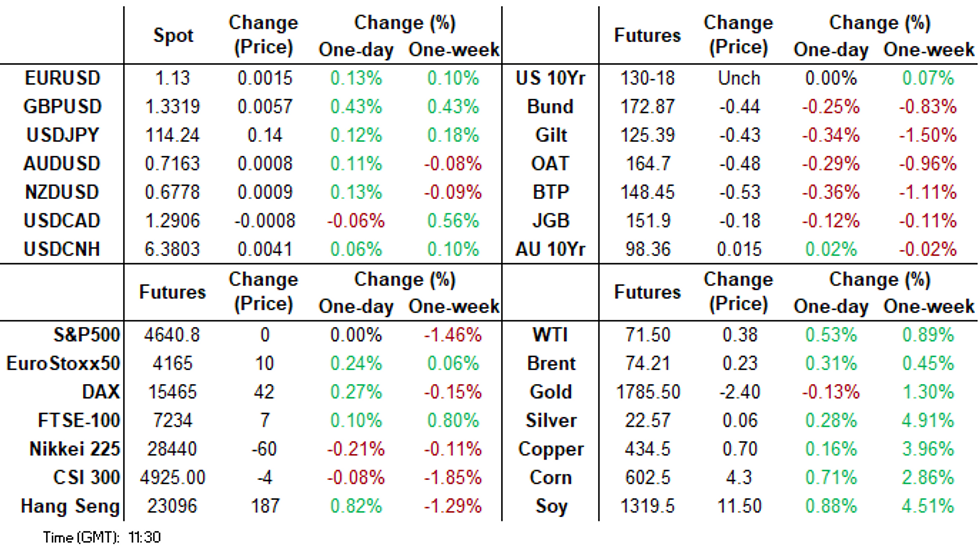

- Cash Tsys have resumed their sell-off after rallying late yesterday on the strong 20Y auction, even if flat S&P E-Minis and a relative small uptick in oil suggest risk-on moves elsewhere are more muted.

- 2Y yields are +1.4bps at 0.679%, 5Y +2.1bps at 1.237%, 10Y +2.1bps at 1.482% and 30Y +2.4bps at 1.887%.

- In 10Y space, the US lags Europe on the day with Gilts +4.4bps and Bunds +3.5bps.

- TYH2 futures have sold off to a low of 130-17, which is also back to yesterday’s session low prior to the 20Y auction results, on low volumes.

- Data releases include the third print of Q3 GDP (0830ET) before the Conference Board consumer survey for Dec and existing home sales for Nov (1000ET). No Fedspeak.

- NY Fed buy-op: Tsy 10Y-22.5Y, appr $1.625B (1030ET).

- US Tsy $17B 5Y TIPS auction re-open (1300ET).

EGB / GILTS: Risk-on and inflation expectations the drivers

A combination of risk-on sentiment (on hopes of Omicron developments) and higher inflation expectations (with European gas prices still close to yesterdays highs - despite being lower intraday) have helped EGBs/gilts lower.

- Gilts are the biggest movers, with the curve moving in a fairly parallel fashion as yields rise just under 5bp. SONIA futures have seen Whites move up to 3 ticks lower on the day (up to 9 tick 2-day move), Reds move 4.5-5.5 ticks lower on the day (11.5-15.0 tick 2-day move) and Greens/Reds 5.5-6.5 ticks lower on the day (16.5-19.5 tick 2-day move).

- The Independent Office for Police Conduct will decide today whether to conduct an investigation into the Downing Street parties as soon as today (after the Cabinet Office has concluded its investigation). Boris Johnson has moved to new all-time lows in the polls as the fallout continues.

- The German curve has bear steepened, with Euribor futures a little lower on the day (Greens/Blues down 8-10 ticks over 2 days now). 10-year yields are up 3.3bp while BTP-Bund 10-year spreads are 1.7bp wider on the day.

EUROPE OPTION FLOW SUMMARY

- ERZ2 100.375/100.25/100.125p fly bought for 1 in 2.5k

- 0RH2 100.125/100.25/100.50 c fly bought for 0.75 in 1.5k

FOREX: NOK leads in G10s

- USD is mixed so far today, during our early European morning trading session.

- Early mover was the GBP, with a small bid emerging.

- Cable tested session high, albeit well within the last few session's ranges, and by just a few pips.

- Cable sees small resistance moving down to 1.3308 initially, printed 1.3320 high, at the time of typing. Our technical analyst sees the next resistance at 1.3374.

- The Pound trades in the green against all G10s, besides the NOK.

- NOK has extended gains, with a broader base bid going through.

- The currency is up against all the majors and test session high against USD, EUR, JPY. USDNOK eyes the December low and lowest level since mid November at 8.8624 next.

- Looking ahead, sees US 3rd GDP reading

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000-02(E1.5bln), $1.2070-75(E538mln), $1.2100(E1.1bln), $1.2120-25(E814mln-EUR puts), $1.2150-55(E1.4bln-EUR puts), $1.2200(E2.3bln), $1.2225-35(E903mln-EUR puts), $1.2250(E410mln-EUR puts), $1.2275(E477mln-EUR puts), $1.2300-10(E1.0bln)

USD/JPY: Y103.00($1.2bln-USD puts), Y103.50-60($1.1bln), Y103.70-90($1.2bln), Y104.00($550mln), Y104.20-40($639mln), Y105.00-05($807mln)

EUR/JPY: Y127.10(E598mln-EUR puts)

EUR/GBP: Gbp0.9000-10(E670mln-EUR puts)

USD/NOK: Nok8.75($695mln-USD puts)

AUD/USD: $0.7440-50(A$1.1bln), $0.7500(A$630mln-AUD puts), $0.7530-50(A$711mln-AUD puts), $0.7570-80(A$1.4bln-AUD puts)

USD/CNY: Cny6.50($1.1bln-USD puts), Cny6.55($536mln-USD puts), Cny6.65($560mln-USD puts)

USD/MXN: Mxn19.50($673mln), Mxn20.00($1.3bln-USD puts), Mxn20.50($535mln)

Price Signal Summary - Bund and Gilt Futures Head South

- In the equity space, S&P E-minis remain vulnerable despite the recovery from Monday’s low. The sell-off late last week and earlier this week, signals potential for a deeper pullback. A resumption of weakness would open 4485.75, the Dec 3 low. Watch resistance at 4668.00, the Dec 17 high. EUROSTOXX 50 futures remain vulnerable too, having failed to hold onto last week’s high of 4234.00 on Dec 16 and despite the recent recovery. Monday’s bearish pressure has exposed the key support handle at 3980.00, the Nov 30 low and the bear trigger. On the upside, a clear break of the 20-day, at 4170.20, that has been probed would ease bearish pressure

- In FX, EURUSD is still trading sideways. The pair remains below resistance at 1.1383, Nov 30 high where a break is required to signal potential for a stronger recovery. Support to watch lies at 1.1222, Dec 15 low and 1.1186, Nov 24 low. The latter is a key support and the bear trigger. GBPUSD failed to hold onto last week’s high of 1.3374 on Dec 16. The reversal lower highlights a potential resumption of the underlying downtrend and attention is on support at 1.3163, the Dec 8 low and the bear trigger. The USDJPY near-term directional triggers are; 114.26, the Dec 15 high and 113.14, Friday’s low. The resistance at 114.26 has been breached this morning and this opens 114.38 next, the 61.8% retracement of the Nov 24 - 30 downleg. The 76.4% level is at 114.81.

- On the commodity front, last week’s channel break in Gold appears to have been a false one and the strong recovery from last week’s low of $1753.7, Dec 15 low suggests the yellow metal is reversing its recent downtrend. Watch resistance at $1815.6, the Nov 26 high. A breach would strengthen bullish conditions. Support is at $1772.2, the channel base. WTI futures traded lower Monday and despite the rebound from that day’s low, the contract remains vulnerable. A resumption of weakness would open $65.45, the Dec 6 low and more importantly expose key support at $62.26, the Dec 2 low. Key near-term resistance is seen at $73.13, the Dec 9 high and is just above the 50-day EMA at $73.06.

- In the FI space, Bund futures have breached support at 173.40, the Dec 8 low. This also means that the price is trading back below the 20-day EMA. The break suggests scope for a deeper short-term pullback and has opened 172.70, the Nov 26 low. Gilts yesterday breached support at 126.34, Dec 16 low and the contract is trading below its 20-day EMA. The break lower places on hold a recent bullish focus and instead opens 124.94, the Nov 25 high and a gap low on the daily chart.

EQUITIES: Mixed moves this morning

- Japan's NIKKEI up 44.62 pts or +0.16% at 28562.21 and the TOPIX up 1.72 pts or +0.09% at 1971.51

- China's SHANGHAI closed down 2.507 pts or -0.07% at 3622.618 and the HANG SENG ended 131 pts higher or +0.57% at 23102.33

- German Dax up 31.29 pts or +0.2% at 15479.72, FTSE 100 down 2.93 pts or -0.04% at 7294.43, CAC 40 up 13.23 pts or +0.19% at 6978.22 and Euro Stoxx 50 up 10 pts or +0.24% at 4184.99.

- Dow Jones mini up 30 pts or +0.08% at 35404, S&P 500 mini down 1 pts or -0.02% at 4639.75, NASDAQ mini down 26.25 pts or -0.16% at 15953.

COMMODITIES: European natgas off its highs, but most other commodities higher

- WTI Crude up $0.4 or +0.56% at $71.44

- Natural Gas (NYM) up $0.03 or +0.88% at $3.909

- Natural Gas (ICE Dutch TTF) down $2.77 or -1.53% at $176.7

- Gold spot down $0.2 or -0.01% at $1790.03

- Copper up $3.5 or +0.81% at $437.85

- Silver up $0.09 or +0.41% at $22.6181

- Platinum up $2.88 or +0.31% at $941.19

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2021 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 22/12/2021 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2021 | 1500/1000 | *** |  | US | NAR existing home sales |

| 22/12/2021 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 22/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/12/2021 | 0800/0900 | *** |  | ES | GDP (f) |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 23/12/2021 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/12/2021 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/12/2021 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2021 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2021 | 1330/0830 | * |  | CA | Payroll employment |

| 23/12/2021 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/12/2021 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2021 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/12/2021 | 1500/1000 | *** |  | US | new home sales |

| 23/12/2021 | 1500/1000 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/12/2021 | 1500/1000 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/12/2021 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/12/2021 | 2130/1630 | ** |  | US | Fed Weekly Money Supply Data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.