-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Bunds leading FI Higher

Highlights:

Core fixed income moves higher, led by the German curve.

Highlights of the data calendar are ECB Accounts and US existing home sales.

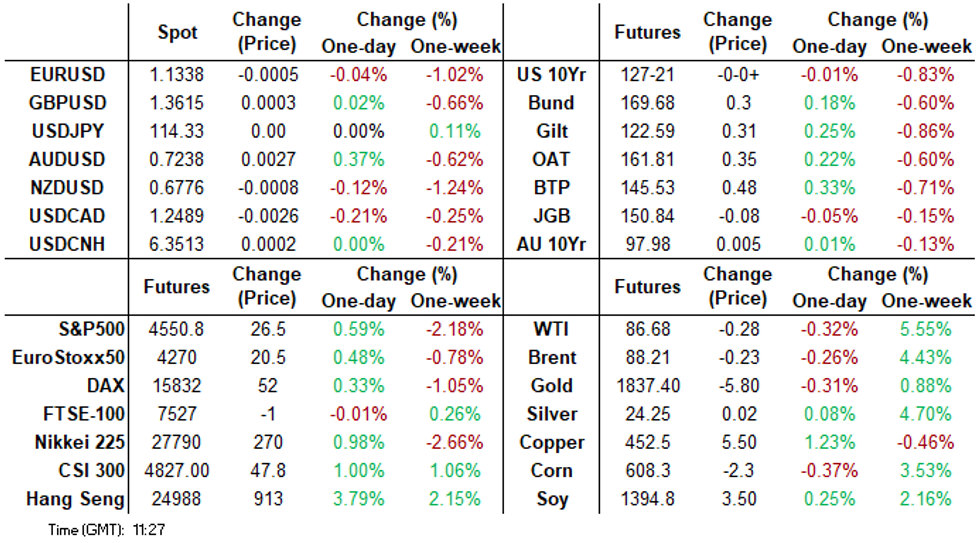

US TSYS SUMMARY: Treasury Rally Resumes

- Cash Tsys have rallied this morning after doing so for much of yesterday’s US session before a late reversal, after most of the curve saw new post-pandemic highs early yesterday.

- 2Y yields are -2.4ps at 1.033%, 5Y -3.0bps at 1.618%, 10Y -3.2bps at 1.833% and 30Y -2.9bps at 2.147%.

- TYH2 is back towards both session and yesterday’s highs at 127-21 on more typical volumes after two solid days. Resistance is seen at 128-01+ (Jan 18 high) and support at 127-02 (Jan 19 low).

- Data: jobless claims for a payrolls survey week, Philly Fed for Jan (of note after a surprisingly weak Empire on Tue) and existing home sales for Dec.

- NY Fed buy-op: Tsy 10Y-22.5Y, appr $1.625B steady (1030ET).

- Issuance: US Tsy $50B 4W, $40B 8W bill auctions (1120ET) before US Tsy $16B 10Y TIPS auction (1300ET).

EGB/GILT SUMMARY: BTP catches up with Bund

- Bund, Gilt, are at session high, initially led by Germany, as desk defend the 0% 10yr yield and following a Dovish Lagarde earlier.

- Move in Bund, push the Tnotes/Bund 2.3bps tighter and Gilt/Bund so far just 0.4bp.

- Italy has since caught up and is up 49 ticks vs 32 ticks in Bund.

- BTP/Bund is 1.7bps wider.

- With investors and traders pricing a more punchy, aggressive Rate hike outlook for the UK.

- The Gilt/Bund spread still trade at widest levels since October.

- Further widening would target the October high at 130.763, which was the widest level since May 2016.

- Mar Bund futures (RX) up 33 ticks at 169.71 (L: 169.21 / H: 169.8)

- Germany: The 2-Yr yield is down 0.5bps at -0.575%, 5-Yr is up 4bps at -0.301%, 10-Yr is down 1.4bps at -0.026%, and 30-Yr is down 2bps at 0.273%.

- Mar Gilt futures (G) up 27 ticks at 122.55 (L: 122.24 / H: 122.67)

- UK: The 2-Yr yield is down 0.2bps at 0.906%, 5-Yr is down 0.5bps at 1.052%, 10-Yr is down 2bps at 1.236%, and 30-Yr is down 2.2bps at 1.35%.

- Mar BTP futures (IK) up 50 ticks at 145.55 (L: 144.93 / H: 145.61)

- Mar OAT futures (OA) up 36 ticks at 161.82 (L: 161.27 / H: 161.89)

- Italian BTP spread down 1.7bps at 133.4bps

- Spanish bond spread down 0.5bps at 69.2bps

- Portuguese PGB spread down 0.7bps at 61.7bps

- Greek bond spread down 0.1bps at 174.2bps

EUROPE ISSUANCE UPDATE

Spain 5-year Bono / 8y/20y Obli

E2.157bln 0% Jan-27 Bono, Avg yield 0.088% (prev -0.11%), bid-to-cover 1.63x (prev 1.62x)

E1.386bln 0.50% Apr-30 Obli, Avg yield 0.429% (prev 0.55%), bid-to-cover 1.91x (prev 1.44x)

E1.177bln 0% 1.20% Oct-40 Obli, Avg yield 1.21% (prev 1.14%), bid-to-cover 1.73x (prev 1.68x)

France MT OATs:

E4.397bln 0% Feb-25 OAT, Avg yield -0.35% (prev -0.69%), bid-to-cover 3.25x (prev 2.86x)

E3.962bln 0% Feb-27 OAT, Avg yield -0.15% (prev -0.37%), bid-to-cover 2.32x (prev 2.56x)

E2.138bln 0% Nov-28 OAT, Avg yield -0.01%% (prev -0.30%), bid-to-cover 2.92x (prev 2.73x)

France Linkers:

E684mln 0.10% Mar-26 OATei, Avg yield -2.08% (prev -2.38%), bid-to-cover 3.03x (prev 3.41x)

E602mln 0.10% Jul-31 OATei, Avg yield -1.50% (prev -1.68%), bid-to-cover 2.81x (prev 2.40x)

E460mln 0.10% Mar-32 OATi, Avg yield -1.33% (prev -1.41%), bid-to-cover 2.87x (prev 3.36x)

OPTION FLOW SUMMARY

RXH2 172c, bought for 24 in 3

DUH2 111.80/111.60ps, bought for 2.75 in 5k

0NH2 98.90/98.70/98.50 put ladder sold at 7.25 in 5k0NK2 98.40/98.20 ps vs 98.90c, bought the ps for 2 in 6k

SFIK2 99.00/99.10/99.20/99.30c condor, bought for 3 in 1.5k

Week4 TY (expiry 28th, Fed is on the 26th) 126.5/126ps, bought for 3 in 10k (7% del)

FOREX: USD trends in the red in early Europe

- A steady start for FX during the morning European session.

- USD is overall offered and a touch in the red against most G10s.

- The Greenback is holding onto small gains versus the NOK and NZD.

- Most pairs trade with this week's ranges, EUR and GBP were underpinned earlier, a function of the USD, and Omicron outlook for Europe and the UK, with countries starting to fully re-open, is keeping the EUR and the Pound underpinned.

- Nonetheless, EUR still trades in a 28 pip range and has lost some of the upside momentum, after a Dovish comments from ECB Lagarde during a French radio interview, pouring cold water on a 2022 hike.

- AUD is the best early performer versus the USD in G10, albeit just up 0.37%, after pairing overnight gains.

- AUD tested another session high against the Yen.

- Resistance in the latter is seen at this week's high at 82.963.

- Looking ahead, we have no tier 1 data left for the session.

- Worth an option expiry note, with EURUSD seeing 5.84bn between 1.1300/1.1400 for today.

FX OPRTIONS: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E997mln), $1.1280-90(E1.1bln), $1.1300-15(E3.8bln), $1.1345-58(E2.2bln), $1.1400-10(E635mln), $1.1450(E1.1bln)

- USD/JPY: Y114.00-20($1.4bln), Y114.65-75($674mln)

- GBP/USD: $1.3750-70Gbp632mln)

- AUD/USD: $0.7260-70(A$526mln)

Price Signal Summary - Gold Clears Resistance

- In the equity space, S&P E-minis traded lower again yesterday. This week’s sell-off has resulted in a break of support at 4572.75, the Jan 10 low. This once again highlights the developing bearish risk and exposes 4520.25, the Dec 20 low (probed) and the next key support at 4485.75, Dec 3 low. EUROSTOXX 50 futures briefly probed support at 4216.50 yesterday, the Jan 10 low. This level has held for now and support has again surfaced below the 50-day EMA. Weakness below 4212.00, Jan 19 low, would trigger a resumption of bearish pressure. Key near-term resistance to watch is at 4324.50, Jan 13 high.

- In FX, this week’s sell-off in EURUSD has resulted in a breach of the 20- and 50-day EMAs. The sell-off threatens the recent bullish theme and suggests that at this stage, last week’s range and bear channel breakout appears to have been a false one. Further weakness would expose 1.1272, the Jan 4 low. GBPUSD trend conditions remain bullish. Attention is on the 200-dma, at 1.3735. This average has been probed, a clear break would open 1.3835, Oct 20 high. Support to watch is at 1.3553, the 20-day EMA. USDJPY remains above Friday's low of 113.49. The Jan 14 doji candle pattern continues to highlight a reversal and signals the end of the recent corrective pullback. A resumption of gains would open 115.68, Jan 11 high. Sub 113.49 levels would be bearish.

- On the commodity front, Gold traded sharply higher yesterday. This has resulted in a break of resistance at $1831.9, Jan 3 high and a bull trigger. The break reinforces bullish conditions following the recent recovery from the base of its bull channel drawn from the Aug 9, 2021 low. Attention is on $1848.0 next, 76.4% retracement of the Nov 16 - Dec 15 downleg. WTI futures remain in an uptrend and the contract traded higher once again yesterday. The focus is on $87.47, 2.00 projection of the Dec 2 - 9 - 20 price swing.

- In the FI space, Bund futures remain vulnerable. The focus is on 168.31, the Nov 2 low (cont). Gilts remain in a downtrend. This week’s move lower has resulted in a break of former support at 122.78, Jan 10 low. This confirms a resumption of the underlying downtrend. The focus is 121.61, the Nov 13 2018 low on the continuation chart.

Generally Higher Across the Board

- Japan's NIKKEI up 305.7 pts or +1.11% at 27772.93 and the TOPIX up 18.81 pts or +0.98% at 1938.53

- China's SHANGHAI closed down 3.117 pts or -0.09% at 3555.063 and the HANG SENG ended 824.5 pts higher or +3.42% at 24952.35

- German Dax up 27.66 pts or +0.18% at 15845.91, FTSE 100 down 4.84 pts or -0.06% at 7584.24, CAC 40 down 3.94 pts or -0.05% at 7166.08 and Euro Stoxx 50 up 11.92 pts or +0.28% at 4282.57.

- Dow Jones mini up 157 pts or +0.45% at 35081, S&P 500 mini up 24 pts or +0.53% at 4550.25, NASDAQ mini up 133.5 pts or +0.89% at 15175.75.

Platinum and copper pushing things higher

- WTI Crude down $0.28 or -0.32% at $86.68

- Natural Gas (NYM) down $0.02 or -0.37% at $4.022

- Natural Gas (ICE Dutch TTF) up $0.25 or +0.33% at $74.2

- Gold spot down $2.46 or -0.13% at $1837.38

- Copper up $5.4 or +1.21% at $452.45

- Silver up $0.08 or +0.35% at $24.2135

- Platinum up $24.98 or +2.43% at $1051.79

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

| 21/01/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/01/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.