-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US OPEN: Equity Weakness Resumes

EXECUTIVE SUMMARY:

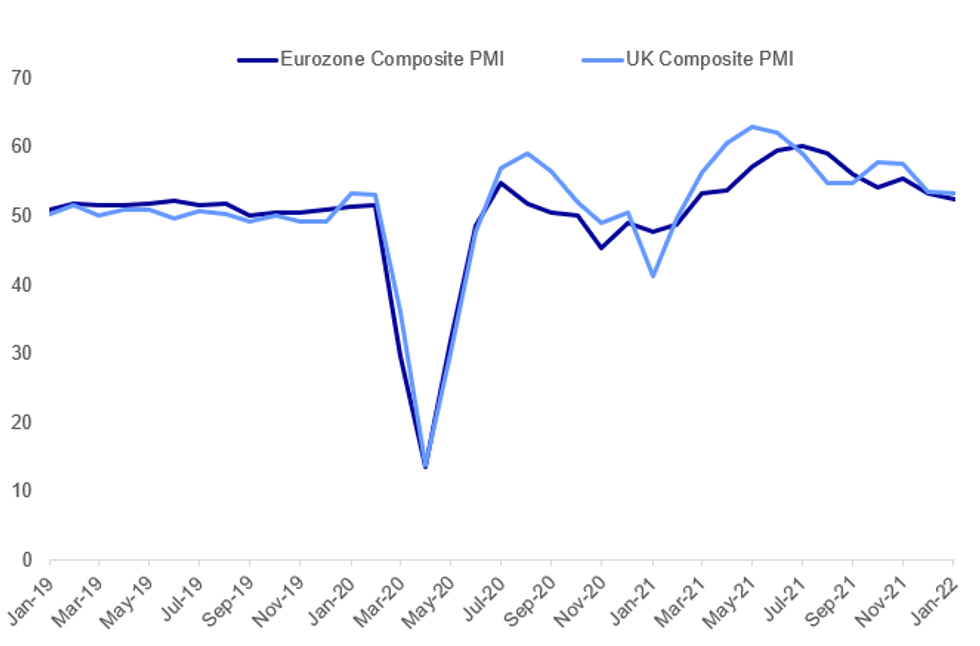

- EUROPEAN PRELIM PMI READINGS DISAPPOINT IN JANUARY

- NATO: FORCES ON STANDBY, MORE SHIPS/JETS TO EASTERN EUROPE

- ITALY PRESIDENTIAL ELECTION BEGINS TODAY, WITH DRAGHI FAVORITE

Fig. 1: European Flash Jan PMIs Disappoint

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

RUSSIA-UKRAINE/NATO: A NATO statement has confirmed that NATO allies are putting forces on standby, and that ships and jets are being sent to NATO deployments amidst a continued heightening of tensions on the Russo-Ukrainian border. NATO Secretary General Jens Stoltenberg: "I welcome Allies contributingadditional forces to NATO. NATO will continue to take all necessary measuresto protect and defend all Allies, including by reinforcing the eastern partof the Alliance. We will always respond to any deterioration of our securityenvironment, including through strengthening our collective defence."

ITALY POLITICS: The process to elect the next Italian president gets underway today, with deputies, senators, and regional representatives gathering in Rome to decide on Sergio Mattarella's successor. Prime Minister Mario Draghi is favourite to win through the electoral process, well known for back-room dealings and horse-trading between parties and factions. Over the weekend, former Prime Minister Silvio Berlusconi withdrew his name from consideration, with speculation that he had been admitted to hospital.

GAS / RUSSIA / EUROPE (BBG): European natural gas rose for a second session as the risk of conflict over Ukraine increased, threatening supplies in the region.Benchmark futures jumped as much as 8%. Russian flows to Europe could be curtailed for “an indefinite period” if the nation’s Nord Stream 2 pipeline project to Germany is hit by sanctions as a result of escalating tensions over Ukraine, according to Goldman Sachs Group Inc. Prices may also reach fresh records, the bank said in a note.

OIL/ MIDDLE EAST (BBG): Yemen’s Iranian-backed Houthi group targeted the United Arab Emirates on Monday for the second time in a week, raising concerns of an escalation in the oil-exporting region even as the Gulf nation said it had intercepted the strike. Oil gained, remaining near the highest levels since 2014 as geopolitical tensions and the prospect of improving demand pushed crude to five straight weekly gains. Brent crude traded near $90 a barrel on Monday after reports of the attack.

ECB (BBG): Eurozone inflation still forecast to remain above 2% this year before settling below the 2% target in 2023, 2024, Irish central bank governor Gabriel Makhlouf says in speech at the Institute of Directors. Says risks to Irish inflation forecasts judged to be on upside; will remain above pre-pandemic levels

UK POLITICS (BBG): Prime Minister Boris Johnson’s Cabinet is considering delaying a 12-billion-pound ($16 billion) rise in national insurance amid concerns about the rising cost of living in the U.K., the Daily Mail reported on Monday.The paper quoted an unnamed Cabinet minister saying the whole of Johnson’s top team would back delaying the 1.25% rise in the payroll tax due to come into effect in April. That’s a crunch month for Britons as energy bills are also due to increase, as wider inflation touches its highest level in a decade.

COVID VACCINES (BBG): A fourth vaccine dose for older adults leaves them better protected against coronavirus infection than peers who received three shots, a study released by Israel’s health ministry found. The preliminary analysis compares data from about 400,000 people aged 60 and over who received a fourth dose in January and some 600,000 people in the same age group who got only three doses -- with the third shot administered four months or more previously. The researchers found that those who had the fourth dose had twice the protection from infection as the others, and at least three times the protection from severe illness.

DATA:

FRANCE FLASH JAN SERVICES PMI 53.1; DEC 57.0

France Services/Composite disappoint by 2 points, manuf in line

Manufacturing PMI largely in line but composite and services PMIs miss by 2 points. Inflationary pressures are still accelerating. Growth is continuing but starting to slow, albeit where there is growth it seems to be linked to better demand conditions. Most of the details seem to back up the headline in this print. Highlights from the press release:

- On inflation: "Overall input costs rose at the fastest rate since October 2004, reflecting greater expenses relating to staff, transport, energy and a wide array of raw materials. In response, selling charges were raised to the quickest extent since records began in October 2002."

- "Latest survey data showed economic activity rising at a slower rate at the beginning of 2022, with combined manufacturing and service sector output growth easing to a nine-month low."

- "Where an increase in activity was reported, this was often linked to better demand conditions. That said, output was hindered by staff shortages, according to firms"

- "Overall new orders at private sector firms in France increased during January. The upturn in sales was also broad-based across both manufacturing and services, but the rate of expansion eased in both cases."

GERMANY FLASH JAN SERVICES PMI 52.2; DEC 48.7

Big beats for German PMIs

Manufacturing 3.5 points higher than expected at 60.5 (highest since August), services 4.2 points better than expected at 52.2 (close to October/November levels) and copositive 4.9 points better at 54.3 (highest since September). Some divergence in confidence between manufacturing and services while inflationary pressures were not as high as some other recent months.

- "The goods-producing sector drove a renewed increase in new orders at the start of the year. Overall inflows of new business showed the strongest rise since last September "

- "New export business received by services firms continued to fall, however, hinting that the upturn here was driven by the domestic market."

- In manufacturing "growth projections for the year ahead were the most positive since last June, reflecting easing supply-chain concerns and hopes of stronger demand as the Omicron wave of COVID-19 subsides. Service sector expectations meanwhile ticked down slightly from December’s four-month high but remained comfortably above the long-run average."

- On inflation: "Input cost inflation ticked up fractionally in January and was among the fastest on record (exceeded only by those in June, August, October and November last year)"

- "The rate of inflation in January was second only to that recorded in November last year. Indeed, both monitored sectors saw faster increases in charges, with goods prices continuing to rise particularly sharply."

EUROZONE FLASH JAN SERVICES PMI 51.2; DEC 53.1

Pan Eurozone-PMI also disappoints

Services disappoint 0.8 points, manufacturing beat by 1.5 points and composite disappoints by 0.4 points. The latter moving to an 11-month low while services are at a 9-month low. This report seems more in line with the disappointing French report than the more upbeat German report. Highlights from the press release:

- "Tourism and recreation activity consequently fell at a rate not seen since last February, with transportation and media work also in decline. However, many other business service providers and financial services firms continued to report solid growth, being less affected by the Omicron wave than consumer-facing industries"

- "The survey gauge of new orders signalled a further expansion of demand, albeit at the slowest rate since the upturn began last March. While new orders for goods increased to the greatest extent since last August, inflows of new business into the service sector slowed to near-stagnation"

- Inflation: "A new record was seen in the service sector as costs were driven higher by energy and wage costs. Prices charged for goods leaving the factory gate also rose at an increased rate, just shy of November’s survey high, though an easing in manufacturers’ input price inflation to the lowest since last April was also reported, linked in part to the alleviating supply crunch."

UK FLASH JAN SERVICES PMI 53.3; DEC 53.6

FIXED INCOME: Ukraine and poor Eurozone PMIs push core FI higher

We have seen bull flattening in core fixed income through the European session driven by a combination of Ukraine concerns and disappointing French and Eurozone PMIs. Gilts have been the outperformers on the day overall with the biggest flattening seen in USTs where the 2-year yields are now largely unchanged on the day.

- Looking ahead there is only really the US PMI to look for today with markets already looking towards Wednesday's FOMC meeting.

- TY1 futures are up 0-5+ today at 128-15+ with 10y UST yields down -3.5bp at 1.725% and 2y yields up 0.1bp at 1.006%.

- Bund futures are up 0.50 today at 170.79 with 10y Bund yields down -3.3bp at -0.100% and Schatz yields down -2.2bp at -0.647%.

- Gilt futures are up 0.36 today at 123.57 with 10y yields down -4.3bp at 1.126% and 2y yields down -2.2bp at 0.854%.

FOREX: Risk-Off Keeps Last Week's USD Index High Under Pressure

- The negative close of Wall Street Friday has fed through into Monday's NY crossover, with index futures again pointing lower and indicating more near-term pain for equity longs. The price action has favoured haven currencies so far, with the greenback, CHF and JPY the early beneficiaries.

- The nearing Fed meeting remains the focal point for markets, with outside expectations that the FOMC will shift to a focus on quantitative tightening as soon as this Wednesday. This has kept the USD Index close to last week's highs, narrowing in on first major resistance at the 96.02 50-dma, a break above which would open gains toward YTD highs of 96.462.

- The outperformance in the CHF puts the EUR/CHF cross at new cycle lows of 1.0318 and the lowest level since mid-2015, with 1.0315 and 1.0296 the next levels to watch. Markets will continue to speculate over the involvement of the SNB at these levels, which may look to smooth any erratic declines.

- Risk off trades puts growth and commodity-tied currencies at the bottom of the pile, with AUD, NOK and NZD among the session's poorest performers.

- Preliminary US PMI data takes focus going forward, with markets expecting both the manufacturing and services metrics to decelerate from the prior. There are no major central bank speakers, with the FOMC remaining in their pre-meeting media blackout period.

EQUITIES: US Futures Erase Overnight Bounce

- Asian markets closed mixed: Japan's NIKKEI closed up 66.11 pts or +0.24% at 27588.37 and the TOPIX ended 2.69 pts higher or +0.14% at 1929.87. China's SHANGHAI closed up 1.537 pts or +0.04% at 3524.105 and the HANG SENG ended 309.09 pts lower or -1.24% at 24656.46.

- European equities are sharply lower, with the German Dax down 230.54 pts or -1.48% at 15377.79, FTSE 100 down 51.2 pts or -0.68% at 7442.95, CAC 40 down 94.61 pts or -1.34% at 6974.98 and Euro Stoxx 50 down 74.88 pts or -1.77% at 4154.55.

- U.S. futures had a nascent bounce vs Friday's losses in the overnight session early Monday but have given up those gains: Dow Jones mini up 10 pts or +0.03% at 34168, S&P 500 mini down 1 pts or -0.02% at 4389, NASDAQ mini down 19 pts or -0.13% at 14407.5.

COMMODITIES: Copper Weaker Amid Broader Risk-Off

- WTI Crude up $0.26 or +0.31% at $85.39

- Natural Gas down $0.1 or -2.4% at $3.9

- Gold spot up $4.87 or +0.27% at $1840.13

- Copper down $5.55 or -1.23% at $446.75

- Silver down $0.14 or -0.59% at $24.1555

- Platinum up $0.9 or +0.09% at $1034.64

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/01/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 25/01/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 25/01/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 25/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/01/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/01/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 25/01/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/01/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 25/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 25/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 25/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.