-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US OPEN: Ukraine Tensions Ratchet Up Again

EXECUTIVE SUMMARY:

- UKRAINE TENSIONS RATCHET UP AGAIN AMID ALLEGATIONS OF CEASEFIRE VIOLATIONS

- ECB'S DE COS: POLICY DIRECTION CLEAR BUT PROCESS TO BE GRADUAL

- MNI HOSTING WEBINAR W ECB'S LANE TODAY

- JAPAN CUTS OVERALL ECONOMIC VIEW, SPENDING, BUT UPS CAPEX

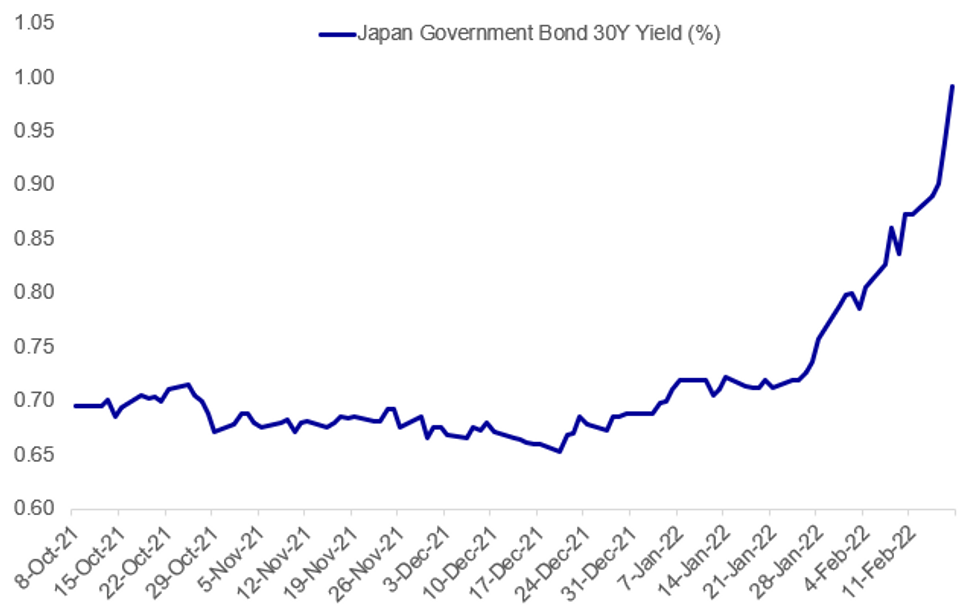

Fig. 1: The Rise And Rise Of Long-End JGB Yields

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UKRAINE (WSJ): Pro-Russian separatists and Ukrainian authorities on Thursday traded allegations of cease-fire violations along the tense front line separating the two sides, as Western officials said Moscow continued to mass troops along the border of its smaller neighbor. Representatives of two breakaway Russian-backed and Russian-armed statelets in Ukraine's eastern Donbas region, known as the Luhansk People's Republic and the Donetsk People's Republic, said Ukraine's armed forces had launched grenades and mortars into their territory. Ukraine's military said Russian-controlled forces had violated the cease-fire at eight places in the 24 hours up to 7 a.m. local time with mortars, antitank grenades and small arms. Later Thursday, Ukrainian state media said a projectile hit a kindergarten building.

UKRAINE (RTRS): Artillery shelling was heard on Thursday near Donetsk airport and Elenovka, a village in Donetsk province, both parts of eastern Ukraine controlled by Russian-backed rebels, a witness told Reuters. Fuelling Russia-West tensions over Ukraine, the rebels and Ukrainian government forces accused each other of violating ceasefire agreements on Thursday and using heavy weaponry including mortars and artillery.

UKRAINE (BBG): Kindergarten in Stanytsya Luhanska town in Luhansk region was hit by separatist shelling, Ukrainian United Forces Operation says in statement on Facebook. Two civilians were concussed by shelling; half of town suffered power cut. Town in Ukraine’s east is controlled by government, but near areas held by separatists. Separately, Ukrainian railway company Ukrzaliznytsia says its depot in Luhansk was hit by separatist artillery; no casualties, as per preliminary information. No immediate comment was available from the separatist groups.

RUSSIA-US (RTRS): Russia will send a reply to the United States on the issue of security guarantees on Thursday, the TASS news agency quoted Russian Foreign Minister Sergei Lavrov as saying. Moscow will make the letter public, Lavrov said. Russia has demanded that Ukraine not be allowed to join NATO, something that Washington and Brussels have so far refused to promise.

RUSSIA-NATO (AP): NATO allies accused Russia of misleading the world by saying it was returning some troops to bases, reporting that Moscow has instead added as many as 7,000 more forces near its tense border with Ukraine. The alliance warned Thursday that the buildup has only strengthened its resolve. After a handful of positive signals from Russia that eased tensions earlier in the week, the pendulum appeared to be swinging in the opposite direction again. The NATO chief welcomed Kremlin offers to keep pursuing diplomatic solutions, but he and others warned that the U.S.-led alliance has still seen no sign of the military withdrawal that Moscow announced. “We have seen the opposite of some of the statements. We have seen an increase of troops over the last 48 hours, up to 7,000," said British Defense Secretary Ben Wallace ahead of a meeting of the western alliance in Brussels. “We are deadly serious,” he added, “and we’re going to face the threat that is currently being posed.”

RUSSIA-US-UK (BBG): Russia’s Foreign Ministry denied a claim by the U.S. and Britain that it’s added as many as 7,000 troops to what President Joe Biden has said are around 150,000 soldiers already near Ukraine’s borders.Russian state media cited Moscow-backed separatists as saying Ukrainian forces violated cease-fire rules in eastern Ukraine overnight. The Organization for Security and Co-operation in Europe, which monitors cease-fire compliance, regularly reports dozens of violations from both sides on a daily basis.

RUSSIA (RTRS) : Russia and Belarus will end their joint military drills on Feb. 20 as previously planned, Russian Foreign Minister Sergei Lavrov said on Thursday, addressing Western concerns that Russian troops may stay in Belarus for a longer time. Separately, the RIA news agency quoted Kremlin spokesman Dmitry Peskov as saying that the matter of extending Russian troops' stay in Belarus was not on the agenda. The drills in Belarus have added to Western fears of a possible Russian invasion of neighbouring Ukraine. Moscow has denied planning such an attack.

ECB (BBG): European Central Bank Governing Council member Pablo Hernandez de Cos cautions against rushing to determine the timing of policy changes. “The direction in which we need to head is clear, but we should not draw premature conclusions as to the time frame,” De Cos tells online event. “The process will be both gradual and data-dependent”.“The probability of inflation stabilizing at around 2% in the medium term has clearly increased”. Warns that premature tightening would risk negative consequences for demand. “I see no reason to overreact”. “The ECB should not constitute an additional source of uncertainty, but should rather maintain a clear, gradual and predictable path for its policy”.

JAPAN: Japan's government lowered its monthly main economic assessment for the first time since September 2021 along with private consumption, but upgraded its views on capital investment, the Cabinet Office said on Thursday. The Cabinet Office said the Japanese economy “continues to show movements of pickup up, although some weaknesses are seen as a severe situation due to the Novel Coronavirus remains."

ECB / MNI WEBCAST: MNI is hosting a webcast event today with Philip R. Lane, Member of the Executive Board of the European Central Bank and Chief Economist. To register please go to: MNI Webcast Registration

Topic of discussion: 'The Eurozone Economy and ECB Policy'

- Time: 9am-10:30am New York time; 2pm-3:30pm London time; 3pm-4:30pm Frankfurt time

- Date: Thursday 17th February 2022

- This event is on the record.

IMF/ECB (BBG): Supply disruptions took a chunk out of euro-area economic growth last year and may persist into 2023 because of the pandemic, presenting a test for the European Central Bank, the International Monetary Fund warned.“The prospect of prolonged supply bottlenecks raises challenges for monetary-policy makers,” the Washington-based lender said Thursday in a report. “Keeping medium-term inflation expectations stable despite transient boosts to inflation, including from supply disruptions and surging energy prices, is key.”

ECB (BBG): The European Central Bank’s profit was decimated last year as a result of negative interest rates and financial risks tied to pandemic rescue measures.Profit fell to 192 million euros ($218 million) from 1.6 billion euros the year before, owing largely to a 610 million-euro risk provision as well as lower income from foreign reserve assets and securities bought as part of its monetary policy. The ECB launched a 1.85 trillion-euro bond-buying program in 2020 to contain the fallout of the coronavirus pandemic. Negative interest income on that portfolio amounted to 252 million euros last year because of depressed sovereign-bond yields.

NORGES BANK (BBG): “If prospects continue more or less as we saw it in our December report, and there’s not that much new information, of course there are uncertainties around and every focus would change, but I think there are all the reasons to be quite optimistic on behalf of the Norwegian economy going forward,” Norges Bank Governor Oystein Olsen says in an interview on Bloomberg TV.

RIKSBANK (BBG): The Riksbank looks a lot at underlying inflation as forecasting price developments has become more difficult amid volatility during the pandemic, Deputy Governor Anna Breman says at seminar. Says there is “clearly” an upside risk to food prices in coming years.

CHINA FX: The Chinese yuan's position as a currency for global payment jumped to a record high in January as the internationalisation of the currency gets promoted, according to a payments trade body on Thursday. The Society for Worldwide Interbank Financial Telecommunications (SWIFT), the usage of the yuan in international transactions climbed to 3.2% of market share, ranking the fourth most active currency , the highest level ever.

DATA:

No key data released in the European morning session.

FIXED INCOME: Core fixed income higher; gilts seeing biggest moves again

Core fixed income markets are again at the mercy of Ukraine-related headlines this morning. After rallying on reports of Ukraine firing shells on seperatists ahead of the European open, further reports of shelling around 8:30GMT saw core FI spike higher before giving up most of those gains.

- Gilts are again the biggest movers and again seeing upside pressure. 2-year yields are down 7.8bp on the day with 10-year yields down 3.9bp. Again, no UK specific headlines but just the market reaction to having become so stetched in terms of what's priced in.

- In terms of events later, ECB's Lane will appear in an MNI webcast (click here to register) at 14:00GMT / 9:00ET today, with any comments on ECB policy and inflation likely to be closely watched by markets. We are also due to hear from the Fed's Bullard and Mester as well as receive US housing data.

- TY1 futures are up 0-9+ today at 126-03+ with 10y UST yields down -3.2bp at 2.008% and 2y yields down -4.0bp at 1.484%.

- Bund futures are up 0.22 today at 165.45 with 10y Bund yields down -1.6bp at 0.258% and Schatz yields down -2.0bp at -0.389%.

- Gilt futures are up 0.32 today at 120.47 with 10y yields down -3.9bp at 1.484% and 2y yields down -8.1bp at 1.320%.

FOREX: Havens Rally Amid Mixed Messages in Eastern Ukraine

- Haven currencies are on the front foot Thursday, with JPY and CHF outperforming all others. Markets have adopted a risk-off poise amid mixed messages emerging from eastern Ukraine - with early reports of shelling in separatist regions unsettling traders. Reports of the activity circulated in late Asia-Pac hours, prompting a sharp tick lower in EUR/JPY, which slipped around 100 pips and remains weak at the NY crossover.

- The reports are less than clear-cut, however, with shelling and the exchange of fire along the line of control in the Donbas a frequent occurrence and not necessarily an indication of Russian incursion. However, the tense situation in the region has understandably made each headline a potential signal of imminent conflict. As a result, front-end vols are inching higher, while 1m contracts also add a Fed-premium as they begin to capture the March FOMC rate decision.

- Antipodean currencies have swiftly recouped some of the earlier risk-off selling pressure, with a solid set of jobs numbers from Australia adding a tailwind. Employment change figures came in well ahead of expectations, with a rising participation rate, helping AUD/USD hold close to the top end of the recent range. The 0.7245 100-dma marks the next key resistance line.

- US weekly jobless claims numbers are the data highlight Thursday, but markets may also pay some heed to building permits and housing starts numbers for January. The speaker slate could be of more interest, with MNI hosting a webinar with ECB's Lane (Sign up link here: https://www.eventbrite.co.uk/e/philip-r-lane-executive-board-member-and-chief-economist-at-the-ecb-tickets-241129283177 ) as well as scheduled appearances from Fed's Bullard and Mester - both of which speak on the policy outlook.

EQUITIES: Ukraine-Russia Headlines Weigh Once Again

- Asian markets closed mixed: Japan's NIKKEI closed down 227.53 pts or -0.83% at 27232.87 and the TOPIX ended 15.39 pts lower or -0.79% at 1931.24. China's SHANGHAI closed up 2.204 pts or +0.06% at 3468.035 and the HANG SENG ended 73.87 pts higher or +0.3% at 24792.77

- European equity markets are mostly higher (UK the exception), with the German Dax up 16.44 pts or +0.11% at 15366.86, FTSE 100 down 47.73 pts or -0.63% at 7554.6, CAC 40 up 13.56 pts or +0.19% at 6979.19 and Euro Stoxx 50 up 3.36 pts or +0.08% at 4134.72.

- U.S. futures are slightly lower on the session and well off late Wednesday's highs, with the Dow Jones mini down 162 pts or -0.46% at 34689, S&P 500 mini down 22.75 pts or -0.51% at 4447.25, NASDAQ mini down 88 pts or -0.6% at 14512.25.

COMMODITIES: Oil Remains Under Pressure With Iran Deal Optimism

- WTI Crude down $2.15 or -2.3% at $92.08

- Natural Gas down $0.09 or -1.84% at $4.636

- Gold spot up $16.39 or +0.88% at $1888.25

- Copper down $1.6 or -0.35% at $451.95

- Silver up $0.1 or +0.44% at $23.7467

- Platinum up $16.62 or +1.56% at $1084.35

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 17/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 17/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/02/2022 | 1330/0830 | *** |  | US | housing starts |

| 17/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/02/2022 | 1400/1500 |  | EU | ECB Lane on MNI Webcast on ECB Policy | |

| 17/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/02/2022 | 1600/1100 |  | US | St. Louis Fed's James Bullard | |

| 17/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 17/02/2022 | 2200/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 18/02/2022 | 2330/0830 | *** |  | JP | CPI |

| 18/02/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 18/02/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/02/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 18/02/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 18/02/2022 | 1000/1100 | ** |  | EU | construction production |

| 18/02/2022 | 1300/1400 |  | EU | ECB Elderson speech on industry climate risks | |

| 18/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 18/02/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 18/02/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/02/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/02/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 18/02/2022 | 1515/1015 |  | US | Chicago Fed's Charles Evans | |

| 18/02/2022 | 1515/1015 |  | US | Fed Governor Christopher Waller | |

| 18/02/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 18/02/2022 | 1830/1930 |  | EU | ECB Panetta on CB digital currencies | |

| 18/02/2022 | 1830/1330 |  | US | Fed Governor Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.