-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US OPEN: More Quiet On The Eastern Front

EXECUTIVE SUMMARY:

- ECB'S KAZIMIR BACKS END OF QE IN AUGUST, FLEXIBILITY ON HIKES

- RUSSIA ANNOUNCES MISSILE TEST LAUNCHES SATURDAY

- KREMLIN SAYS SITUATION IN DONBASS ALARMING, POTENTIALLY VERY DANGEROUS

- UK JAN RETAIL SALES REBOUND, EXCEED FORECASTS

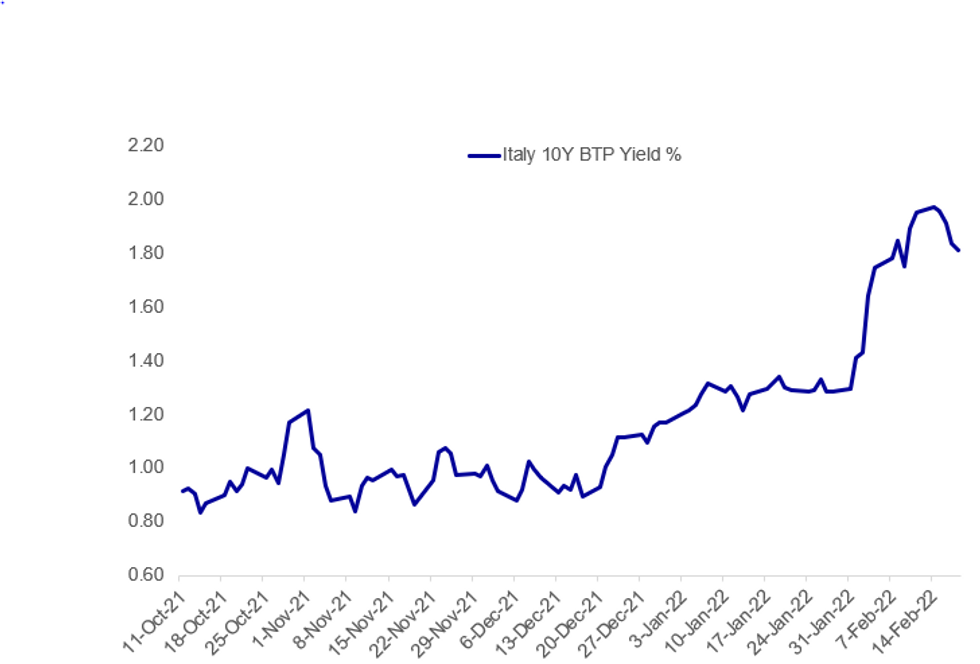

Fig. 1: BTPs Lead Fixed Income Gains Early Friday

Source: Bloomberg, MNI

Source: Bloomberg, MNI

NEWS:

ECB (BBG): The European Central Bank should wind down net bond-buying in the summer, while giving itself more flexibility on the timetable for any subsequent interest-rate increase, according to Governing Council member Peter Kazimir. The Slovak central bank chief said the tool -- which was created to stave off deflation after Europe’s debt crisis and was expanded during the pandemic -- has outlived its usefulness. The ECB doesn’t have a firm end date for its regular purchases, known as APP. “The risks this instrument was designed to address have subsided, while on the other hand the negative side effects are becoming more significant,” Kazimir said Thursday in an interview. “Trading activity weakens in August so that would be a good natural timing for ending the program.”

RUSSIA (BUSINESS INSIDER): Russia announced plans to hold missile test launches the day after threatening a military response in the escalating standoff with Ukraine. The Russian Defense Ministry said on Friday that the drills will be held on Saturday alongside its nuclear forces, the country's RIA news agency reported. The ministry said in a statement, according to RIA: "The exercise of the strategic deterrence forces was planned earlier to check the readiness of military command and control bodies, launch combat crews, crews of warships and strategic missile carriers to carry out assigned tasks, as well as the reliability of the weapons of strategic nuclear and non-nuclear forces."

RUSSIA (RTRS): The Kremlin said on Friday that Moscow was alarmed by the situation in eastern Ukraine's Donbass region and that the situation there looked potentially very dangerous.

EUROPE-RUSSIA/IRAN: Later today the foreign ministers of Germany, France, and the United Kingdom are set to meet on the sidelines of the Munich Security Conference, which gets underway at 1230CET (0630ET, 1130GMT).

- Two major topics of conversation between the three ministers being the ongoing tensions in eastern Ukraine as well as the prospect of a deal being reached with Tehran on the Joint Comprehensive Plan of Action (JCPoA, the Iran nuclear deal).

- While Russia is not sending a delegation to the MSC, Iranian Foreign Minister Hossein Amir-Abdollahian will be in attendance, potentially setting the stage for a sidelines meeting between he and one or more of the E3 foreign ministers.

- In recent days, French FM Jean-Yves Le Drian has stated a deal with Iran is 'days away', while Wang Qun - head of the Chinese delegation in the Vienna talks - stated that "We are in the final stages of negotiations. I hope that the [final] steps will be taken towards each other, because we are one step closer to the final agreement.”

CHINA: China will further cut taxes and fees to support key sectors, counter economic headwinds, and set an appropriate debt ratio to prevent risks in 2022, Finance Minister Liu Kun wrote in the People's Daily on Friday. The tax and fee reductions will focus on the manufacturing, small and medium-sized companies, and tech innovation. But the measures will be for a limited time, considering the economic slowdown has weighed on fiscal revenues, Liu noted.

DATA:

MNI: UK JAN RETAIL SALES +1.9% M/M, +7.2% Y/Y

MNI BRIEF: UK Jan Retail Sales Rebound; Exceed Forecasts

UK retail sales far exceeded analysts’ expectations in January, rising by 1.9%, outstripping predications of a 0.9% gain. But that failed to make up for a 4.0% plunge in December, revised downward from the originally-reported 3.7% decline.

Fourth quarter sales were revised down to a fall of 0.5% from the initially-reported 0.2% decline. That means retail will shave 0.05 percentage points from Q4 GDP revisions, compared to a 0.02 percentage point reduction in the first estimate.

Food sales kept the January rebound in check, dropping by 2.3%, taking supermarket sales some 0.8% below pre-pandemic levels in February of 2020, while non-food sales rose by 3.4%, lifted by a 7.5% jump in household goods. Department store sales rose by 7.1%, with the increase concentrated in homewares, according to an ONS official. Internet sales, measured by value, decreased by 4.5% between December and January, taking the proportion of all retailing down to 25.3%, the lowest ratio since March of 2020.

MNI: EZ DEC CONSTRUCTION -4.0% M/M, -3.9% Y/Y; NOV -0.2% M/M

Eurozone Construction Slumps in Dec

EZ DEC CONSTRUCTION -4.0% M/M, -3.9% Y/Y; NOV -0.2% M/M

- Eurozone construction output fell 4.0% M/M in December, the strongest contraction since April 2022.

- Surging Covid cases in the region and associated restrictions were likely the key driver of the slide in output growth.

- Austria, Germany and France led the declines with construction falling by 7-8% m/m across the regions.

FIXED INCOME: Safe Haven favoured

- A much lighter open in terms of Volumes this morning, after decent volumes traded during the first 4 hours of trading this week, every single day.

- Most investors are on the sideline, but safe haven (Bonds) are underpinned, which will likely be the trend today and into the end of the session going into the weekend, as desk position to alleviate any potential escalations in Eastern Europe.

- Fairly steady in peripheral spreads, although the Greek/Bund spread continues to edge at widest level since Mat 2020.

- BTP has closed the gap and Yield area support noted yesterday.

- Yield support was seen at 1.811%, and the 10yr yield low is 1.811%.

- Gilt have outperformed with BTP, translating in a 1.2bp tighter Gilt/Bund spread.

- Similar price action for Treasuries, but the US strip has lagged Europe, still Tnotes are off the low and flat at the time of typing.

- Looking at the calendar, there is no market moving data for the session, and the market will keep an eye on any developments in Eastern Europe.

- Speakers include, ECB Vale, Panetta, and Fed Evans, William and Brainard.

EQUITIES: Non-Cyclicals Lead Early

- Asian stocks closed mixed: Japan's NIKKEI closed down 110.8 pts or -0.41% at 27122.07 and the TOPIX ended 6.93 pts lower or -0.36% at 1924.31. China's SHANGHAI closed up 22.722 pts or +0.66% at 3490.757 and the HANG SENG ended 465.06 pts lower or -1.88% at 24327.71.

- European stocks are likewise mixed (Germany underperforming, France leading), with the German Dax down 34.4 pts or -0.23% at 15238.69, FTSE 100 up 19.95 pts or +0.26% at 7558.53, CAC 40 up 33.75 pts or +0.49% at 6981.34 and Euro Stoxx 50 down 2.09 pts or -0.05% at 4113.59.

- U.S. futures are a little higher, with the Dow Jones mini up 111 pts or +0.32% at 34342, S&P 500 mini up 19.5 pts or +0.45% at 4393.75, NASDAQ mini up 86.5 pts or +0.61% at 14249.5.

FOREX: Markets Stabilise, Prompting Minor Bounce in USD/JPY

- Markets are relatively sanguine so far Friday, with Thursday's risk-off weakness across equities and growth proxies pausing and allowing for a minor retracement. This puts JPY at the bottom-end of the G10 table, with USD/JPY improving back above the Y115.00 handle.

- Risk and growth proxies including AUD and NZD are modestly higher, helping AUD/USD extend the recovery off recent lows. This works in favour of AUDUSD at this stage and negates the bearish signals evident in the bearish candle pattern posted late last week. As such, markets re-target the early February highs of 0.7249 to sustain any rally, while a return back below 0.7086 would prove bearish.

- UK retail sales data came in ahead of expectations, with monthly sales rising 1.7% ex-auto fuel. Nonetheless, negative revisions for the December readings countered any feed through to sentiment, keeping GBP/USD just above the 1.35 handle. The outlook is bullish following recent gains from 1.3358, the Jan 27 low and scope is seen for a test of 1.3662 next, Jan 20 high.

- Data highlights Friday include Canadian retail sales for December and US existing home sales. The central bank speaker slate should prove more interesting, with Fed's Evans, Waller, Williams and Brainard on the docket as well as ECB's Panetta.

COMMODITIES: WTI Dips Below $90 As Geopolitical Concerns Ease

- WTI Crude down $1.81 or -1.97% at $90.01

- Natural Gas down $0.06 or -1.23% at $4.43

- Gold spot down $5.36 or -0.28% at $1893.18

- Copper up $2.15 or +0.47% at $454.95

- Silver up $0.02 or +0.07% at $23.8635

- Platinum down $1.13 or -0.1% at $1092.5

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/02/2022 | 1300/1400 |  | EU | ECB Elderson speech on industry climate risks | |

| 18/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 18/02/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 18/02/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/02/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/02/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 18/02/2022 | 1515/1015 |  | US | Chicago Fed's Charles Evans | |

| 18/02/2022 | 1515/1015 |  | US | Fed Governor Christopher Waller | |

| 18/02/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 18/02/2022 | 1830/1930 |  | EU | ECB Panetta on CB digital currencies | |

| 18/02/2022 | 1830/1330 |  | US | Fed Governor Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.