-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: Tentative Geopolitical Relief Rally

EXECUTIVE SUMMARY:

- BOE'S BAILEY TELLS MARKETS NOT TO GET CARRIED AWAY ABOUT RATE RISES

- MNI CHINA LIQUIDITY INDEX FALLS TO 10.0 IN FEBRUARY

- IRAN: WE HOPE TO SETTLE REMAINING NUCLEAR TALKS ISSUES IN NEXT FEW DAYS

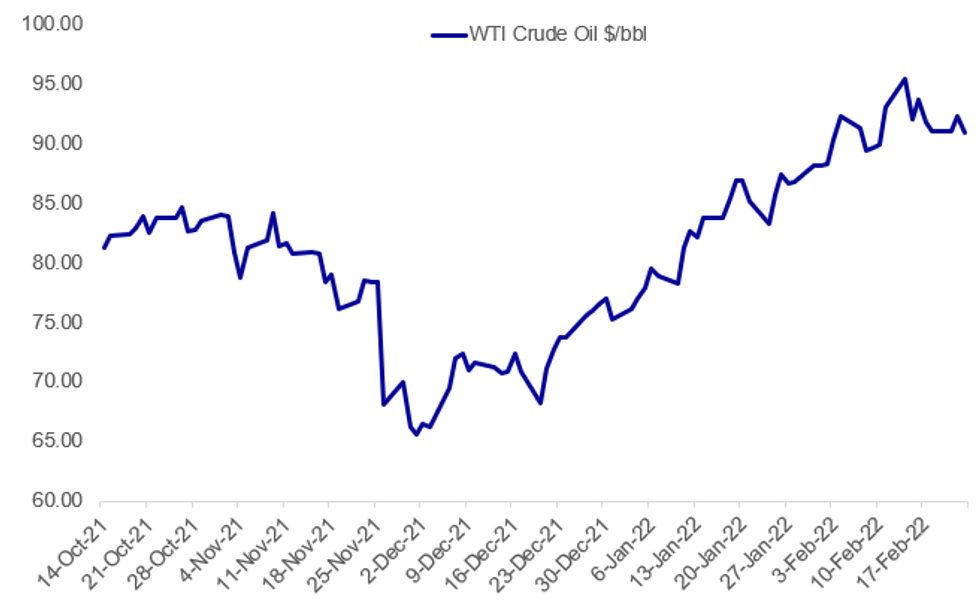

Fig. 1: Oil Falling On Geopolitical Tensions Easing

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE (RTRS): Bank of England Governor Andrew Bailey said on Wednesday there was "very clearly" a risk that high inflation gets embedded in Britain's economy if there is a cycle of higher prices pushing up wages. "It's not just wage setting, it's also price setting ... it's both," Bailey told lawmakers. "There is very clearly an upside risk there. The upside risk ... comes through from the second-round effects." Bailey told parliament's Treasury Committee that there were also downside risks that inflation comes in lower than the BoE's forecasts over the next three years.

BOE (MNI): Bank of England Monetary Policy Committee members have rejected the idea that they were split over whether inflation was transitory or permanent, with Jonathan Haskel, who voted in the minority for a 50 basis point hike at the February saying that the labels were unhelpful. Both Dep Gov Ben Broadbent and Silvana Tenreyro defended the idea that the current inflation shock was transitory, by textbook definitions, but took the view that this did not preclude dealing with higher inflation through tighter monetary policy.

UKRAINE-RUSSIA (BBG): Ukraine’s Foreign Ministry issued an alert to its citizens urging them to leave Russia immediately and to avoid traveling there, a day after President Volodymyr Zelenskiy said he’s considering breaking diplomatic ties with Moscow. The ministry said the “intensification of Russian aggression” may limit Ukraine’s ability to provide consular services to people located on the territory of its former Soviet partner. Ignoring this recommendation will “significantly complicate” the ability to protect Ukrainians in Russia, it said in a statement.

UKRAINE-RUSSIA (BBG): Ukraine will seek to impose a nationwide state of emergency over the rising tensions with Russia, Secretary of the National Security and Defense Council Oleksiy Danilov says after meeting of that body.

UK-RUSSIA (BBG): Foreign Secretary Liz Truss said British intelligence still shows that Putin could be headed for an invasion of Ukraine, including the capital, Kyiv. “We think it’s highly likely that he will follow through on his plan for a full-scale invasion of Ukraine,” Truss told Sky News in London, without providing details on the intelligence underpinning that calculation. She later told LBC radio that Britain was ready to impose sanctions on more Russian individuals, banks and companies in the event of a full invasion.

EUROPE ENERGY (BBG): Prices for natural gas and electricity in Europe advanced after President Joe Biden said Russia had begun to invade neighboring Ukraine and imposed a range of sanctions on Moscow. Benchmark Dutch futures increased as much as 5.9%, rising for a third day as traders take stock of the latest developments in the standoff between the West and Moscow. German power for next year rose as much as 3.6%, a fourth consecutive gain.

IRAN (BBG): Iran’s foreign minister said that he hopes outstanding issues in negotiations with world powers to restore the 2015 nuclear deal will be resolved in the “next few days”.Hossein Amirabdollahian told reporters that overall he was optimistic about the talks currently taking place Vienna and hoped some remaining “sensitive and important issues” will be settled this week. He added that the Islamic Republic won’t concede any of its “red lines” in the negotiations.

DATA:

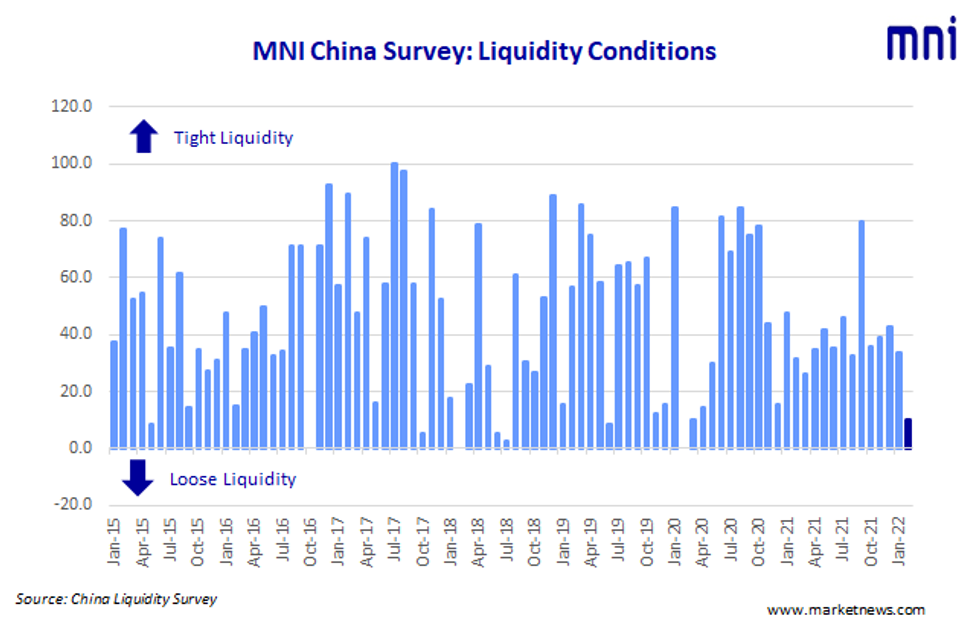

MNI China Liquidity Index™– Falls To 10.0 in in February

Liquidity across China’s interbank money market eased in February, helped by a boost to liquidity as China returned from the Lunar New Year holiday, the latest MNI Liquidity Conditions Index shows.

- The Economy Condition Index stood at 36.7, the highest level since June, as Beijing policy mix seen helping the slower economy.

- The PBOC Policy Bias Index remained below 50 for an 8 th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed-income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted Feb 7 – Feb 18

Click below for the full press release:

MNI_China_Liquidity_Index_-2022-02_pressera.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

EZ JAN FINAL HICP +0.3% M/M; +5.1% Y/Y; DEC +5.0% Y/Y

EZ JAN FINAL CORE HICP -0.9% M/M; +2.3% Y/Y; DEC +2.6% Y/Y

FIXED INCOME: A more steady European morning session

- A more stable morning session for EGBs and Bund, after the large ranges that they traded yesterday.

- Headline on Russia have been more subdued this morning, with nothing emerging regarding the tensions.

- Bund is flat at the time of typing, and similar price action in peripheral spreads, with all of them flat against the German 10yr.Gilt outperforms, and is 1.3bp tighter versus Bund.

- BOE's Bailey, Broadbent, Haskel and Tenreyro are testifying and sound not as Hawkish as they have been previously.

- BoE Broadbent: We are likely to need to further tightened, but not an inexorable rise.

- Most of the action in Treasuries remains in spread, with desk taking advantage of the more stable markets.

- Looking ahead, there is no data of note, but plenty of speakers, including h ECB Villeroy, Guindos, de Cos, BoE Bailey, Tenreyro, and Fed Daly

FOREX: Greenback Lower For Third Consecutive Session

- The greenback is leading losses Wednesday, putting the USD Index lower for a third consecutive session as markets continue to watch the tense situation in eastern Ukraine and any Russian response to Western sanctions pressures applied by the US, the EU and the UK yesterday.

- Antipodean currencies are extending their relief rally, with AUD and NZD higher against all others in G10 so far. This keeps the uptrend in AUD/USD intact, with the pair now north of both the 100-dma of 0.7242 as well as the mid-February high of 0.7249. Similarly NZD/USD touched 0.68 in overnight trade, putting the pair at a fresh monthly high. This opens the 100-dma level at 0.6859.

- Both EUR and GBP are more rangebound, with EUR/GBP holding just below 0.8350. Members of the Bank of England MPC are testifying in front of the Treasury Select Committee, in which members again stressed their focus on price setting and wages for the future of monetary policy.

- Data releases are few and far between Wednesday, with no major releases due. This should keep focus on the central bank slate, with ECB's de Guindos & de Cos, Fed's Daly and BoE's Tenreyro due to speak.

EQUITIES: Relief Rally

- Asian markets closed higher (though Japan observed a holiday). China's SHANGHAI closed up 32 pts or +0.93% at 3489.146 and the HANG SENG ended 140.28 pts higher or +0.6% at 23660.28.

- European equities are up sharply as Russia-Ukraine risks are seen easing, with cyclical stocks outperforming and energy underperforming. German Dax up 190.54 pts or +1.3% at 14693, FTSE 100 up 44.44 pts or +0.59% at 7494.21, CAC 40 up 107.67 pts or +1.59% at 6787.6 and Euro Stoxx 50 up 64.6 pts or +1.62% at 3985.47.

- U.S. futures are also gaining, with the Dow Jones mini up 274 pts or +0.82% at 33799, S&P 500 mini up 42.5 pts or +0.99% at 4342.5, NASDAQ mini up 192.5 pts or +1.39% at 14055.25.

COMMODITIES: WTI $5/bbl Off Tuesday High

- WTI Crude down $0.73 or -0.79% at $91.11

- Natural Gas down $0.03 or -0.62% at $4.47

- Gold spot down $7.18 or -0.38% at $1896.32

- Copper up $2.15 or +0.48% at $453.95

- Silver down $0.03 or -0.13% at $24.0798

- Platinum up $1.69 or +0.16% at $1080.93

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2022 | 1130/1230 |  | EU | ECB de Guindos Q&A at El Español & Invertia symposium | |

| 23/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/02/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/02/2022 | 1500/1500 |  | UK | BOE Tenreyro speaks at NIESR Institute lecture | |

| 23/02/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 23/02/2022 | 2030/1530 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 24/02/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 24/02/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2022 | 0900/1000 | * |  | IT | industrial orders |

| 24/02/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/02/2022 | 1315/1315 |  | UK | BOE Bailey Intro at BEAR Research Conference | |

| 24/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 24/02/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 24/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/02/2022 | 1500/1000 | *** |  | US | new home sales |

| 24/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 24/02/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 24/02/2022 | 1600/1700 |  | EU | ECB Schnabel panels BOE BEAR conference on Unwinding QE | |

| 24/02/2022 | 1600/1600 |  | UK | BOE Broadbent moderates panel at BEAR Conference on QE | |

| 24/02/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 1610/1110 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 25/02/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.