-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: Joint EU Bond Issuance Spurs Optimism

EXECUTIVE SUMMARY:

- EU TO CONSIDER MASSIVE JOINT BOND SALES TO FUND ENERGY, DEFENSE (BBG SOURCES)

- GERMANY'S HABECK DOESN'T SEE RUSSIA HALTING NORD STREAM 1 FLOWS: RTL

- NEW PACKAGE OF EU SANCTIONS PREPARED AGAINST RUSSIA

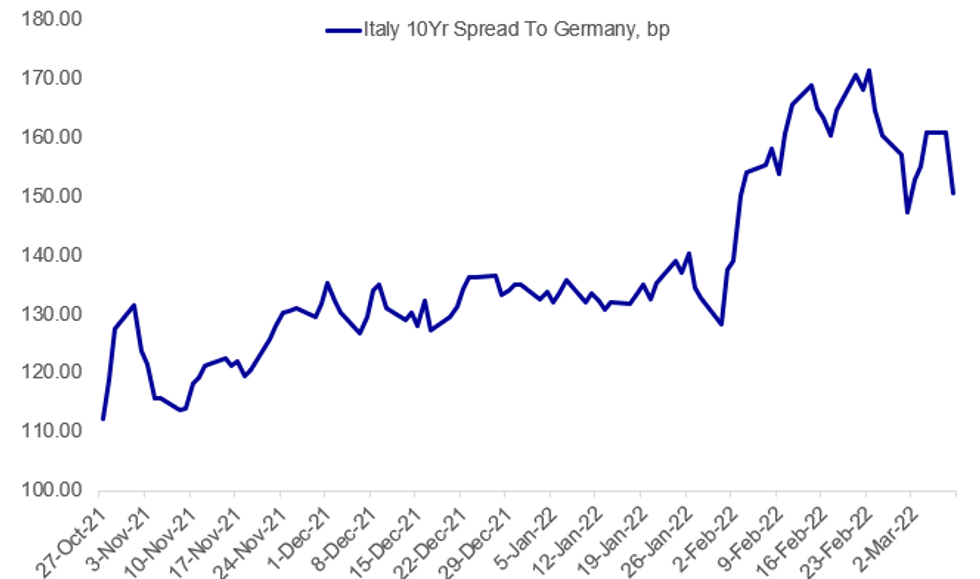

Fig. 1: EU Joint Bond Issuance Headlines Drive BTP Spread Compression

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EU ISSUANCE (BBG): The European Union will unveil a plan as soon as this week to jointly issue bonds on a potentially massive scale to finance energy and defense spending in the 27 member states as the bloc copes with the fallout from Russia’s invasion of Ukraine. The proposal may be presented after the bloc’s leaders hold an emergency summit in Versailles, France, March 10-11, according to officials familiar with the preparations. Officials are still working out the details on how the debt sales would work and how much money they intend to raise. The extraordinary move comes just a year after the EU launched a 1.8 trillion-euro ($2 trillion) emergency package backed by joint debt to finance member states’ efforts to deal with the pandemic. Now, the bloc faces massive financing needs as it begins to reform its military and energy infrastructure following Russia’s invasion of Ukraine.

GERMANY /RUSSIA ENERGY (BBG): German Economy Minister Robert Habeck doesn’t expect Russia to follow through on its threat to halt gas flows through the Nord Stream 1 pipeline, he said in an interview with RTL/NTV.“I don’t expect this to happen because Russia must know that if they do this, then they are an unreliable supplier,” and Europe wouldn’t come back: Habeck. Also says Germany would nonetheless be prepared if flows were halted.

GERMANY / EUROPE ENERGY (BBG): The last three remaining nuclear power plants will go offline by Dec. 31 as planned, German Economy Minister Robert Habeck tells RTL/ntv Fruehstart. Keeping the power plants open for longer would add little energy supply in the next winter and would bring safety risks: Habeck. “That’s why I came to the conviction that this path is the wrong one”: Habeck.

EU-RUSSIA SANCTIONS: Wires and social media reporting that according to unnamed sources, the European Commission is preparing a new package of sanctions to be implemented against both Russia and Belarus. Package is set to be discussed by EU ambassadors later today. Any sanctions must have unanimous approval from all EU member states. European High Representative for Foreign Policy and Security Josep Borrell tweets: "We need protect our democracies from foreign interference and attempts to manipulate. I will propose a new horizontal regime that will allow us to sanction malign disinformation actors. This will be part of a broader toolbox that will enhance our capacity to deter and to act."

DATA:

MNI: GERMANY JAN IP +2.7% M/M, +1.8% Y/Y; DEC +1.1%r M/M

GERMANY: IP Boosted by Construction Growth

GERMANY JAN IP +2.7% M/M, +1.8% Y/Y; DEC +1.1%r M/M

- The January IP print for Germany saw a substantial upside surprise, alongside considerable upwards revisions of the December numbers.

- IP grew +2.7% m/m, strongly outpacing the forecasted 0.5% m/m growth and December's softer 1.1% m/m expansion (revised upwards from -0.3% m/m).

- In the annualised print, IP increased 1.8% y/y, a significant expansion following December's -2.7%r y/y contraction and 3.5 points above the forecasted -1.7% y/y decline.

- Production remained 3.0% below pre-pandemic February 2020 levels.

- In January, production in construction was boosted by 10.1%, with consumer and capital goods production rising by 4.0% and 1.2% respectively.

MNI: SPAIN JAN IP -0.1% M/M, +1.7% Y/Y: DEC -0.5%r M/M

FIXED INCOME: Bunds underperform

After a quiet start to the day, we saw huge moves on the back of a Bloomberg sources story that stated the EU could agree as soon as this week to start a common EU issuance programme to raise funds for energy and military purposes. This would reduce the risks to inflation (through limiting consumer energy prices) and reduce the possibility of stagflation. We discuss the market reaction and implications in more detail here.

- Euribor Reds have seen the biggest moves of the day followed by SONIA futures. The Eurodollar strip is also lower on the day and has seen some steepening as far out as Blues.

- A similar story is seen in bond markets with Bunds underperforming gilts and Treasuries. The German curve, however, has seen more of a parallel move while gilts have bear flattened and Treasuires bear steepened. At the time of writing 10-year BTP-Bund spreads were 12.8bp tighter on the day, GGB-Bund 15.3bp tightenm Portugal and Spain around 8bp tighter and even OAT-Bund is 4.1bp tighter.

- TY1 futures are down -0-22+ today at 127-13 with 10y UST yields up 5.5bp at 1.831% and 2y yields up 4.1bp at 1.593%.

- Bund futures are down -1.04 today at 165.63 with 10y Bund yields up 8.0bp at 0.061% and Schatz yields up 8.0bp at -0.619%.

- Gilt futures are down -0.66 today at 124.00 with 10y yields up 5.6bp at 1.359% and 2y yields up 6.6bp at 1.228%.

FOREX: Regional Currencies Recovering, EUR/CHF Off Lows

- Regional currencies in close proximity to Ukraine are bouncing early Tuesday, putting the much beleaguered SEK and NOK at the top of the G10 pile. Recent outperformers - most notably the AUD - are weaker, with AUD/USD forming a bearish candle chart pattern during the Monday reversal, known as a bearish shooting star.

- The greenback is more middling, with the dollar mixed against the rest of G10, while the EUR fares more favourably. The single currency saw some support in early Europe on the back of reports that the European Union are to unveil plans as soon as this week that detail sizeable joint bond sales with an eye on defence and energy funding. EUR/USD support put the pair just shy of the Monday NY high at 1.0932, which markets need to rally through in order to narrow the gap with 1.0969 - the 23.6% retacement for the Ukraine-inspired downleg.

- In sympathy with the more solid price action in G10, equities in Europe are in the green and off lows - which has worked against CHF - the worst performer among developed market FX today.

- The data slate is relatively light Tuesday, with US/Canadian trade balance on the books, following shortly afterwards by wholesale trade sales and inventories numbers. The pre-meeting Fed media blackout period keeps the central bank speaker slate quiet, with just RBA's Lowe on the docket.

EQUITIES: EU Joint Bond Issuance News Buoys European Stocks

- Asian markets closed weaker: Japan's NIKKEI closed down 430.46 pts or -1.71% at 24790.95 and the TOPIX ended 34.17 pts lower or -1.9% at 1759.86. China's SHANGHAI closed down 79.325 pts or -2.35% at 3293.53 and the HANG SENG ended 291.76 pts lower or -1.39% at 20765.87

- European stocks have rebounded on news of the EU considering joint bond issuance: the German Dax up 172.71 pts or +1.35% at 12834.65, FTSE 100 down 2.41 pts or -0.03% at 6959.48, CAC 40 up 98.72 pts or +1.65% at 5982.27 and Euro Stoxx 50 up 55.82 pts or +1.59% at 3512.22.

- U.S. futures are a little higher, with the Dow Jones mini up 74 pts or +0.23% at 32857, S&P 500 mini up 14.5 pts or +0.35% at 4213, NASDAQ mini up 26.75 pts or +0.2% at 13347.5.

COMMODITIES: Oil Rebounds From Overnight Lows, Still Below Monday Highs

- WTI Crude up $3.12 or +2.61% at $122.41

- Natural Gas down $0.15 or -3.1% at $4.738

- Gold spot up $8.02 or +0.4% at $2017.49

- Copper up $6.55 or +1.38% at $489.9

- Silver up $0.35 or +1.35% at $26.0704

- Platinum up $21.45 or +1.9% at $1153.46

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/03/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/03/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/03/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 08/03/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/03/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 09/03/2022 | 0900/1000 | * |  | IT | industrial production |

| 09/03/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/03/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 09/03/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 09/03/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/03/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/03/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.