-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Equity Rally Pauses

EXECUTIVE SUMMARY:

- PUTIN TOLD SCHOLZ UKRAINE IS TRYING TO STALL TALKS: KREMLIN

- BOJ KURODA: NO POLICY CHANGE IF CPI HITS 2% (MNI STATE OF PLAY)

- PUTIN PROPOSES NABIULLINA FOR NEW TERM AS RUSSIA CENTRAL BANK GOVERNOR

- NICKEL DROPS 12% IN ANOTHER GLITCHY START TO LONDON TRADING

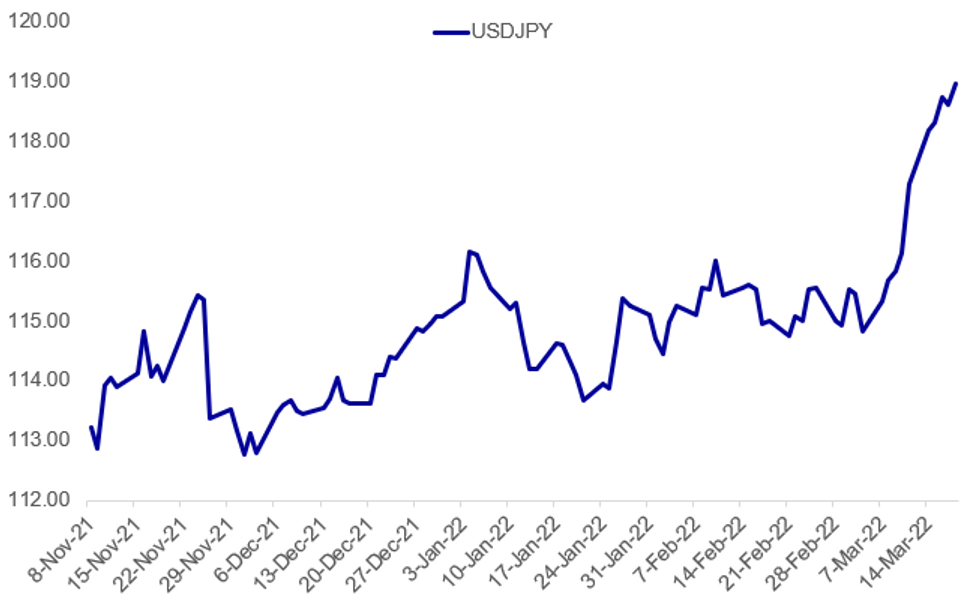

Fig. 1: Yen Weakness Extends

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA-UKRAINE (BBG): Russian President Vladimir Putin told German Chancellor Olaf Scholz that Ukraine is trying to “stall” talks by putting out “more and more new unrealistic demands,” according to the readout of the phone talks from the Kremlin. Says Russia is ready to work to find solution, Moscow’s conditions are “well-known”.

RUSSIA-GERMANY (BBG): German Chancellor Olaf Scholz spoke on the phone with Russian President Vladimir Putin on Friday morning, according to emailed statement from the German chancellery.Chancellery says Scholz urged the Russian President to work toward a cease-fire as soon as possible, to improve the humanitarian situation and to make progress in finding a diplomatic solution to the conflict.

BANK OF JAPAN (MNI STATE OF PLAY): Bank of Japan Governor Haruhiko Kuroda said on Friday that Japan’s core consumer prices may rise to 2% on the back of high import prices and the fading impact of cheap mobile phone charge in or after April but will not cause any policy adjustments. “The rapid rise in commodity prices (caused by the Russia’s invasion of Ukraine) will boost (Japan’s) import prices and then push up core CPI to close to 2%,” Kuroda told reporters.

BANK OF RUSSIA (BBG): President Vladimir Putin proposed a new term for Bank of Russia Governor Elvira Nabiullina, according to a statement on the State Duma’s website Friday. The lower house of parliament’s council will consider the proposal on March 21, according to the statement. Nabiullina has led the Bank of Russia through multiple crises since 2013, gaining global recognition as a hawkish technocrat focused on fighting inflation even at the expense of economic growth.

LME / NICKEL (BBG): Nickel dropped by the maximum allowed for a third day in another glitchy opening for trading in London, as the price continues its retreat from an unprecedented short squeeze last week. It was the third straight day that electronic trading in LME nickel had suffered from apparent glitches, as the LME has run into problems with its new trading limits, which were introduced for the first time in the wake of last week’s price runaway price spike. Nickel dropped 12% to the daily limit of $36,915 a ton, although at least three trades went through at a price below the lower bound set by the exchange, according to Bloomberg data. The trades outside of the limit will be canceled, a spokesperson for the LME said.

CHINA-US (RTRS): China sailed an aircraft carrier through the sensitive Taiwan Strait on Friday, shadowed by a U.S. destroyer, a source with direct knowledge of the matter said, just hours before the Chinese and U.S. presidents were due to talk. China claims democratically ruled Taiwan as its own territory, and has over the past two years stepped up its military activity near the island to assert its sovereignty claims, alarming Taipei and Washington. The source, who was not authorised to speak to the media and spoke on condition of anonymity, told Reuters the carrier Shandong sailed close to the Taiwan-controlled island of Kinmen, which sits directly opposite the Chinese city of Xiamen.

OIL (BBG): Oil extended gains after the biggest daily surge in 16 months pushed prices back above $100 a barrel as the Kremlin cast doubt on the progress of peace talks with Ukraine. Futures in New York rose to trade near $106 a barrel after jumping 8.4% on Thursday. Crude rallied after the Kremlin said a report of major progress in negotiations over Ukraine was “wrong,” but that discussions will continue. Oil is still set for a second weekly loss after another tumultuous period of trading that’s seen West Texas Intermediate swing over $9 in three sessions.

DATA:

FIXED INCOME: Gilts outperform, continue to price in more dovish BOE

Gilts are outperforming as they continue to re-price following yesterday's dovish MPC meeting, while the rest of core fixed income is drifting higher this morning, with little in the way of headline drivers.

- The biggest moves this morning have been at the front-end of the UK curve with SONIA futures up to 12.5 ticks higher on the day at writing. 2-year gilt yields down 7.0bp with the curve bull steepening.

- Treasuries have outperformed Bunds a little. The UST curve is bull flattening while the German curve is seeing more of a parallel shift.

- Looking ahead, we have the first Fed-talk since the FOMC presser with Waller, Kashkari, Barkin and Bowman all due to speak today but the data calendar is light with Eurozone trade data and US existing home sales the highlights.

- TY1 futures are up 0-8 today at 124-18+ with 10y UST yields down -2.1bp at 2.152% and 2y yields up 0.4bp at 1.921%.

- Bund futures are up 0.32 today at 161.33 with 10y Bund yields down -1.4bp at 0.368% and Schatz yields down -1.7bp at -0.364%.

- Gilt futures are up 0.49 today at 122.29 with 10y yields down -4.1bp at 1.521% and 2y yields down -7.0bp at 1.216%.

FOREX: JPY Under Early Pressure

- Markets are extending the risk-on move posted since Wednesday's Fed rate decision, resulting in JPY being the poorest performer in G10 so far Friday. This keeps USD/JPY upside under pressure with the cycle highs of 119.12 in view. A break above here opens levels not seen since early 2016.

- Russia-Ukraine tensions remain front and centre, with Russia's President Putin speaking with the German Chancellor this morning, noting the Ukrainian demands in peace talks as "unrealistic". Putin speaks with Macron later in the day.

- CHF and CAD outperform, while the greenback trades more mixed. The EUR retraces a part of recent impressive gains, but the bias remains for further corrective rallies.

- Focus turns to any outcomes from today's meeting between US President Biden and his Chinese counterpart Xi - who are due to discuss Sino-US relations and, inevitably, the ongoing Ukraine crisis. On the data front, Canadian retail sales and US existing home sales are the focus.

- Fed speakers will also draw attention, with Kashkari, Barkin and Bowman the first FOMC members to comment since Powell's press conference on Wednesday.

EQUITIES: Modest Retracement

- Asian markets closed mostly higher (though the Hang Seng gave back a modest portion of recent outsized gains): Japan's NIKKEI closed up 174.54 pts or +0.65% at 26827.43 and the TOPIX ended 10.26 pts higher or +0.54% at 1909.27. China's SHANGHAI closed up 36.029 pts or +1.12% at 3251.073 and the HANG SENG ended 88.83 pts lower or -0.41% at 21412.4

- European equities are a little weaker, with the German Dax down 77.88 pts or -0.54% at 14399.02, FTSE 100 down 9.5 pts or -0.13% at 7385.34, CAC 40 down 31.9 pts or -0.48% at 6612.52 and Euro Stoxx 50 down 11.5 pts or -0.3% at 3889.93.

- U.S. futures are pointing lower as well, with the Dow Jones mini down 171 pts or -0.5% at 34290, S&P 500 mini down 26.25 pts or -0.6% at 4384, NASDAQ mini down 91.75 pts or -0.65% at 14020.

COMMODITIES: Oil Continues To Gain Ground Above $100

- WTI Crude up $1.58 or +1.53% at $104.37

- Natural Gas down $0.14 or -2.83% at $4.836

- Gold spot down $9.31 or -0.48% at $1932.9

- Copper up $0.2 or +0.04% at $471.75

- Silver down $0.11 or -0.42% at $25.3084

- Platinum up $7.19 or +0.7% at $1029.69

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 18/03/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/03/2022 | 1720/1320 |  | US | Richmond Fed's Tom Barkin | |

| 18/03/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 18/03/2022 | 1800/1400 |  | US | Fed Governor Michelle Bowman | |

| 21/03/2022 | 0300/1100 |  | CN | PBOC LPR decision | |

| 21/03/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/03/2022 | 0730/0830 |  | EU | ECB Lagarde at Institut Montaigne Event | |

| 21/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2022 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/03/2022 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 21/03/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/03/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/03/2022 | 0730/0830 |  | EU | ECB de Guindos in Panel at Money Review Banking Summit | |

| 22/03/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1300/1400 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1730/1830 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 23/03/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | 1100/0700 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/03/2022 | 0105/2105 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 24/03/2022 | 0830/0930 | *** |  | CH | SNB policy decision |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/03/2022 | 0930/1030 |  | EU | ECB Elderson at IIEA Webinar | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.