-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, December 9

MNI US OPEN: Bonds Bounce As Biden Heads To Brussels

EXECUTIVE SUMMARY:

- BIDEN HEADS TO EUROPE WITH PLANS FOR MORE RUSSIA SANCTIONS

- RUSSIA ACCUSES U.S. OF HINDERING UKRAINE TALKS

- UK INFLATION SURGES, OUTPACES ANALYST EXPECTATIONS

- GERMANY STICKS WITH DEBT SALE PLAN DESPITE MASSIVE SPENDING PUSH

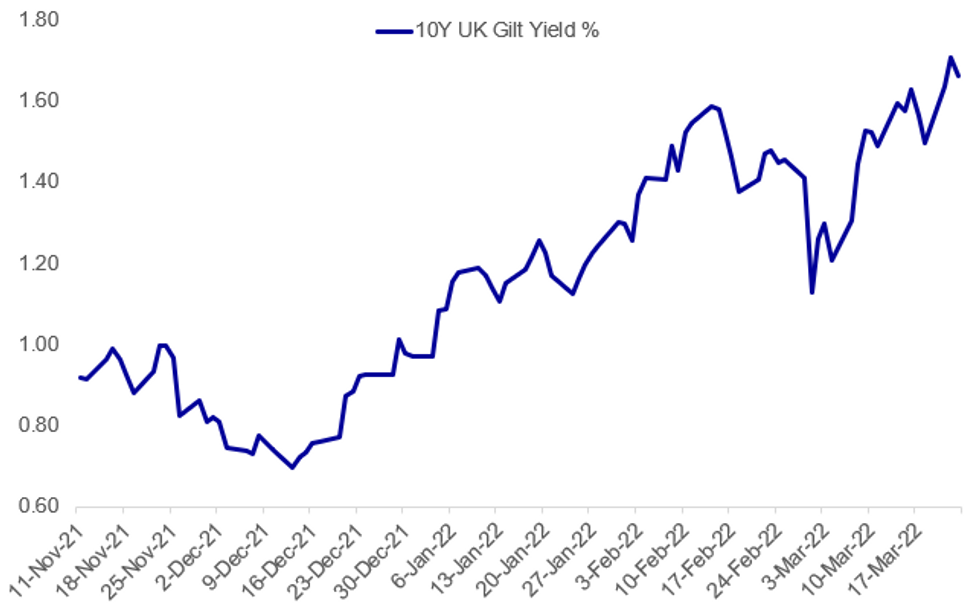

Fig. 1: Gilts A Little Stronger Post-CPI, Pre-Spring Statement

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US-EUROPE (RTRS): US President Joe Biden departs for Brussels on Wednesday for talks with European leaders about Russia's invasion of Ukraine, carrying with him plans for more sanctions on Moscow that sources said include members of the Russian parliament. Biden leaves the White House at 08:40 (EDT) on a trip that will include talks in Brussels with NATO and European leaders and a visit to Warsaw for consultations with Polish President Andrzej Duda. Two sources familiar with the situation said Biden and his team were developing plans to impose sanctions on members of the Russian parliament, the Duma, in retaliation for Russia's invasion of Ukraine. The sanctions are expected to be announced on Thursday.

RUSSIA-US-UKRAINE (AFP): Russian Foreign Minister Sergei Lavrov on Wednesday accused the United States of wanting to hinder Moscow's talks with Ukraine aimed at ending the almost month-long conflict. "The talks are tough, the Ukrainian side constantly changes its position. It's hard to avoid the impression that our American colleagues are holding their hand," Lavrov told students in Moscow, claiming the US "apparently wants to keep us in a state of military action as long as possible".

UK BUDGET (MNI): Our preview looks at expectations ahead of the Spring Statement. A median of 12 GEMM expectations for the remit comes in at GBP153.5bln with estimates ranging from GBP124.5bln to GBP211.2bln.

GERMANY / BUNDS (BBG): Germany is sticking to its program for federal debt sales in the second quarter for the time being even as the government pursues plans to massively ramp up spending on defense and climate protection. Debt issuance will total 106.5 billion euros ($117.4 billion) in the three months through June, in line with a plan published in December, according to a statement by the German Finance Agency on Wednesday. The Agency added the usual caveat that amounts and issue dates may change depending on the ruling coalition’s financing requirements. At the same time, the government plans to stick to the issuance program already adopted “to the largest extent possible,” the Agency said.

GERMANY: Frank Jordans at AP tweets select comments from Chancellor Olaf Scholz's speech to the Bundestag:

- "German Chancellor Olaf Scholz praises "great bravery" of Ukrainian fighting Russian invasion, pledges that Ukraine "can rely on our help."

- Scholz cites financial support to Ukraine from Germany and EU, and the punitive sanctions imposed on Russia that he says are already taking a heavy toll on the Russian economy.

- Scholz says Germany will "end the dependence (on Russian oil and gas) as quickly as possible" but nobody is served if own economy is harmed by a boycott.

ECB / EUROZONE: Corporate insolvency levels are likely to rise as a result of the coronavirus pandemic, but by less than would be expected historically, a paper published Wednesday as part of the latest ECB Economic Bulletin concludes. Corporate indebtedness levels increased during the pandemic, and High corporate leveraging could deter investment during the recovery, while ongoing structural changes will also influence the outlook for firms.

DATA:

MNI: UK FEB CPI +0.8% M/M, +6.2% Y/Y

MNI: UK FEB OUTPUT PPI +0.8% M/M, +10.1% Y/Y

MNI BRIEF: UK Inflation Surges, Outpaces Analysts Expectations

UK consumer price inflation rose to 6.2% year-on-year in February, the highest level since the latest series began in 1997, the Office for National Statistics said Tuesday. The rate, up from 5.5% in February and higher than currently expected by the Bank of England or City analysts, was the highest since March 1992 in a historically modelled series, when it stood at 7.1%. Although the BOE saw inflation lower at this stage in the cycle, it expects prices to rise by around 8% per annum by April.

In February, CPI rose by 0.8% m/m, compared with a rise of 0.1% in the same month last year. This was the largest monthly CPI increase between January and February since 2009.

Factory gate inflation also rose sharply, underlining just how embedded inflation is becoming in the supply chain, with the headline rate of output prices showed positive growth of 10.1% on the year to February 2022, up from 9.9% in January 2022.

The headline rate of input prices showed positive growth of 14.7% on the year to February 2022, up from 14.2% in January 2022. Food products and metals and non-metallic minerals provided the largest upward contributions to the annual rates of output and input inflation, respectively.

MNI BRIEF: German Inflation Outlook Revised Higher - Ifo

Germany will see higher inflation through 2022 than previously expected the Munich-based Ifo Institute said Wednesday, with the annual rate now seen rising as higher as between 5.1 to 6.1%. That forecast rate is sharply higher than the 3.3% seen in the Ifo's December forecast.

Russia's invasion of Ukraine is also curtailing economic growth, with Ifo now expecting growth to reach no more than between 2.2 and 3.1 percent this year.

FIXED INCOME: Core FI moves higher with Spring Statement in focus

Core fixed income continued to drift lower overnight, but has reversed all of these losses so far in European trading with Bund and gilt futures approaching yesterday's highs at the time of writing.

- There has not been too much in terms of headline flow driving markets this morning, instead it seems as though investors are reacting to yields moving to cycle highs and buying the dip.

- Gilts continue to outperform Bunds which outperform USTs. This despite UK headline and core CPI suprising consensus by 0.2ppt to the upside.

- Peripheral spreads are mixed with Italy, Spain and Portugal seeing spreads tighten but eastern European states and semi-core are generally seeing spreads widen a little today.

- The focus later today will be on the release of the gilt remit and the Chancellor's Spring Statement (mini-budget). This will begin around 12:30GMT / 8:30ET with the remit normally out around an hour or so later. For our full preview click here.

- Elsewhere we have a number of central bankers speaking. At the BIS Innovation Summit we have a panel consisting of Fed's Powell, BOE's Bailey and ECB's Nagel at midday GMT / 8:00ET (monpol probably won't be discused) while we also have ECB's Visco and Fed's Daly and Bullard due to speak.

- TY1 futures are unch today at 122-24 with 10y UST yields down -1.6bp at 2.368% and 2y yields down -1.9bp at 2.148%.

- Bund futures are up 0.40 today at 159.83 with 10y Bund yields down -2.6bp at 0.476% and Schatz yields down -2.3bp at -0.266%.

- Gilt futures are up 0.42 today at 120.84 with 10y yields down -5.0bp at 1.657% and 2y yields down -5.6bp at 1.347%.

FOREX: USD/JPY Consolidates After Hitting New Cycle High

- Risk sentiment is generally slightly firmer, with European equities following the Wall Street lead after Tuesday's positive close. JPY was initially offered further in Asia-Pac trade, putting USD/JPY at a new multi-year high of 121.41 - before consolidating a profit-taking brought the pair slightly lower into the NY crossover.

- GBP is the poorest performer so far Wednesday, despite headline CPI data coming in ahead of expectations - mimicking the higher-than-forecast inflation releases across Europe and the US. The 0.2ppt increase marked the 5th consecutive upside surprise. GBP/USD has ebbed off the overnight high of 1.3298, erasing a small part of the sizeable Tuesday rally.

- SEK has firmed, with EUR/SEK returning back toward the 100-dma support at 10.3666 following a somewhat hawkish speech from Riksbank deputy governor Breman, who noted that policy rates may need to be hiked earlier, shrugging off the February rate path which is "now a thing of the past".

- Focus turns to US new home sales data for February, the Spring Statement from the UK Chancellor and the BIS Innovation Summit, at which Fed's Powell, BOE's Bailey and ECB's Nagel are due to speak. Monetary policy may not be discussed, but markets will keep a close eye regardless. ECB's Visco, Fed's Daly & Bullard are also due.

EQUITIES: European Stocks Higher, Led By Energy

- Asian markets closed sharply higher: Japan's NIKKEI closed up 816.05 pts or +3% at 28040.16 and the TOPIX ended 44.96 pts higher or +2.33% at 1978.7. China's SHANGHAI closed up 11.17 pts or +0.34% at 3271.032 and the HANG SENG ended 264.8 pts higher or +1.21% at 22154.08

- European equities are gaining, with the German Dax up 54.8 pts or +0.38% at 14528.09, FTSE 100 up 39.33 pts or +0.53% at 7515.4, CAC 40 up 20.17 pts or +0.3% at 6681.59 and Euro Stoxx 50 up 8.95 pts or +0.23% at 3935.57.

- U.S. futures are a little lower, with the Dow Jones mini down 38 pts or -0.11% at 34671, S&P 500 mini down 4.5 pts or -0.1% at 4500.5, NASDAQ mini down 13.75 pts or -0.09% at 14640.

COMMODITIES: Oil, Precious Metals Tick Higher From Overnight Lows

- WTI Crude up $1.07 or +0.98% at $110.29

- Natural Gas down $0.06 or -1.06% at $5.132

- Gold spot up $1.9 or +0.1% at $1923.63

- Copper up $4.1 or +0.87% at $474.1

- Silver up $0.2 or +0.8% at $24.9842

- Platinum down $3.98 or -0.39% at $1021.68

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1200/0800 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/03/2022 | 0105/2105 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 24/03/2022 | 0830/0930 | *** |  | CH | SNB policy decision |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/03/2022 | 0930/1030 |  | EU | ECB Elderson at IIEA Webinar | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1230/0830 |  | US | Minneapolis Fed's Neel Kashkari | |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 25/03/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.